In todays fast-paced world, managing transactions and agreements can sometimes feel like navigating a complex maze. Whether youre a small business owner, a freelancer, an event organizer, or just someone engaging in a significant personal transaction, ensuring clarity and protection is paramount. Thats where a well-crafted payment and non liability form comes into play, offering a clear framework for both parties involved. It helps set expectations, document financial exchanges, and most importantly, mitigate potential future disputes or claims.

Think of it as your essential toolkit for professionalizing your interactions, no matter the scale. It isnt just about protecting yourself; its also about building trust and demonstrating transparency with the other party. By clearly outlining terms for payment and explicitly detailing any limitations of liability, you create a solid foundation for a smooth and successful exchange.

What Exactly is a Payment and Non Liability Form Template?

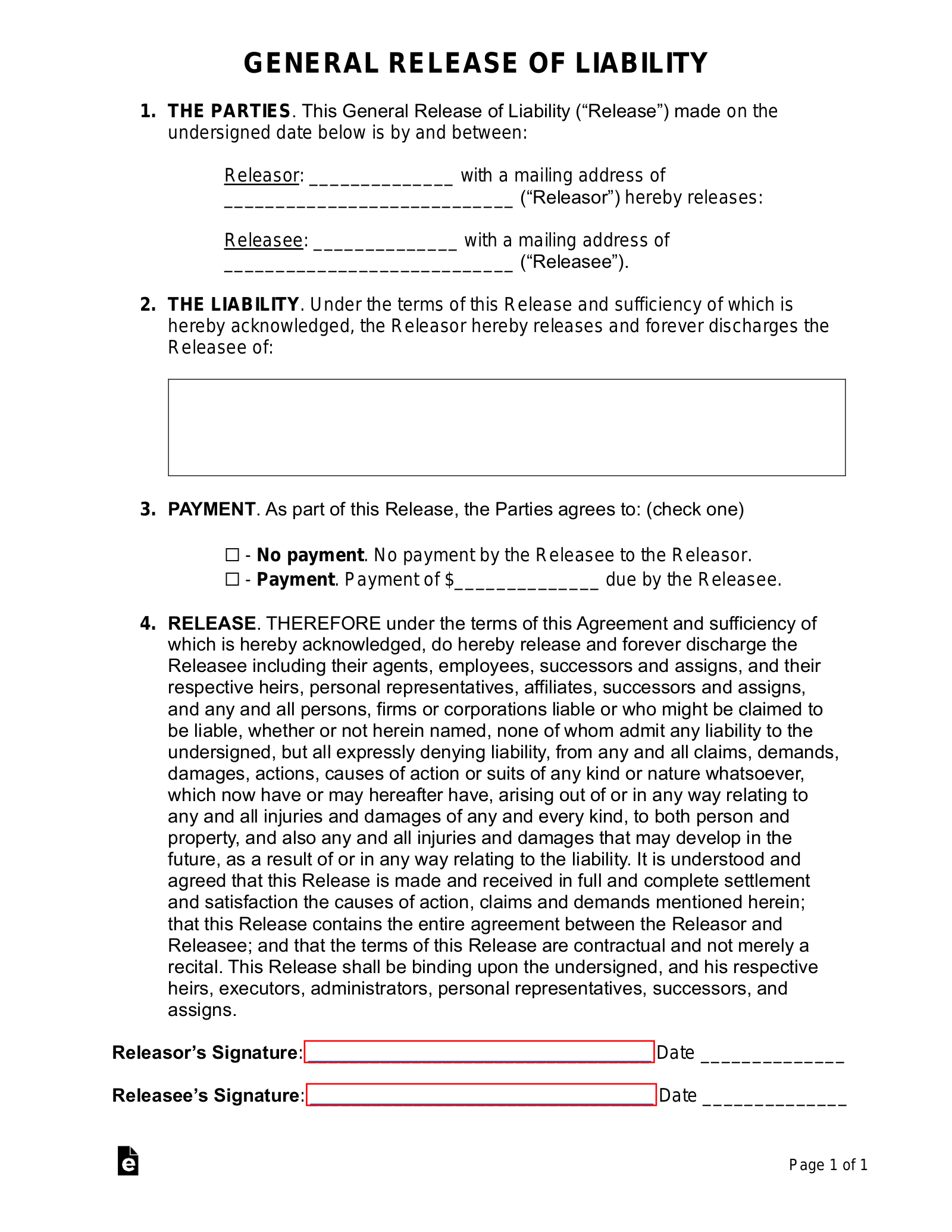

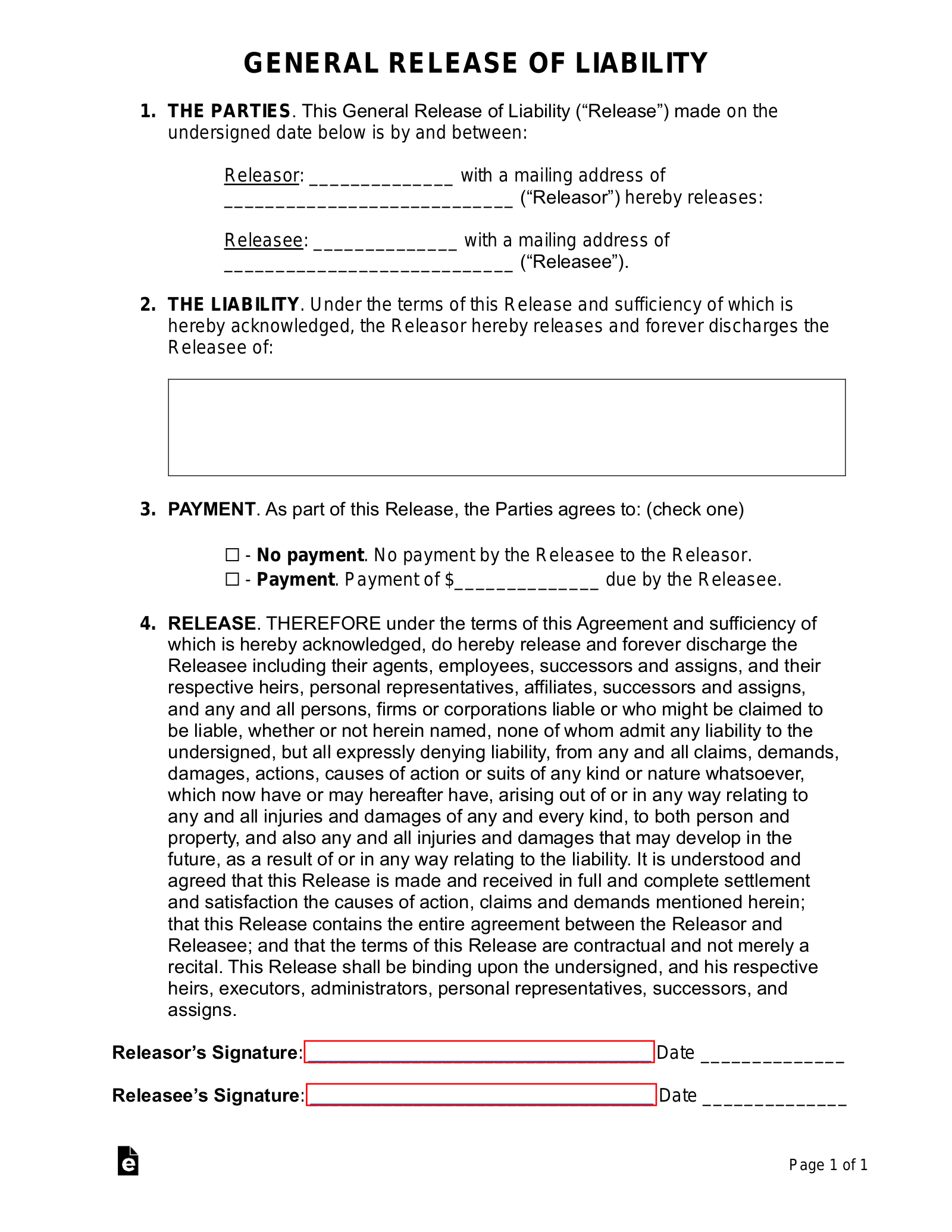

At its core, a payment and non liability form template is a dual-purpose document designed to serve two critical functions simultaneously. Firstly, it acknowledges the receipt of payment for goods or services rendered. This creates an official record of the financial transaction, eliminating any ambiguity about whether a payment was made, when it was made, and for what specific purpose. It acts as a formal receipt that both parties can refer back to, ensuring financial clarity and preventing misunderstandings.

Secondly, and equally important, it includes a non liability clause, often referred to as a liability waiver. This part of the document is designed to protect one party from potential legal claims or responsibilities arising from certain activities, services, or events. It typically states that the participant or client agrees not to hold the service provider or organizer responsible for specific risks, injuries, or damages that might occur during the course of their interaction. This is crucial for businesses and individuals who engage in activities that carry inherent risks, even minor ones.

Imagine you are hosting an event or providing a service. Despite your best efforts, unforeseen circumstances can arise. A well-worded non liability section in your form can help shield you from frivolous lawsuits or claims for situations clearly outlined and agreed upon by the other party. It fosters an understanding that while you provide a service or activity, there are certain risks that the other party accepts responsibility for.

Key Elements to Include in Your Template

To make your payment and non liability form template truly effective, it should incorporate several key components:

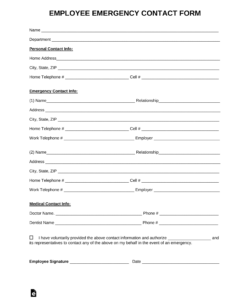

- **Identification of Parties:** Clearly state the full names and contact information of all involved parties, the payer and the payee, or the service provider and the client.

- **Description of Services or Goods:** Provide a detailed description of the services rendered or goods purchased for which the payment is being made. Specificity here helps avoid confusion.

- **Payment Details:** Clearly state the amount paid, the date of payment, and the method of payment. This section confirms the financial transaction.

- **Liability Waiver Clause:** This is the core of the non liability aspect. It should clearly outline the risks involved and state that the signing party understands and accepts these risks, releasing the other party from liability for certain types of damages or injuries.

- **Acknowledgement and Agreement:** A statement that the signing party has read, understood, and agrees to all terms and conditions, especially regarding the waiver of liability.

- **Signatures and Date:** Space for all involved parties to sign and date the document, affirming their agreement. Signatures make the document legally binding.

Having these elements ensures your form is comprehensive and robust.

Who Needs This Form and Why It’s Indispensable

A wide array of individuals and entities can greatly benefit from using a payment and non liability form. Essentially, anyone involved in a transaction where money changes hands and there is a potential for risk or dispute could find this document incredibly useful. Think about independent contractors offering specialized services, event organizers putting on a festival or workshop, or even landlords dealing with tenants. Its about laying down clear rules from the outset, protecting all parties involved and minimizing the chances of future headaches.

For example, a freelance photographer might use it when a client pays for a photoshoot, ensuring the payment is recorded and that the client understands the limits of the photographer’s liability if, say, an unexpected technical issue occurs with equipment that is out of the photographers control. Similarly, a fitness instructor might use it before starting a new training program with a client, confirming payment for sessions and having the client acknowledge the inherent risks of physical activity, thus protecting the instructor from liability for muscle strains or injuries not directly caused by negligence.

Consider businesses that offer experiential services, such as adventure tours, educational workshops, or even hair salons. While the primary service is clear, there are always underlying risks clients should be aware of. Using this form allows these businesses to secure payment for their services and simultaneously obtain an acknowledgment from the client regarding their understanding and acceptance of certain risks. This proactive approach helps to prevent misunderstandings and potentially costly legal battles down the line. It serves as an essential component of good business practice and risk management.

The necessity of this type of form extends to virtually any scenario where a service is exchanged for payment and there is a need to clarify responsibilities and mitigate risks. It is not merely a formality; it is a strategic tool that contributes to a more secure and professional business environment. By having a clear payment and non liability form template ready, you equip yourself with a powerful instrument for smooth transactions and peace of mind.