Utilizing a structured spreadsheet for personal finances provides several advantages. It enables accurate tracking of income and expenses, simplifies net worth calculation, and supports informed financial decision-making. Furthermore, a well-organized financial statement can prove invaluable for loan applications, tax preparation, and estate planning.

The following sections will delve deeper into the core components of a well-structured personal financial statement, offering practical guidance on its creation and utilization for improved financial management.

1. Accessibility

Accessibility in the context of a personal financial statement template refers to the ease with which individuals can access, use, and modify the template to manage their finances. This encompasses various facets, impacting both the usability and overall effectiveness of the template for diverse users.

- Platform CompatibilityA truly accessible template functions seamlessly across various operating systems (Windows, macOS, iOS, Android) and devices (desktops, laptops, tablets, smartphones). This cross-platform compatibility ensures users can access their financial data regardless of their preferred technology. For instance, a cloud-based template allows access from any internet-connected device, while offline functionality caters to situations without internet connectivity.

- Software RequirementsMinimizing software dependencies is crucial for accessibility. Ideally, the template should function with readily available software, such as Microsoft Excel or Google Sheets, or be accessible through a web browser without requiring specialized software installations. This reduces barriers to entry and ensures broader usability. For example, a template requiring a specific, less common version of Excel might limit accessibility for some users.

- Assistive Technology CompatibilityTemplates should be designed to work effectively with assistive technologies like screen readers and keyboard navigation. Proper labeling, structured data, and alternative text for images enable users with disabilities to interact with the template effectively. This inclusivity ensures equal access to financial management tools for all individuals. A template compatible with screen readers empowers visually impaired users to manage their finances independently.

- User Interface and DesignA clear, intuitive user interface enhances accessibility. This includes a logical layout, easy-to-understand terminology, and sufficient contrast between text and background colors. A well-designed interface simplifies data entry and interpretation, promoting user engagement and reducing the likelihood of errors. For example, clear section headings and intuitive data input fields contribute to a more accessible user experience.

By addressing these aspects of accessibility, a personal financial statement template becomes a valuable tool for a wider range of individuals, empowering them to effectively manage their financial well-being regardless of their technical proficiency, preferred devices, or specific needs.

2. Customization

Customization is paramount for a personal financial statement template to effectively serve diverse financial situations and goals. A generic template may not adequately capture the nuances of individual financial circumstances. Customization allows users to tailor the template to reflect their specific assets, liabilities, income streams, and expense categories. This ability to adapt the template is essential for accurate financial tracking and analysis.

Consider, for example, an individual with significant investment holdings in various asset classes. A customizable template allows for detailed tracking of each investment, including cost basis, current value, and performance metrics. Conversely, someone primarily focused on debt reduction might customize the template to highlight loan balances, interest rates, and payoff timelines. The flexibility of customization empowers users to prioritize the information most relevant to their financial objectives.

Several practical applications demonstrate the significance of customization. Real estate investors can modify asset sections to include property details and rental income. Freelancers can customize income categories to reflect diverse project-based earnings. Furthermore, customization extends to visual elements, allowing users to adjust formatting, colors, and charts for enhanced readability and analysis. Addressing the specific needs of each user through customization transforms a generic tool into a personalized financial management solution.

3. Comprehensive Structure

A comprehensive structure is fundamental to the efficacy of a personal financial statement template. This structure provides the organized framework necessary for accurately capturing all relevant financial data. A well-designed template encompasses key categories, including assets (e.g., cash, investments, real estate), liabilities (e.g., loans, credit card debt), income (e.g., salary, investments), and expenses (e.g., housing, transportation, utilities). Without a comprehensive structure, crucial financial elements might be overlooked, leading to an incomplete and potentially misleading representation of one’s financial position. For instance, omitting investment income or contingent liabilities could significantly skew net worth calculations and hinder informed financial planning.

The impact of a comprehensive structure extends beyond simply listing assets and liabilities. It facilitates a deeper understanding of financial interconnectedness. By categorizing expenses, users can identify areas for potential savings. Tracking income sources alongside expenses provides insights into spending patterns and cash flow dynamics. A template that segregates short-term and long-term assets and liabilities enables users to assess their liquidity and long-term financial health. Consider an individual analyzing their investment portfolio. A comprehensive template allows them to categorize investments by asset class, track performance individually, and assess the overall portfolio diversification, facilitating more strategic investment decisions.

In essence, a comprehensive structure within a personal financial statement template provides the scaffolding for sound financial management. It ensures all essential financial elements are accounted for, promotes a nuanced understanding of financial interconnectedness, and empowers users to make informed decisions based on a complete and accurate view of their financial standing. Failing to incorporate a comprehensive structure undermines the template’s utility and can hinder effective financial planning and analysis.

4. Automated Calculations

Automated calculations are integral to the effectiveness of a personal financial statement template, significantly enhancing accuracy, efficiency, and overall utility. By leveraging the computational capabilities of spreadsheet software, these automated features streamline the process of aggregating financial data, performing calculations, and generating meaningful insights. This automation minimizes manual data entry and reduces the risk of human error, freeing users to focus on analysis and financial decision-making rather than tedious calculations.

- Net Worth CalculationA fundamental function of a personal financial statement is net worth calculation. Automated calculations instantly compute net worth by subtracting total liabilities from total assets. This real-time feedback provides a clear snapshot of one’s financial position and eliminates the need for manual calculations. For example, as asset values or liabilities change, the net worth figure automatically updates, providing a dynamic view of financial health.

- Debt ManagementAutomated calculations can be employed to track loan amortization schedules, calculate interest payments, and project payoff timelines. This facilitates informed decision-making regarding debt management strategies. Consider an individual with multiple loans. Automated calculations can determine the impact of making extra payments toward specific loans, assisting in prioritizing debt reduction efforts.

- Investment TrackingFor individuals with investment portfolios, automated calculations can track investment performance, calculate returns, and provide insights into asset allocation. This automation streamlines portfolio management and simplifies performance analysis. For example, the template can automatically calculate portfolio diversification percentages and track unrealized gains or losses.

- Budgeting and ForecastingBy integrating income and expense tracking, automated calculations can project future cash flow, enabling users to create and monitor budgets more effectively. Automated alerts for budget overruns empower users to make timely adjustments to spending habits. This forward-looking perspective enhances financial planning and promotes responsible resource allocation.

By automating these critical calculations, a personal financial statement template becomes a dynamic tool that empowers users with accurate, real-time financial insights. This efficiency not only saves time but also reduces the potential for errors, enabling more informed and proactive financial management. The resulting clarity and control over financial data are crucial for achieving financial goals and maintaining long-term financial well-being.

5. Data Security

Data security is paramount when utilizing a personal financial statement template, given the sensitive nature of the information contained within. Protecting this data from unauthorized access, misuse, or loss is crucial for maintaining financial privacy and preventing potential fraud or identity theft. A robust approach to data security must consider various facets, each playing a vital role in safeguarding financial information.

- Password ProtectionImplementing strong, unique passwords for accessing devices and files containing the financial statement template is a fundamental security measure. Password managers can assist in generating and securely storing complex passwords. This prevents unauthorized individuals from gaining access to sensitive financial data. For instance, utilizing a password manager with two-factor authentication adds an extra layer of security, requiring a second verification method beyond the password.

- File EncryptionEncrypting the file containing the personal financial statement adds another layer of protection. Encryption transforms the data into an unreadable format, requiring a decryption key for access. This safeguards the information even if the device is lost or stolen. Full-disk encryption and file-specific encryption are options depending on the level of security required. For example, encrypting the Excel file itself ensures data remains protected even if copied to another device.

- Secure StorageChoosing a secure storage location for the financial statement template is essential. Cloud storage services with robust security measures, including encryption and two-factor authentication, offer a viable option. Regularly backing up the file to a secure location ensures data recovery in case of device failure or accidental deletion. Offline storage options, such as an external hard drive, can also be employed, ensuring the data is not susceptible to online threats. Utilizing a cloud service with end-to-end encryption provides enhanced security, ensuring only the user holds the decryption key.

- Software UpdatesKeeping the software used to access the template (e.g., Microsoft Excel, operating system) up-to-date is critical. Software updates often include security patches that address vulnerabilities, protecting against malware and other threats. Failing to update software increases the risk of data breaches. Enabling automatic updates ensures timely patching of security vulnerabilities, reducing the risk of exploitation.

These data security practices are essential for safeguarding the sensitive information within a personal financial statement template. By implementing these measures, individuals can effectively mitigate risks, protect their financial privacy, and maintain control over their financial data. Neglecting these precautions can have severe consequences, potentially leading to identity theft, financial loss, and significant disruption. Therefore, prioritizing data security is not merely a best practice but a necessity for responsible financial management.

6. Integration Potential

Integration potential significantly enhances the utility of a personal financial statement template within a broader financial management ecosystem. Seamless data flow between the template and other financial tools streamlines financial tracking, analysis, and decision-making. This interconnectivity empowers users to leverage their financial data more effectively, gaining a holistic view of their financial landscape.

- Budgeting SoftwareIntegrating the template with budgeting software allows for automated data transfer between the two platforms. Income and expense data from the financial statement can populate budget categories, facilitating accurate budget creation and monitoring. For example, actual spending data from the statement can be compared against budgeted amounts, providing insights into spending patterns and deviations from the budget. This integration eliminates manual data entry and ensures consistency between financial tracking and budgeting efforts.

- Investment PlatformsConnecting the template to investment platforms enables automatic updates of investment holdings, values, and performance data. This real-time synchronization eliminates the need for manual entry, ensuring the financial statement accurately reflects current portfolio status. For instance, changes in stock prices, dividend payments, and transaction history can be automatically reflected in the template, providing an up-to-date view of investment performance and asset allocation. This integration empowers informed investment decisions based on accurate and current data.

- Tax Preparation SoftwareIntegration with tax preparation software streamlines the tax filing process. Relevant financial data from the template, such as income, expenses, and investment gains or losses, can be directly imported into tax software, reducing manual data entry and minimizing the risk of errors. This integration simplifies tax preparation and ensures consistency between financial records and tax filings. For example, deductible expenses tracked within the template can be easily transferred to the tax software, maximizing deductions and simplifying the tax filing process.

- Financial Planning ToolsConnecting the template with financial planning tools provides a holistic view of financial health. Data from the template can inform financial projections, retirement planning scenarios, and other long-term financial goals. This integration empowers informed financial planning and facilitates more effective goal setting. For instance, current asset and liability data from the template can be used to project future net worth under various scenarios, aiding in retirement planning and other long-term financial decisions.

By leveraging these integration capabilities, a personal financial statement template transcends its role as a static document and becomes a dynamic component of a comprehensive financial management strategy. This interconnectedness empowers users to harness the full potential of their financial data, facilitating more informed decisions, improved financial control, and enhanced progress toward financial goals. The seamless flow of information between various financial tools fosters a more comprehensive and efficient approach to managing personal finances.

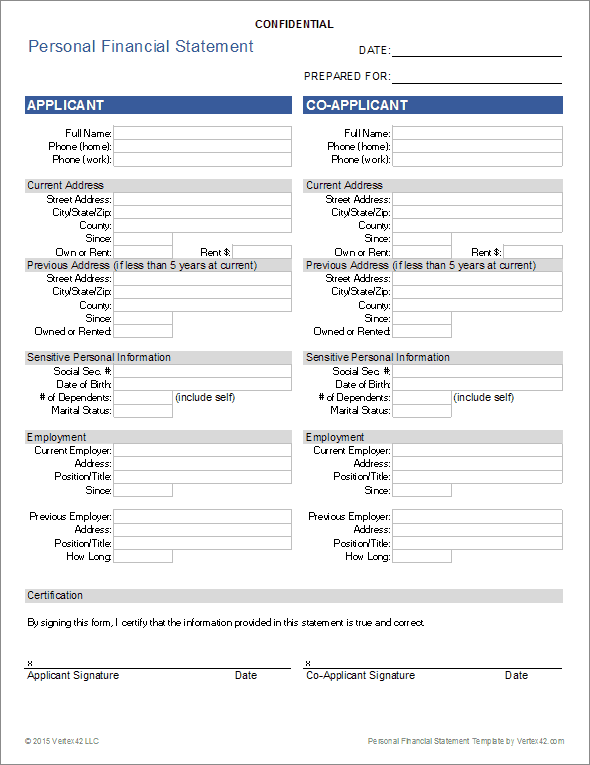

Key Components of a Personal Financial Statement Template

A well-structured personal financial statement template provides a comprehensive overview of an individual’s financial position. Several key components ensure the template’s effectiveness in capturing, organizing, and analyzing financial data.

1. Assets: This section details everything an individual owns with monetary value. Categorization typically includes liquid assets (cash, checking/savings accounts), investments (stocks, bonds, mutual funds), and fixed assets (real estate, vehicles). Accurate valuation is crucial for a realistic net worth calculation. For example, real estate should be listed at its current market value, not the original purchase price.

2. Liabilities: This section outlines all outstanding debts and financial obligations. Common categories include secured debt (mortgages, auto loans), unsecured debt (credit card balances, personal loans), and other liabilities (taxes owed, outstanding medical bills). Accurate reporting of outstanding balances and interest rates is crucial for debt management planning.

3. Net Worth: This crucial component represents the difference between total assets and total liabilities. A positive net worth signifies assets exceed liabilities, while a negative net worth indicates the opposite. Net worth serves as a key indicator of financial health and progress over time.

4. Income: This section documents all sources of income, including salaries, wages, investment income (dividends, interest), rental income, and any other recurring income streams. Accurate income reporting is fundamental for budgeting and financial forecasting.

5. Expenses: This component details all expenditures, categorized for analysis. Typical categories include housing, transportation, food, utilities, healthcare, and debt payments. Detailed expense tracking provides insights into spending patterns and identifies areas for potential savings.

6. Financial Goals: While not always included directly within the template itself, a section for outlining short-term and long-term financial goals is essential. This clarifies the purpose of financial tracking and provides direction for decision-making. Examples include saving for a down payment, retirement planning, or paying off debt.

Accurate and consistent data entry across these interconnected components provides a clear, actionable snapshot of one’s financial standing, supporting informed financial planning, decision-making, and progress toward financial goals. Regular updates and analysis of these components contribute to long-term financial well-being.

How to Create a Personal Financial Statement in Microsoft Excel

Creating a personal financial statement in Microsoft Excel provides a structured approach to organizing and analyzing financial data. The following steps outline the process of building a comprehensive template.

1. Open a New Workbook: Begin by opening a new Excel workbook. This provides a blank canvas for creating the financial statement template.

2. Create Worksheet Tabs: Create separate worksheets within the workbook for different aspects of the financial statement. Recommended tabs include “Assets,” “Liabilities,” “Income,” “Expenses,” and “Net Worth.” This organization enhances clarity and navigation.

3. Structure the “Assets” Worksheet: Within the “Assets” worksheet, create columns for “Asset Name,” “Asset Type” (e.g., Liquid, Investment, Fixed), and “Current Value.” List all assets and their corresponding values. Utilize Excel formulas for automatic summation of asset values.

4. Structure the “Liabilities” Worksheet: In the “Liabilities” worksheet, create columns for “Liability Name,” “Liability Type” (e.g., Secured, Unsecured), and “Outstanding Balance.” List all liabilities and their respective balances. Employ formulas to calculate total liabilities.

5. Structure the “Income” Worksheet: The “Income” worksheet should contain columns for “Income Source” and “Amount.” List all income sources and their corresponding amounts. Utilize formulas to calculate total income.

6. Structure the “Expenses” Worksheet: Within the “Expenses” worksheet, create columns for “Expense Category” and “Amount.” Categorize and list all expenses. Implement formulas to calculate total expenses.

7. Calculate Net Worth: In the “Net Worth” worksheet, create a formula to calculate net worth by subtracting total liabilities (from the “Liabilities” worksheet) from total assets (from the “Assets” worksheet). This provides a dynamic net worth calculation that updates automatically as asset and liability values change.

8. Incorporate Formatting and Charts: Apply formatting for enhanced readability. Utilize Excel’s charting capabilities to visually represent data, providing insights into spending patterns, asset allocation, and net worth trends. Conditional formatting can highlight key data points.

Regularly updating and analyzing this structured template fosters informed financial decision-making, promotes financial awareness, and supports long-term financial well-being. The use of formulas and visual aids transforms a static spreadsheet into a dynamic tool for managing personal finances effectively.

A Microsoft Excel-based personal financial statement template provides a structured framework for organizing and analyzing financial data. Key benefits include accessibility across devices, customization options for individual needs, a comprehensive structure encompassing all aspects of personal finance, automated calculations for accuracy and efficiency, robust data security measures to protect sensitive information, and integration potential with other financial management tools. Utilizing such a template empowers informed financial decision-making through clear visualization of assets, liabilities, income, and expenses, culminating in a dynamic net worth calculation.

Effective financial management requires consistent monitoring, analysis, and adaptation. A personal financial statement template serves as a valuable tool in this ongoing process, providing the insights necessary for proactive financial planning and informed decisions. Regular engagement with this tool fosters greater financial awareness and contributes significantly to achieving long-term financial well-being and stability.