Life often throws unexpected curveballs, or sometimes, you simply need a little help managing certain affairs when you’re unable to do so yourself. Whether you’re traveling, dealing with a health issue, or just need someone to handle a very specific transaction, assigning power to another person can be incredibly useful. This is where the concept of a limited power of attorney comes into play, offering a practical solution for delegating authority without giving away complete control.

Unlike a general power of attorney, which grants broad authority, a limited power of attorney is precisely what its name suggests: it’s restricted in scope, duration, or both. It allows you, the principal, to empower another individual, known as the agent or attorney-in-fact, to act on your behalf for a clearly defined purpose. This targeted approach provides peace of mind, knowing that the person you’ve chosen can only perform the specific tasks you’ve authorized, making it a safe and flexible tool for various situations.

Understanding the Specifics of a Limited Power of Attorney

A limited power of attorney is a legal document that grants a specific, narrowly defined authority to an agent. This precision is its greatest strength, as it prevents the agent from making decisions or acting on matters beyond what you explicitly permit. For instance, you might authorize an agent to sell a particular piece of real estate, collect a specific debt, or manage your financial affairs for a brief period while you are out of the country. This contrasts sharply with a general power of attorney, which typically grants wide-ranging authority over almost all personal and financial matters.

The scenarios where a limited power of attorney proves invaluable are numerous and diverse. Imagine you are purchasing a car but cannot be present to sign the final paperwork; a limited power of attorney can empower a trusted friend to do so for you. Perhaps you need someone to access your safe deposit box, manage an investment account temporarily, or even care for your child and make medical decisions for a set duration. In each of these cases, the document clearly outlines the exact boundaries of the agent’s authority, ensuring they operate within the specific parameters you have established.

Crafting this document requires careful attention to detail and clear, unambiguous language. Vague wording can lead to misinterpretations or unintended consequences, potentially granting more power than you intended or less than is needed. It’s crucial to specify exactly what actions the agent can take, for how long they can take them, and under what conditions their authority terminates. Being precise in your instructions protects both you and your agent, preventing any confusion down the line.

The parties involved in a limited power of attorney are straightforward: you are the principal, the person granting the authority, and the individual you appoint is the agent or attorney-in-fact. It is essential to choose someone you trust implicitly, as even with limited authority, they will be handling sensitive matters on your behalf. Their role is to faithfully execute the powers you’ve granted, always acting in your best interest and within the confines of the document.

Key Elements to Include

Why a Limited Power of Attorney Form Template is Your Go-To Resource

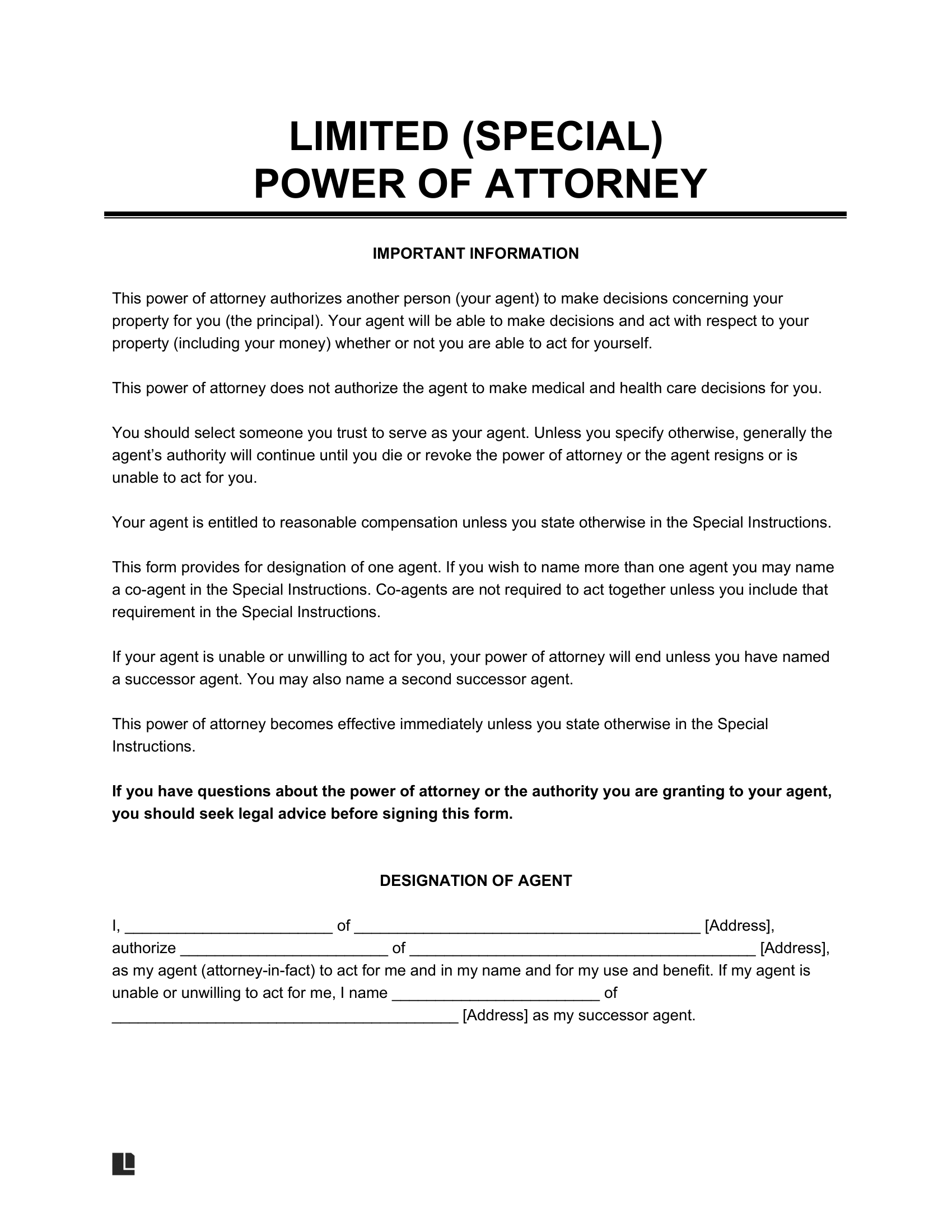

When faced with the need to create such an important legal document, starting from scratch can feel daunting. This is where a limited power of attorney form template becomes an incredibly valuable asset. Templates provide a pre-structured framework that includes all the essential sections and legal language commonly found in these documents. They save you significant time and effort, guiding you through the necessary information you need to provide without having to worry about missing crucial elements.

Using a template simplifies the entire process, making it accessible even if you’re not a legal expert. Instead of trying to remember every clause or legal term, the template prompts you for the specific details, such as the names of the parties, the exact powers to be granted, and the duration of the authority. This systematic approach ensures that you create a comprehensive and legally sound document, tailored to your specific needs, while minimizing the risk of oversight.

While a template provides a fantastic starting point, it’s important to remember that it’s a general guide. Each situation is unique, and state laws regarding powers of attorney can vary significantly. Therefore, after filling out a limited power of attorney form template, it’s always advisable to have it reviewed by a qualified attorney in your jurisdiction. This final legal review can ensure that the document fully complies with local laws and accurately reflects your intentions, offering an extra layer of security and peace of mind.

Finding a reliable and comprehensive limited power of attorney form template is easier than ever, with many legal resource websites and state bar associations offering downloadable versions. When selecting a template, look for one that is specific to your state, if possible, as this will help ensure its legal validity. A well-designed template will not only guide you through the content but also help you understand the implications of each section, making the process transparent and empowering.

Empowering someone to act on your behalf for a specific task is a smart way to manage your affairs efficiently and confidently. A limited power of attorney offers a precise and controlled method for delegating authority, ensuring that your intentions are respected and executed exactly as you wish. It’s a foundational element of sound personal planning, providing flexibility without sacrificing security.

Whether for financial transactions, property management, or personal care decisions, having this specific legal tool in place provides incredible peace of mind. It allows you to maintain control over your assets and decisions, even when you cannot be physically present or directly involved, ensuring that your interests are always protected by a trusted individual.