Regularly generating these statements allows businesses to track performance against budget, identify areas for improvement, and make informed decisions. This frequency enables proactive management of finances, facilitating timely adjustments to strategies and operations. The insights derived can be crucial for securing funding, attracting investors, and fostering sustainable growth. Moreover, consistent monthly reporting builds a valuable historical record, useful for analyzing long-term trends and making future projections.

The following sections will delve deeper into the specific components of these statements, offering practical guidance on their creation and interpretation. Further exploration will highlight best practices and common pitfalls to avoid, equipping readers with the knowledge to effectively utilize this essential financial tool.

1. Standardized Format

A standardized format is crucial for a monthly profit and loss statement template. Consistency in presentation allows for accurate tracking of financial performance over time and facilitates meaningful comparisons across different reporting periods. A standardized structure ensures all essential data points, such as revenue, cost of goods sold, and operating expenses, are consistently categorized and presented. This eliminates ambiguity and allows for reliable trend analysis. For example, comparing marketing expenses across multiple months requires consistent categorization within the template.

Without a standardized format, analyzing trends and identifying anomalies becomes significantly more challenging. Variability in data presentation can obscure underlying performance issues and lead to inaccurate conclusions. Consider a scenario where operating expenses are categorized differently each month. This inconsistency makes it difficult to identify specific areas where costs are increasing or decreasing, hindering effective cost management. A standardized template provides the framework for accurate and reliable performance evaluation, supporting data-driven decision-making.

Standardization ensures the reliability and comparability of financial data, crucial for informed decision-making. A well-designed template allows stakeholders to quickly grasp the financial health of the organization and track key metrics over time. While specific needs may vary, adhering to a consistent structure ensures the integrity of the financial narrative, supporting strategic planning and operational adjustments. Challenges may arise in adapting a standardized template to unique business models, but the benefits of comparability and analytical clarity outweigh the initial implementation effort.

2. Key Performance Indicators (KPIs)

Key performance indicators (KPIs) are essential metrics derived from the monthly profit and loss statement that provide insights into a company’s financial health and operational efficiency. These indicators offer a quantifiable measure of progress towards strategic objectives and serve as a basis for data-driven decision-making. A well-chosen set of KPIs, integrated into the monthly statement template, allows for effective performance monitoring and identification of areas needing attention. For example, tracking gross profit margin reveals pricing effectiveness and production efficiency, while monitoring operating expense ratios highlights areas of potential cost optimization.

The selection of relevant KPIs depends on the specific industry and business goals. Common KPIs include gross profit margin, net profit margin, operating expense ratio, and revenue growth rate. Calculating these metrics from the monthly profit and loss statement allows for trend analysis and identification of potential issues. For instance, a consistently declining net profit margin, despite increasing revenue, could indicate rising costs or inefficient spending. This insight prompts further investigation and corrective action. Regular monitoring of KPIs enables proactive management and facilitates timely adjustments to strategy and operations.

Effective utilization of KPIs requires careful selection and consistent tracking within the monthly profit and loss statement template. These indicators provide a concise summary of financial performance, enabling stakeholders to quickly assess progress and identify areas requiring intervention. Challenges may arise in selecting the most relevant KPIs and interpreting their fluctuations. However, the insights gained from consistent monitoring and analysis are crucial for driving operational efficiency and achieving strategic financial goals.

3. Regular Monthly Tracking

Regular monthly tracking forms the cornerstone of effective utilization of a monthly profit and loss statement template. The template provides the structure, but consistent, monthly updates bring it to life, transforming static data into a dynamic tool for financial management. This regular cadence allows businesses to monitor performance trends, identify emerging issues, and react proactively to changing market conditions. Without consistent updates, the template remains a static document, failing to deliver its full potential for financial insight. For example, a business experiencing a sudden drop in sales can quickly pinpoint the decline through monthly tracking and investigate the underlying causes, whether related to seasonality, market competition, or internal operational issues. This timely identification enables prompt corrective action, mitigating potential losses.

The benefits of regular monthly tracking extend beyond immediate problem-solving. Consistent data accumulation builds a valuable historical record, enabling trend analysis and informed forecasting. This historical context informs strategic planning, resource allocation, and investment decisions. For instance, consistent monthly data reveals seasonal sales patterns, allowing businesses to optimize inventory management and marketing campaigns. Furthermore, regular tracking facilitates performance benchmarking against previous periods and industry averages, providing a clear picture of competitive positioning and areas for improvement. This data-driven approach empowers businesses to make informed decisions based on concrete evidence rather than speculation.

Regular monthly tracking, therefore, is not merely a procedural task but an integral component of leveraging the full power of a monthly profit and loss statement template. It transforms a static report into a dynamic management tool, enabling proactive responses to changing business dynamics, informed strategic planning, and sustainable growth. While maintaining this regularity requires dedicated effort and discipline, the insights gained are invaluable for long-term financial health and success. The potential challenges of data entry and analysis are outweighed by the significant benefits of timely identification of trends and potential issues, enabling informed, proactive decision-making.

4. Comparative Analysis

Comparative analysis is essential for extracting meaningful insights from monthly profit and loss statement templates. It provides context, revealing trends, and highlighting performance deviations that might otherwise go unnoticed. By comparing current performance against various benchmarks, businesses gain a deeper understanding of their financial health and operational efficiency. This understanding is crucial for informed decision-making and strategic planning.

- Prior Period ComparisonComparing the current month’s performance with the previous month or the same month in the prior year reveals trends and seasonality. For example, a retailer might observe consistently higher sales in December compared to other months, reflecting holiday shopping patterns. Understanding these patterns allows for proactive adjustments to inventory, staffing, and marketing efforts. Significant deviations from established trends warrant further investigation to identify underlying causes and potential corrective actions.

- Budgetary ComparisonComparing actual results against the budgeted figures highlights areas of overspending or underperformance. If actual marketing expenses consistently exceed the budget, it signals a need to review marketing strategies and spending efficiency. Conversely, consistently exceeding revenue targets suggests effective sales strategies and potential opportunities for further growth. Budgetary comparison provides a framework for performance evaluation and resource allocation decisions.

- Competitor AnalysisWhile accessing detailed competitor financials is often challenging, industry benchmarks and publicly available data provide valuable context. Comparing key metrics, such as profit margins and operating expense ratios, against industry averages reveals a company’s competitive positioning. For example, a significantly lower gross profit margin than the industry average might suggest pricing pressures or inefficiencies in the supply chain. This insight prompts further investigation and strategic adjustments to enhance competitiveness.

- Internal Departmental AnalysisComparative analysis can also be applied within an organization to assess the performance of different departments or product lines. Comparing the profitability of different product lines, for example, informs decisions regarding resource allocation and product development. This internal analysis allows for identification of high-performing areas and those requiring improvement, optimizing overall organizational efficiency.

These comparative analyses, facilitated by the consistent structure of monthly profit and loss statement templates, provide a comprehensive view of financial performance. By integrating these comparisons into regular review processes, businesses can identify trends, pinpoint areas for improvement, and make data-driven decisions to enhance profitability and achieve strategic objectives. The insights gained from these comparisons empower proactive management and drive sustainable growth.

5. Informed Decision-Making

Effective financial management hinges on informed decision-making, a process heavily reliant on accurate and timely financial data. Monthly profit and loss statement templates provide a structured framework for capturing this crucial data, enabling stakeholders to gain clear insights into financial performance and make sound strategic choices. Regularly generated statements become powerful tools for evaluating progress, identifying challenges, and making data-driven decisions that optimize resource allocation and drive sustainable growth.

- Resource AllocationUnderstanding where capital is most effectively deployed is paramount. Monthly profit and loss statements reveal which departments, products, or initiatives generate the highest returns and which require further investment or restructuring. For example, consistent profitability in a specific product line might justify increased investment in research and development for that area, while persistent losses in another might necessitate streamlining or discontinuation. These statements provide the necessary data to support such resource allocation decisions, optimizing capital deployment for maximum impact.

- Pricing StrategiesPricing decisions significantly impact profitability. Analyzing gross profit margins on a monthly basis reveals the effectiveness of current pricing strategies. Declining margins might signal the need for price adjustments, while healthy margins provide opportunities to explore competitive pricing adjustments or invest in premium features. The data provided by these statements allows businesses to fine-tune pricing strategies, balancing profitability with market competitiveness.

- Cost ManagementControlling costs is crucial for maintaining profitability. Monthly profit and loss statements provide detailed insights into operating expenses, allowing businesses to identify areas of potential cost optimization. For example, consistently increasing administrative expenses might warrant a review of operational processes and resource utilization. These statements facilitate proactive cost management, ensuring efficient resource utilization and maximizing profitability.

- Investment DecisionsInvestment decisions, whether internal or external, require careful consideration of financial performance. Consistent profitability, demonstrated through monthly profit and loss statements, strengthens applications for external funding and attracts potential investors. Internally, these statements provide the financial justification for investments in new equipment, expansion projects, or employee development initiatives. Data-driven insights from these statements enhance the credibility and effectiveness of investment proposals.

The insights derived from regularly generated monthly profit and loss statements empower stakeholders to make informed decisions across various facets of business operations. From resource allocation and pricing strategies to cost management and investment decisions, these statements provide the crucial data foundation for sound judgment and strategic planning. By incorporating these insights into decision-making processes, businesses enhance their agility, optimize performance, and navigate the complexities of the market with greater confidence and effectiveness. This iterative process of analysis and adjustment, informed by consistent monthly data, drives continuous improvement and sustainable growth.

Key Components of a Monthly Profit and Loss Statement

A comprehensive monthly profit and loss statement provides a detailed overview of financial performance. Several key components contribute to this comprehensive view, each offering unique insights into operational efficiency and profitability.

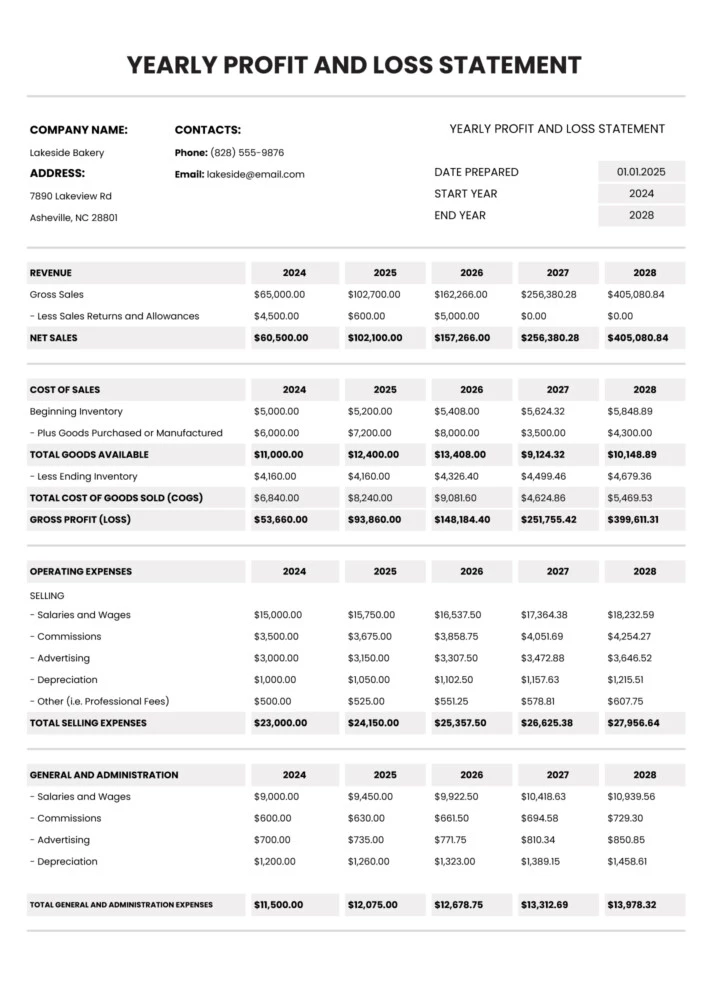

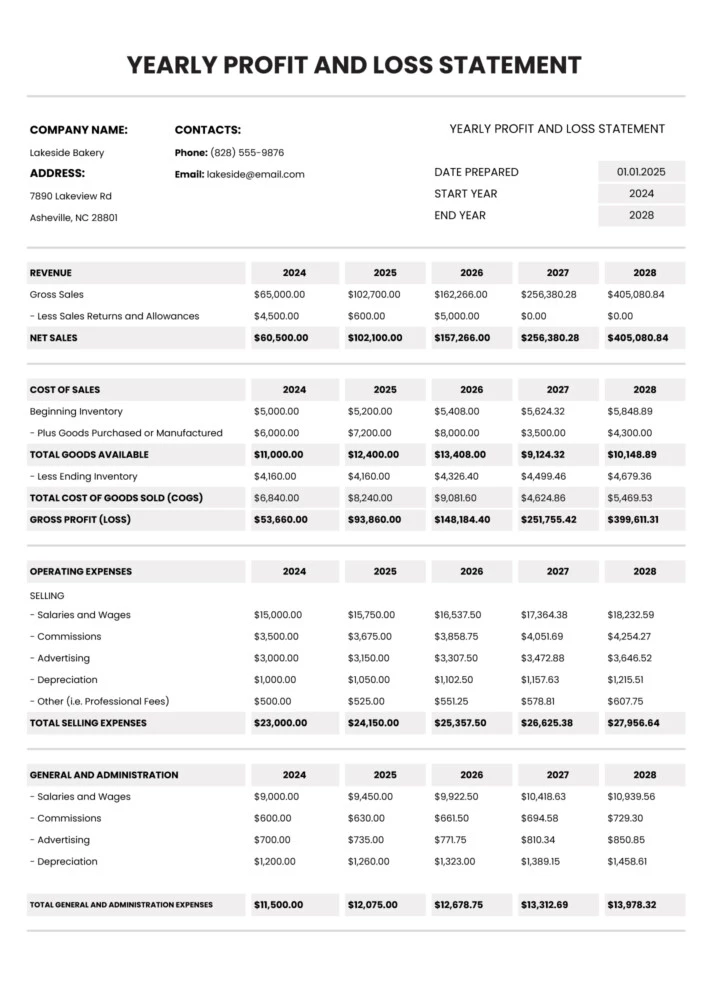

1. Revenue: This section details all income generated from sales of goods or services during the month. It typically includes various revenue streams, broken down for clarity. Accurate revenue recognition is crucial for a reliable financial picture.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold during the month. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit reflects the profitability of core business operations before accounting for operating expenses. Analyzing gross profit trends helps assess pricing strategies and production efficiency.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. Examples include rent, salaries, marketing expenses, and administrative costs. Careful tracking of operating expenses is crucial for cost management.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income represents the profitability of the business after accounting for all operating costs. This metric offers valuable insights into operational efficiency.

6. Other Income/Expenses: This section captures income or expenses not directly related to core business operations, such as interest income, investment gains, or losses. These items are often presented separately to provide a clearer picture of core business profitability.

7. Net Income/Loss: This bottom-line figure represents the overall profit or loss for the month after accounting for all revenues, expenses, and other income/expenses. Net income is a key indicator of financial performance and sustainability.

These interconnected components provide a holistic view of financial performance. Analyzing these elements individually and collectively allows for a thorough understanding of profitability drivers, cost structures, and overall financial health, enabling informed decision-making and strategic planning.

How to Create a Monthly Profit and Loss Statement Template

Creating a robust template ensures consistent tracking and analysis of financial performance. A well-structured template facilitates clear insights, supporting informed decision-making.

1. Define Reporting Periods: Establish a consistent monthly reporting cycle. Clearly define the start and end dates for each reporting period to ensure data accuracy and comparability.

2. Structure Key Components: Organize the template with distinct sections for each key component: Revenue, Cost of Goods Sold (COGS), Gross Profit, Operating Expenses, Operating Income, Other Income/Expenses, and Net Income/Loss. This structured approach ensures clarity and facilitates analysis.

3. Categorize Revenue Streams: Break down revenue into specific categories relevant to the business. This detailed view allows for analysis of individual revenue stream performance and identification of growth opportunities or potential weaknesses.

4. Itemize Operating Expenses: Create a comprehensive list of operating expenses, categorized for effective cost management. Detailed expense tracking allows for identification of areas for potential cost optimization and improved efficiency.

5. Incorporate Formulas for Calculations: Automate calculations within the template using formulas. This ensures accuracy and reduces manual effort in calculating key metrics like gross profit, operating income, and net income. Automated calculations also enhance efficiency when updating the template with new monthly data.

6. Choose Relevant KPIs: Select key performance indicators (KPIs) aligned with business objectives. Incorporate these KPIs into the template to track progress towards strategic goals and identify areas needing attention. Examples include gross profit margin, net profit margin, and operating expense ratio.

7. Design for Clarity and Accessibility: Ensure the template is visually clear, easy to navigate, and accessible to relevant stakeholders. A well-designed template facilitates efficient data entry and analysis, promoting informed decision-making.

8. Regularly Review and Refine: Periodically review the template’s effectiveness and make adjustments as needed. Business needs evolve, so the template should adapt to remain relevant and provide the necessary insights for ongoing financial management.

A well-designed template, consistently applied, provides valuable insights into financial performance, enabling proactive management and informed strategic decision-making. This structured approach to financial reporting fosters operational efficiency and drives sustainable growth.

Profit and loss statement templates, utilized on a monthly basis, provide a crucial tool for financial management. These structured reports offer a detailed overview of revenue, costs, and expenses, culminating in a clear depiction of net income or loss. Regularly generating these statements enables businesses to track performance trends, identify areas for improvement, and make informed decisions regarding resource allocation, pricing strategies, and cost management. Consistent application of these templates, coupled with comparative analysis against prior periods, budgets, and industry benchmarks, empowers data-driven decision-making, fostering operational efficiency and sustainable growth. Furthermore, meticulous attention to key components, such as revenue streams, cost of goods sold, and operating expenses, ensures a comprehensive understanding of financial performance drivers.

Effective financial stewardship necessitates a commitment to consistent and insightful reporting. Leveraging the power of monthly profit and loss statement templates allows organizations to navigate the complexities of the financial landscape with greater clarity and control. Regular review and analysis of these statements are not merely procedural tasks but essential practices for informed decision-making, strategic planning, and long-term financial health. The insights gleaned from these reports provide the foundation for proactive management, enabling businesses to adapt to changing market dynamics, optimize performance, and achieve sustained success.