Life often throws unexpected curveballs, and sometimes these can directly impact our ability to work and earn a living. Whether it’s an unfortunate accident, a sudden illness, or another unforeseen event, losing wages can quickly become a significant financial burden, affecting not just your immediate income but also your long-term stability and peace of mind. Navigating the aftermath of such an event requires careful attention to detail, especially when it comes to recovering what you’ve lost.

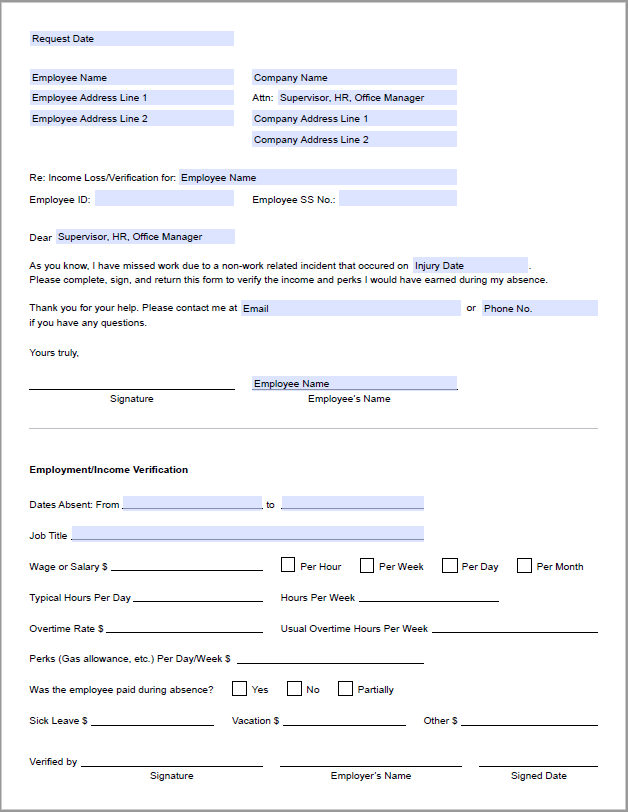

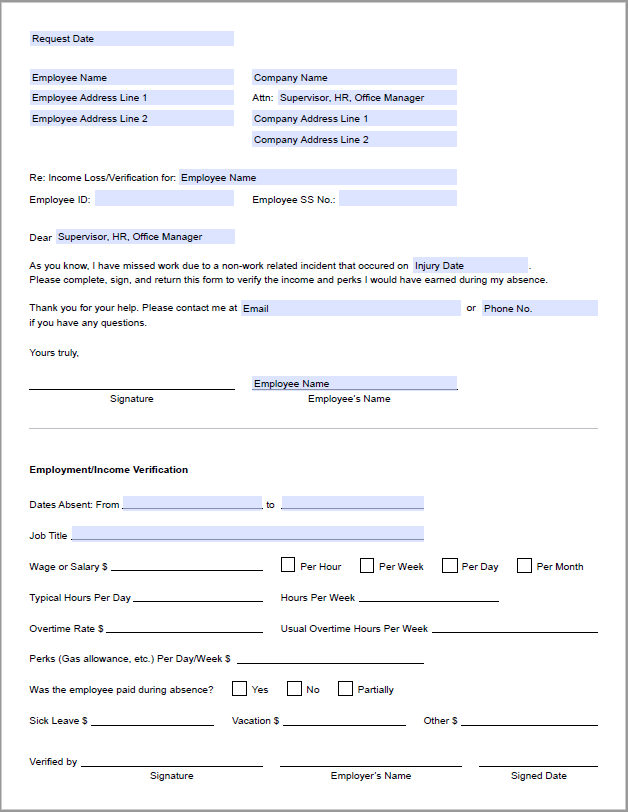

This is precisely where a well-structured loss of wages claim form template becomes an indispensable tool. It serves as your comprehensive record, detailing the extent of your income loss, and is often the foundational document required by insurance companies, employers, or legal representatives when you seek compensation. Understanding how to properly utilize and populate such a template can make all the difference in ensuring a smooth and successful claim process during what is undoubtedly a challenging period.

Understanding the Importance of Documenting Lost Income

When you’ve suffered an incident that prevents you from working, the immediate concern often shifts to recovery and managing the disruption to your daily life. However, just as crucial is the meticulous documentation of any income you’ve lost as a direct result. This could stem from a variety of situations, such as a car accident that leaves you unable to commute or perform your job duties, a workplace injury requiring extended time off, or a personal injury sustained elsewhere that leads to temporary disability. Without clear records, proving your financial losses can be incredibly difficult, leaving you vulnerable to delays or even denial of your claim.

The financial ripple effect of lost wages extends far beyond just missing a paycheck. It can impact your ability to pay rent, cover utility bills, manage medical expenses, or even put food on the table for your family. This is why official documentation is not merely a formality; it’s a critical step in protecting your financial future. Insurance adjusters and legal professionals rely heavily on concrete evidence to assess the validity and extent of your claim. A haphazard collection of notes or verbal estimations simply won’t suffice when you’re trying to recover significant income.

This is precisely where the strategic use of a reliable loss of wages claim form template comes into play. It provides a standardized framework for collecting all the necessary details, ensuring that you don’t overlook any crucial piece of information. Rather than starting from scratch, trying to remember every date, amount, and contact detail, a template guides you step-by-step, making the process less daunting and more accurate. It transforms a potentially confusing task into a clear, manageable process, which is especially important when you’re already under stress.

By presenting your claim through a professional and detailed template, you significantly enhance its credibility and readability. It shows that you are serious about your claim and have taken the time to compile all required information systematically. This not only aids the party reviewing your claim but also empowers you with confidence that you’ve presented your case thoroughly and accurately.

What Information Does a Good Template Capture?

- Your complete personal identification details, including your full name, current address, and contact information.

- Comprehensive employer information, such as the company name, address, contact person, and your specific job title or position.

- Detailed specifics of the incident that led to your wage loss, including the exact date, type of event, and a concise description of how it impacted your ability to work.

- Precise dates of your work absence, clearly indicating the start and end dates of the period for which you are claiming lost wages.

- Your regular earning rate, whether hourly, weekly, or annual salary, along with any benefits or commissions you typically receive.

- A clear calculation of the total amount of wages lost over the specified period.

- A checklist of essential supporting documentation required, such as doctor’s notes, employer statements, copies of recent pay stubs, and any relevant police reports or incident logs.

- Spaces for necessary signatures and dates, authenticating the information provided.

Leveraging a Template for an Efficient Claim Process

Using a dedicated loss of wages claim form template isn’t just about collecting data; it’s about optimizing the entire claim process. One of the primary advantages is the consistency it brings. Instead of scattering information across various documents or relying on memory, a template ensures that all pertinent details are organized in a uniform manner. This consistency not only makes it easier for you to fill out but also simplifies the review process for insurance adjusters or legal teams who are accustomed to seeing information presented in a structured way. This can significantly reduce the back-and-forth communication, leading to a faster resolution.

Moreover, a well-designed template acts as a comprehensive checklist. In stressful situations, it’s easy to overlook critical pieces of information that might seem minor but could be vital to your claim’s success. The template prompts you for every necessary detail, from the exact dates you were unable to work to your specific hourly wage and the name of your supervisor. By ensuring completeness from the outset, you minimize the chances of your claim being delayed or rejected due to missing information, ultimately saving you considerable time and frustration in the long run.

Beyond the practical benefits, there’s a significant psychological advantage to using a structured form. Facing a loss of income can be incredibly stressful and overwhelming. Having a clear, step-by-step guide like a template provides a sense of control and clarity during a chaotic time. It simplifies a complex task, breaking it down into manageable sections, which can alleviate anxiety and help you focus on recovery rather than worrying about the intricacies of paperwork. It brings order to what might feel like a chaotic situation.

Ultimately, a robust loss of wages claim form template serves as a vital bridge between your loss and the compensation you deserve. It’s a tool that benefits all parties involved: it guides you, the claimant, in providing accurate and complete information; it helps insurance companies and legal professionals process your claim efficiently; and it provides clear, verifiable evidence should the claim escalate to a legal dispute. This structured approach fosters transparency and builds confidence in the validity of your wage loss claim, ensuring that your efforts to recover are supported by solid documentation.

When you’re faced with the challenge of lost income, remember that preparation and proper documentation are your strongest allies. Having all your details meticulously organized, from your employment information to the precise dates of your absence and the calculations of your lost wages, makes a profound difference in how your claim is perceived and processed. It empowers you to clearly articulate the financial impact you’ve experienced.

Navigating the aftermath of an incident that causes wage loss can be daunting, but with the right tools, you can ensure that your financial recovery process is as smooth and successful as possible. By presenting a clear, comprehensive, and well-supported claim for your lost earnings, you significantly enhance your chances of receiving the compensation you are rightfully owed, allowing you to focus on rebuilding and moving forward.