Managing finances in a non profit organization can often feel like juggling a dozen balls at once, especially when it comes to tracking and reimbursing expenses incurred by dedicated staff and volunteers. Without a clear, standardized process, you risk errors, delays, and even potential compliance issues. That’s where a well-designed non profit reimbursement form template becomes an absolute game-changer, simplifying what can often be a complex and time-consuming task.

Having a consistent template not only ensures accuracy and accountability but also fosters transparency within your organization. It helps maintain donor trust by demonstrating responsible financial stewardship and provides a smooth experience for those who generously spend their own money on behalf of your mission. Let’s delve into why streamlining your reimbursement process is crucial and how the right template can make all the difference.

Why a Robust Reimbursement Process is Essential for Nonprofits

For any non profit, financial transparency isn’t just a good idea; it’s a fundamental pillar of operation. Donors, grant providers, and the public expect to see that funds are managed with the utmost care and integrity. A sloppy or inconsistent reimbursement process can quickly erode that trust, raising questions about accountability. By standardizing how expenses are submitted and approved, you create an auditable trail that clearly demonstrates where money is going and why.

Beyond external perceptions, internal efficiency is significantly boosted. Imagine the time saved by your accounting department and the reduced frustration for your team members when everyone knows exactly what information is needed and how to submit it. No more chasing down missing receipts or deciphering handwritten notes. A clear process, supported by a comprehensive form, means fewer errors, faster processing times, and more time for your team to focus on their core mission activities rather than administrative headaches.

Legal and tax compliance also heavily depend on accurate record-keeping. Nonprofits often operate under strict regulations regarding how funds are spent and reported. Proper documentation of reimbursed expenses is vital for tax filings, audits, and maintaining your non profit status. A well-structured reimbursement form helps ensure that all necessary information is captured upfront, reducing the risk of non-compliance and potential penalties down the line.

Ultimately, a robust reimbursement system contributes to overall organizational health. It protects your non profit from financial discrepancies, streamlines operations, and builds a culture of trust and efficiency. A standardized form is the backbone of this system, providing a clear, uniform method for everyone involved.

Key Elements of an Effective Reimbursement Form

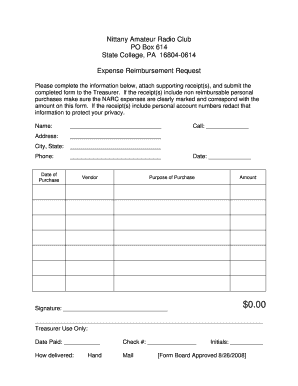

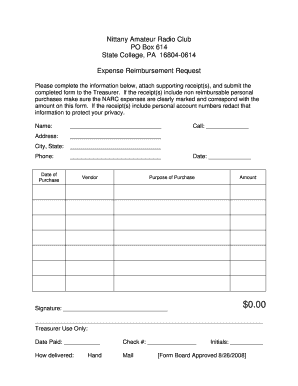

- Requester Information: Name, department, contact details.

- Expense Details: Date of expense, clear description of what was purchased, amount, and purpose directly related to the non profit’s mission.

- Categorization: Designated fields to classify the expense (e.g., travel, supplies, program costs).

- Proof of Purchase: A designated area for attaching receipts or invoices.

- Approval Signatures: Spaces for the manager and finance department to sign off.

- Payment Method: How the reimbursement should be issued (e.g., direct deposit, check).

Customizing Your Non Profit Reimbursement Form Template

While a generic template can provide a good starting point, the real magic happens when you tailor your non profit reimbursement form template to the specific needs and operational nuances of your organization. Every non profit is unique, from its size and structure to its funding sources and the types of activities it undertakes. What works perfectly for a small community outreach program might need significant adjustments for a large international aid organization.

Consider your internal policies and workflows. Do you have different approval tiers for varying expense amounts? Are certain types of expenses handled differently? Your template should reflect these existing rules, making it easier for everyone to follow the established procedures. Incorporating specific fields for grant numbers or project codes, for instance, can be incredibly useful if your funding is tied to particular grants.

Think about the user experience for your staff and volunteers. Is the form intuitive and easy to fill out? Can it be submitted digitally, or is a paper copy preferred? Modern templates often allow for digital signatures and attachments, greatly speeding up the process and reducing paper waste. Ensuring your template is user-friendly will encourage compliance and reduce the number of incomplete or incorrectly submitted forms.

Finally, remember that your reimbursement form is a living document. It should be reviewed periodically to ensure it still meets your organization’s needs and aligns with current best practices and regulations. As your non profit grows or its operations evolve, your reimbursement process, and thus your template, should adapt accordingly. Regular feedback from both those submitting expenses and those processing them can provide invaluable insights for continuous improvement.

Implementing a standardized, easy-to-use reimbursement process transforms a potential source of frustration into a seamless operation. It frees up valuable time and resources, allowing your team to dedicate more energy to achieving your mission and serving your community. Investing in a robust system for managing expenditures is an investment in your non profit’s long-term health and success.

By taking the time to set up and refine your reimbursement procedures, you are not just handling paperwork; you are building a foundation of financial integrity and operational excellence. This commitment to clear, efficient financial practices will undoubtedly strengthen your organization, enhancing its reputation and maximizing its impact for years to come.