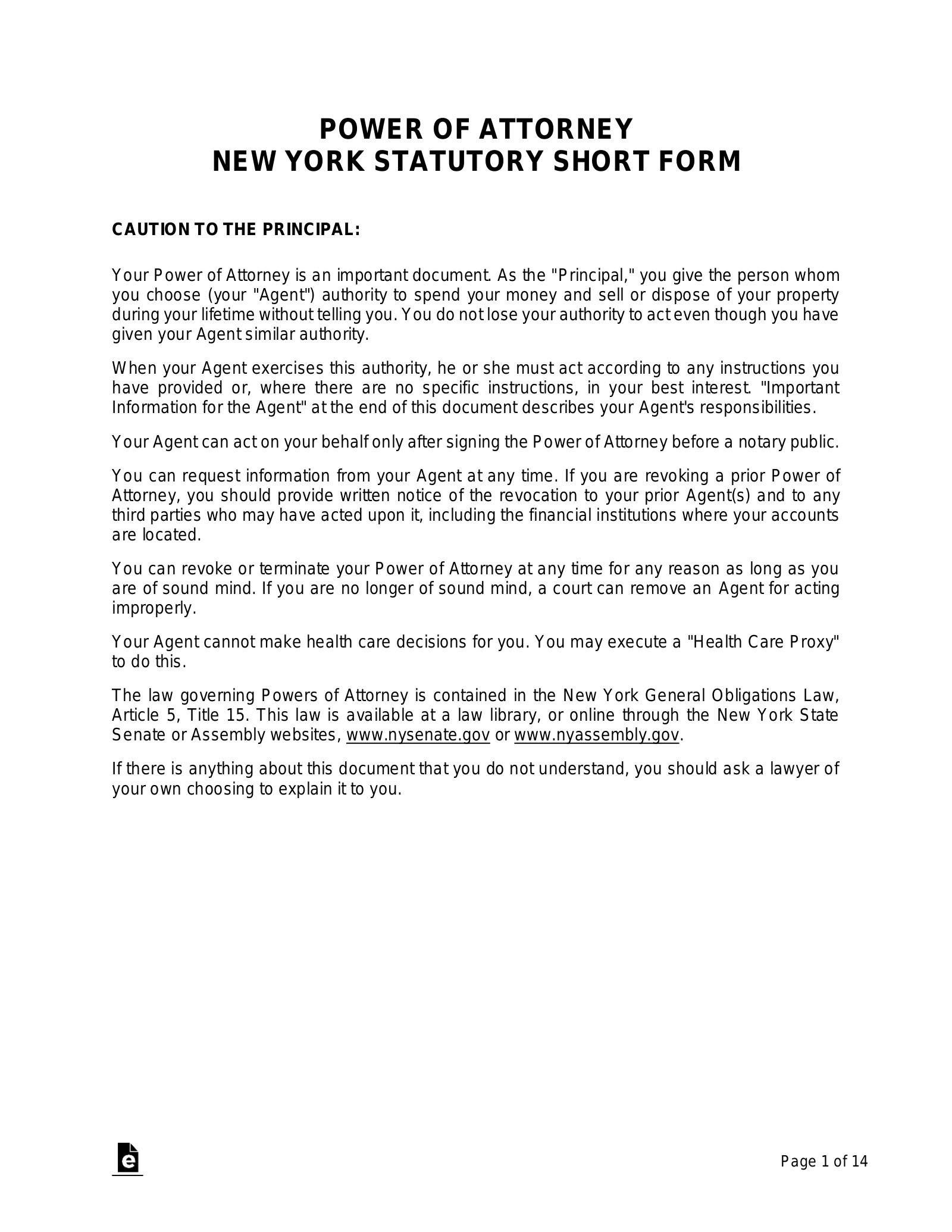

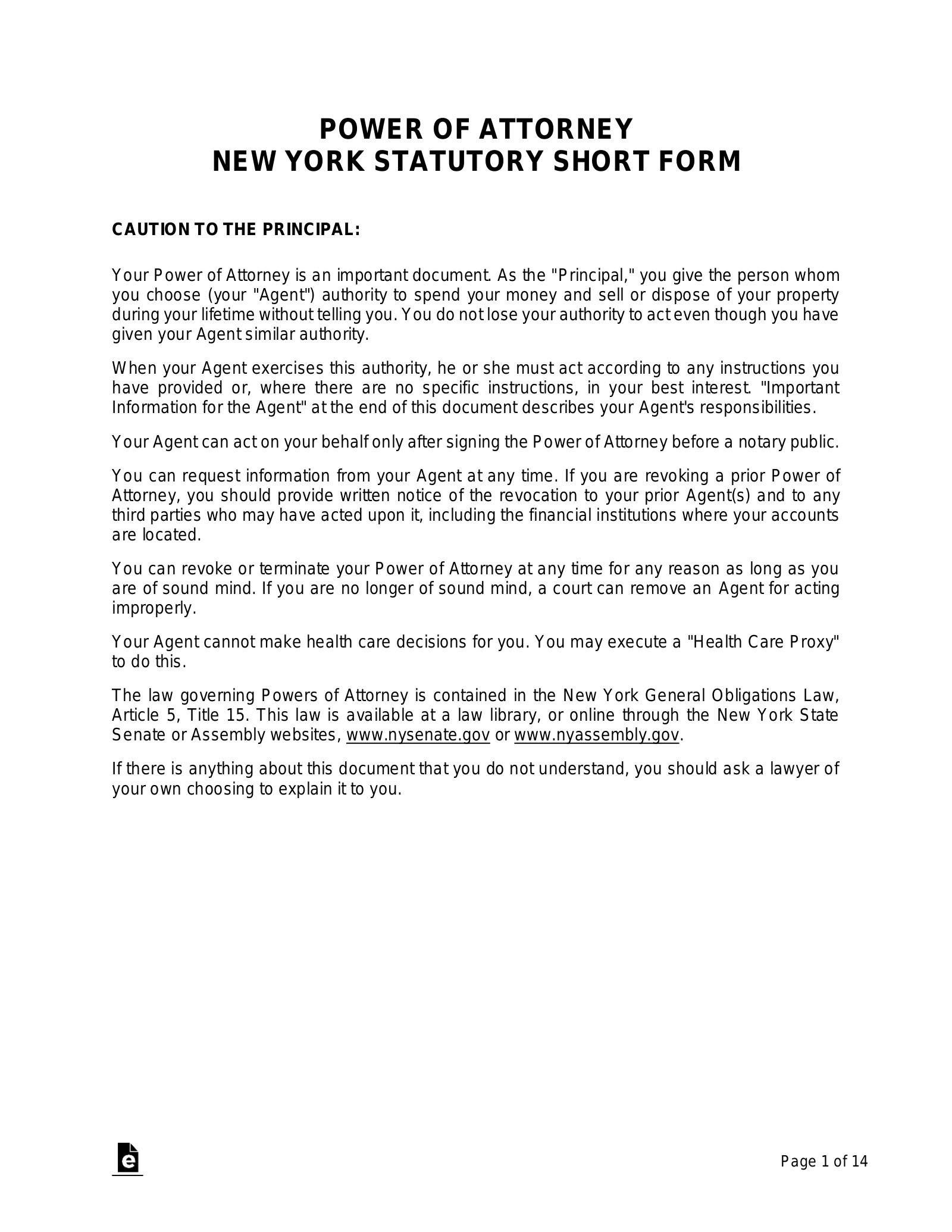

Navigating the complexities of personal finance and legal matters can be daunting, especially when thinking about future uncertainties. One crucial document that offers immense peace of mind is a Power of Attorney. This legal instrument allows you, the “principal,” to appoint someone you trust, an “agent,” to make financial decisions on your behalf if you become unable to do so yourself. In New York, there’s a specific “Statutory Short Form” that streamlines this process, making it more accessible and understandable for everyday citizens.

Understanding and utilizing the proper power of attorney new york short form template is key to ensuring your financial affairs are handled exactly as you wish, without the need for lengthy court proceedings. This guide will walk you through what the New York Statutory Short Form Power of Attorney entails, its benefits, and how it empowers both you and your chosen agent to manage your financial landscape effectively. It’s about preparedness, trust, and ensuring your wishes are honored, no matter what life brings.

Understanding the New York Statutory Short Form Power of Attorney

The New York Statutory Short Form Power of Attorney is a standardized legal document designed to be easily understood and widely accepted. It’s a powerful tool for anyone in New York who wants to designate a trusted individual to manage their financial matters. This could include everything from paying bills and managing bank accounts to handling real estate transactions or making investment decisions. The form itself is structured to be clear and comprehensive, minimizing ambiguity and ensuring that the agent’s powers are clearly defined.

Unlike a custom-drafted power of attorney, the “short form” adheres to specific state statutes, which means its format and the general scope of powers it grants are pre-defined by New York law. This standardization offers a layer of protection and clarity, as financial institutions and other entities are familiar with its structure and legal standing. It simplifies the process for individuals who might find the prospect of legal drafting overwhelming, providing a reliable and legally sound option right off the shelf.

The document clearly identifies the “principal” (the person granting the power) and the “agent” (the person receiving the power). It also allows for the designation of successor agents, ensuring continuity if your primary agent is unable or unwilling to serve. This foresight is crucial for long-term planning, preventing potential gaps in financial management should circumstances change unexpectedly.

Key Features to Note

- Durability: The New York short form is typically “durable,” meaning it remains effective even if the principal becomes incapacitated. This is a critical feature, as the primary purpose of a power of attorney is often to provide financial management during times of illness or cognitive decline.

- Effective Date: You can specify whether the power of attorney becomes effective immediately upon signing or at a later date, such as upon the occurrence of a specific event or incapacitation.

- Specific Powers: The form includes a detailed list of potential financial powers, such as banking, real estate, business operations, and gifts. You, as the principal, can select which of these powers you wish to grant to your agent, providing a high degree of customization within the standardized framework.

Proper execution of this document is paramount. It must be signed by the principal in the presence of a notary public, and the agent must also sign an acknowledgment. These steps ensure the document’s validity and enforceability, safeguarding your interests and those of your designated agent.

Navigating the Powers and Responsibilities of an Agent

When you designate an agent using the power of attorney new york short form template, you are entrusting them with significant authority over your financial life. The powers granted can be extensive, ranging from routine transactions like accessing bank accounts and paying bills to more complex matters such as buying or selling real estate, managing investments, or handling retirement plan distributions. It’s vital for both the principal and the agent to have a clear understanding of the specific powers being conveyed and the implications of those powers.

An agent acts as a fiduciary, which means they are legally obligated to act in the principal’s best interest, avoiding conflicts of interest and exercising caution and good judgment. This is a serious responsibility, and agents must maintain accurate records of all transactions undertaken on behalf of the principal. They cannot use the principal’s assets for their personal benefit, and any deviation from acting solely for the principal’s welfare could lead to legal repercussions.

Open communication and absolute trust between the principal and agent are cornerstones of an effective power of attorney. Before signing the document, it’s highly recommended that the principal discusses their financial situation and wishes in detail with the chosen agent. This ensures that the agent is fully prepared for the role and understands the principal’s preferences regarding spending, investments, and other financial decisions.

- Banking and Financial Transactions: Managing checking and savings accounts, making deposits and withdrawals, cashing checks, and accessing safe deposit boxes.

- Real Estate Matters: Buying, selling, leasing, or mortgaging real property.

- Business Operations: Operating a business, including managing employees, contracts, and finances.

- Claims and Litigation: Pursuing or defending legal actions on the principal’s behalf.

- Government Benefits and Retirement: Applying for and managing social security, Medicare, Medicaid, and retirement benefits.

- Gift-Giving: The ability to make gifts, though this specific power usually requires a separate “Statutory Gift Rider” in New York to grant significant gifting authority.

The power of attorney becomes effective on the date specified in the document, or immediately upon signing if no date is specified. It remains in effect until it is revoked by the principal, until the principal passes away, or until the agent resigns or becomes incapacitated. Principals always retain the right to revoke the power of attorney at any time, as long as they have the mental capacity to do so, by providing written notice to the agent.

Having a properly executed New York Statutory Short Form Power of Attorney provides an invaluable layer of security and control over your financial future. It ensures that your affairs can be managed smoothly and efficiently, even if you are unable to act on your own. This proactive step can alleviate considerable stress for both you and your loved ones, knowing that your financial well-being is in trusted hands, precisely according to your wishes.

While the short form is designed for ease of use, the implications of a power of attorney are significant. Therefore, it is always advisable to consult with an attorney to discuss your specific needs and ensure that the document perfectly aligns with your intentions and is properly executed. A legal professional can offer personalized guidance, ensuring you make informed decisions that best protect your interests and provide true peace of mind for what lies ahead.