Navigating the complexities of medical insurance can often feel like deciphering a secret code. For both healthcare providers and patients, understanding what services are covered and to what extent is crucial. Errors or misunderstandings at this stage can lead to significant financial headaches, claim denials, and administrative burdens that eat into valuable time and resources. The initial step of verifying a patient’s insurance benefits sets the foundation for a smooth and transparent healthcare experience, yet it’s a process fraught with potential pitfalls if not handled systematically.

That’s where a standardized approach becomes indispensable. Having a reliable medical insurance verification of benefits form template can transform a chaotic and error-prone task into an efficient and accurate routine. This tool provides a structured framework for collecting all the necessary information, ensuring nothing is overlooked and that both the provider and the patient have a clear understanding of the financial landscape before services are rendered. It’s not just about filling out a form; it’s about establishing clarity, preventing surprises, and ultimately enhancing the patient journey.

The Indispensable Role of a Structured Verification Process

In the fast-paced environment of healthcare, every minute counts, and every piece of information must be precise. A well-designed medical insurance verification of benefits form template is far more than just a piece of paper; it’s a critical tool for operational efficiency and financial stability within any medical practice. It standardizes the data collection process, meaning that regardless of who is performing the verification, the same essential questions are asked, and the same crucial details are recorded. This consistency dramatically reduces the likelihood of missing vital information that could lead to denied claims or delayed payments down the line.

For healthcare providers, having a clear understanding of a patient’s benefits upfront means they can discuss potential out-of-pocket costs with greater accuracy. This transparency builds trust with patients, as they are less likely to be hit with unexpected bills after receiving care. It also empowers providers to make informed decisions about treatment plans, ensuring that recommended services align with what the patient’s insurance will cover, or at least that the patient is fully aware of their financial responsibility for uncovered services. This proactive communication can significantly improve patient satisfaction and reduce payment disputes.

Furthermore, a comprehensive template acts as a central repository of all benefit information. This means that if there are questions or issues with a claim later on, all the verified details are readily accessible. This can save countless hours of research and phone calls to insurance companies. By capturing details like co-pays, deductibles, out-of-pocket maximums, and specific coverage for various services (e.g., therapy, diagnostics, specialist visits), the practice can better anticipate revenue and manage its accounts receivable more effectively. It’s about building a robust administrative backbone that supports the clinical care provided.

Ultimately, the consistent application of a medical insurance verification of benefits form template contributes to better compliance with insurance regulations and reduces the risk of audit issues. It provides an auditable trail of due diligence, demonstrating that the practice has made a good-faith effort to verify coverage. In an industry where financial errors can have significant consequences, proactive and thorough verification is not just a best practice; it’s a necessity for sustainable operation.

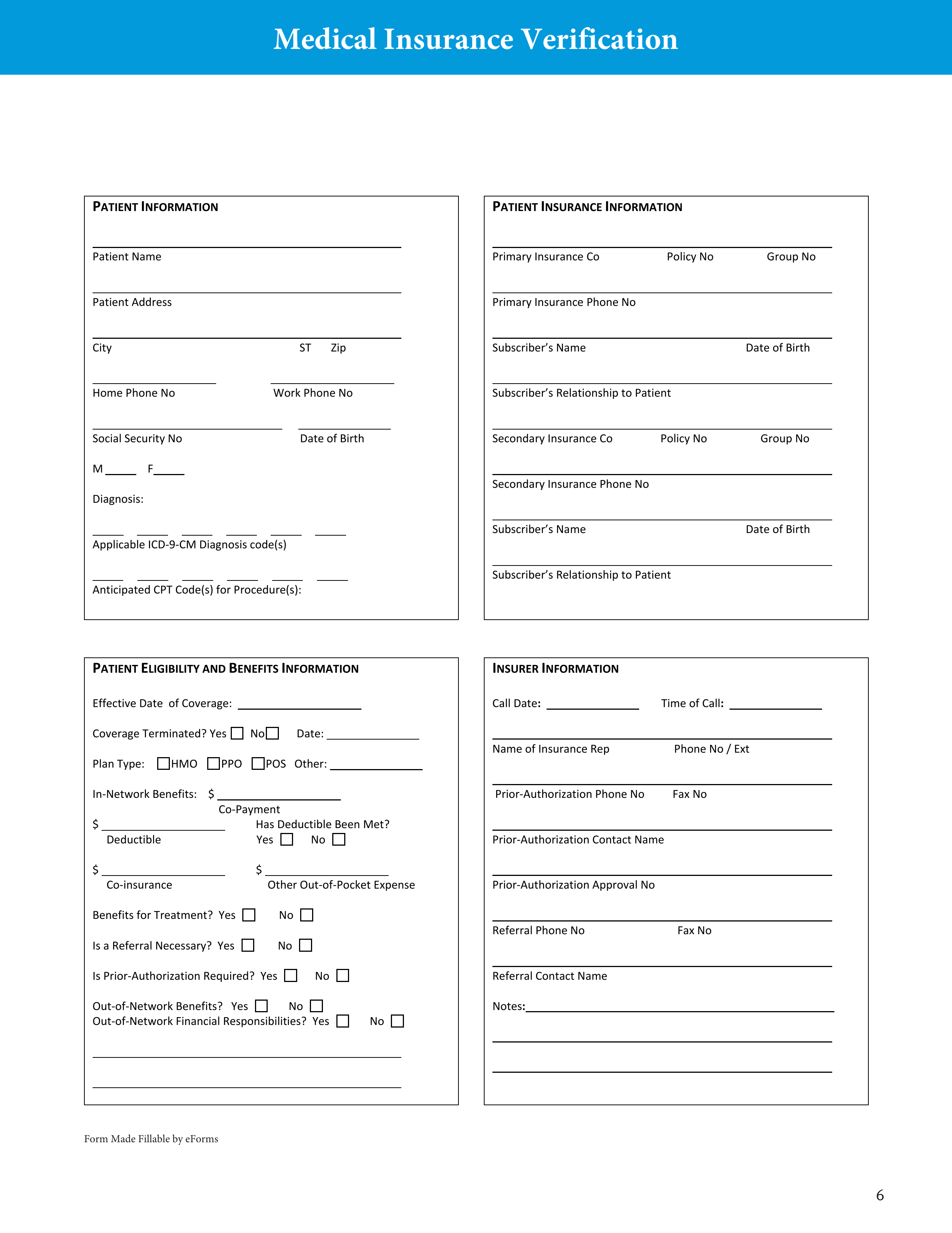

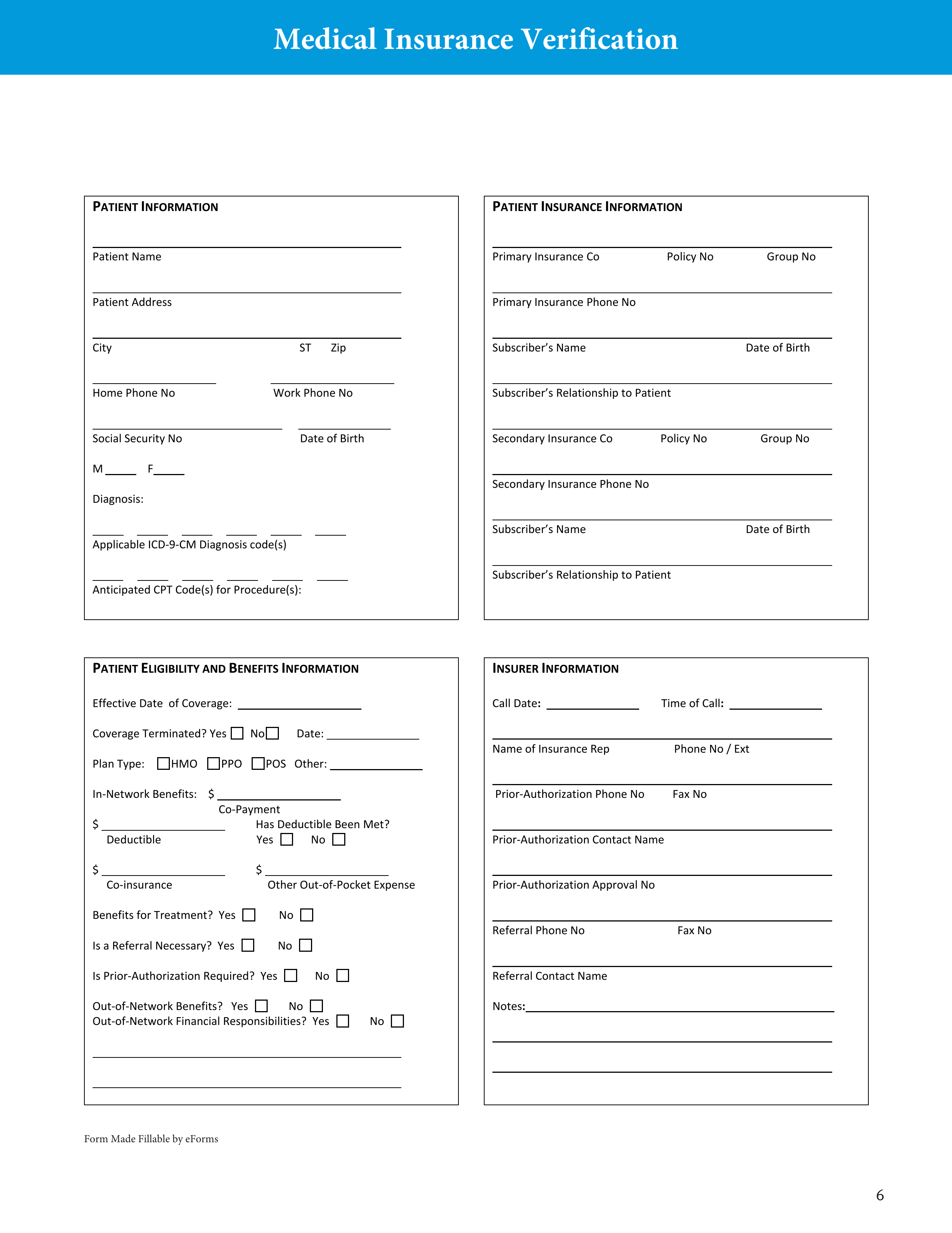

Key Information to Include for Comprehensive Verification

- Patient Demographics: Full name, date of birth, contact information.

- Insurance Information: Carrier name, policy number, group number, subscriber name, relationship to insured.

- Benefit Details: Co-pay amount, deductible amount (met/remaining), out-of-pocket maximum (met/remaining).

- Specific Service Coverage: Details on coverage for the specific service being provided (e.g., office visit, surgery, imaging, therapy).

- Referral/Authorization Requirements: If a referral or prior authorization is needed.

- Effective/Termination Dates: Policy start and end dates.

- Verification Agent Details: Name of person verifying, date of verification, insurance representative’s name and reference number.

Crafting and Utilizing Your Verification Template Effectively

Designing an effective medical insurance verification of benefits form template involves more than just listing a few questions; it requires a thoughtful approach to ensure it captures all critical data points necessary for accurate billing and patient communication. Start by identifying the most frequently asked questions by your billing team and the common reasons for claim denials. Incorporate fields for patient identification, insurance policy details, specific benefit information (deductibles, co-pays, co-insurance, out-of-pocket maximums), and any special requirements like prior authorizations or referrals. Don’t forget space for the verifier’s name, date, and the insurance representative’s reference number, which are invaluable for follow-up.

Once your template is developed, the true value comes from its consistent application. Train all administrative staff involved in patient intake and billing on how to properly use the template. This includes understanding the nuances of insurance terminology, knowing which questions to ask, and how to accurately record the information obtained from the insurance carrier. Role-playing scenarios or regular refreshers can help reinforce best practices and ensure that everyone is on the same page. Consistency in data collection leads to fewer errors and a more efficient workflow for the entire practice.

Beyond initial training, it’s vital to integrate the verification process into your practice’s workflow seamlessly. This might involve assigning dedicated staff members to handle all verifications, establishing clear timelines for when verifications should occur (e.g., always before a new patient’s first appointment, or for existing patients when a new service is planned), and creating a system for flagging any potential issues or discrepancies that arise during the verification call. Timely and thorough verification helps prevent last-minute scrambles and ensures that financial discussions with patients can happen well in advance of their appointment.

Finally, remember that insurance policies and regulations change frequently, so your medical insurance verification of benefits form template should not be a static document. Periodically review and update it to reflect new industry standards, common denials your practice experiences, or changes in insurance plan structures. Gathering feedback from billing staff on what works well and what could be improved can also lead to enhancements that make the template even more robust and user-friendly. An adaptive template is a powerful asset in maintaining a healthy revenue cycle.

Implementing a comprehensive and well-utilized verification system is a cornerstone of efficient practice management. It empowers your team to work more effectively, reduces the likelihood of financial surprises for patients, and significantly streamlines the billing process. By dedicating resources to this crucial administrative step, you are investing in the financial health and operational smoothness of your entire organization.

Ultimately, the effort put into a robust benefits verification process pays dividends in reduced administrative burden, improved cash flow, and enhanced patient satisfaction. It’s a proactive measure that mitigates financial risks and ensures that both providers and patients can focus more on health outcomes and less on the complexities of insurance coverage.