Regular use of such a form facilitates informed decision-making. It enables businesses to identify trends, manage budgets effectively, and pinpoint areas of inefficiency. This structured financial overview provides valuable insights for stakeholders, investors, and management, supporting strategic planning and operational adjustments. Early detection of potential problems allows for proactive interventions, contributing to long-term stability and profitability.

This understanding of the structure and importance of these financial reports provides a solid foundation for exploring related topics, such as specific components of the form, methods of analysis, and strategies for improving financial outcomes.

1. Revenue

Revenue, the lifeblood of any business, forms the cornerstone of a monthly profit and loss statement. Accurately capturing and analyzing revenue is paramount for understanding financial performance and making informed business decisions. A thorough grasp of its various facets provides valuable insights into a company’s health and potential for growth.

- Sales RevenueThis represents income generated from the core business operations, typically the sale of goods or services. For a retail store, sales revenue comprises the total value of products sold. For a consulting firm, it includes fees earned from client engagements. Accurate tracking of sales revenue is fundamental to assessing overall performance and identifying growth opportunities.

- Other RevenueBeyond core operations, businesses may generate income from other sources. These can include interest earned on investments, rental income from owned properties, or licensing fees. While often secondary to sales revenue, these streams contribute to the overall financial picture and should be meticulously documented.

- Revenue RecognitionThis principle dictates when revenue is recorded. Generally Accepted Accounting Principles (GAAP) provide guidelines for proper revenue recognition, ensuring accuracy and consistency in financial reporting. Understanding and applying these principles is crucial for compliance and for providing a reliable financial picture to stakeholders.

- Revenue AnalysisSimply recording revenue is insufficient; analyzing trends and variances is critical. Comparing current revenue to previous periods, budget projections, and industry benchmarks provides valuable insights into business performance. This analysis can highlight areas of strength, identify potential weaknesses, and inform strategic adjustments.

By understanding these facets of revenue and their accurate representation within a monthly profit and loss statement, businesses gain a comprehensive understanding of their financial health. This clarity enables data-driven decision-making, fostering growth, and ensuring long-term stability. Accurate revenue reporting provides the foundation for effective financial management and informed strategic planning.

2. Expenses

Accurate expense tracking is crucial for a comprehensive understanding of profitability, reflected within a monthly profit and loss statement. Expenses represent the outflow of money required to operate a business. Categorizing and analyzing these outflows provides valuable insights into cost control and resource allocation. A well-structured template facilitates this process by providing a standardized framework for recording and analyzing various expense types.

Consider a manufacturing company. Its monthly profit and loss statement would detail expenses like raw materials, factory labor, and utilities. These direct costs, classified as Cost of Goods Sold (COGS), directly impact profitability. Separately, operating expenses such as administrative salaries, marketing costs, and office rent, though not directly tied to production, are equally important to track. Understanding the proportion of each expense category relative to revenue enables informed decisions regarding pricing strategies, cost reduction initiatives, and resource allocation. For example, a significant increase in raw material costs might necessitate adjustments in pricing or exploration of alternative suppliers.

Effective expense management hinges on accurate categorization and consistent tracking within the monthly profit and loss statement template. This allows businesses to identify trends, pinpoint inefficiencies, and implement cost-saving measures. Regular review of these figures empowers stakeholders to make informed decisions, optimize resource allocation, and ultimately, enhance profitability. This disciplined approach to expense management contributes significantly to long-term financial health and sustainable growth.

3. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Accurate calculation of COGS is essential for determining gross profit and net income, key metrics within a monthly profit loss statement template. Understanding its components provides valuable insights into production efficiency and profitability.

- Direct MaterialsThis includes the raw materials used in production. For a furniture manufacturer, direct materials would encompass wood, fabric, and hardware. Accurate tracking of these costs within the monthly statement helps monitor material usage and identify potential areas for cost savings.

- Direct LaborDirect labor represents the wages paid to employees directly involved in production. For the furniture manufacturer, this includes assembly line workers and finishers. Monitoring direct labor costs helps assess production efficiency and labor utilization within the monthly reporting cycle.

- Manufacturing OverheadThis encompasses indirect costs associated with the production process, such as factory rent, utilities, and depreciation of manufacturing equipment. Allocating these costs accurately within the monthly profit loss statement is crucial for a comprehensive understanding of overall production expenses.

- Inventory ChangesThe difference between beginning and ending inventory levels affects COGS. An increase in inventory suggests lower COGS, while a decrease implies higher COGS. Reflecting these changes accurately in the monthly statement ensures a precise calculation of profitability.

Accurate COGS calculation is fundamental for a reliable monthly profit loss statement. By meticulously tracking these components, businesses gain valuable insights into production costs, pricing strategies, and overall profitability. This detailed analysis empowers informed decision-making and contributes to effective financial management.

4. Gross Profit

Gross profit, a key performance indicator, reveals the profitability of a company’s core business operations after accounting for direct production costs. Its placement within a monthly profit loss statement template provides crucial insights into pricing strategies, production efficiency, and overall financial health. A thorough understanding of gross profit is essential for informed decision-making and effective financial management.

- CalculationGross profit is calculated by subtracting the cost of goods sold (COGS) from revenue. This figure represents the remaining income available to cover operating expenses and generate net profit. Accurate calculation within the monthly statement relies on precise tracking of both revenue and COGS.

- AnalysisAnalyzing gross profit trends over time provides valuable insights into business performance. Declining gross profit margins may indicate rising production costs, pricing pressures, or inefficiencies in the production process. Conversely, increasing margins suggest effective cost management or successful pricing strategies.

- Industry ComparisonComparing a company’s gross profit margin to industry benchmarks provides context for performance evaluation. Lower margins than competitors may signal a need for cost reduction initiatives or pricing adjustments. Higher margins may indicate a competitive advantage in production efficiency or pricing power.

- Impact on Net ProfitGross profit directly impacts a company’s net profit. A healthy gross profit margin provides a larger base from which to cover operating expenses, ultimately contributing to higher net income. Therefore, maximizing gross profit is crucial for achieving overall profitability and financial success.

Understanding gross profit and its implications is fundamental for interpreting a monthly profit loss statement template effectively. This metric provides a crucial lens through which to assess a company’s core business profitability, informing strategic decisions related to pricing, cost control, and resource allocation. Regular monitoring and analysis of gross profit trends contribute significantly to informed financial management and long-term sustainability.

5. Net Profit/Loss

Net profit/loss, often referred to as the “bottom line,” represents the ultimate measure of a company’s financial performance over a given period. Within the context of a monthly profit loss statement template, it signifies the residual earnings after all revenue and expenses have been accounted for. This crucial figure demonstrates the financial outcome of a company’s operations for that specific month. A positive net profit indicates profitability, while a negative net profit, or net loss, signifies that expenses exceeded revenues. The net profit/loss figure is derived by subtracting all operating expenses, including cost of goods sold (COGS), administrative expenses, marketing costs, and other overhead, from the total revenue generated during the month.

Consider a retail business that generates $50,000 in revenue during a given month. After deducting COGS of $20,000 and operating expenses of $25,000, the resulting net profit is $5,000. This positive net profit indicates the business effectively managed its costs and generated a profit from its operations. Conversely, if operating expenses had risen to $35,000, the business would have incurred a net loss of $5,000, signaling a need for operational adjustments. This calculation, clearly presented within a monthly profit loss statement template, allows stakeholders to assess the overall financial health and sustainability of the business.

Understanding net profit/loss within the framework of a monthly profit loss statement is essential for effective financial management. This key metric provides a concise overview of a company’s financial performance, enabling informed decision-making regarding pricing strategies, cost control measures, and investment opportunities. Consistent monitoring of net profit/loss trends facilitates proactive adjustments to business operations, contributing to long-term financial stability and growth. Furthermore, this information is crucial for stakeholders, including investors and lenders, who rely on this data to assess the financial viability and potential of the business.

6. Operating Expenses

Operating expenses represent the costs incurred in running a business’s day-to-day activities, excluding the direct costs of producing goods or services (COGS). Within a monthly profit loss statement template, these expenses provide crucial insights into a company’s cost structure and efficiency. Accurately categorizing and tracking operating expenses is essential for informed financial management and strategic decision-making. These expenses are distinct from capital expenditures, which represent investments in long-term assets.

A typical monthly profit loss statement template categorizes operating expenses into several key areas. Selling, general, and administrative expenses (SG&A) often comprise a significant portion, encompassing salaries for administrative staff, marketing and advertising costs, rent for office space, and utilities. Research and development (R&D) expenses, crucial for innovation-driven companies, reflect investments in new product development and process improvements. Other operating expenses may include depreciation of non-production assets, such as office equipment, and amortization of intangible assets, like patents. For example, a software company’s operating expenses would include salaries for software developers (if not directly tied to a specific product’s development and thus categorized under COGS), marketing campaigns, and rent for office space, while a manufacturing company might incur higher expenses related to factory maintenance and utilities. Analyzing these figures within the context of the monthly statement allows businesses to identify areas for cost optimization and efficiency improvements.

Careful analysis of operating expenses within the monthly profit loss statement template provides valuable insights into cost control and profitability. Tracking trends in operating expenses relative to revenue reveals changes in efficiency and can highlight potential areas for improvement. Comparing these metrics against industry benchmarks provides further context for evaluating performance and identifying competitive advantages or disadvantages. Effective management of operating expenses directly impacts a company’s bottom line, influencing both profitability and long-term sustainability. Understanding this relationship is crucial for making informed decisions regarding pricing strategies, resource allocation, and overall financial planning. Furthermore, transparent and accurate reporting of operating expenses is essential for building trust with investors and stakeholders.

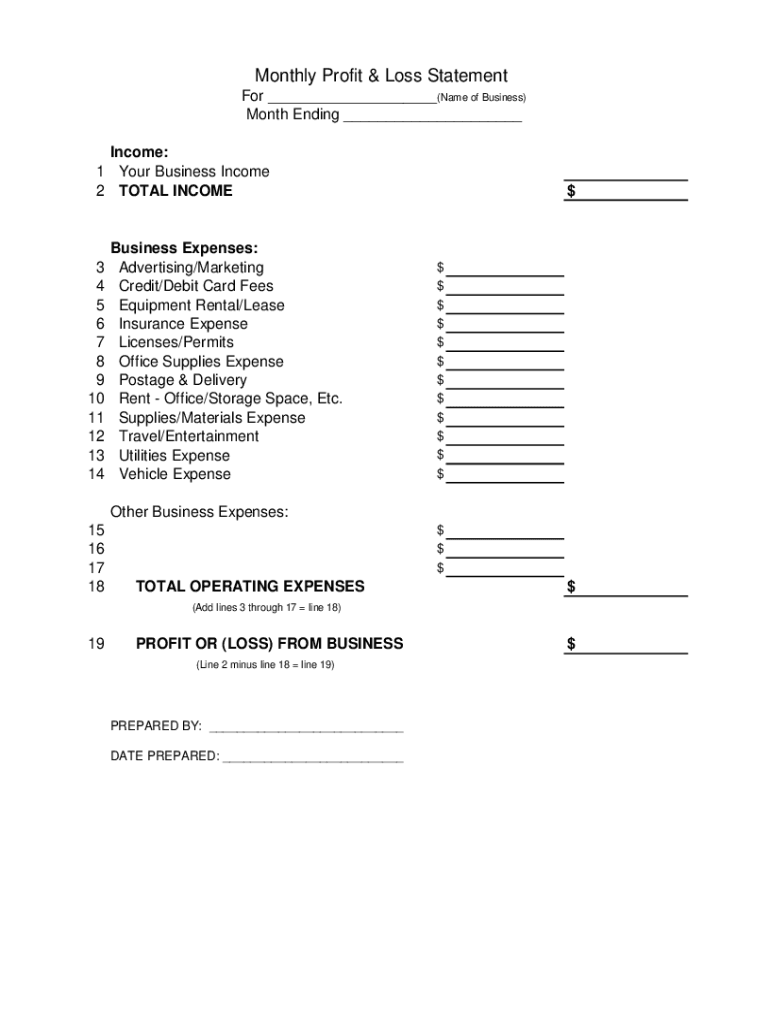

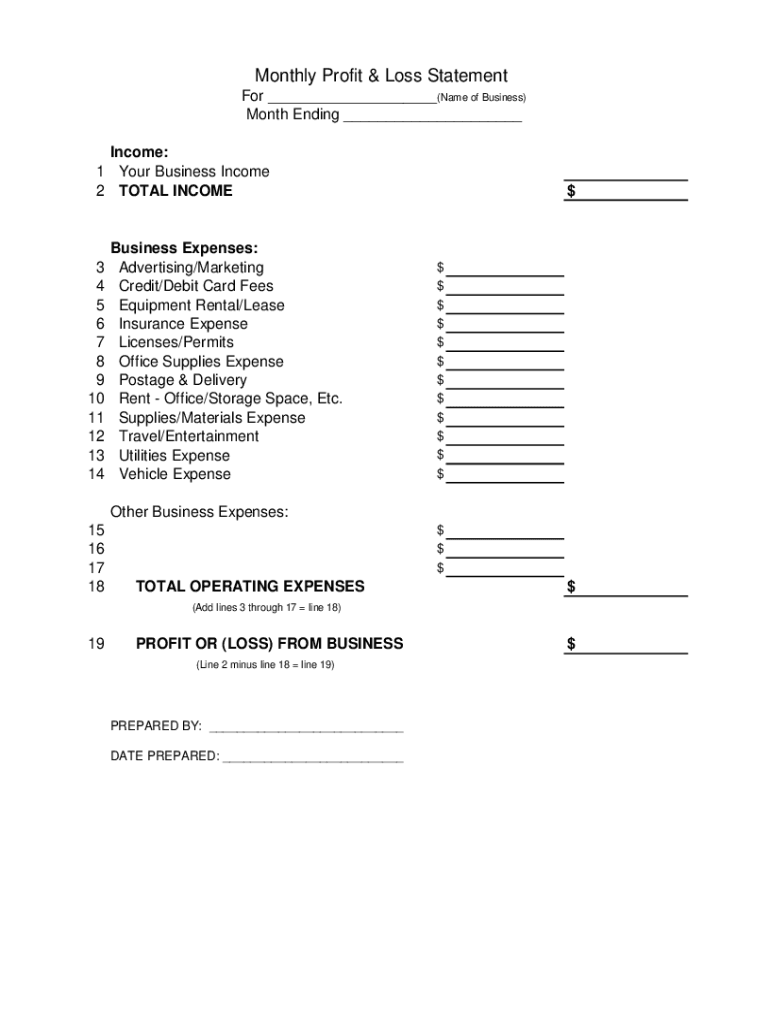

Key Components of a Monthly Profit and Loss Statement

A well-structured monthly profit and loss statement provides a comprehensive overview of a company’s financial performance. Understanding its key components is essential for effective financial management and informed decision-making.

1. Revenue: This represents income generated from sales of goods or services, and other income streams such as interest or royalties. Accurate revenue recognition is crucial for a reliable financial picture.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated as revenue minus COGS, gross profit reflects the profitability of core business operations. Analyzing gross profit trends provides insights into pricing strategies and production efficiency.

4. Operating Expenses: These expenses encompass the costs of running day-to-day business operations, excluding COGS. Examples include salaries, rent, marketing, and administrative expenses. Effective management of operating expenses is crucial for profitability.

5. Operating Income: This represents earnings from core business operations after deducting COGS and operating expenses. It provides a clear picture of profitability before considering non-operating income and expenses.

6. Other Income/Expenses: This category includes income or expenses not directly related to core business operations, such as interest income, gains or losses from investments, or one-time expenses.

7. Net Profit/Loss: Often referred to as the “bottom line,” net profit/loss represents the overall profitability of the company after accounting for all revenues and expenses. This key metric provides a concise summary of financial performance.

These components, working in concert, provide a detailed and insightful overview of a company’s financial health, enabling stakeholders to make informed decisions and drive strategic growth. Regular review and analysis of these figures within a structured monthly statement are crucial for effective financial management and long-term sustainability.

How to Create a Monthly Profit and Loss Statement

Developing a monthly profit and loss statement requires a systematic approach to ensure accuracy and consistency. The following steps outline the process of creating this essential financial report.

1. Choose a Template or Software: Utilizing a pre-designed template, whether spreadsheet-based or within accounting software, streamlines the process and ensures consistency. Numerous free templates are available online, while accounting software offers more robust features, including automated calculations and reporting.

2. Establish a Reporting Period: Define the specific timeframe for the report, typically a calendar month. Consistent reporting periods facilitate accurate tracking and analysis of financial trends over time.

3. Record Revenue: Meticulously document all income generated during the reporting period. Categorize revenue streams, differentiating between sales revenue, interest income, and other sources. Ensure accurate revenue recognition principles are applied.

4. Calculate Cost of Goods Sold (COGS): Determine the direct costs associated with producing goods sold. Include raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

5. Determine Gross Profit: Subtract COGS from revenue to arrive at gross profit. This figure represents the profitability of core business operations after accounting for direct production costs.

6. Itemize Operating Expenses: Categorize and record all operating expenses incurred during the reporting period. Include salaries, rent, marketing expenses, administrative costs, and depreciation. Accurate expense tracking is crucial for understanding overall profitability.

7. Calculate Operating Income: Subtract operating expenses from gross profit to determine operating income. This figure reflects profitability from core business operations before considering non-operating income and expenses.

8. Account for Other Income and Expenses: Include any non-operating income or expenses, such as interest income or losses from asset sales. These items are not directly related to core business operations but impact overall profitability.

9. Calculate Net Income/Loss: Subtract other expenses from other income and then subtract the result from Operating Income (or add if the result is a net gain) to arrive at net income or loss. This “bottom line” figure represents the overall profitability for the reporting period.

A consistently applied, methodical approach ensures accuracy and provides a clear picture of financial performance. Regular generation and analysis of this statement allow for informed decision-making and proactive financial management.

Standardized financial reports provide a crucial tool for understanding business performance. Regularly generated reports offer insights into revenue streams, cost structures, and overall profitability. Analysis of these key financial metrics empowers informed decision-making, enabling proactive adjustments to operations, pricing strategies, and resource allocation. Accurate and consistent utilization of these structured templates is essential for effective financial management.

Effective financial stewardship requires a commitment to consistent monitoring and analysis. Leveraging the insights provided by these financial tools allows businesses to navigate challenges, capitalize on opportunities, and achieve long-term financial stability and growth. The disciplined application of these principles contributes significantly to sustainable success in a dynamic business environment.