Dealing with taxes can feel like navigating a complex maze, especially when it comes to specific requirements like personal property tax. In Maryland, businesses and individuals who own certain types of tangible personal property need to understand and comply with these tax obligations. Finding the right maryland personal property tax form template and knowing how to fill it out correctly is crucial for smooth operation and avoiding penalties.

This isn’t always straightforward. The forms can seem complex, and the rules around what to declare and how to value it might raise a few eyebrows. But don’t worry, we’re here to demystify the process, helping you understand the ins and outs of Maryland personal property tax and how to effectively utilize the necessary templates to meet your filing responsibilities.

Understanding Maryland Personal Property Tax: What You Need to Know

Maryland’s personal property tax primarily applies to businesses, not individual homeowners for their residential real estate. It targets tangible personal property used in a trade or business. Think office furniture, machinery, equipment, tools, and even inventory in some cases. It’s a key distinction from real estate property tax, focusing instead on assets that are movable and not permanently affixed to land.

So, who exactly needs to file? Generally, any individual, partnership, limited liability company, or corporation that owns tangible personal property used in a business in Maryland is required to file a personal property tax return. This includes home-based businesses with dedicated equipment, independent contractors with specialized tools, and large corporations alike. Even if your business has no taxable property for a given year, you might still need to file a “no property” return to remain compliant and avoid delinquency notices.

Accurate and timely filing is paramount. The State Department of Assessments and Taxation (SDAT) administers this tax, and failing to file or misrepresenting your assets can lead to significant penalties, including fines and interest charges. It’s not just about paying the tax; it’s about maintaining good standing with the state and ensuring your business records are clean and verifiable. Proper valuation of assets and understanding depreciation schedules are critical components of this process.

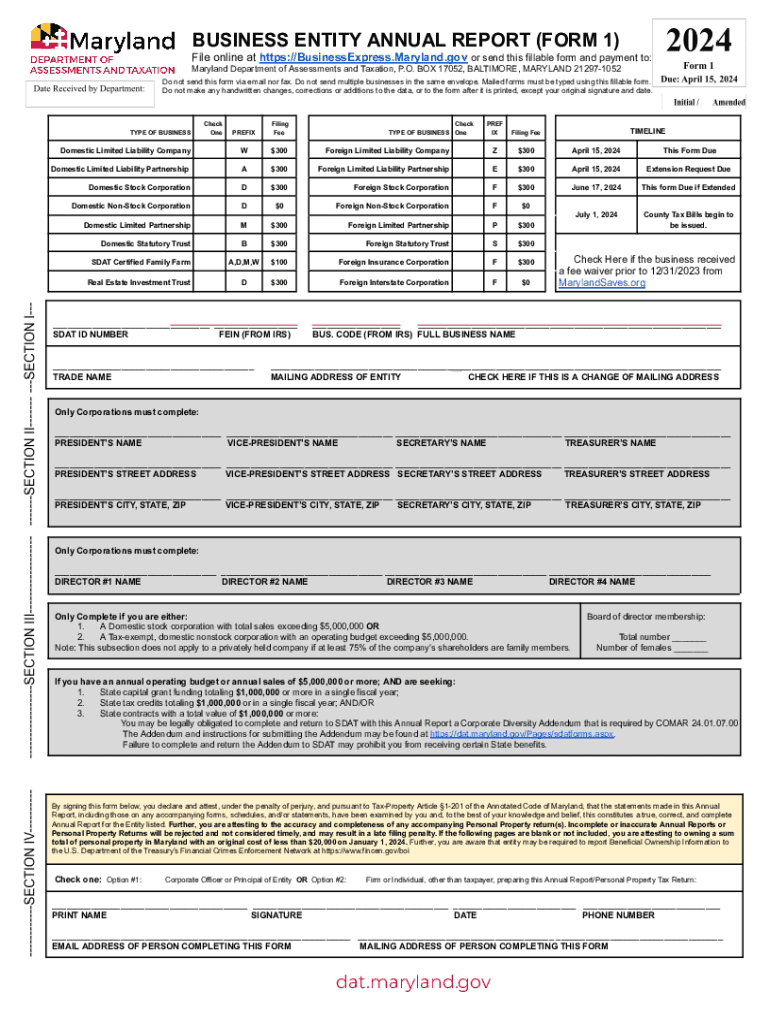

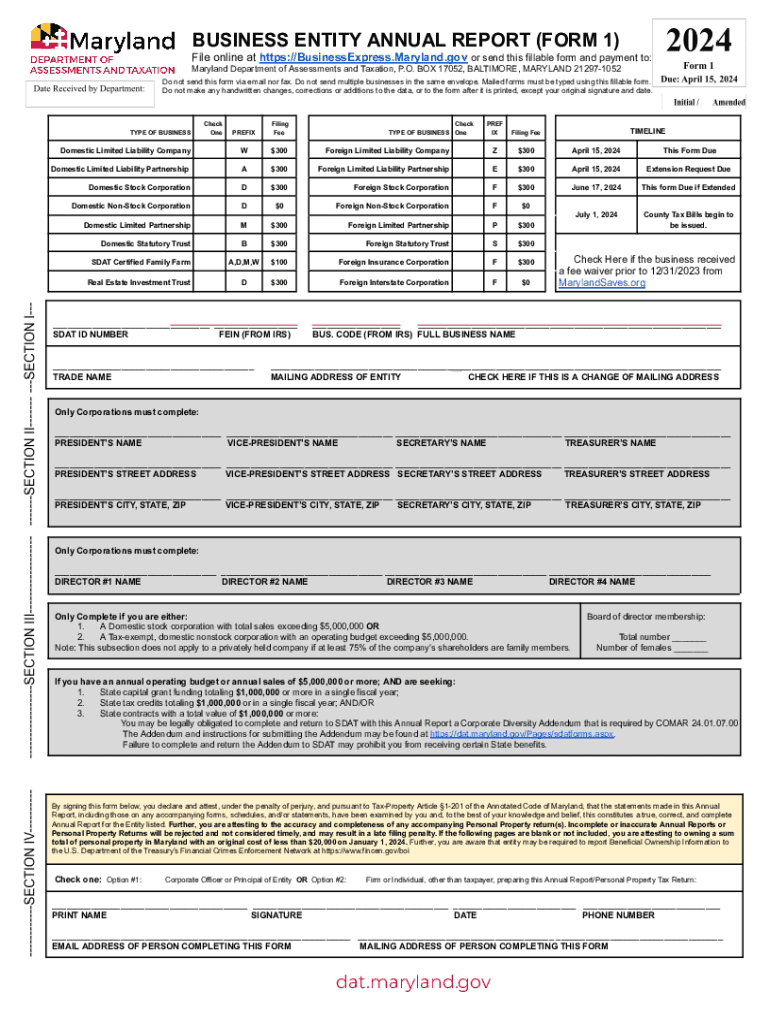

When you look at a maryland personal property tax form template, you’ll notice it’s designed to capture specific information about your business and its assets. It’s not just a blank sheet; it’s a structured document guiding you through the declaration process. Familiarizing yourself with its layout before you start gathering your data can save a lot of time and frustration.

Key Sections of the Maryland Personal Property Tax Form

- Business Identification Information: Your business name, address, federal employer identification number (FEIN), and account number.

- Asset Listing Schedule: A detailed breakdown of all taxable tangible personal property, typically categorized by year of acquisition and type.

- Original Cost and Depreciation: Columns to report the initial cost of assets and apply the appropriate depreciation based on state guidelines.

- Valuation and Assessment: Sections where the assessed value of your property is calculated for tax purposes.

- Signatures and Certifications: A declaration that the information provided is accurate to the best of your knowledge.

Each of these sections requires careful attention. For instance, accurately listing your assets means not just remembering what you bought, but also when, for how much, and ensuring you apply the correct depreciation methods. This often means delving into your purchase records and accounting ledgers, so having these organized throughout the year is incredibly beneficial.

Navigating the Filing Process and Accessing Official Forms

Once you understand what’s required, the next step is accessing the official forms and understanding the submission process. The most reliable place to find the current maryland personal property tax form template is directly on the website of the Maryland State Department of Assessments and Taxation (SDAT). They provide downloadable PDF versions of the annual returns, ensuring you’re using the most up-to-date and legally valid document. Be wary of unofficial sources, as tax forms can change slightly year to year.

Filing your personal property tax return in Maryland offers a few options. While paper forms can be downloaded, completed, and mailed, many businesses now opt for electronic filing. SDAT provides an online filing portal that often simplifies the process, allowing for direct data entry and sometimes even pre-filling information from previous years. This digital approach can also provide immediate confirmation of submission, which is invaluable for record-keeping.

Deadlines are crucial. The personal property tax return for most businesses is due by April 15th each year, covering the previous calendar year’s property. Missing this deadline can result in penalties, so marking your calendar and planning ahead is essential. If you anticipate needing more time, extensions are sometimes available, but these typically need to be requested in advance and might only extend the filing period, not the payment deadline.

Beyond just the form, effective management of your personal property tax involves proactive record-keeping. Throughout the year, maintaining detailed logs of all asset purchases, including invoices, acquisition dates, and original costs, will make tax season significantly less stressful. This foresight prevents a last-minute scramble and ensures the accuracy of your declarations, which is vital for compliance.

- Tips for a Smooth Filing Experience:

- Maintain Meticulous Records: Keep all purchase receipts and depreciation schedules organized.

- Understand Your Assets: Clearly identify what constitutes tangible personal property for tax purposes in Maryland.

- Consult Official Sources: Always use forms and instructions directly from the SDAT website.

- Consider Professional Advice: If your business has complex assets or you’re unsure about specific valuations, a tax professional can provide invaluable guidance.

- File Early: Avoid the last-minute rush and potential technical issues by submitting your return well before the deadline.

Complying with Maryland’s personal property tax obligations doesn’t have to be a daunting task. By understanding what property is taxable, who needs to file, and familiarizing yourself with the structure of the official forms, you can approach this annual responsibility with confidence. The key is knowing where to find the correct documents and dedicating time to accurate reporting.

Properly managing your personal property tax not only keeps your business in good standing with the state but also contributes to sound financial practices. With the right information and a methodical approach, you can ensure your business meets its tax requirements efficiently, allowing you to focus more on growth and operations.