Navigating the world of fuel tax compliance can feel like a winding road, especially for truckers and motor carriers operating across state lines. The International Fuel Tax Agreement, or IFTA, is designed to simplify reporting and payment of fuel taxes, but for many, the actual process of gathering data and filling out forms remains a significant hurdle. Whether you’re a small independent operator or managing a fleet, keeping accurate records is not just good practice, it’s a legal requirement that can save you from costly audits and penalties.

While digital solutions are increasingly popular, many still prefer the tangible nature of a paper system. There’s something inherently reliable about having physical records, neatly organized and readily accessible. For those operating out of the Show-Me State, having a dedicated missouri paper form template ifta can be incredibly beneficial, streamlining what can often feel like a tedious quarterly task into a much more manageable process. Let’s explore why these templates are so valuable and how they can simplify your fuel tax reporting.

Understanding IFTA and Its Paperwork Demands

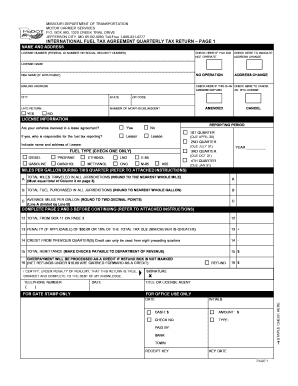

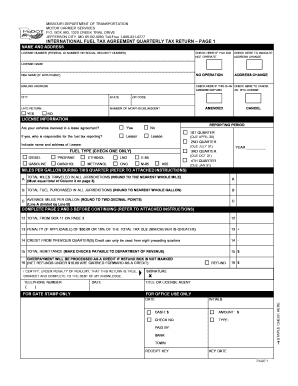

IFTA is essentially a cooperative agreement among U.S. states and Canadian provinces, simplifying the reporting of fuel used by interstate motor carriers. Instead of filing separate fuel tax reports with each jurisdiction you travel through, IFTA allows you to file a single quarterly report with your base state, which then distributes the taxes to the other jurisdictions on your behalf. This system is a huge convenience, but it hinges entirely on accurate and meticulous record-keeping. Every gallon of fuel purchased and every mile driven in each jurisdiction needs to be accounted for.

The challenges often arise in the day-to-day tracking. When you’re focused on making deliveries and navigating routes, remembering to log every fuel stop and odometer reading can be easily overlooked. This is where a structured approach becomes indispensable. Many carriers find that a well-designed paper form helps them capture this critical information consistently. It acts as a constant reminder and provides a clear framework for recording data as it happens, rather than trying to recall details weeks later.

A typical IFTA report requires a breakdown of miles traveled in each jurisdiction, along with the total fuel purchased in each. This means you need to track your routes carefully and ensure all fuel receipts are kept safe. Trying to piece this together from disparate notes or a pile of loose receipts at the end of a quarter can be a nightmare. A paper template provides dedicated spaces for all the necessary data points, ensuring nothing important is missed. It’s about turning a complex task into a routine checklist.

Key Information to Track for Your IFTA Report

- Date of Trip: When the travel occurred.

- Origin and Destination: The start and end points of each trip segment.

- Total Miles Traveled: Odometer readings at the beginning and end of each trip.

- Miles per Jurisdiction: Breakdown of miles driven in each state or province.

- Fuel Purchases: Date, location (city/state), gallons, and fuel type.

- Vendor Name: Where the fuel was purchased.

- Vehicle Number: Which truck was used for the trip.

Having a systematic way to record these details is paramount. Whether you prefer a physical logbook or a stack of printed sheets, the key is consistency. Many find that a physical log, updated daily or per trip, offers a reliable backup even if they also use digital methods. It’s about creating a habit that supports compliance and reduces stress when tax time rolls around.

Navigating Missouri-Specific IFTA Filing with Templates

For those based in Missouri, understanding the nuances of your base state’s IFTA requirements is crucial. While IFTA is an international agreement, the administration and specific forms often vary slightly from state to state. Missouri, like other jurisdictions, has its own processes for how they prefer the data presented, even if the core information required remains consistent. This is where a specialized missouri paper form template ifta can be a game-changer, acting as a tailored tool designed to align perfectly with the state’s expectations.

Imagine a template that not only prompts you for all the generic IFTA data but also includes specific columns or sections that align with Missouri’s particular reporting layout. This can significantly reduce the chances of errors or omissions that might lead to delays or requests for additional information from the Department of Revenue. Such a template isn’t just a blank sheet; it’s a structured guide that walks you through each piece of information needed for accurate quarterly filing.

Finding or creating the right template might involve looking at official Missouri Department of Revenue resources, or utilizing commercial templates designed with state-specific considerations in mind. The goal is to have a consistent document you can rely on every day, every trip, to capture the necessary fuel and mileage data. This consistency is your best friend when it comes to compiling your quarterly IFTA return, making the transition from daily logs to final report as smooth as possible.

Beyond just recording, these templates also encourage good organizational habits. By having dedicated forms, you can easily file them away, ensuring that when an auditor comes knocking, all your records are neatly organized and accessible. This level of preparedness not only speeds up the audit process but also demonstrates your commitment to compliance, which can often lead to a smoother experience overall. It’s about building a robust system that supports your business long-term.

Ultimately, managing your IFTA obligations doesn’t have to be a source of constant dread. By adopting a systematic approach, especially with the aid of a well-designed paper form template, you can transform a complex task into a manageable routine. Whether you’re recording fuel purchases at a truck stop or logging miles on the open road, having a clear and consistent method for data capture is your strongest asset against compliance headaches.

Embracing a structured paper system provides a tangible record that complements any digital tools you might use, offering peace of mind and ensuring that all necessary information is at your fingertips when quarterly reporting deadlines approach. It’s about empowering yourself with the right tools to maintain accurate records, satisfy regulatory requirements, and keep your wheels turning smoothly down the highway of business.