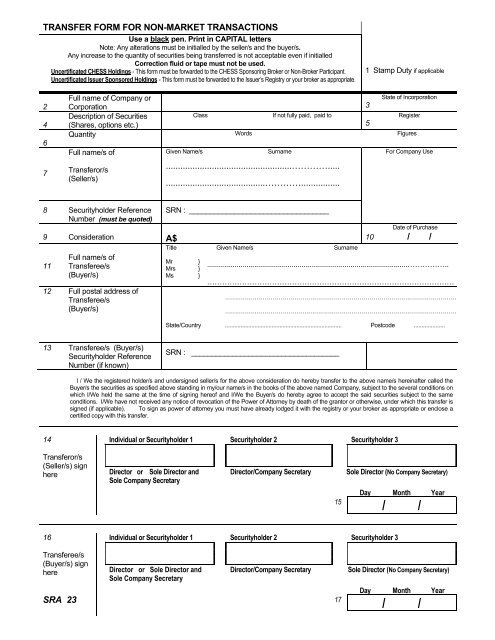

Ever found yourself in a situation where you need to transfer ownership of something valuable, but it’s not going through a public exchange or a traditional sale? Maybe you’re gifting shares to a family member, inheriting property, or simply moving assets between your own accounts in a private capacity. These "off-market" transactions are incredibly common, yet they often come with a lingering question: how do you properly document them to ensure everything is legal, clear, and undisputed? That’s where having the right paperwork becomes absolutely essential.

Navigating these private transfers can feel a bit daunting without a clear roadmap. Unlike buying or selling on a public platform where the process is standardized, off-market transfers require specific documentation to formalize the change of ownership and protect all parties involved. A well-designed form acts as your critical tool, providing a structured way to record all necessary details and ensure compliance with various regulations. This article aims to shed light on why such forms are indispensable and what you should look for in a robust off market transfer form template.

What Exactly is an Off-Market Transfer and Why Do You Need a Form?

An off-market transfer, at its core, refers to the change of ownership of an asset – be it shares, property, intellectual property rights, or even certain types of personal items – that happens outside of a regulated public marketplace or exchange. Think of it as a direct deal between two parties, without the intermediaries or public bidding process you’d typically see with a stock exchange or a real estate listing. These transactions are private by nature, but that doesn’t mean they don’t require formal documentation to be legally sound.

There are numerous reasons why an off-market transfer might occur. Perhaps you’re looking to transfer shares of a privately held family business to the next generation, gift a piece of land to a charity, or even transfer ownership of a vehicle between spouses. Corporate restructurings, divorce settlements, and inheritances are other common scenarios. In each case, while money might or might not exchange hands, the fundamental need to legally document the change in ownership remains paramount to avoid future disputes or complications.

The necessity for a specific off market transfer form template arises from the need for a clear, undeniable legal record. This form serves as the official document that proves who owned the asset before and who owns it now. Without it, verifying the transfer, dealing with tax implications, or resolving any future claims can become a bureaucratic nightmare. It ensures that both the grantor (the one giving up the asset) and the grantee (the one receiving it) are in agreement, and that all relevant details are captured for regulatory bodies, financial institutions, or land registries.

Ultimately, using a comprehensive template protects everyone involved. It minimizes ambiguity, establishes a paper trail for auditing and compliance, and provides peace of mind that the transfer has been executed correctly. It’s not just about filling out a piece of paper; it’s about creating a legally binding testament to a significant change in asset ownership, ensuring that the new owner can fully exercise their rights and responsibilities without hindrance.

Key Elements of a Comprehensive Transfer Form

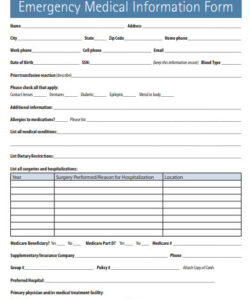

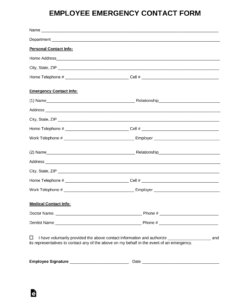

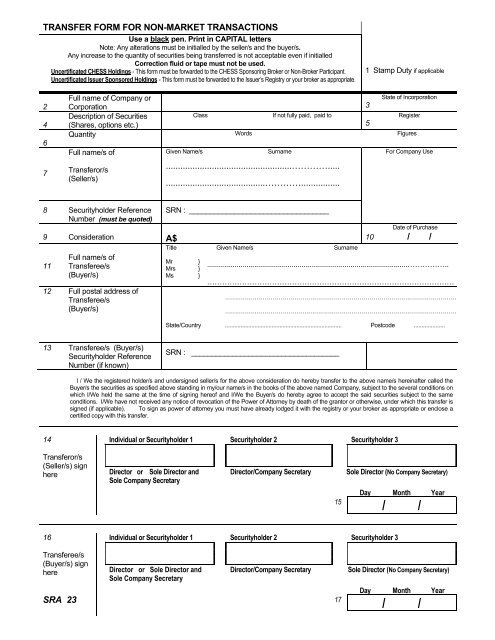

- **Identification of Parties:** Full legal names, addresses, and contact information for both the transferor (current owner) and the transferee (new owner). If applicable, their respective legal entities or trusts should also be clearly stated.

- **Asset Description:** A precise and unambiguous description of the asset being transferred. For shares, this would include the company name, class of shares, and number of shares. For property, it would be the full legal description, address, and any identifying parcel numbers.

- **Transfer Details:** The effective date of the transfer, the reason for the transfer (e.g., gift, sale, inheritance, corporate reorganisation), and the consideration (the value exchanged, if any). If it’s a gift, stating “nil consideration” is common.

- **Declarations and Warranties:** Statements from both parties confirming their legal capacity to enter the transfer, that the asset is free of encumbrances (unless specified), and that all information provided is true and accurate.

- **Signatures and Witnesses:** Spaces for the dated signatures of both the transferor and transferee, along with spaces for witnesses to attest to the signing, which often adds legal weight and can be required for notarization.

Navigating the Off-Market Transfer Process with Ease

Once you understand the ‘why’ behind using a dedicated form, the ‘how’ becomes the next important step. The process of executing an off-market transfer, while private, still requires careful attention to detail to ensure everything is above board. It’s not just about having the right template; it’s about following a sequence of steps that bring the transfer to a successful and legally recognized close. The form itself acts as the central document that ties all these steps together.

The initial stage involves clearly identifying the asset that needs to be transferred and the specific nature of the transfer. Is it a full transfer or partial? Is it a gift, a sale, or part of a larger legal arrangement? Understanding these specifics will guide you in populating your off market transfer form template accurately. Gathering all relevant details about the asset, such as unique identification numbers for shares or precise legal descriptions for property, is paramount before you even begin filling out the paperwork.

After meticulously completing the form, paying close attention to every detail and ensuring all parties involved are correctly identified and the asset fully described, the next crucial step is typically the signing. Often, for legal validity and to prevent future disputes, the signatures on these forms need to be witnessed, or even notarized, especially for high-value assets or those regulated by specific government bodies like land registries or corporate registrars. This step adds a layer of official verification to the transfer.

Finally, once the form is properly signed and attested, it often needs to be submitted to the relevant authority for formal recording. For shares, this might be the company’s share registrar. For property, it’s typically the land registry. There might be associated fees or taxes that need to be paid at this stage, so it’s wise to research these requirements beforehand to avoid any last-minute surprises. Keep diligent records of all submitted documents and receipts for your own files.

By understanding the distinct purpose of an off market transfer form template and following the proper steps for its execution, you can navigate what might initially seem like a complex process with confidence. It transforms a potentially ambiguous private agreement into a clear, legally sound transaction, providing a solid foundation for new ownership and peace of mind for everyone involved.