Ever feel like your money disappears without a trace each month? You’re not alone. Many of us struggle to keep tabs on where our hard-earned cash goes, leading to financial stress and uncertainty. Understanding your financial flow is the first crucial step towards achieving your money goals, whether that’s saving for a down payment, paying off debt, or simply having peace of mind.

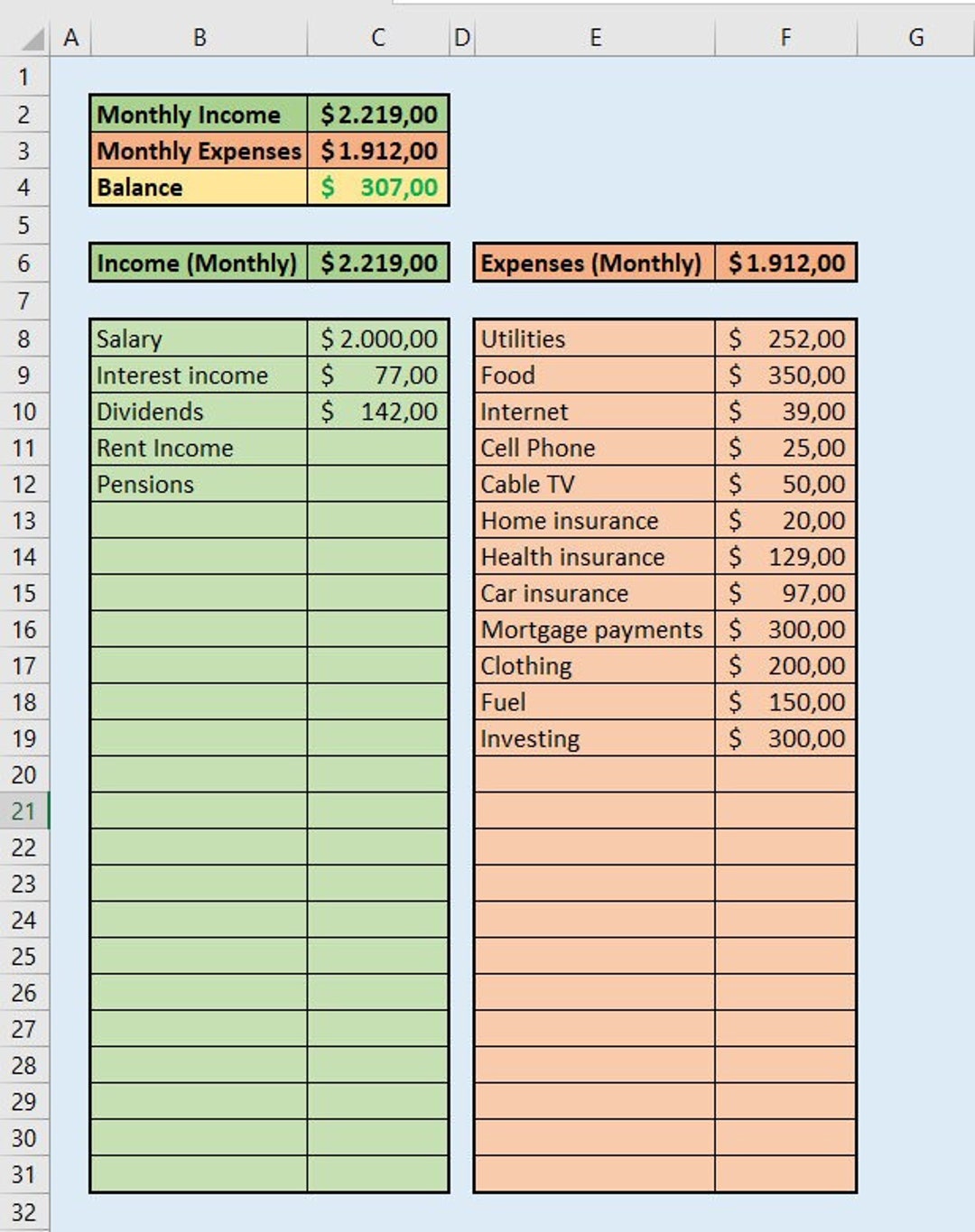

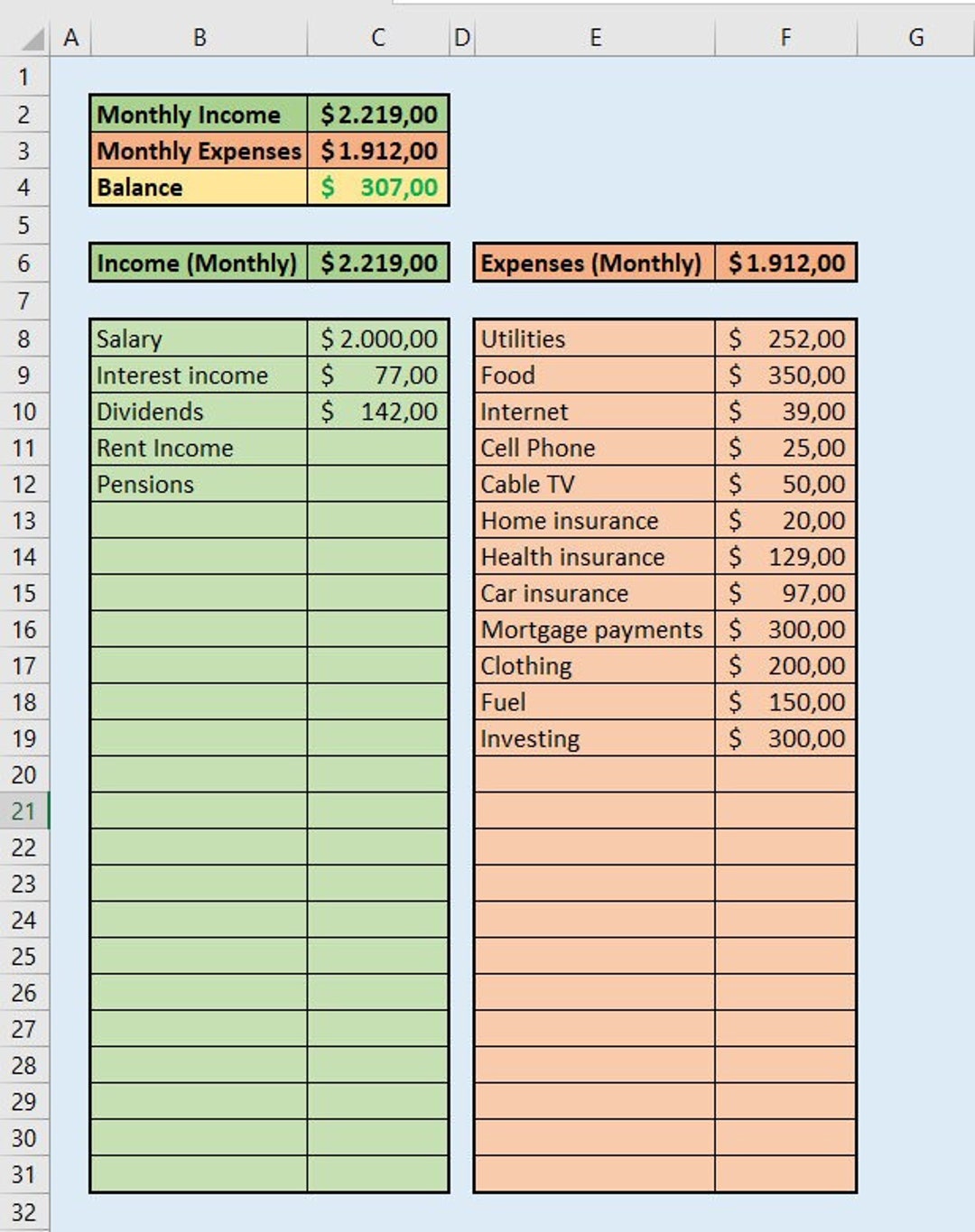

This is where a practical tool like a monthly income and expense form template becomes incredibly valuable. It provides a clear, organized snapshot of your financial life, empowering you to make informed decisions and take control. Think of it as your personal financial compass, guiding you towards a healthier money mindset and smarter spending habits.

The Power of a Monthly Income and Expense Form

Understanding your financial position starts with knowing what comes in and what goes out. A comprehensive monthly income and expense form acts as your central command center for this vital information. It helps you categorize every penny, moving you from guesswork to absolute clarity. Without this foundational knowledge, it’s virtually impossible to create a realistic budget, identify areas for savings, or plan for future financial milestones.

Many people find the idea of tracking their finances overwhelming, imagining complicated spreadsheets or cumbersome apps. However, a well-designed template simplifies this process immensely. It provides a structured framework, prompting you to fill in the blanks rather than starting from scratch. This ease of use encourages consistency, which is key to long-term financial awareness. Instead of dreading the task, you’ll find yourself looking forward to the insights it provides.

The benefits extend far beyond simple tracking. By consistently using a monthly income and expense form, you gain invaluable insights into your spending habits. You might discover hidden subscriptions, realize how much you’re spending on dining out, or identify areas where you can comfortably cut back without sacrificing your quality of life. This newfound awareness is the bedrock for effective budgeting and smart financial planning, allowing you to allocate funds more intentionally towards your goals.

Key Elements You’ll Find

A robust monthly income and expense form template typically breaks down your finances into two main sections: income and expenses. The income section captures all the money flowing into your household or personal accounts. This can be more diverse than just your primary paycheck.

- Salaries and wages

- Freelance income or side hustle earnings

- Investment dividends or interest

- Rental income

- Alimony or child support

- Pension or retirement distributions

On the other side, the expense section is usually much more detailed, encompassing every outflow of cash. These are often categorized to help you quickly identify where your money is going. Common categories include fixed expenses, which are usually the same each month, and variable expenses, which fluctuate.

- Housing (rent or mortgage, property taxes, home insurance)

- Utilities (electricity, water, gas, internet)

- Transportation (car payments, fuel, public transport, maintenance)

- Food (groceries, dining out, coffee runs)

- Debt Payments (credit cards, personal loans, student loans)

- Insurance (health, life, car)

- Personal Care (haircuts, toiletries, gym memberships)

- Entertainment and Leisure (movies, hobbies, subscriptions)

- Savings and Investments

- Miscellaneous and unexpected costs

Beyond Tracking: Making Your Template Work for You

While merely filling out your monthly income and expense form is a great start, the real magic happens when you move beyond just recording data to actively analyzing it. This template isn’t just a ledger; it’s a diagnostic tool. Once you’ve diligently logged all your income and expenses for a month or two, take the time to review the complete picture. Look for trends, surprises, and patterns that emerge. Are there specific categories where you consistently overspend? Are you underestimating certain variable costs?

Consistency is paramount for the template to truly serve its purpose. Make it a routine to update your form regularly, whether it’s daily, weekly, or bi-weekly. Waiting until the end of the month can make the task feel daunting and increase the chances of forgetting small, yet significant, transactions. Many find that setting aside 15-30 minutes once a week to gather receipts and update their form keeps the process manageable and accurate.

Identifying your spending patterns is a powerful step towards financial empowerment. Perhaps you realize that your daily coffee habit adds up to a significant sum over the month, or that you’re paying for streaming services you rarely use. This direct feedback from your own financial data allows you to make conscious choices about where your money goes. It’s not about deprivation, but about intentional allocation, ensuring your spending aligns with your values and financial goals.

Ultimately, a well-maintained monthly income and expense form template transforms financial management from a chore into an empowering habit. It provides the necessary data for creating a realistic and effective budget, highlighting areas where you can save, and even revealing opportunities for increasing income. By consistently engaging with your financial information, you transition from passively spending to actively directing your money, setting yourself on a solid path towards financial stability and achieving your long-term aspirations.

- Automate income entries and recurring bills where possible to save time.

- Categorize every expense, even small ones, to ensure accuracy.

- Review your completed form at the end of each month to analyze spending.

- Use the insights gained to adjust your budget for the following month.

- Don’t be afraid to experiment with different categories until you find what works best for your situation.

- Set realistic savings goals based on your income and expense data.

Taking control of your finances might seem like a complex endeavor, but with the right tools, it becomes an achievable and rewarding process. A clear understanding of your income and expenses lays the groundwork for making smarter financial decisions, reducing stress, and building a secure future. It’s about building awareness, one transaction at a time.

Embracing the habit of tracking your money is an investment in your financial well-being. By consistently monitoring where your money comes from and where it goes, you empower yourself to live within your means, save effectively, and confidently pursue your financial dreams. Start today and experience the clarity and control that comes with true financial insight.