Buying a home is often the biggest financial decision many of us will make and it can be a complex journey filled with paperwork and specific requirements. One common scenario in this exciting process involves getting a little help from friends or family sometimes called gift funds. When someone who isn’t officially on the mortgage application wants to contribute to your down payment or closing costs lenders need to make sure everything is above board and transparent. This is where a clear and concise document becomes absolutely essential for a smooth transaction.

Understanding the ins and outs of these contributions is vital because improper documentation can easily delay your mortgage approval or even put your home purchase at risk. Lenders are very particular about the source of funds to prevent fraud and ensure financial stability for the borrower. They need to verify that any gifted money is truly a gift with no expectation of repayment and that it comes from a legitimate source. Having the right paperwork in hand simplifies this verification process for everyone involved and helps keep your home buying dream on track.

Understanding Non Borrower Contributions and Why the Form Matters

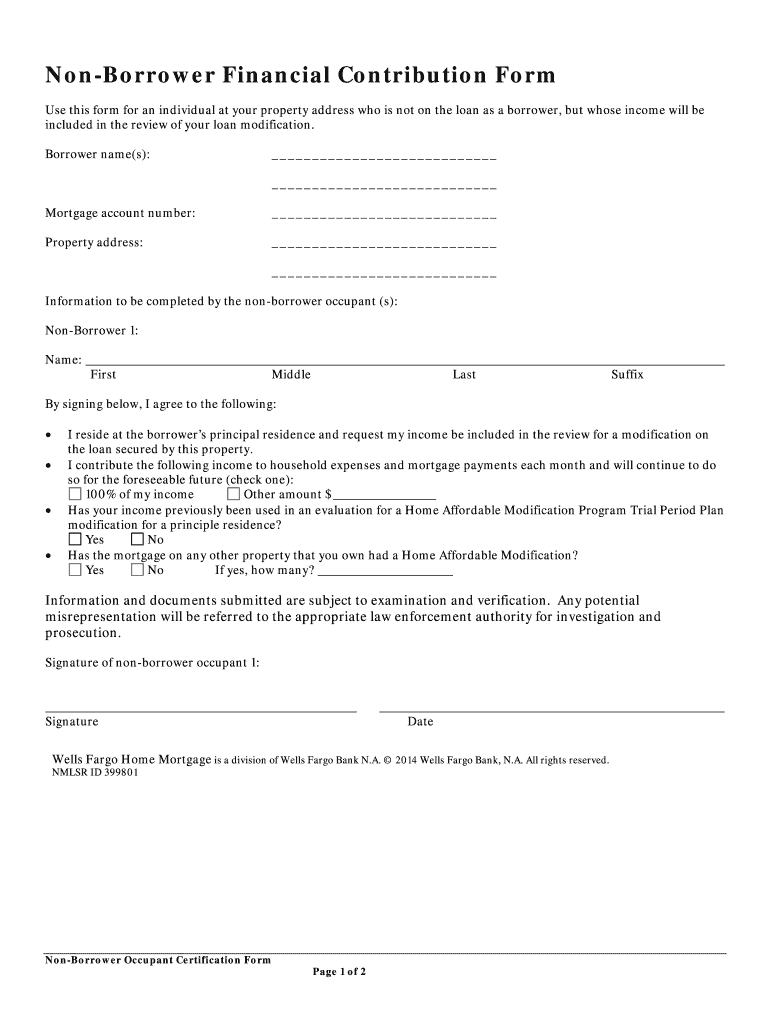

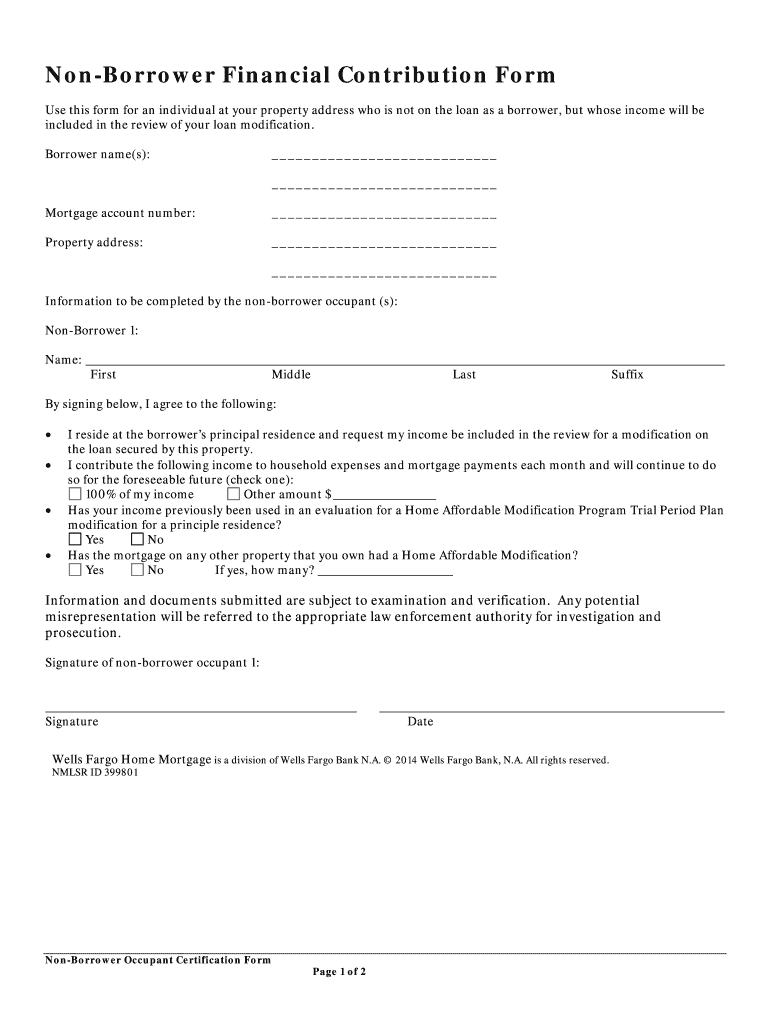

A non borrower contribution refers to financial assistance provided by someone who is not a party to the mortgage loan but wishes to help the borrower with funds for the home purchase. This typically includes a down payment or closing costs. Common non borrowers are usually close family members such as parents grandparents siblings or even sometimes charitable organizations. Lenders require thorough documentation for these funds primarily to comply with anti money laundering regulations and to ensure that the gift is genuinely a gift and not a disguised loan that could add to the borrower’s debt burden.

The purpose of a non borrower contribution form template is to formally declare that the funds are indeed a gift and not a loan. This distinction is incredibly important for the lender’s risk assessment. If the funds were a loan even from a family member it would impact the borrower’s debt to income ratio potentially disqualifying them from the mortgage or changing the terms of the loan. The form provides a clear written record directly from the donor confirming their intent and the nature of the contribution eliminating any ambiguity. It serves as a critical piece of evidence during the underwriting process proving the legitimacy of the funds.

Using a standardized non borrower contribution form template brings consistency and clarity to a part of the mortgage process that could otherwise be quite confusing. It ensures that all necessary information is collected in one place making it easier for lenders to review and approve the gift funds. Without this form you might find yourself scrambling to provide various bank statements letters and other documents potentially delaying your closing date. This template acts as a universal language between the donor the borrower and the lender ensuring everyone is on the same page.

Key Elements of a Non Borrower Contribution Form

A comprehensive non borrower contribution form usually contains several crucial pieces of information to satisfy lender requirements. These elements are designed to provide a complete picture of the gift and its source.

- Donor’s full legal name and current contact information

- Donor’s relationship to the borrower

- The exact amount of the gift in monetary terms

- A clear statement confirming that the funds are a gift with no expectation of repayment

- The source of the gift funds for example from a savings account or sale of an asset

- A statement that the gift does not originate from a party to the transaction such as the seller or real estate agent unless specifically permitted by loan guidelines

- Date of the gift transfer

- Signatures of both the donor and the borrower acknowledging the terms

The benefit of using a well structured template is that it guides all parties to provide precisely what the lender needs.

Navigating the Process Tips for Using Your Non Borrower Contribution Form Template

The ideal time to prepare your non borrower contribution form is early in the mortgage application process as soon as you know that gift funds will be part of your financing strategy. Your loan officer will be able to provide you with their preferred non borrower contribution form template or direct you to where you can find one that meets their specific requirements. It is crucial that the form is completed accurately and entirely. Any missing information or discrepancies can cause delays during underwriting. Always double check all names addresses amounts and ensure dates are consistent across all submitted documents.

When it comes to who fills out the form it is generally the donor who provides the details about their contribution and signs it. However the borrower usually signs it as well to acknowledge receipt of the gift. Communication is key during this step. Ensure the donor fully understands what they are signing and why. Some lenders might also require bank statements from the donor to verify the source of the gift funds and to show that the money has been seasoned meaning it has been in the donor’s account for a certain period usually 60 days. This helps to prevent financial fraud and confirms the stability of the funds.

Common pitfalls to avoid include submitting incomplete forms or forms with incorrect information. Mismatched names or addresses, incorrect gift amounts, or a failure to clearly state that the funds are a gift can all lead to complications. Another issue arises if the gift funds are deposited into the borrower’s account too close to the loan application date without proper documentation. This can make it difficult for the lender to track the origin of the funds, as large unexplained deposits can be a red flag. Always consult with your loan officer before depositing any large sums of money into your account.

To ensure a smooth process for everyone involved consider these best practices.

- For Donors:

- Be prepared to provide bank statements if requested by the lender.

- Understand that the gift must be truly a gift with no repayment expected.

- Sign the form exactly as your name appears on your identification.

- For Borrowers:

- Discuss gift fund plans with your loan officer early.

- Do not deposit gift funds into your account until you have the signed form and have confirmed the best timing with your lender.

- Keep clear records of all communications and documents related to the gift.

Properly documenting non borrower contributions is a small but mighty step in your home buying journey. It ensures transparency and compliance building trust with your lender and paving the way for a successful closing. Taking the time to understand and correctly utilize a non borrower contribution form template protects everyone involved and helps you step into your new home with confidence and peace of mind.