Life has a way of throwing unexpected curveballs, doesn’t it? Whether it’s a natural disaster, a theft, or simply the need to plan for the future, having a clear understanding of everything you own can bring immense peace of mind. That’s where a well-organized personal asset inventory form template comes into play, serving as your comprehensive record of valuables, finances, and important documents. It’s not just about knowing what you have; it’s about providing a structured way to keep track of it all, making stressful situations a little less daunting.

Think of this inventory as your personal financial snapshot, invaluable for everything from filing insurance claims after an incident to simplifying estate planning for your loved ones. It helps ensure that nothing is overlooked and that your affairs are in order, giving you and your family a sense of security. Taking the time now to compile this information will save countless hours and potential headaches down the line, ensuring that you’re always prepared for whatever comes next.

The Undeniable Value of a Detailed Personal Asset Inventory

Creating a comprehensive inventory of your personal assets is far more than just a chore; it’s a foundational step in robust financial planning and emergency preparedness. Imagine trying to recall every single item in your home after a fire, or listing all your financial accounts for an estate settlement without any records. Without an inventory, you’re left guessing, which can lead to significant financial losses and added emotional strain during already difficult times. This process provides a clear, documented list of everything you possess, from your family heirlooms to your digital subscriptions.

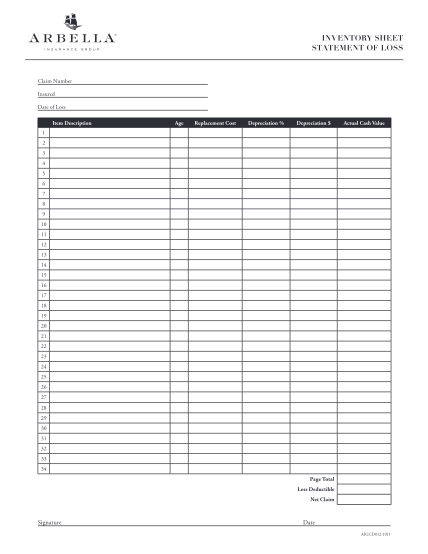

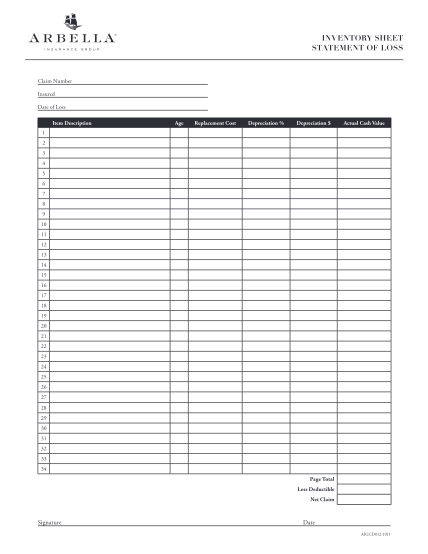

One of the most immediate benefits of a detailed asset inventory is its crucial role in insurance claims. In the unfortunate event of theft, fire, or other damage, your insurance company will require a list of lost or damaged items, often with proof of ownership and value. A well-maintained inventory, complete with purchase dates, prices, and even photographs, can significantly expedite this process, helping you recover your losses more efficiently. It removes the burden of memory during a stressful period and provides concrete evidence to support your claim.

Beyond emergencies, an asset inventory is a cornerstone of effective estate planning. When the time comes, your loved ones will be responsible for managing your estate, and a clear, organized list of all your assets – including bank accounts, investments, properties, and even sentimental items – will be an invaluable guide. It helps ensure that your wishes are carried out accurately and reduces the potential for disputes or overlooked assets, making the probate process smoother and less stressful for those you leave behind.

Furthermore, a personal asset inventory is an excellent tool for simply understanding your net worth and managing your financial health. By systematically cataloging everything you own, you gain a clearer picture of your overall financial standing. This awareness can inform investment decisions, help identify areas for growth or consolidation, and provide a sense of control over your financial future. It’s a proactive approach to wealth management, ensuring you’re always aware of what you have.

Key Categories to Include in Your Inventory

- Real Estate: Details of all properties owned, including addresses, deeds, and mortgage information.

- Vehicles: Cars, boats, RVs, motorcycles – include make, model, VIN, and registration details.

- Financial Accounts: Bank accounts, investment portfolios, retirement funds, and cryptocurrency holdings.

- Valuables: Jewelry, artwork, collectibles, antiques, and other high-value items with appraisals if available.

- Household Contents: Furniture, electronics, appliances, and other significant items within your home.

- Digital Assets: Online accounts, domain names, intellectual property, and important digital files.

Making the Most of Your Personal Asset Inventory Form Template

Once you recognize the incredible value of tracking your assets, the next step is actually putting together your inventory. The good news is that you don’t need to start from scratch. Utilizing a personal asset inventory form template takes the guesswork out of the process, providing a structured framework that guides you through collecting all the necessary information. These templates are designed to be intuitive, ensuring you capture important details like descriptions, serial numbers, purchase dates, and estimated values for each item.

To effectively fill out your template, begin by gathering all relevant documents. This includes receipts, appraisals, deeds, insurance policies, and statements from financial institutions. Systematically go through each room in your home, opening drawers and closets, and listing items as you encounter them. For larger or more valuable items, consider taking photographs or even video recordings as supplementary evidence. Remember, the more detailed your inventory, the more beneficial it will be in the long run.

Maintaining your asset inventory is just as important as creating it. Life changes constantly, and so do your possessions. Aim to review and update your personal asset inventory form template at least once a year, or whenever you acquire significant new assets, sell off old ones, or experience major life events. This regular maintenance ensures that your inventory remains accurate and reflects your current situation, providing an up-to-date record that truly serves its purpose.

Finally, consider how you will securely store your completed inventory. While a physical copy is a good start, it’s wise to keep digital backups in a secure, off-site location, such as a cloud storage service, a secure external hard drive, or a safety deposit box. Sharing a copy with a trusted family member or executor can also be a proactive measure. The peace of mind that comes from knowing your detailed records are safe and accessible, even if your physical home is not, is truly invaluable.

Embarking on the journey of documenting your assets might seem like a considerable undertaking at first, but the long-term benefits far outweigh the initial effort. It’s an empowering step towards financial clarity and preparedness, providing a solid foundation for managing your wealth and protecting your interests. This organized approach to your possessions and financial life simplifies complex situations and offers a sense of control over your future.

Taking the initiative to compile a comprehensive record of your assets is one of the most proactive steps you can take for your financial well-being and the security of your loved ones. It’s a testament to responsible planning and thoughtful preparation, ensuring that no matter what life brings, you have a clear, documented path forward. Start today, and experience the profound peace of mind that comes from knowing your affairs are in meticulous order.