Ever wondered how much your personal belongings are truly worth? It’s a question many of us don’t ponder until a less-than-ideal situation arises, like a natural disaster or theft. Having a clear, organized record of your possessions isn’t just about knowing their value; it’s about peace of mind and preparedness. A personal property inventory form template can be your best friend in such scenarios.

Think of it as a comprehensive snapshot of everything you own, from your antique furniture to your latest gadgets. This isn’t a task to dread; rather, it’s an empowering step towards protecting your assets and simplifying potentially complicated situations down the line. It ensures that if the unthinkable happens, you have a solid foundation to work from, making insurance claims smoother and recovery less stressful.

Why You Absolutely Need a Personal Property Inventory

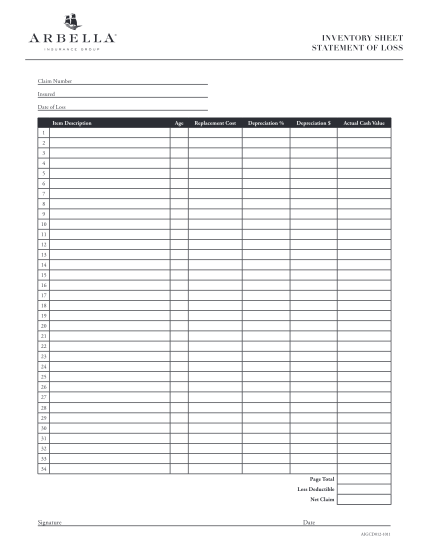

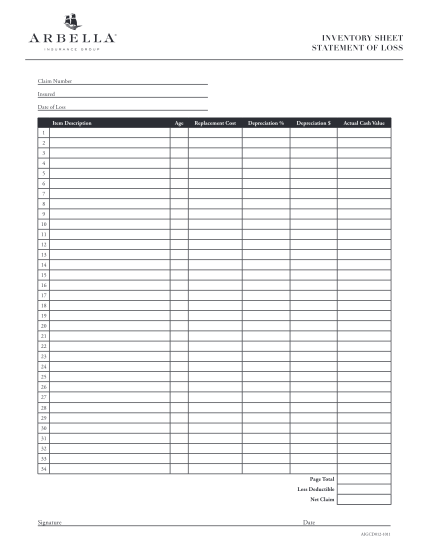

The primary reason for creating a detailed personal property inventory is for insurance purposes. In the event of a fire, flood, or theft, your insurance company will require a list of lost or damaged items to process your claim. Without a pre-existing inventory, recalling every single item you owned, its purchase date, and its estimated value can be an overwhelming and often impossible task during an already stressful time.

Imagine trying to remember every book on your shelves, every piece of jewelry, or every kitchen utensil. It’s a daunting prospect. A well-maintained inventory drastically simplifies this process, providing concrete evidence to your insurer, which can significantly speed up your claim and ensure you receive fair compensation for your losses. It shifts the burden from your memory to a reliable document.

Key Information to Include in Your Inventory

To make your inventory truly effective, it needs to be comprehensive. Don’t just list an item’s name; delve into the specifics. The more detail you provide, the stronger your documentation will be. Consider organizing your inventory by room or category to make it easier to navigate and update over time.

- Item description: Be specific (e.g., “Sony Bravia 65-inch 4K Smart TV”).

- Model and serial numbers: Crucial for electronics and appliances.

- Purchase date and location: Helps with depreciation and proof of ownership.

- Original cost: Essential for valuation.

- Estimated current value: Consider wear and tear or market fluctuations.

- Photos or videos: Visual evidence is incredibly powerful.

- Receipts or appraisals: Attach or note where they are stored.

Beyond the written details, photographic evidence is invaluable. Take clear pictures or videos of your items, especially valuable ones. Store this inventory and all supporting documents, like receipts and appraisals, in a secure location, preferably off-site or in a cloud storage service, so they are accessible even if your physical property is compromised.

Making the Most of Your Personal Property Inventory Form Template

Getting started with your personal property inventory form template might seem like a huge undertaking, but it doesn’t have to be. Break it down into manageable chunks. You could dedicate an hour each week, or tackle one room at a time until your entire home is documented. The key is consistency and starting, rather than waiting for an urgent need.

Begin with the most valuable items, such as electronics, jewelry, artwork, and collectibles. These are often the items with the highest replacement cost and the ones most likely to be targeted in a theft. Once you’ve documented these, move on to less expensive but still important items. Remember, even seemingly small items can add up quickly in value if lost.

Your inventory isn’t a one-and-done project. Life changes, and so do your possessions. It’s vital to update your personal property inventory regularly, especially after major purchases, sales, or significant events like moving or remodeling. A good rule of thumb is to review and update your inventory annually, perhaps around tax time or when you renew your insurance policy.

For maximum security and accessibility, consider using digital tools. Many templates are available online, or you can create your own spreadsheet. Once compiled, store your inventory on a cloud service, an external hard drive stored off-site, or both. Having multiple copies in different locations ensures that your vital information is protected, even if one copy is lost or destroyed. This forward-thinking approach provides a safety net for your most cherished possessions.

Creating a comprehensive record of your belongings is more than just a task; it’s an investment in your financial security and peace of mind. It transforms a potentially chaotic situation into a structured, manageable process, offering clarity and invaluable support when you need it most.

Taking the time now to organize your assets with a detailed inventory will save you immeasurable stress and potential financial loss in the future. It’s a proactive step that ensures you’re always prepared, no matter what challenges life may bring your way.