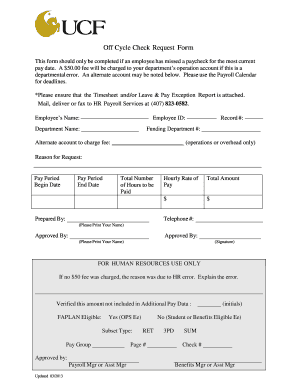

Ever found yourself in a situation where an employee or vendor needed payment *now*, but it was nowhere near your regular payroll or accounts payable run? It’s a common scenario in many businesses, from small startups to large corporations. These unexpected, urgent payments can throw a wrench into your carefully planned financial processes if you don’t have a clear system in place. That’s where an off cycle check request form template becomes an absolute lifesaver.

An off cycle payment is essentially any payment issued outside of the standard, pre-defined payment schedule. It could be for a final paycheck, a sudden reimbursement, an urgent vendor invoice, or even a bonus. Without a standardized approach, handling these requests can lead to errors, delays, and a lot of unnecessary stress for your finance team. Having a dedicated template streamlines the process, ensures all necessary information is captured, and maintains internal controls.

Why a Dedicated Off Cycle Check Request Template is Essential

Implementing a specific form for off cycle payments isn’t just about administrative neatness; it’s a critical component of robust financial management. Think about it: without a clear path, requests might come in through emails, sticky notes, or hurried phone calls, each potentially missing vital details. This unstructured approach significantly increases the risk of errors, such as incorrect amounts, wrong payees, or even duplicate payments. A standardized template acts as a central hub, ensuring consistency and accuracy across all such urgent transactions.

Moreover, a well-designed template enhances accountability. When every request must go through a formal process, complete with required fields and necessary approvals, it becomes much easier to track who requested what, why, and when. This audit trail is invaluable for internal reconciliation, compliance checks, and troubleshooting any discrepancies that may arise down the line. It moves these unique payments from the realm of informal favors into a professional, auditable financial operation.

Key Benefits of Using a Template

Beyond error reduction and accountability, an off cycle check request form template offers several distinct advantages that contribute to smoother business operations and stronger financial health. Let’s delve into some of the primary ways it can benefit your organization:

- Efficiency Gains: Standardized forms mean less back and forth. Requesters know exactly what information is needed, and approvers can quickly review and sign off, speeding up the entire payment cycle for urgent needs.

- Reduced Risk of Fraud: By clearly outlining the approval hierarchy and requiring specific documentation, a template adds layers of control that make it harder for fraudulent or unauthorized payments to slip through the cracks.

- Improved Compliance: Many regulations, particularly those related to payroll and financial reporting, require detailed records. A comprehensive form ensures you’re collecting all the necessary data to remain compliant.

- Better Budget Management: While off cycle payments are by nature often unplanned, having a process to log and track them helps in understanding their frequency and impact on cash flow, aiding future financial planning.

Ultimately, by formalizing these ad hoc requests, you’re not just creating a piece of paper; you’re building a more resilient, transparent, and efficient financial ecosystem within your company. It ensures that urgent payments are handled with the same care and precision as your regular payment runs, minimizing disruption and maximizing control.

What to Include in Your Off Cycle Check Request Form Template

Creating an effective off cycle check request form template involves more than just listing a few blank spaces; it requires thoughtful consideration of all the critical information your finance department will need to process the payment correctly and efficiently. The goal is to make it as comprehensive yet as user-friendly as possible, ensuring no vital detail is overlooked. A well-designed form will typically capture details about the payee, the payment itself, and the necessary authorizations.

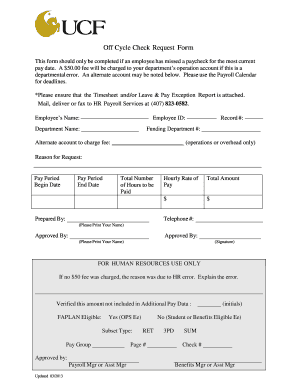

First and foremost, you’ll need clear identification details for the payee. This includes their full legal name or company name, mailing address, and contact information. If it’s an employee, you might also need their employee ID number. For vendors, their vendor ID, if applicable, and perhaps their tax identification number (TIN) become crucial. Accuracy here is paramount to avoid payments going to the wrong recipient or being undeliverable.

Next, focus on the payment details themselves. This segment should cover the exact amount to be paid, the currency, and the reason for the off cycle payment. A dedicated field for a detailed description or explanation is incredibly important, as it provides the context necessary for finance to understand the urgency and legitimacy of the request. You should also include fields for the preferred payment method, whether it’s a physical check, direct deposit, or wire transfer, along with any relevant account numbers or routing details.

Finally, and perhaps most critically, the template must incorporate robust approval sections. This ensures that every off cycle payment is authorized by the appropriate personnel, preventing unauthorized disbursements. Consider including:

- Requester Information: Name, department, and contact details of the person initiating the request.

- Department Head/Manager Approval: A signature and date from the immediate supervisor or department head to verify the need.

- Finance Department Approval: Approval from an authorized finance team member, ensuring funds are available and the request aligns with financial policies.

- Executive/Senior Management Approval (for larger amounts): For significant sums, an additional layer of approval from senior leadership can be a crucial control.

By including these key components, your off cycle check request form template becomes a powerful tool for managing urgent payments effectively. It transforms a potentially chaotic process into a structured, auditable, and secure operation, benefiting everyone involved and strengthening your financial controls significantly.

Navigating the occasional need for an off cycle payment doesn’t have to be a headache for your organization. By investing a little time into developing and implementing a robust off cycle check request form template, you equip your finance team and other departments with a clear, efficient, and secure method for handling these urgent disbursements. It’s about bringing order to what could otherwise be a source of constant disruption, ensuring that every payment, regardless of its timing, meets the same high standards of accuracy and accountability.

Ultimately, a well-designed template is more than just paperwork; it’s a strategic asset that supports your operational efficiency, strengthens your internal controls, and provides peace of mind. It allows your business to respond quickly to urgent financial needs while maintaining the integrity and transparency of your financial records. Embracing such a standardized approach is a clear sign of a mature and well-managed financial operation, ready for any unexpected payment requirement that comes its way.