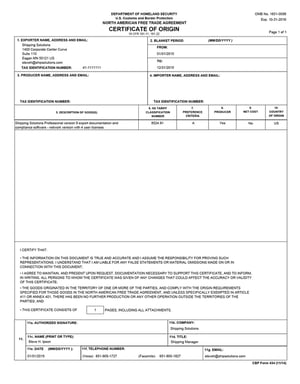

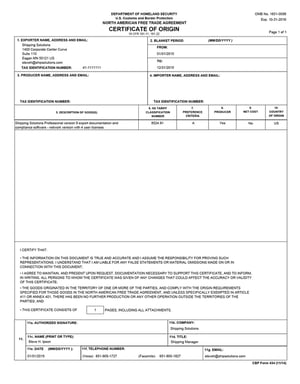

Navigating the world of international trade can feel like deciphering a complex puzzle, especially when it comes to paperwork. For businesses importing or exporting goods between the United States, Canada, and Mexico under the North American Free Trade Agreement, one document stood out as absolutely crucial: the NAFTA Certificate of Origin. This certificate was the golden ticket for claiming preferential tariff treatment, meaning lower or even zero duties on eligible goods.

Understanding how to properly fill out this certificate was vital, as errors could lead to costly delays, penalties, or the denial of preferential duty rates. Many businesses, especially small to medium-sized enterprises, often sought a reliable nafta certificate of origin form template to ensure they included all the necessary information and formatted it correctly. It provided a clear guide, making the process less daunting and helping to maintain compliance with intricate trade regulations.

Understanding the NAFTA Certificate of Origin and Its Importance

The NAFTA Certificate of Origin was more than just a piece of paper; it was a legally binding document that certified whether goods qualified as originating in North America under the rules of the North American Free Trade Agreement. Its primary function was to allow importers to claim reduced or eliminated customs duties when bringing goods from one NAFTA country into another. Without this certificate, importers would typically pay the higher Most-Favored-Nation (MFN) duty rates, significantly impacting the cost-effectiveness of their trade.

This certificate was critical for both exporters and importers. Exporters were responsible for providing the completed and signed certificate to their customers, assuring them that the goods met the origin requirements. Importers, on the other hand, needed to retain this document for their records, as customs authorities could request it to verify claims of preferential treatment. The agreement applied specifically to trade between the U.S., Canada, and Mexico, aiming to foster free trade and economic integration across the continent.

Preparing the certificate required a thorough understanding of the “rules of origin,” which were detailed and specific criteria determining if a product genuinely originated in a NAFTA country. These rules often involved assessing where the goods were wholly obtained or produced, or if non-originating materials used in production underwent a sufficient change in tariff classification or met certain regional value content requirements. It was a complex area that often necessitated careful analysis of manufacturing processes and supply chains.

That’s why having a solid nafta certificate of origin form template was incredibly beneficial. It provided a structured framework, ensuring that all nine mandatory data elements were included. This template acted as a checklist, helping businesses avoid omissions that could lead to customs issues. Even though NAFTA has been superseded, the principles behind its certificate of origin offer valuable lessons in trade compliance.

Key Fields You’d Find on a NAFTA Certificate

- Exporter Information: Full legal name, address, and tax identification number.

- Blanket Period: A specified period (up to 12 months) for which the certificate applies to multiple shipments of identical goods.

- Importer Information: Full legal name, address, and tax identification number (if known).

- Producer Information: Full legal name, address, and tax identification number. This could be different from the exporter.

- Description of Goods: A detailed description of each good, including its Harmonized System (HS) tariff classification.

- Origin Criterion: A specific code (A, B, C, D, E, F) indicating how the goods qualified as originating.

- Net Cost Method: Indication if the net cost method was used (for certain goods meeting regional value content requirements).

- Country of Origin: Clearly stating whether the goods originated in the US, Canada, or Mexico.

- Authorized Signature: Signature of the authorized individual, along with their name, title, date, and contact information.

Transitioning from NAFTA: The USMCA and Modern Trade Documentation

While the NAFTA Certificate of Origin was a cornerstone of North American trade for over two decades, the landscape has evolved significantly. On July 1, 2020, the United States-Mexico-Canada Agreement (USMCA), also known as CUSMA in Canada and T-MEC in Mexico, officially replaced NAFTA. This new agreement brought with it updated rules of origin and, importantly, a new approach to certifying origin for preferential tariff treatment.

One of the most notable changes under USMCA is the elimination of a prescribed certificate of origin form. Unlike NAFTA, which required a specific, standardized template, USMCA allows for much more flexibility. Instead of a formal document, traders can now provide a “Certification of Origin” as part of any commercial document, such as an invoice, packing list, or even a company letterhead. This shift aims to streamline the process and reduce administrative burdens for businesses engaged in cross-border trade.

Despite the move away from a specific form, the underlying requirement to prove origin remains paramount. The USMCA Certification of Origin still requires certain data elements to be present, albeit without a rigid format. These elements typically include details about the certifier, exporter, importer, producer, a description of the goods, their HS tariff classification, the origin criteria, and the date of the certification. Businesses must ensure that all these details are accurately provided, regardless of the document they choose to use.

For businesses that previously relied heavily on a nafta certificate of origin form template, this transition required an adjustment in their documentation practices. While historical records or internal training might still reference the old NAFTA template, it’s crucial for current trade operations to adhere to USMCA guidelines. Staying updated on these changes is not just about compliance; it’s about ensuring smooth customs clearance and avoiding potential penalties for misrepresenting origin.

Navigating the complexities of international trade agreements demands constant vigilance and adaptability. While the specific form of the NAFTA Certificate of Origin may be a relic of the past, the core principles of accurately declaring origin and understanding trade agreement rules remain fundamental. Businesses engaged in trade across North America must ensure their processes and documentation align with the current USMCA requirements to continue benefiting from preferential tariff treatment and maintain efficient supply chains. This often means consulting with trade experts or customs brokers who are well-versed in the latest regulations to ensure full compliance and avoid costly missteps.