Navigating the mortgage landscape can be complex, and for professionals in real estate, finance, or even related service industries, connecting clients with the right mortgage broker or lender is a valuable service. Referrals are the lifeblood of many businesses, but ensuring these hand-offs are smooth, professional, and efficient often requires a structured approach. That’s where a well-designed system comes into play, helping you manage these crucial connections without missing a beat.

Imagine a world where every referral you send out or receive is accompanied by all the necessary information, clearly laid out and easy to understand. This isn’t just a dream; it’s a practical reality achievable through the use of a specialized form. Having a consistent way to handle referral requests not only saves time but also significantly enhances the professionalism of your service, ensuring that both the referrer and the client have a seamless experience from start to finish.

Why a Streamlined Referral Process is Essential for Your Business

In today’s fast-paced business environment, efficiency is paramount, especially when it comes to client interactions and inter-professional collaborations. A haphazard approach to mortgage referrals can lead to missed opportunities, duplicated efforts, and a generally unprofessional image. By implementing a standardized process, perhaps through a tailored mortgage referral request form template, you immediately elevate your operational standards. It shows that you value precision and client satisfaction, fostering trust with both your referral partners and the clients they entrust to you.

Think about the time wasted when you have to chase down missing information or clarify details that weren’t properly communicated. A comprehensive form eliminates this back-and-forth, ensuring that all pertinent data is collected upfront. This means that the mortgage professional receiving the referral can hit the ground running, armed with everything they need to assess the client’s needs and initiate the mortgage application process without delay. It’s about creating a smooth pipeline that benefits everyone involved.

Moreover, consistency in your referral process helps in tracking and measuring the effectiveness of your partnerships. When every referral goes through the same channels and uses the same data points, it becomes much easier to analyze which referral sources are most valuable and how efficiently your team is converting those leads. This data-driven insight is invaluable for strategic planning and optimizing your business development efforts. It transforms an informal “handshake” agreement into a robust, measurable system.

Beyond efficiency, using a dedicated form also aids in compliance and record-keeping. In industries like real estate and finance, proper documentation is not just good practice; it’s often a regulatory requirement. A well-structured mortgage referral request form template provides a clear audit trail of who referred whom, when, and for what purpose, helping you adhere to industry standards and protect your business from potential disputes or misunderstandings down the line. It acts as a professional agreement, ensuring clarity and accountability.

Key Benefits of Using a Template:

- Ensures comprehensive data capture.

- Enhances professionalism and brand image.

- Streamlines communication between parties.

- Reduces errors and follow-up time.

- Aids in compliance and record-keeping.

- Facilitates performance tracking and optimization.

Crafting Your Ideal Mortgage Referral Request Form Template

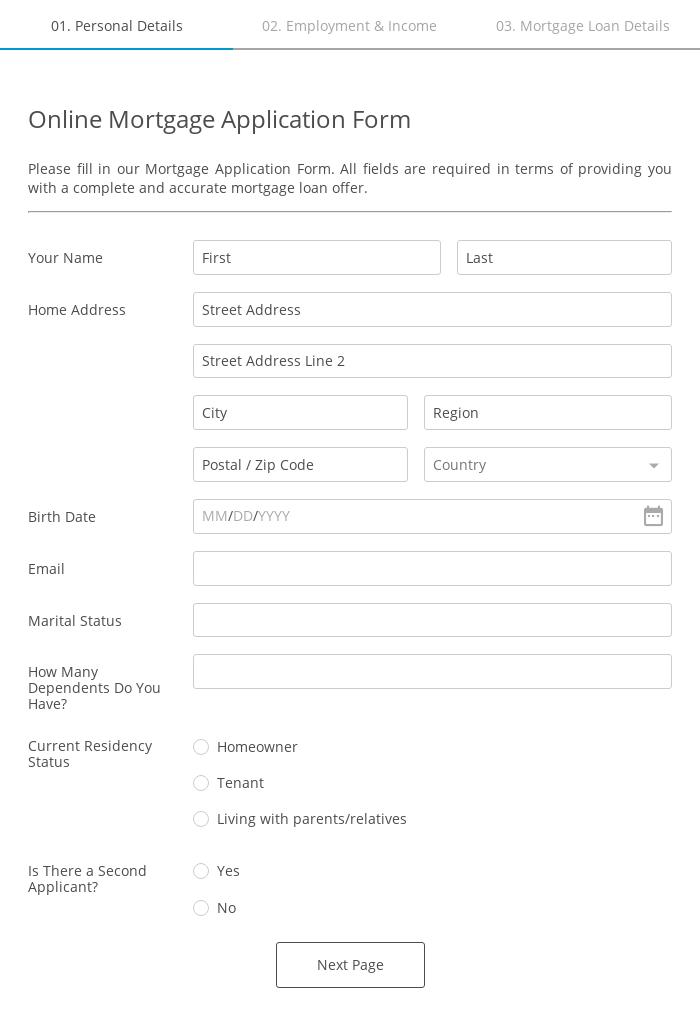

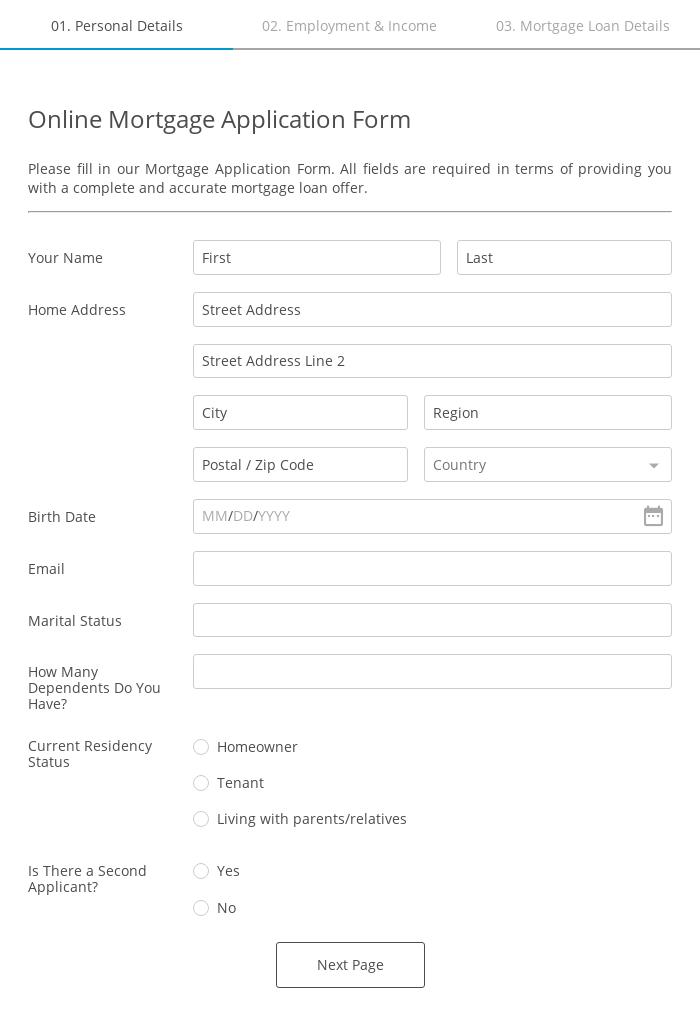

Building an effective mortgage referral request form template isn’t just about throwing some fields onto a page; it’s about thoughtful design that anticipates the needs of all parties. The best forms are intuitive, easy to fill out, and capture precisely the information required without being overly burdensome. Start by considering the fundamental data points that are always necessary for any mortgage inquiry, ensuring clarity and conciseness in your questions.

Your template should begin with the referrer’s information. This includes their name, company, contact details (phone, email), and how they prefer to be contacted. This seems obvious, but having it clearly structured helps in acknowledging the referral and maintaining a strong professional relationship. Then, move onto the client’s basic information: their name, best contact number, email address, and perhaps a preferred time for contact. Remember, the easier it is for the referrer to provide this, the more likely they are to use your form.

The core of the form will be dedicated to the client’s mortgage needs. This section should gather details like the type of mortgage they’re seeking (purchase, refinance, equity line), the property type, a general idea of the loan amount, and any specific deadlines or urgency. You might also include a field for any special circumstances or notes the referrer wants to share about the client’s situation, which can provide invaluable context to the mortgage professional. This comprehensive detail helps in pre-qualifying and preparing for the initial consultation.

Finally, consider including a section for disclosures and permissions. It’s crucial to ensure that the client has consented to be contacted and that the referrer is aware of any terms related to the referral fee or agreement. This transparency builds trust and avoids future complications. A simple checkbox for “I have received permission from the client to share their information” can go a long way in ensuring compliance and ethical practices within your referral network.

Implementing a dedicated system for managing your mortgage referrals is more than just a convenience; it’s a strategic move that enhances efficiency, professionalism, and profitability. By standardizing your approach with a well-designed form, you ensure that every referral is handled with the attention to detail it deserves, fostering stronger relationships and a more robust pipeline of business opportunities. It’s about building a seamless bridge between those who need mortgage services and the experts who provide them.

The right tools can truly transform how you operate, turning what might be a fragmented process into a smooth, consistent, and highly effective channel for growth. By focusing on clarity, comprehensiveness, and ease of use in your referral system, you’re not just processing requests; you’re cultivating a thriving network of trusted partnerships that will continue to yield dividends for years to come.