For any business, big or small, keeping a sharp eye on finances is absolutely crucial. You might be tracking sales, managing expenses, and sending invoices, but there’s one foundational task that ties it all together: bank reconciliation. It’s not just about making sure your bank account matches your internal records; it’s about safeguarding your assets, catching errors, and gaining a clear picture of your cash flow. Think of it as a vital health check for your financial operations, ensuring everything is aligned and accurate.

However, for many busy entrepreneurs and finance managers, the process can feel like a daunting chore. Sifting through statements, identifying discrepancies, and meticulously adjusting records can be time-consuming and prone to human error. This is precisely where a well-designed monthly bank reconciliation business form template comes into play, transforming a complex task into a streamlined, manageable, and highly effective routine. It provides the structure and clarity needed to make this essential financial practice straightforward and efficient.

Why Your Business Needs a Solid Monthly Bank Reconciliation Process

Bank reconciliation isn’t merely an accounting exercise; it’s a critical component of robust financial management. Regularly comparing your internal cash records with your bank statements helps you uncover discrepancies that could signal anything from simple data entry mistakes to more serious issues like unauthorized transactions. Without a consistent reconciliation process, you might be operating with an inaccurate understanding of your true cash position, which can lead to poor decision-making or missed opportunities.

Beyond just balancing the books, timely reconciliation acts as an internal control mechanism. It helps in the early detection of fraud, whether internal or external, by highlighting suspicious withdrawals or deposits that don’t match your records. Moreover, it allows you to identify bank errors, ensuring you’re not overcharged for fees or missing out on earned interest. This proactive approach protects your financial health and provides an added layer of security to your monetary assets.

Key Benefits of Regular Reconciliation

-

Accuracy in Financial Reporting: Ensures your cash balance on your balance sheet is precise, leading to more reliable financial statements.

-

Fraud and Error Prevention: Helps to quickly identify and rectify unauthorized transactions, incorrect charges, or deposits, protecting your business from financial loss.

-

Improved Cash Flow Insights: Provides a clearer understanding of when money is truly available, aiding in better financial planning and operational decisions.

-

Audit Readiness: Keeps your records neat and organized, making annual audits or financial reviews a much smoother and less stressful experience.

Implementing a structured approach to this task, particularly through the use of a standardized template, removes the guesswork and ensures every crucial step is followed. It creates a consistent workflow that can be easily adopted by anyone in your finance team, minimizing training time and maximizing efficiency. This consistency is key for maintaining high standards of financial integrity month after month.

Ultimately, a solid monthly bank reconciliation process provides peace of mind. Knowing that your cash balances are accurate and that your financial records reflect reality allows you to focus on growing your business with confidence. It transforms a potentially overwhelming task into a clear, methodical procedure that contributes significantly to the overall stability and success of your enterprise.

What to Look for in an Effective Bank Reconciliation Template

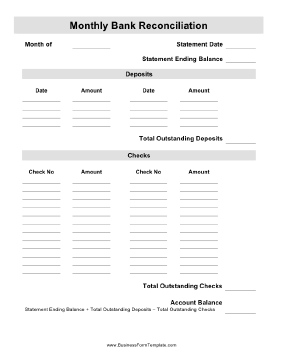

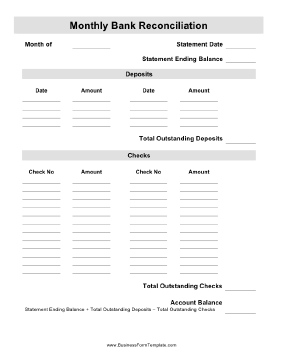

When you’re searching for a monthly bank reconciliation business form template, you want more than just a blank sheet; you need a tool that guides you through the process, making it intuitive and comprehensive. A truly effective template should break down the reconciliation into logical steps, ensuring that no detail is overlooked. It needs to be flexible enough to accommodate various types of transactions while maintaining a clear, organized layout that promotes accuracy.

The core of a good template lies in its ability to clearly separate and track the different elements that cause discrepancies between your book balance and your bank statement balance. This includes items that have been recorded by the bank but not yet by your business, and vice-versa. Having dedicated sections for each type of adjustment ensures a systematic approach, reducing the likelihood of errors and speeding up the identification of mismatched amounts.

-

Bank Statement Balance Section: A clear spot to enter the ending balance from your bank statement.

-

Additions to Bank Balance: Space for deposits in transit, which are deposits you’ve recorded but the bank hasn’t yet processed.

-

Deductions from Bank Balance: Areas for outstanding checks, which are checks you’ve written but the bank hasn’t yet cleared.

-

Book Balance Section: Where you input the ending balance from your internal cash ledger or accounting software.

-

Additions to Book Balance: For items the bank has added that you haven’t yet recorded, such as interest earned or bank collections.

-

Deductions from Book Balance: For items the bank has deducted that you haven’t yet recorded, like bank service charges, NSF checks, or automatic payments.

-

Error Correction Section: A dedicated space to note and correct any errors found in either your books or the bank statement.

-

Reconciled Balance Section: The crucial part where the adjusted bank balance should perfectly match the adjusted book balance.

-

Date and Preparer Fields: Essential for tracking when the reconciliation was performed and by whom, ensuring accountability.

Look for a template that is straightforward to use, even if you’re not an accounting expert. It should be easily adaptable, whether you prefer to fill it out digitally or print it for manual entry. The best templates offer a balance of structure and simplicity, guiding you through the reconciliation process without overwhelming you with unnecessary complexities. A clean, uncluttered design significantly contributes to ease of use and reduces the chances of misinterpretation.

Consistency is key for any ongoing financial task. A well-designed monthly bank reconciliation business form template ensures that the same procedure is followed every time, making it easier to spot trends, anomalies, and maintain a high level of accuracy over the long term. It becomes a reliable part of your monthly financial close, empowering your business with accurate, real-time financial data for informed decision-making.

By investing a little time upfront in selecting or customizing the right template, you’ll save countless hours down the line. It transforms bank reconciliation from a chore into a seamless, productive activity, contributing directly to the robust financial health and operational efficiency of your business. This simple tool becomes a powerful asset in maintaining precise financial records and fostering trust in your numbers.