Navigating financial agreements can sometimes feel like walking through a maze. Whether you’re lending money to a friend, family member, or even a business associate, there’s always an underlying need for assurance. You want to make sure that if things go sideways, there’s a clear understanding and a legal framework to help you recover what’s owed. That’s precisely where a robust guarantee comes into play, providing a crucial layer of security and peace of mind for both parties involved in a lending scenario.

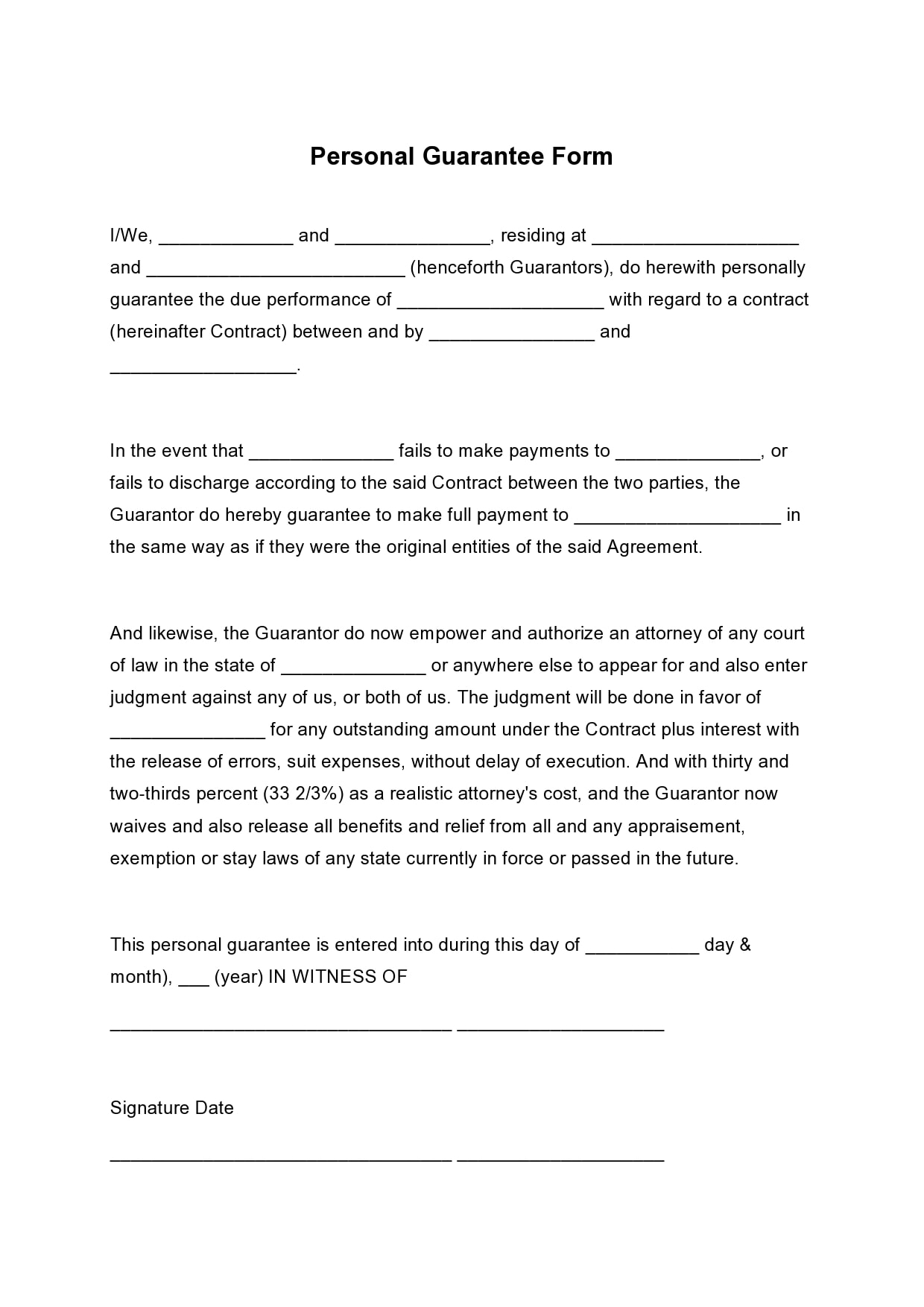

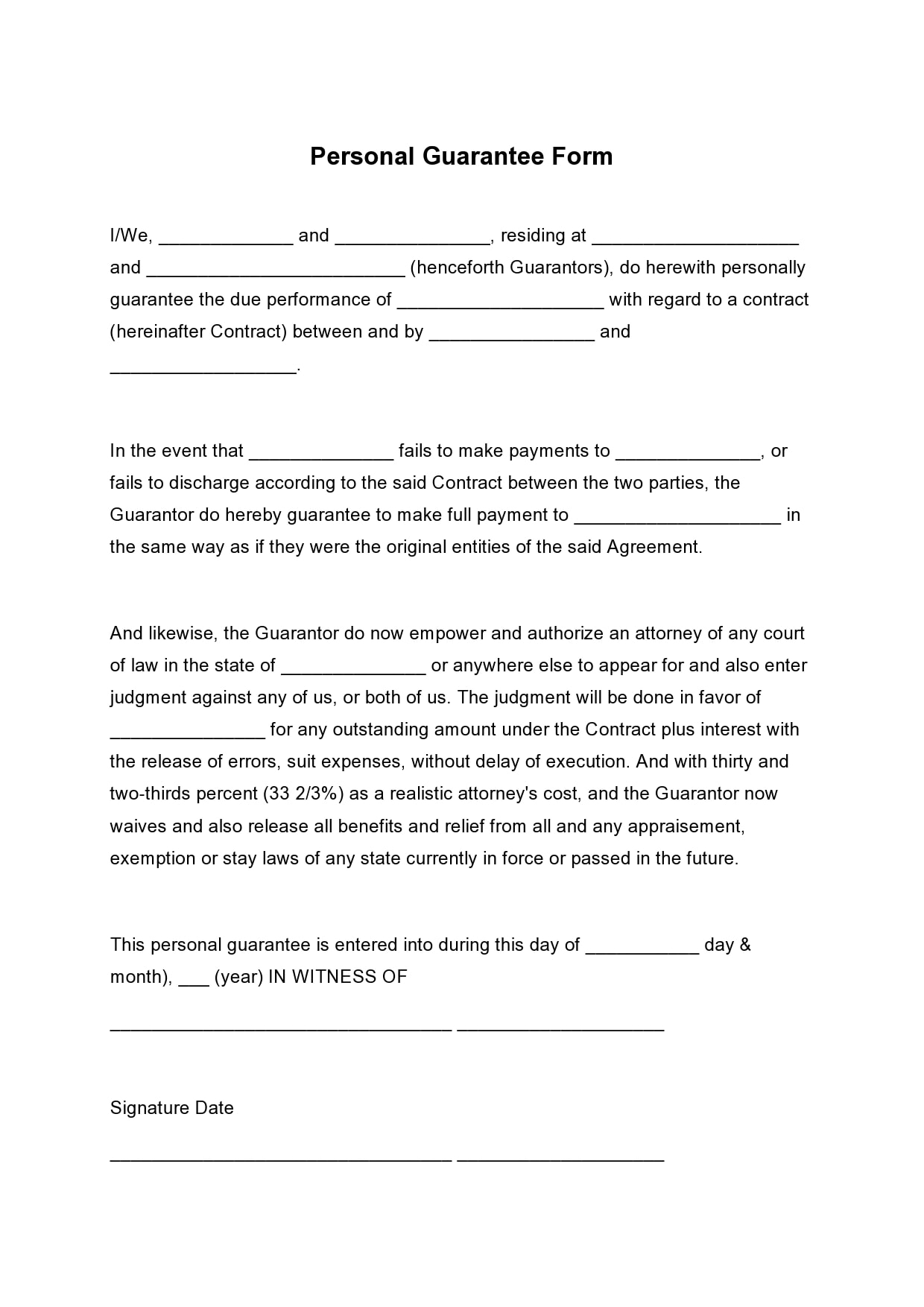

A well-crafted personal repayment guarantee form template isn’t just a piece of paper; it’s a powerful tool that outlines the commitment of a third party to repay a debt should the primary borrower fail to do so. Think of it as a safety net that protects the lender’s interests and clarifies the guarantor’s obligations. This document is essential for reducing risk and ensuring that all parties are fully aware of their responsibilities before any money changes hands. It helps prevent misunderstandings and potential disputes down the road, fostering trust in the transaction.

The Essentials of a Solid Guarantee Document

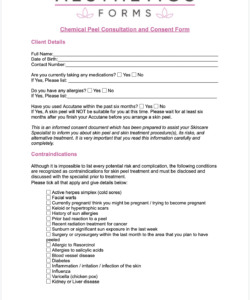

When you’re looking to create or use a personal repayment guarantee, understanding its core components is paramount. This isn’t just about filling in blanks; it’s about ensuring the document is legally sound and effectively protects your interests. Every key section serves a specific purpose, collectively forming a binding agreement that clarifies roles, responsibilities, and repercussions. Missing even one crucial element could weaken its enforceability and leave you vulnerable in a default situation, which is precisely what you’re trying to avoid with such a safeguard.

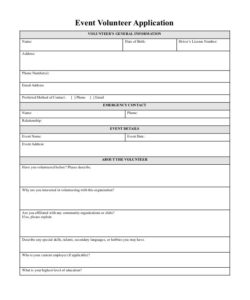

One of the first things to clearly define is the identification of all parties involved. This includes the principal debtor, the lender, and the guarantor. Full legal names, addresses, and contact information are non-negotiable details that must be accurately recorded. Following this, a precise description of the debt itself is vital. This means stating the exact amount owed, the terms of repayment, interest rates if applicable, and the original agreement to which this guarantee is tied. Ambiguity here can lead to significant problems later on.

Key Elements to Include

- Clear Identification of Parties: Ensure full legal names, addresses, and contact details for the borrower, lender, and guarantor are meticulously recorded.

- Specific Debt Details: Outline the exact amount of the debt, repayment schedule, interest rates, and any other relevant financial terms. Reference the original loan agreement.

- Scope of Guarantee: Clearly state what the guarantor is guaranteeing (e.g., principal, interest, legal fees, etc.) and if it’s a limited or unlimited guarantee.

- Conditions for Repayment: Detail the circumstances under which the guarantor’s obligation is triggered, typically upon default by the primary borrower.

- Waiver of Defenses: Include clauses where the guarantor waives certain legal defenses they might otherwise have, simplifying enforcement for the lender.

- Governing Law: Specify the jurisdiction whose laws will govern the agreement, which is crucial for dispute resolution.

- Signatures and Dates: All parties must sign and date the document, often with witness signatures or notarization for added validity.

Beyond the basic identification and debt details, the scope of the guarantee needs careful consideration. Is the guarantor responsible for the entire debt, or only a portion? Are they on the hook for accrued interest, penalties, or legal fees in the event of default? These are critical questions that the personal repayment guarantee document must explicitly answer to avoid any misinterpretation. A well-defined scope ensures that everyone understands the extent of the guarantor’s financial commitment, preventing unwelcome surprises should the guarantee need to be invoked.

Finally, consider the legal formalities. While a handshake might feel sufficient between trusted individuals, a written and properly executed guarantee is indispensable. This often means having the document witnessed, or even notarized, depending on the jurisdiction and the value of the debt. These steps add an extra layer of legal enforceability and make it much harder for any party to dispute the validity of the agreement later on. Investing a little time in these administrative details upfront can save considerable headaches and potential financial loss in the future.

When and Why to Use a Personal Repayment Guarantee

You might be wondering, “When exactly should I consider using a personal repayment guarantee?” The answer often boils down to risk mitigation. If you’re extending a significant loan, whether for personal or business purposes, and the primary borrower’s financial standing isn’t as robust as you’d like, or if there’s simply a desire for added security, this document becomes invaluable. It’s particularly useful in situations where the borrower lacks sufficient collateral or has a limited credit history, providing an alternative form of assurance for the lender.

Imagine lending a substantial sum to a startup business where the founders have passion but limited assets. A personal guarantee from one of the founders or even an external investor can significantly reduce the risk profile of the loan. Similarly, within families, while trust is usually high, formalizing a significant loan with a guarantee from a financially stable family member can prevent future disputes and protect relationships by clearly defining responsibilities. It’s about setting clear boundaries and expectations from the outset.

The “why” behind using such a guarantee is equally compelling. Primarily, it enhances the lender’s security. Knowing there’s a second party legally bound to repay the debt if the first defaults provides a strong deterrent against non-payment and a clear path for recourse. This significantly reduces the lender’s potential financial loss. It also encourages more responsible borrowing, as the primary debtor knows that their inability to pay will directly impact someone else, often a close associate or family member, adding an extra layer of pressure for timely repayment.

Furthermore, a personal guarantee can make a loan possible in situations where it might otherwise be denied. For instance, banks often require personal guarantees from business owners for their company loans, especially for smaller businesses, because it links the individual’s assets to the company’s debt, reducing the bank’s exposure. It bridges the gap between the borrower’s perceived risk and the lender’s comfort level, enabling transactions that might not occur without this crucial layer of assurance. It’s a testament to the guarantor’s belief in the borrower’s ability, backed by their own financial commitment.

Ultimately, whether you’re lending money, signing off on a significant contract, or providing goods on credit, ensuring financial agreements are airtight is always a smart move. A comprehensive guarantee document acts as your silent partner, providing a robust framework for accountability and safeguarding your interests should unforeseen circumstances arise. It transforms what might otherwise be a verbal agreement or a less formal arrangement into a legally binding commitment that offers considerable peace of mind and clarity for all involved parties.

Taking the time to implement such a safeguard isn’t about distrust; it’s about sound financial practice and responsible risk management. By clearly defining roles and responsibilities from the outset, you pave the way for smoother transactions and significantly reduce the likelihood of costly and time-consuming disputes. It’s an essential step in protecting your investments and ensuring that all parties understand their obligations, fostering a more secure financial environment for everyone.