Navigating the world of business expenses can sometimes feel like a maze, especially when it comes to mileage. Whether you’re a freelancer, a small business owner, or an employee who frequently travels for work, accurately tracking and claiming your travel costs is crucial. It ensures you’re properly reimbursed for your efforts and that your records are pristine for tax purposes. Without a clear system, reconciling those countless trips to client meetings, conferences, or supplier visits can quickly become a tedious and error-prone task.

That’s where a reliable system comes in handy. Imagine a world where every mile driven for business is easily documented, calculated, and submitted without a hitch. This isn’t just a pipe dream; it’s a reality made possible by structured tools designed to simplify your financial life. We’re talking about something that takes the headache out of expense reporting, providing a clear pathway for legitimate claims.

Why a Mileage Expenses Claim Form Template is Your New Best Friend

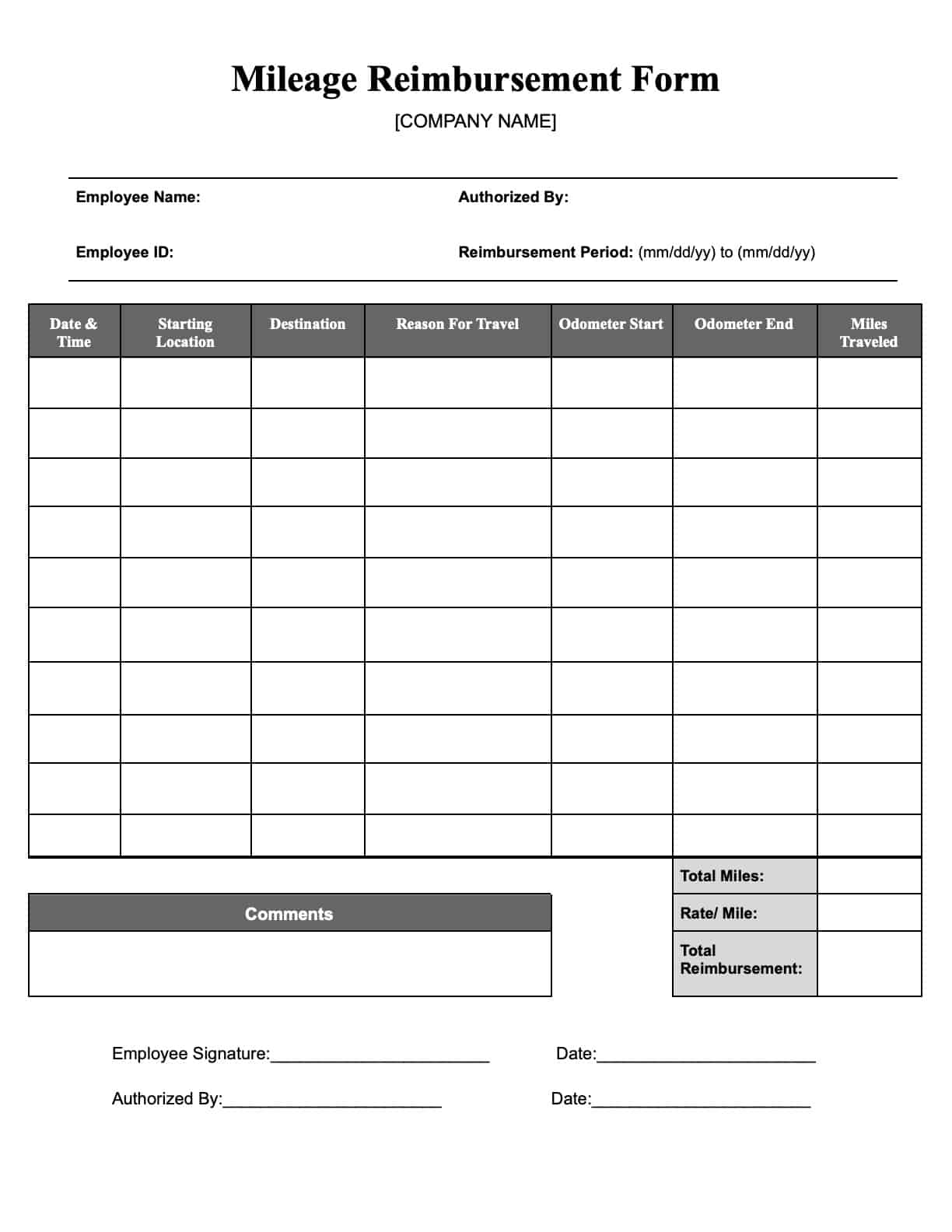

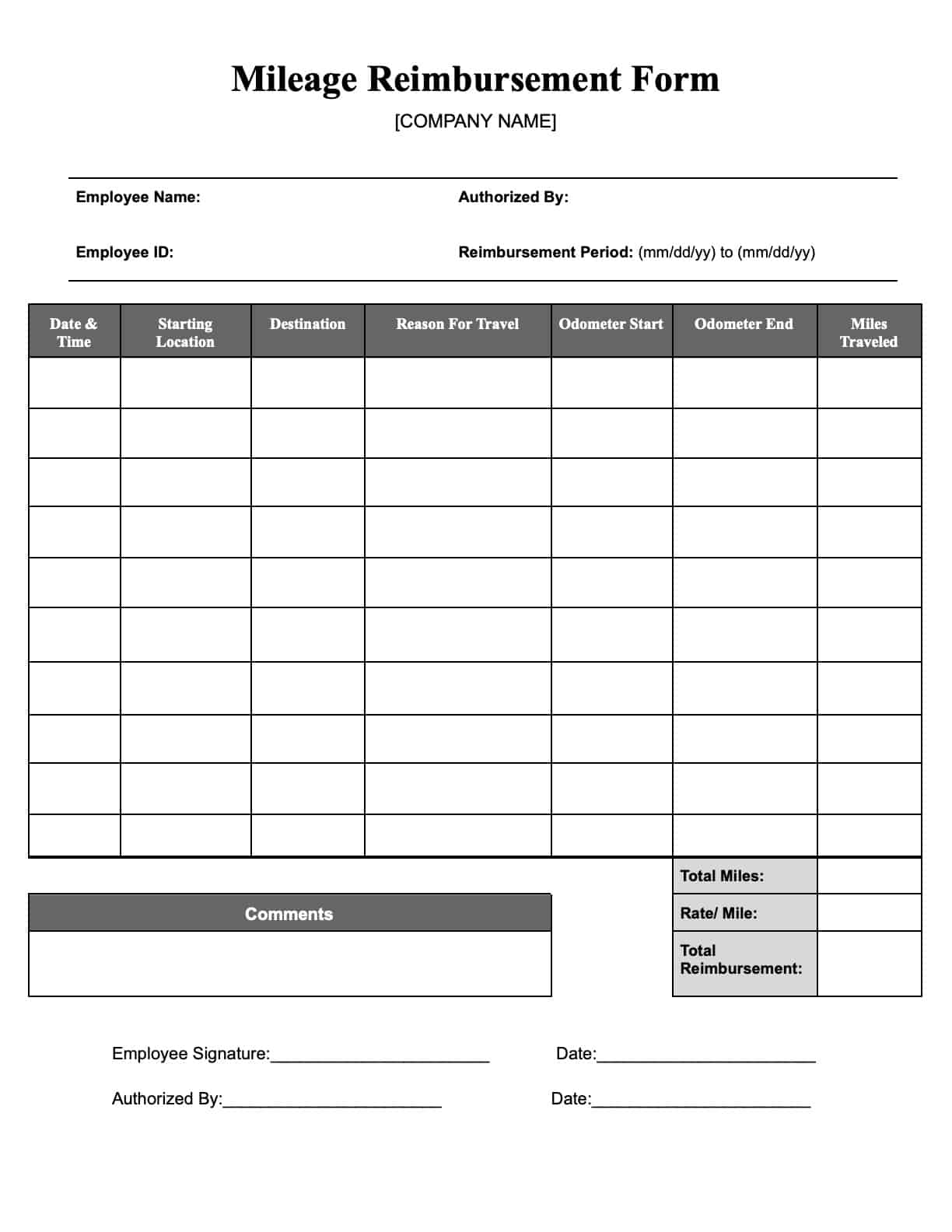

If you’ve ever stared at a blank spreadsheet trying to recall every business trip you took last month, you know the frustration. A dedicated mileage expenses claim form template eliminates this guesswork entirely. It provides a structured format, prompting you for all the necessary details, ensuring nothing important is overlooked. This not only speeds up the reimbursement process for you but also makes it significantly easier for your employer or accountant to review and approve claims. It’s like having a personal assistant dedicated to tracking your vehicle’s business journeys.

Beyond just convenience, using a standardized template helps maintain consistency across all claims, which is vital for compliance and auditing. When every employee uses the same format, it streamlines the internal accounting process, reducing errors and potential disputes. This level of organization is invaluable, particularly for businesses that handle a high volume of expense reports. It fosters transparency and ensures that company policies regarding mileage reimbursement are uniformly applied.

Moreover, a well-designed template acts as a comprehensive record-keeping tool. It provides a clear paper trail (or digital trail) of all your business travel, which is indispensable when it comes to tax season. The tax authorities often require detailed logs to substantiate mileage deductions, and a pre-formatted form ensures you have all the necessary information readily available. This proactive approach saves you from scrambling to gather data months after the fact, making tax preparation far less stressful.

Ultimately, adopting a mileage expenses claim form template is a smart move for anyone looking to simplify their financial administration. It empowers employees to easily claim what they’re owed and provides businesses with a robust system for managing travel expenditures efficiently and compliantly. It’s a win-win situation, fostering accurate records and timely reimbursements for everyone involved.

Key Elements to Look For in a Mileage Expenses Claim Form Template

When choosing or creating your template, ensure it includes fields for all critical information. A comprehensive template typically features:

- Date of Travel

- Start and End Locations (including specific addresses or recognizable landmarks)

- Purpose of Trip (e.g., Client meeting, Conference, Supplier visit)

- Starting Odometer Reading

- Ending Odometer Reading

- Total Miles Driven for Business

- Applicable Reimbursement Rate per Mile

- Calculated Reimbursement Amount

- Space for Employee Signature

- Space for Approver Signature

- Any specific project or department codes

Streamlining Your Reimbursement Process with a Solid Template

Implementing a robust mileage expenses claim form template isn’t just about filling in boxes; it’s about creating an efficient, repeatable process. Once you have a clear template, the actual task of completing your claims becomes incredibly straightforward. Imagine finishing a business trip, pulling out your pre-formatted form, and quickly jotting down the details of your travel. This efficiency means you’re more likely to submit claims promptly, avoiding the backlog of expenses that can accumulate and become overwhelming.

One of the biggest advantages of a well-structured template is its ability to minimize common errors. Without prompts, it’s easy to forget crucial details like the exact purpose of a trip or to miscalculate the total mileage. A template guides you through each necessary piece of information, ensuring accuracy from the get-go. This precision translates directly into faster approval times and fewer queries from your accounting department, making the entire reimbursement cycle much smoother for everyone involved.

Furthermore, a consistent template reinforces company policies regarding mileage claims. If your organization has specific rules about what can be claimed, at what rate, or what documentation is required, the template can be designed to incorporate these nuances. This proactive approach helps employees adhere to guidelines, reducing the need for corrections or rejections of claims. It promotes a culture of accountability and clarity in financial reporting within the company.

Using a template also provides an excellent basis for digital integration. Many businesses are moving towards digital expense management systems. A well-designed mileage expenses claim form template, whether initially paper-based or digital, can easily be adapted into various software solutions, making the transition seamless. This forward-thinking approach ensures that your expense reporting remains adaptable and scalable as your business grows or adopts new technologies.

The right tools can significantly simplify what often seems like a complex administrative task. By adopting a systematic approach to tracking and claiming travel costs, individuals and businesses can ensure accuracy, compliance, and efficiency. It means less time spent on paperwork and more time focusing on what truly matters: driving success.

Embracing a clear, user-friendly form for your travel costs empowers you to manage your financial obligations with ease and confidence. It transforms a potentially daunting process into a streamlined operation, ensuring every mile driven for business is properly accounted for, and everyone involved benefits from crystal-clear records.