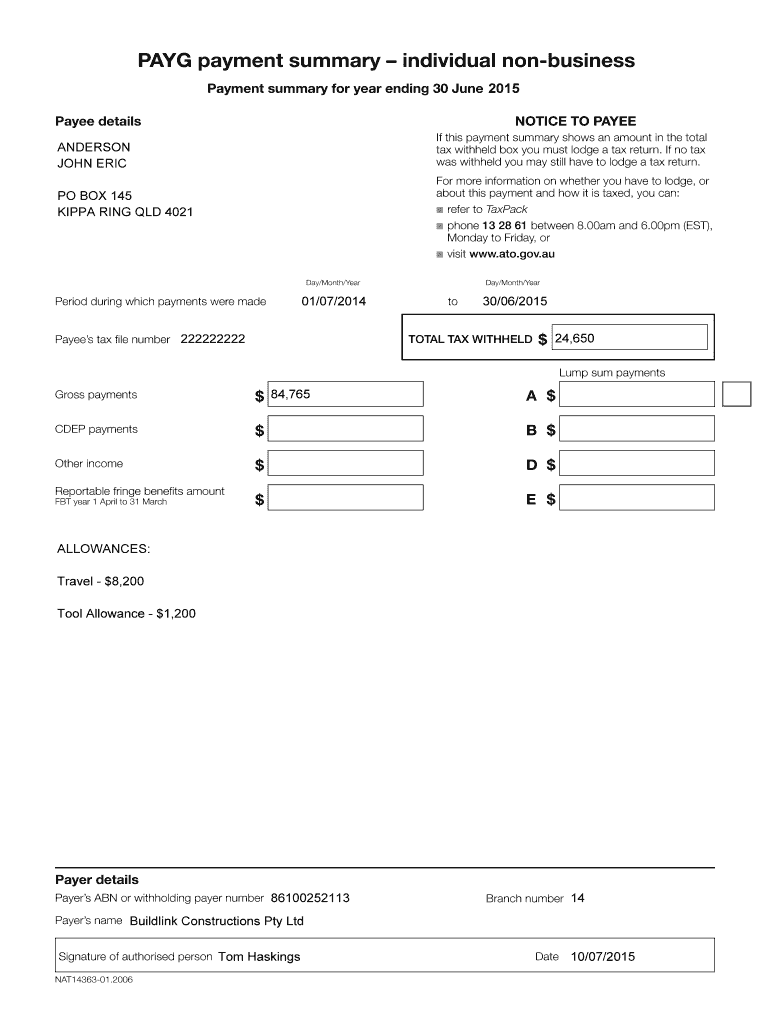

Navigating the intricacies of Australian tax obligations can sometimes feel like a maze, especially when it comes to understanding all the necessary documentation. One crucial document that every employee or contractor receives at the end of the financial year is the PAYG Payment Summary, formerly known as a Group Certificate. This summary details all the payments made to you and the tax withheld throughout the year, making it an indispensable tool for filing your annual income tax return.

For businesses, employers, or even individuals who need to issue these summaries, having a reliable and compliant payg payment summary form template is incredibly beneficial. It ensures accuracy, saves time, and helps in meeting the strict reporting requirements set by the Australian Taxation Office (ATO). Whether you are preparing to lodge your tax return or need to issue these summaries to your staff, understanding this document and how to effectively manage it is key to a smooth financial year end.

Demystifying the PAYG Payment Summary and Why a Template is Crucial

The PAYG Payment Summary, which stands for Pay As You Go, is more than just a piece of paper; it is a comprehensive record of your earnings and the tax your employer has already paid on your behalf to the ATO. Every employer in Australia is legally obligated to provide this summary to their employees by mid-July each year, covering the financial year that ended on June 30. It acts as a bridge between your annual income and the tax you owe, allowing you to accurately declare your earnings and claim any applicable refunds or pay additional tax.

For employers, preparing these summaries accurately is paramount. Errors can lead to penalties from the ATO and can cause significant inconvenience for employees trying to lodge their tax returns. This is where the value of a payg payment summary form template becomes crystal clear. A well-designed template helps streamline the process, ensuring all required fields are present and correctly filled, reducing the chance of oversight or mistakes.

Essential Elements of a Compliant PAYG Payment Summary

A standard PAYG Payment Summary includes a range of information that is vital for both the recipient and the ATO. Understanding these components is key to utilizing any template effectively and ensuring compliance.

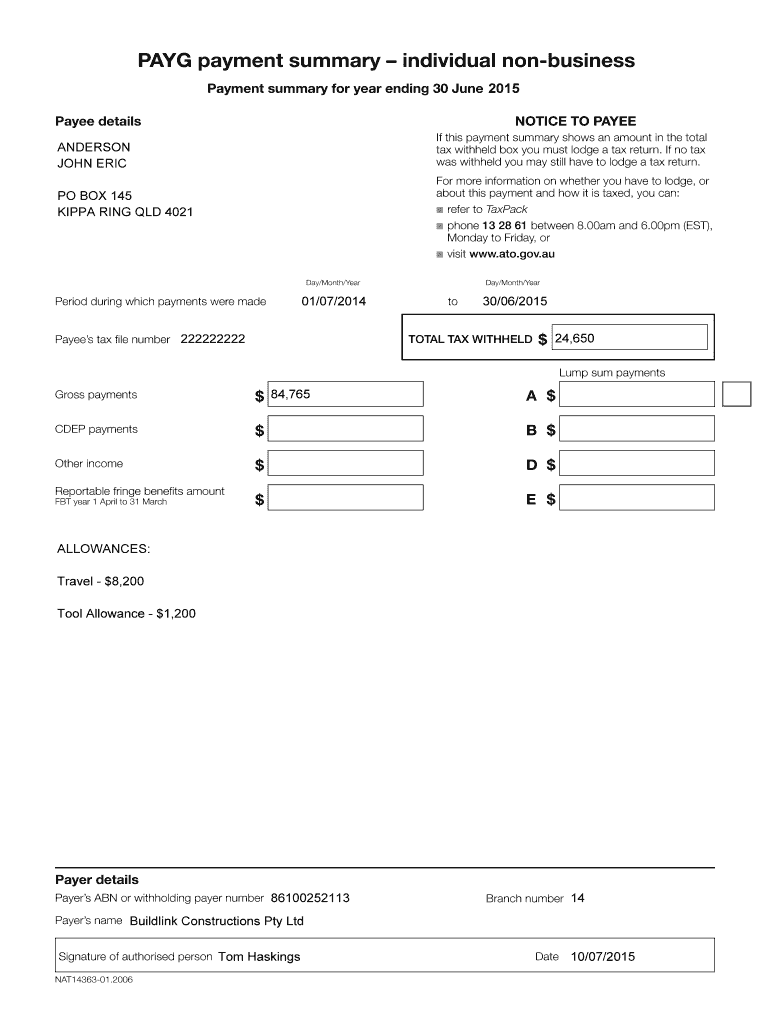

- Gross Payments: This is the total amount of income you received before tax was withheld. It includes wages, salaries, allowances, and other benefits.

- Total Tax Withheld: The cumulative amount of tax your employer deducted from your pay throughout the financial year and sent to the ATO.

- Employer Details: Your employer’s Australian Business Number (ABN), name, and branch number are clearly stated.

- Employee Details: Your tax file number (TFN), name, and address are included to identify the recipient.

- Other Lump Sum Payments: Details of any one-off payments like unused leave or redundancy payouts, which are taxed differently.

Using a template provides a structured approach to gathering and presenting all this information. It acts as a checklist, guiding you through each necessary data point, which is especially helpful for small businesses or those new to managing payroll. This structured approach not only saves time but significantly enhances the reliability of the summary provided.

Accessing and Customizing Your PAYG Payment Summary Form Template

Finding a suitable payg payment summary form template is easier than you might think, with several reliable sources available. The Australian Taxation Office (ATO) website is always the primary and most authoritative source for official forms and templates. They often provide generic templates that can be downloaded and filled out. Additionally, many reputable accounting software providers and professional accounting firms offer their own versions of these templates, sometimes with added functionalities for easier data input or integration with payroll systems.

When selecting a template, it is important to ensure it is the most current version, as ATO requirements can change from year to year. Look for templates that are clear, easy to navigate, and ideally, those that are editable. Many templates come in PDF format, which can be filled digitally, or in spreadsheet formats like Excel, which allow for calculations and easier data management. The goal is to choose a template that aligns with your specific needs, whether you are preparing one summary or hundreds.

Once you have your chosen template, customization for your specific business or individual use is straightforward. For employers, this often involves inputting your ABN and company details accurately. For employees, it means ensuring your personal details, TFN, and all payment figures match your records and payslips. Consistency is vital here to avoid discrepancies that could flag issues with the ATO.

- Verify current financial year: Always ensure the template is for the correct financial year to align with current tax laws.

- Check for editable fields: Opt for templates where you can directly type information rather than print and handwrite.

- Cross-reference data: Double-check all figures against your payroll records or payslips before finalizing.

- Maintain a copy: Always keep a digital or physical copy of the completed summary for your records.

By diligently using and customizing a payg payment summary form template, you empower yourself with a tool that simplifies what can often be a complex annual task. It’s about leveraging efficiency and accuracy to ensure smooth tax reporting for everyone involved.

Embracing the use of a reliable template for your payment summaries significantly streamlines the annual reporting process. It reduces the administrative burden, ensures compliance with ATO regulations, and provides clarity for both employers and employees regarding their financial standings at tax time. This proactive approach to documentation can save valuable time and prevent potential headaches down the line.

Ultimately, having well-prepared and accurate payment summaries is foundational for a stress-free tax season. By leveraging the right tools and understanding the components of these important documents, you contribute to a smoother, more efficient financial close for the year, allowing everyone to focus on what matters most.