Utilizing such a structure offers several advantages. It allows for better budgeting, identification of areas for potential savings, and improved financial planning for future goals like retirement or major purchases. A clear understanding of cash flow empowers individuals to manage debt effectively and achieve financial stability.

This foundation of understanding facilitates informed discussions on topics such as budgeting techniques, debt management strategies, and investment planning. It provides a framework for analyzing financial health and setting realistic financial goals.

1. Income

Accurate income documentation is foundational to a functional cash flow statement. Income represents the inflow of funds, the lifeblood of personal finances. Without a comprehensive understanding of all income sources, a realistic financial picture cannot be established. This includes salaries, wages, investment returns, rental income, and any other form of monetary inflow. For instance, accurately recording dividend payments from investments, even small amounts, contributes to a precise calculation of total income and overall cash flow. Omitting or underestimating income can lead to inaccurate budgeting and flawed financial planning.

The relationship between income and a cash flow statement is causal. Income directly impacts net cash flow, influencing the ability to save, invest, and meet financial obligations. Accurate income reporting provides the basis for realistic budgeting. It allows for a clear understanding of available resources, enabling informed decisions regarding spending and saving. Consider someone planning a significant purchase, like a down payment on a house. A precise understanding of income streams is crucial for determining affordability and planning savings strategies.

In summary, meticulous income tracking within a cash flow statement is essential for sound financial management. It empowers individuals to assess their financial standing, develop achievable goals, and make informed decisions. Challenges may arise from fluctuating or irregular income sources. However, diligent recording of all income, regardless of regularity, allows for the most accurate financial overview, facilitating better long-term financial planning. This understanding is crucial for navigating financial complexities and achieving financial stability.

2. Expenses

A comprehensive understanding of expenses is crucial for utilizing a personal annual cash flow statement template effectively. Accurate expense tracking provides insights into spending patterns, informing financial decisions and facilitating better budget management. Without a clear picture of where money goes, financial planning remains incomplete.

- Fixed ExpensesThese recurring, predictable expenses form the foundation of a budget. Examples include rent or mortgage payments, loan installments, and insurance premiums. Understanding fixed expenses allows for accurate forecasting and planning within a cash flow statement. Knowing the consistent outflow for these expenses helps determine available funds for other categories.

- Variable ExpensesThese fluctuate based on consumption habits and needs. Groceries, utilities, transportation, and entertainment fall under this category. Tracking variable expenses is essential for identifying areas of potential overspending and implementing cost-saving strategies. Analysis within a cash flow statement can reveal trends in variable expenses, allowing for adjustments to align with financial goals.

- Periodic ExpensesThese occur less frequently but often involve significant sums. Examples include annual property taxes, car maintenance, or holiday gifts. Accounting for periodic expenses within a cash flow statement prevents unexpected financial strain. Allocating funds throughout the year for these expenses facilitates smoother cash flow management.

- Discretionary ExpensesThese non-essential expenses represent lifestyle choices and wants rather than needs. Dining out, entertainment subscriptions, and luxury purchases are examples. Monitoring discretionary expenses within a cash flow statement allows for adjustments to align with savings goals and overall financial priorities. Analyzing these expenses can reveal opportunities to redirect funds towards more essential needs or long-term financial objectives.

Categorizing and tracking these various expense types within a personal annual cash flow statement template provides a comprehensive view of spending habits. This understanding allows for informed budgeting, identification of areas for potential savings, and ultimately, greater control over personal finances. By analyzing expense trends and adjusting spending patterns, individuals can work toward achieving their financial goals more effectively.

3. Net Flow

Net flow, the difference between total income and total expenses, represents the core output of a personal annual cash flow statement template. This crucial metric provides a concise overview of financial health, indicating whether an individual has a surplus or deficit. Understanding and analyzing net flow is fundamental for effective financial planning and decision-making.

- SurplusA positive net flow indicates a surplus, where income exceeds expenses. This surplus allows for savings, investments, and debt reduction, contributing to long-term financial stability. For example, a consistent surplus enables contributions to a retirement account or investments in a diversified portfolio. A healthy surplus provides financial flexibility and resilience against unforeseen circumstances.

- DeficitA negative net flow signifies a deficit, where expenses surpass income. This scenario necessitates adjustments to spending habits, exploration of additional income sources, or both. Ignoring a deficit can lead to accumulating debt and financial instability. Addressing a deficit might involve creating a detailed budget, reducing discretionary spending, or seeking ways to increase income through a side hustle or skill development.

- Impact on Financial GoalsNet flow directly impacts the feasibility of achieving financial goals. Whether saving for a down payment, paying off student loans, or early retirement, a positive net flow is essential for making progress. Analyzing net flow within the context of financial goals helps determine realistic timelines and necessary adjustments to spending or income generation. For instance, understanding the current net flow can inform how long it will take to reach a savings goal for a down payment, influencing decisions about housing affordability.

- Trend AnalysisTracking net flow over time provides valuable insights into financial progress. Observing trends allows for identification of periods of overspending, effective cost-saving measures, and the impact of financial decisions. Consistent monitoring of net flow enables proactive adjustments and facilitates better long-term financial management. For example, a downward trend in net flow might indicate the need to re-evaluate spending habits or explore opportunities for increased income.

Analyzing net flow within a personal annual cash flow statement template provides a clear understanding of financial health and progress toward goals. This understanding empowers informed decision-making regarding spending, saving, and investing, contributing to overall financial well-being. By consistently tracking and analyzing net flow, individuals can gain greater control over their finances and work towards long-term financial security.

4. Categorization

Categorization within a personal annual cash flow statement template provides a structured framework for organizing financial data. This systematic approach facilitates a deeper understanding of income sources and spending patterns, enabling informed financial decisions. Without categorization, the template’s utility diminishes, hindering effective analysis and planning.

- Income StreamsCategorizing income streams allows for clear identification of primary and secondary income sources. Distinguishing between salary, investment returns, rental income, or side hustle earnings provides insights into the stability and diversification of income. This granular view enables informed decisions regarding financial diversification and risk management. For example, understanding the proportion of income derived from investments versus a salary can inform investment strategies and retirement planning.

- Expense TrackingCategorizing expenses provides a detailed overview of spending habits. Grouping expenses into categories like housing, transportation, food, and entertainment illuminates areas of potential overspending and highlights opportunities for cost optimization. This detailed breakdown facilitates budget adjustments and informed spending decisions. For instance, recognizing a high percentage of spending on dining out allows for targeted adjustments to reduce expenses and increase savings.

- Needs versus WantsCategorization facilitates differentiation between essential needs and discretionary wants. Separating necessities like housing and groceries from discretionary spending like entertainment and luxury purchases allows for prioritization and strategic allocation of resources. This distinction empowers individuals to make conscious spending choices aligned with financial goals. For example, categorizing spending on streaming services as a “want” versus groceries as a “need” can inform budget adjustments to prioritize essential expenses.

- Goal-Oriented AnalysisCategorization supports goal-oriented financial analysis. By aligning expenses and income with specific financial goals like debt reduction, saving for a down payment, or retirement planning, individuals can track progress and make necessary adjustments. This targeted approach enhances the effectiveness of financial planning and improves the likelihood of achieving desired outcomes. For example, categorizing debt payments separately allows for focused tracking of progress towards debt reduction goals and informs decisions about allocating additional funds towards debt repayment.

Effective categorization within a personal annual cash flow statement template is crucial for gaining actionable insights into financial behavior. This structured approach enables informed decision-making, facilitates proactive financial management, and contributes to achieving long-term financial goals. By understanding the nuances of income and expenses through categorization, individuals can gain greater control over their financial well-being.

5. Regular Tracking

Regular tracking forms the cornerstone of effective utilization of a personal annual cash flow statement template. Consistent monitoring of both income and expenses provides dynamic insights into financial behavior, allowing for timely adjustments and proactive financial management. Without regular updates, the template becomes a static document, failing to reflect real-time financial status and hindering informed decision-making. The relationship between regular tracking and the template is symbiotic; the template provides the structure, while regular tracking breathes life into it. For instance, tracking monthly utility expenses reveals seasonal fluctuations, informing budget adjustments for higher summer cooling costs or winter heating expenses. Similarly, tracking investment income allows for assessment of portfolio performance and adjustments to investment strategies.

The importance of regular tracking as a component of the template cannot be overstated. It enables identification of spending trends, assessment of progress toward financial goals, and early detection of potential financial challenges. Consider someone aiming to reduce debt. Regular tracking allows them to monitor the impact of debt reduction strategies, adjust payments based on available funds, and visualize progress toward becoming debt-free. Conversely, irregular or infrequent tracking obscures spending patterns, delays identification of financial imbalances, and hinders effective financial planning. For example, failing to track recurring subscription fees can lead to unexpected expenses and budget overruns, impeding progress toward savings goals.

In conclusion, regular tracking is indispensable for maximizing the benefits of a personal annual cash flow statement template. It empowers individuals to maintain an accurate, up-to-date understanding of their financial standing, facilitating informed decision-making and proactive financial management. Challenges may include maintaining consistency and accurately recording all transactions. However, the long-term benefits of informed financial control and improved financial well-being significantly outweigh the effort required for regular tracking. This diligent practice fosters financial awareness, enabling individuals to navigate financial complexities and achieve long-term financial stability.

6. Template Usage

Effective utilization of a personal annual cash flow statement template is crucial for gaining a comprehensive understanding of personal finances. Template usage provides a structured approach to organizing financial data, facilitating informed decision-making and contributing to long-term financial well-being. Understanding the various facets of template usage unlocks its full potential.

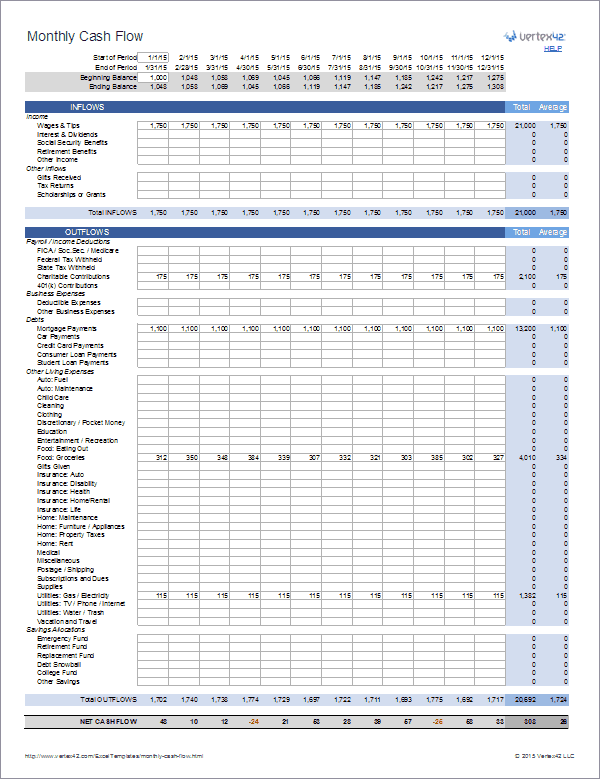

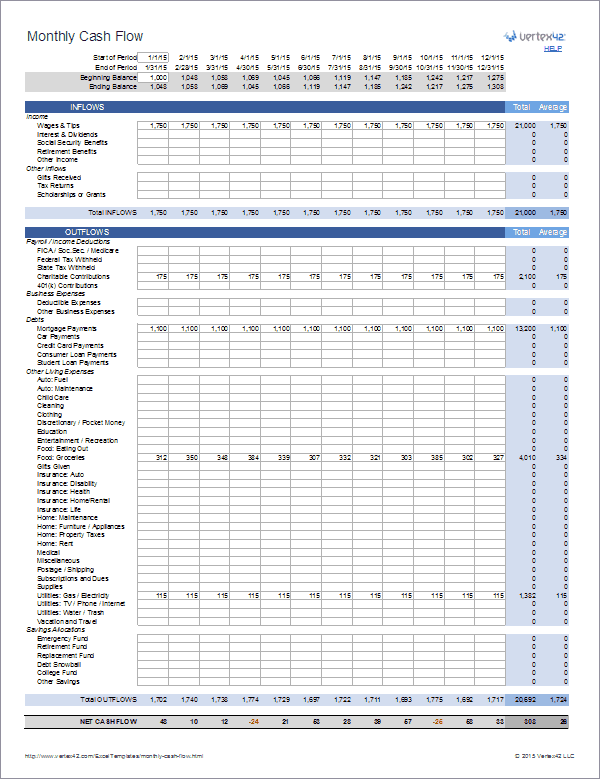

- SelectionChoosing an appropriate template is the first step. Various templates exist, catering to different needs and levels of financial complexity. Selecting a template that aligns with individual circumstanceswhether a simple spreadsheet or a sophisticated software applicationis crucial for effective usage. For example, a freelancer with irregular income might benefit from a template designed to accommodate fluctuating income streams, while a salaried employee might prefer a simpler format. Choosing the right template ensures ease of use and accurate data representation.

- CustomizationAdapting the template to specific needs enhances its utility. Customizing categories, adding sections for specific financial goals, or integrating with other financial tools allows for a personalized approach to financial management. For instance, an individual prioritizing debt reduction might customize the template to highlight debt payments and track progress toward debt-free status. Customization ensures the template reflects individual financial priorities and goals.

- IntegrationIntegrating the template with other financial tools streamlines financial management. Connecting the template to bank accounts, budgeting apps, or investment platforms facilitates automatic data import and reduces manual data entry. This integration provides a holistic view of finances, enabling more informed decisions. For example, linking the template to a budgeting app allows for real-time tracking of expenses against budget allocations, facilitating proactive adjustments to spending habits.

- Regular MaintenanceConsistent and disciplined use of the template is essential for maximizing its benefits. Regularly updating income and expenses, reviewing progress towards goals, and periodically analyzing spending patterns ensures the template remains a relevant and dynamic tool for financial management. Failing to maintain the template regularly diminishes its accuracy and effectiveness, hindering informed financial decision-making. Consistent maintenance ensures the template remains a valuable tool for long-term financial planning and management.

Effective template usage transforms a simple document into a powerful tool for financial empowerment. By selecting the right template, customizing it to individual needs, integrating it with other financial tools, and maintaining it regularly, individuals can gain a comprehensive understanding of their financial standing, make informed decisions, and achieve their financial goals. This proactive approach to financial management fosters financial stability and contributes to long-term financial well-being.

Key Components of a Personal Annual Cash Flow Statement

A comprehensive personal annual cash flow statement requires careful consideration of several key components. These elements provide a structured framework for understanding financial health and informing future decisions.

1. Income: All sources of income must be meticulously documented. This includes earned income (salaries, wages, freelance earnings), investment income (dividends, interest, capital gains), and any other form of regular or irregular monetary inflow. Accurate income reporting forms the foundation of a reliable cash flow statement.

2. Expenses: Thorough expense tracking is crucial. Expenses should be categorized to provide granular insights into spending patterns. Categories might include housing, transportation, food, utilities, healthcare, debt payments, entertainment, and other relevant areas. Distinguishing between fixed, variable, and periodic expenses provides further clarity.

3. Net Cash Flow: Calculated as the difference between total income and total expenses, net cash flow reveals the overall financial status. A positive net flow indicates a surplus, while a negative net flow signifies a deficit. Understanding net flow is crucial for assessing financial health and planning for future goals.

4. Time Period: The statement should cover a specific period, typically one year. This annual perspective allows for analysis of long-term financial trends and facilitates planning for future financial obligations and goals.

5. Categorization Detail: The level of detail within expense categories influences the statement’s analytical power. More detailed categorization provides greater insights into spending habits and informs more targeted financial decisions. For example, breaking down “food” into “groceries” and “dining out” offers more actionable information.

6. Regular Updates: Maintaining an up-to-date cash flow statement is essential for accurate financial assessment. Regular updates, ideally monthly, ensure the statement reflects current financial realities and facilitates timely adjustments to spending or saving strategies.

7. Template Structure: Utilizing a template provides a standardized format for organizing financial data. This structured approach facilitates consistency, simplifies data entry, and enhances comparability over time. Choosing a template that allows for customization ensures it aligns with individual needs.

Accurate data collection and consistent monitoring of these components provide a robust framework for managing personal finances, enabling informed decisions and contributing to long-term financial well-being. This structured approach facilitates proactive financial management and informed decision-making.

How to Create a Personal Annual Cash Flow Statement

Creating a personal annual cash flow statement involves a structured approach to organizing financial data. This process facilitates a clear understanding of income, expenses, and overall financial health.

1. Choose a Format: Select a format suitable for individual needs. Options include spreadsheets, dedicated budgeting software, or even a simple notebook. A well-structured spreadsheet offers flexibility and customization, while budgeting software often provides automated features.

2. Determine the Time Period: Specify a clear time frame, typically one year, for the statement. This allows for analysis of long-term financial trends and facilitates annual budgeting.

3. Document Income: Meticulously record all sources of income. Categorize income streams for detailed analysis. Include salaries, wages, investment returns, rental income, and any other form of monetary inflow.

4. Track Expenses: Maintain comprehensive records of all expenses. Categorize expenses into relevant groups, such as housing, transportation, food, utilities, healthcare, debt payments, and entertainment. Distinguish between fixed, variable, and periodic expenses.

5. Calculate Net Cash Flow: Subtract total expenses from total income to determine net cash flow. A positive result indicates a surplus, while a negative result signifies a deficit. This crucial metric reveals overall financial health.

6. Review and Analyze: Regularly review the statement, ideally monthly. Analyze spending patterns and identify areas for potential adjustments. Compare actual results against budget projections to monitor financial progress.

7. Refine and Adjust: Based on analysis, refine budgeting strategies and adjust spending habits. Identify opportunities to increase income, reduce expenses, or both. This iterative process promotes continuous improvement in financial management.

8. Utilize a Template (Optional): Using a pre-designed template can streamline the process. Many free templates are available online or within spreadsheet software. Customization might be necessary to align the template with individual needs and preferences.

Consistent application of these steps provides a clear and actionable understanding of financial health, facilitating informed decisions and contributing to long-term financial well-being. This structured approach fosters financial awareness and enables proactive management of personal finances.

A structured approach to managing personal finances, facilitated by a well-maintained annual cash flow statement template, provides crucial insights into income, expenses, and overall financial health. Diligent tracking, accurate categorization, and regular analysis empower informed decision-making regarding spending, saving, and investing. Understanding the nuances of cash flow dynamics, from identifying income streams to categorizing expenses and calculating net flow, is essential for achieving financial stability.

Financial well-being requires proactive management and consistent monitoring. Utilizing a template offers a structured framework for achieving these objectives. This proactive approach facilitates informed financial decisions, contributing to long-term financial security and enabling individuals to navigate financial complexities with greater confidence and control. The insights gained from a comprehensive cash flow statement empower individuals to make informed choices, aligning financial actions with long-term goals and aspirations.