Navigating the landscape of commercial taxation can often feel like deciphering a complex puzzle, especially when dealing with inter-state transactions. For businesses operating or dealing with entities in Madhya Pradesh, the C Form holds significant importance. This document is crucial for availing reduced tax rates on certain purchases made from outside the state, ultimately leading to substantial savings and ensuring compliance with commercial tax regulations. Understanding its nuances and knowing where to find a reliable mp commercial tax c form template is a key step towards smooth business operations.

The need for an accurate and accessible C Form is universal for registered dealers who make interstate purchases of goods specified for use in manufacturing or resale. Without this essential document, businesses might find themselves paying a higher tax rate, impacting their profitability and potentially leading to compliance issues. This article aims to demystify the process, guiding you through the significance of this form and providing insights into effectively utilizing its template for your business needs.

Understanding the MP Commercial Tax C Form: Why It Matters

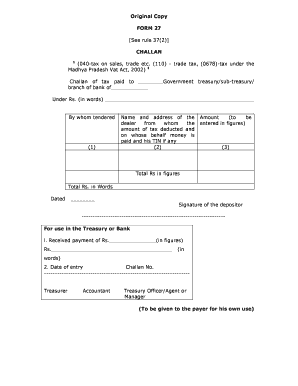

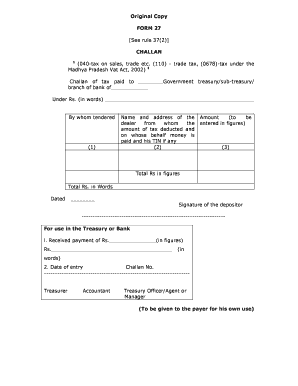

The C Form, officially known as Form C under the Central Sales Tax (CST) Act, 1956, is a declaration form used by a registered dealer to purchase goods at a concessional rate of tax. In the context of Madhya Pradesh, it means businesses registered under the MP Commercial Tax Department can issue or receive this form for eligible inter-state transactions. Its primary purpose is to differentiate between purchases for resale or manufacturing and those for final consumption, allowing the former to be taxed at a lower rate specified by the CST Act, which is significantly less than the standard VAT/SGST rate applicable to general sales.

This mechanism was designed to facilitate inter-state trade by reducing the tax burden on raw materials and intermediate goods that are crucial for a business’s operations or for further sale. Imagine a manufacturer in Madhya Pradesh purchasing machinery parts from a supplier in Maharashtra. If they don’t provide a valid C Form, the supplier might charge the full local sales tax rate of their state. However, with a correctly issued C Form, the manufacturer pays only the concessional CST rate, making their procurement more cost-effective.

The legal framework supporting the C Form ensures transparency and accountability in inter-state trade. It mandates that both the seller and the buyer maintain proper records of these forms, which are subject to verification by the commercial tax authorities. Non-compliance, such as issuing a false C Form or failing to submit it, can lead to penalties, disallowance of concessional tax rates, and even legal action. Therefore, it’s not just about saving money; it’s about adhering to the established taxation guidelines.

Ultimately, mastering the use of the C Form is a cornerstone of prudent financial management for businesses engaged in inter-state commerce within or with Madhya Pradesh. It directly impacts your cash flow and compliance status, ensuring that you remain in good standing with the tax authorities while optimizing your operational costs. A well-understood mp commercial tax c form template is more than just a piece of paper; it’s a tool for strategic financial planning.

Key Elements of a Valid C Form

- Buyer’s Details: Correct name, address, and CST/VAT registration number.

- Seller’s Details: Correct name, address, and CST/VAT registration number.

- Invoice Details: Corresponding invoice number(s) against which the form is issued.

- Goods Description: Clear and accurate description of the goods purchased.

- Value of Goods: Total value of the goods covered by the form.

- Purpose of Purchase: Clearly stated as for resale, manufacturing, processing, or telecommunications.

- Issuing Authority: Authorized signatory’s name and designation with official seal.

Accessing and Utilizing Your MP Commercial Tax C Form Template Effectively

Finding an authentic mp commercial tax c form template is the first step towards ensuring your compliance and financial benefits. In today’s digital age, most commercial tax departments, including Madhya Pradesh’s, provide these forms online. Businesses can typically access them through the official website of the Madhya Pradesh Commercial Tax Department or specific online portals designated for tax filings and declarations. It’s crucial to always download the latest version, as templates can undergo minor updates to align with new regulations or administrative changes, ensuring you are using a form that will be accepted without issues.

Once you have your hands on the template, the real work begins: filling it out accurately. This isn’t just a matter of transcription; it requires careful cross-referencing with your purchase invoices and ensuring that every detail aligns perfectly. Any discrepancies, no matter how small, could lead to the rejection of the form by the tax authorities or the receiving party, potentially undoing the benefit of the concessional tax rate. Pay close attention to the financial year, the period covered by the form, and the total value of goods, matching them precisely with your records.

One common pitfall businesses encounter is misclassifying the purpose of the purchase. The C Form is specifically for goods intended for resale, manufacturing, processing, generation of electricity, or in mining, among a few other specified uses. Using it for general consumption items or goods that do not fall under these categories can lead to severe penalties. Therefore, a thorough understanding of your purchases and their end-use is paramount before you fill in the relevant section on the form.

After filling out the mp commercial tax c form template, ensure it is signed by an authorized signatory of your business and stamped with the official company seal. These steps validate the document and are a mandatory requirement for its acceptance. Finally, maintain meticulous records of all issued and received C Forms. This includes keeping physical copies, if applicable, and digital backups, along with the corresponding invoices. Such diligent record-keeping simplifies audits, resolves discrepancies, and ensures a hassle-free experience with the commercial tax department.

Navigating the requirements of the C Form, while seemingly intricate, is a fundamental aspect of efficient business operations in Madhya Pradesh. By understanding its purpose and meticulously preparing the necessary documentation, businesses can significantly optimize their tax outgoings and ensure full compliance with regulatory standards.

Embracing the correct procedures for handling this essential tax document not only saves resources but also strengthens a business’s standing with tax authorities. It is an investment in accuracy and diligence that yields considerable returns in financial efficiency and peace of mind.