Utilizing a structured format offers numerous advantages. It ensures consistency in reporting, facilitating trend analysis and comparisons across different periods. It also simplifies the process of preparing financial statements, reducing the likelihood of errors. Furthermore, a standardized presentation allows stakeholders to quickly grasp key financial metrics and assess the company’s overall financial health. This promotes transparency and builds trust with investors and creditors.

This document will delve into the specific components of a typical report structure, explore variations based on industry and company size, and discuss how to interpret key financial ratios derived from the information presented.

1. Revenues

Revenue, the lifeblood of any business, forms the cornerstone of the profit and loss income statement. It represents the total income generated from a company’s primary business activities, typically the sale of goods or services. Accurate revenue recognition is critical for a reliable financial statement, providing the basis for assessing profitability and overall financial health. Cause and effect are directly linked; higher revenues, assuming controlled costs, contribute to increased profits and a stronger financial position. Conversely, declining revenues can signal underlying issues requiring immediate attention. For instance, a subscription-based software company recognizes revenue over the lifetime of the subscription, not just at the initial sale.

As the top line of the statement, revenue sets the stage for subsequent calculations. Understanding its composition, growth trends, and underlying drivers is essential for stakeholders. Analyzing revenue streams allows businesses to identify successful product lines, assess market demand, and make informed decisions regarding pricing strategies and resource allocation. Comparing revenue figures across different periods reveals growth patterns and potential vulnerabilities. A retail company might experience seasonal revenue fluctuations, requiring careful inventory management and marketing adjustments. Analyzing these fluctuations helps understand the business’s cyclical nature.

Accurate and detailed revenue reporting ensures transparency and allows for effective performance evaluation. While net income provides the ultimate measure of profitability, revenue analysis offers a deeper understanding of a company’s operational efficiency and market competitiveness. Challenges can arise from complex revenue recognition policies, particularly in industries with long-term contracts or bundled services. However, a well-structured income statement, coupled with diligent accounting practices, ensures reliable revenue figures, enabling stakeholders to make well-informed decisions. This understanding underpins effective financial planning and contributes to long-term sustainability.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Accurately calculating COGS is crucial for determining gross profit and ultimately, net income on the profit and loss income statement. This figure reflects the expenses directly attributable to the production process, offering insights into a company’s operational efficiency and pricing strategies.

- Direct MaterialsDirect materials encompass the raw materials and components used in manufacturing a product. For a furniture manufacturer, this would include wood, fabric, and hardware. The cost of these materials directly impacts COGS and is essential for accurate product costing. Fluctuations in raw material prices can significantly affect profitability, highlighting the importance of strategic sourcing and inventory management.

- Direct LaborDirect labor refers to the wages and benefits paid to employees directly involved in producing goods. In the furniture example, this includes the salaries of carpenters and upholsterers. Effective labor management and productivity improvements can reduce direct labor costs, positively impacting COGS and overall profitability. Labor-intensive industries often face challenges in managing these costs, especially in regions with high labor rates.

- Manufacturing OverheadManufacturing overhead encompasses all other costs directly related to the production process but not classified as direct materials or labor. This includes factory rent, utilities, and depreciation of manufacturing equipment. Allocating overhead costs accurately is crucial for determining the true cost of production. Optimizing overhead expenses contributes to improved efficiency and cost competitiveness. For example, implementing energy-efficient technologies can reduce utility costs and lower manufacturing overhead.

- Inventory ValuationInventory valuation methods, such as FIFO (First-In, First-Out) and LIFO (Last-In, First-Out), influence COGS calculations. The chosen method impacts the reported cost of goods sold and, consequently, profitability. Understanding the implications of different valuation methods is crucial for interpreting financial statements and comparing performance across companies. For example, during periods of inflation, LIFO can result in a higher COGS and lower net income compared to FIFO.

COGS directly impacts a company’s gross profit margin, a key indicator of profitability. Analyzing COGS trends over time helps identify cost control opportunities and potential inefficiencies within the production process. By understanding and effectively managing COGS, businesses gain valuable insights into pricing strategies, product profitability, and overall financial health. This information informs strategic decision-making and contributes to sustained profitability as reflected on the profit and loss income statement.

3. Gross Profit

Gross profit, a key performance indicator, occupies a central position within the profit and loss income statement template. Calculated as revenue less the cost of goods sold (COGS), it represents the profit a company generates after accounting for the direct costs associated with producing its goods or services. Analyzing gross profit provides crucial insights into a company’s pricing strategies, production efficiency, and overall profitability.

- Relationship to Revenue and COGSGross profit forms a bridge between revenue and other profitability metrics. It reflects the portion of revenue remaining after covering the direct costs of production. For example, if a company generates $1 million in revenue and incurs $600,000 in COGS, the gross profit is $400,000. This figure serves as the basis for calculating subsequent profit metrics, such as operating income and net income. A higher gross profit indicates better efficiency in managing production costs relative to revenue generation.

- Gross Profit MarginThe gross profit margin, expressed as a percentage, provides a standardized measure of profitability. Calculated by dividing gross profit by revenue, it allows for comparisons across different companies and industries. A higher gross profit margin generally suggests stronger pricing power and better cost control. For instance, a gross profit margin of 40% indicates that for every dollar of revenue generated, $0.40 contributes to gross profit. Tracking the gross profit margin over time helps identify trends and potential issues requiring attention.

- Industry Benchmarks and ComparisonsComparing a company’s gross profit margin to industry benchmarks offers valuable insights into its competitive position. Industries with high research and development costs, like pharmaceuticals, often have higher gross profit margins compared to industries with lower barriers to entry, such as retail. Understanding these industry dynamics provides context for evaluating a company’s performance and identifying potential areas for improvement.

- Impact on Subsequent Profitability MetricsGross profit directly impacts subsequent profitability calculations within the income statement. Operating expenses are deducted from gross profit to arrive at operating income. This highlights the importance of managing both COGS and operating expenses to maximize overall profitability. A healthy gross profit provides a stronger foundation for absorbing operating expenses and generating net income. Analyzing the relationship between gross profit and operating expenses offers insights into a company’s cost structure and operating efficiency.

Gross profit, therefore, serves as a crucial component of the profit and loss income statement template, providing valuable insights into a company’s operational performance, pricing strategies, and overall financial health. Analyzing gross profit, both in absolute terms and as a percentage of revenue, enables stakeholders to assess a company’s ability to generate profit from its core business activities and provides a foundation for evaluating its long-term sustainability.

4. Operating Expenses

Operating expenses represent the costs incurred in running a business’s core operations, excluding the direct costs of producing goods or services (COGS). Within the profit and loss income statement template, these expenses are deducted from gross profit to arrive at operating income. Careful management of operating expenses is critical for profitability, as they directly impact a company’s bottom line. Categorizing and analyzing these expenses provides valuable insights into resource allocation and operational efficiency.

Several key categories typically comprise operating expenses:

- Selling, General, and Administrative Expenses (SG&A): This broad category includes salaries for non-production staff, marketing and advertising costs, rent, utilities, and office supplies. SG&A expenses are essential for supporting a company’s sales and administrative functions. For example, a software company’s SG&A might include salaries for sales representatives, marketing campaign costs, and office lease expenses.

- Research and Development (R&D): Companies invest in R&D to innovate and develop new products or services. These expenses can include salaries for researchers, laboratory equipment, and testing materials. R&D is crucial for long-term growth but can be a significant expense, particularly in industries like pharmaceuticals or technology. A pharmaceutical company might invest heavily in R&D to develop new drugs, impacting its operating expenses and potentially leading to future revenue streams.

- Depreciation and Amortization: These non-cash expenses reflect the decrease in value of assets over time. Depreciation applies to tangible assets like equipment and buildings, while amortization applies to intangible assets like patents and copyrights. Accurately accounting for depreciation and amortization is essential for matching expenses with the periods they benefit. A manufacturing company might depreciate the cost of its machinery over its useful life, reflecting this expense on the income statement.

Analyzing operating expenses, both individually and as a percentage of revenue, provides valuable insights into a company’s cost structure and efficiency. Comparing these figures to industry benchmarks and tracking them over time allows for the identification of trends and potential areas for improvement. High operating expenses, particularly relative to revenue, can signal inefficiencies and impact profitability. Conversely, effectively managing operating expenses contributes to a healthier bottom line and enhances a company’s ability to reinvest in growth initiatives. Understanding the relationship between operating expenses and other elements within the profit and loss income statement template is fundamental for comprehensive financial analysis and strategic decision-making.

5. Operating Income

Operating income, a crucial line item within the profit and loss income statement template, reveals a company’s profitability from its core business operations. Derived by subtracting operating expenses from gross profit, this figure reflects earnings generated from the company’s primary activities, excluding non-operating income and expenses such as interest or taxes. Analyzing operating income provides valuable insights into a company’s operational efficiency and its ability to generate sustainable profits.

- Relationship to Gross Profit and Operating ExpensesOperating income represents the residual profit after accounting for both the direct costs of production (COGS) and the indirect costs of running the business (operating expenses). This dynamic interplay highlights the importance of managing both COGS and operating expenses to maximize operating income. For example, a company with a high gross profit margin might still report low operating income if its operating expenses are excessive. Understanding this relationship is critical for evaluating a company’s operational efficiency.

- Operating Income MarginExpressing operating income as a percentage of revenue, the operating income margin provides a standardized metric for comparing profitability across different companies and industries. A higher operating income margin generally suggests better cost control and operational efficiency. For instance, an operating margin of 15% indicates that for every dollar of revenue generated, $0.15 contributes to operating income. Tracking this margin over time can reveal trends and highlight potential areas for improvement.

- Impact on Net IncomeOperating income serves as a key stepping stone in calculating net income, the ultimate measure of a company’s profitability. Non-operating items, such as interest income and expense, gains or losses from investments, and income taxes, are added or subtracted from operating income to arrive at net income. Consequently, while operating income reflects core business profitability, net income provides a comprehensive view of a company’s overall financial performance.

- Use in Financial Analysis and ValuationAnalysts frequently utilize operating income in financial analysis and valuation models. Metrics like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which is closely related to operating income, are commonly used to assess a company’s operating performance and cash flow generation potential. These metrics provide a clearer picture of a company’s core earnings power, independent of its capital structure and tax strategies.

In conclusion, operating income within the context of the profit and loss income statement template provides a crucial lens for evaluating a company’s core business profitability and operational efficiency. By analyzing operating income alongside related metrics like the operating income margin and understanding its relationship to other line items within the income statement, stakeholders gain valuable insights into a company’s financial health and its ability to generate sustainable profits. This information plays a critical role in investment decisions, performance evaluation, and strategic planning.

6. Net Income

Net income, often referred to as the “bottom line,” represents the ultimate measure of a company’s profitability over a specific accounting period. Within the profit and loss income statement template, net income signifies the residual earnings after all revenues and gains have been tallied and all expenses and losses have been deducted. This figure encapsulates the cumulative impact of all financial activities, providing a concise snapshot of a company’s financial performance. A positive net income indicates profitability, while a negative net income signifies a loss.

The calculation of net income follows a structured cascade through the income statement. Starting with revenue, the cost of goods sold (COGS) is subtracted to arrive at gross profit. Operating expenses are then deducted from gross profit to determine operating income. Finally, non-operating items, such as interest income and expense, taxes, and extraordinary items, are accounted for to arrive at net income. For example, a retailer might report strong revenue growth, but if COGS and operating expenses increase disproportionately, net income might be negatively impacted. Conversely, a manufacturing company might implement cost-cutting measures that reduce COGS and operating expenses, leading to a higher net income despite flat revenue. Understanding the interplay of these factors is crucial for interpreting net income figures.

Net income serves as a critical indicator of a company’s financial health and sustainability. It informs investment decisions, influences creditworthiness assessments, and provides a benchmark for evaluating management performance. Analyzing net income trends over time offers valuable insights into a company’s growth trajectory and its ability to generate consistent profits. However, relying solely on net income can be misleading. Non-recurring items, accounting methods, and industry-specific factors can influence net income figures. Therefore, a comprehensive analysis requires considering net income in conjunction with other financial metrics and qualitative factors. Examining cash flow statements, balance sheets, and industry trends provides a more holistic understanding of a company’s financial position and its ability to generate sustainable value. This multifaceted approach allows stakeholders to make informed decisions and accurately assess a company’s long-term prospects.

Key Components of a Profit and Loss Income Statement

A profit and loss income statement, whether presented as a formal report or derived from a template, relies on several key components to provide a comprehensive overview of financial performance. Understanding these components is crucial for interpreting the statement and extracting meaningful insights.

1. Revenue: This represents the total income generated from a company’s primary business activities, typically the sale of goods or services. Accurate revenue recognition is fundamental for a reliable income statement.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing the goods sold, including raw materials, direct labor, and manufacturing overhead. This figure is subtracted from revenue to determine gross profit.

3. Gross Profit: Calculated as revenue less COGS, gross profit reflects the profitability of a company’s core production activities before accounting for operating expenses.

4. Operating Expenses: These expenses represent the costs incurred in running the business’s day-to-day operations, encompassing selling, general, and administrative expenses (SG&A), research and development (R&D), and depreciation and amortization.

5. Operating Income: Operating income, derived by subtracting operating expenses from gross profit, reveals the profitability of a company’s core business operations, excluding non-operating income and expenses.

6. Non-Operating Income and Expenses: This category includes income and expenses not directly related to core business operations, such as interest income, interest expense, gains or losses from investments, and taxes.

7. Net Income: Often referred to as the “bottom line,” net income represents the ultimate measure of a company’s profitability after accounting for all revenues, expenses, gains, and losses. It is calculated by adding or subtracting non-operating items from operating income.

These interconnected components provide a structured framework for evaluating a company’s financial performance. Analyzing these elements individually and in relation to each other offers a comprehensive understanding of profitability, cost structure, and operational efficiency, ultimately enabling informed decision-making.

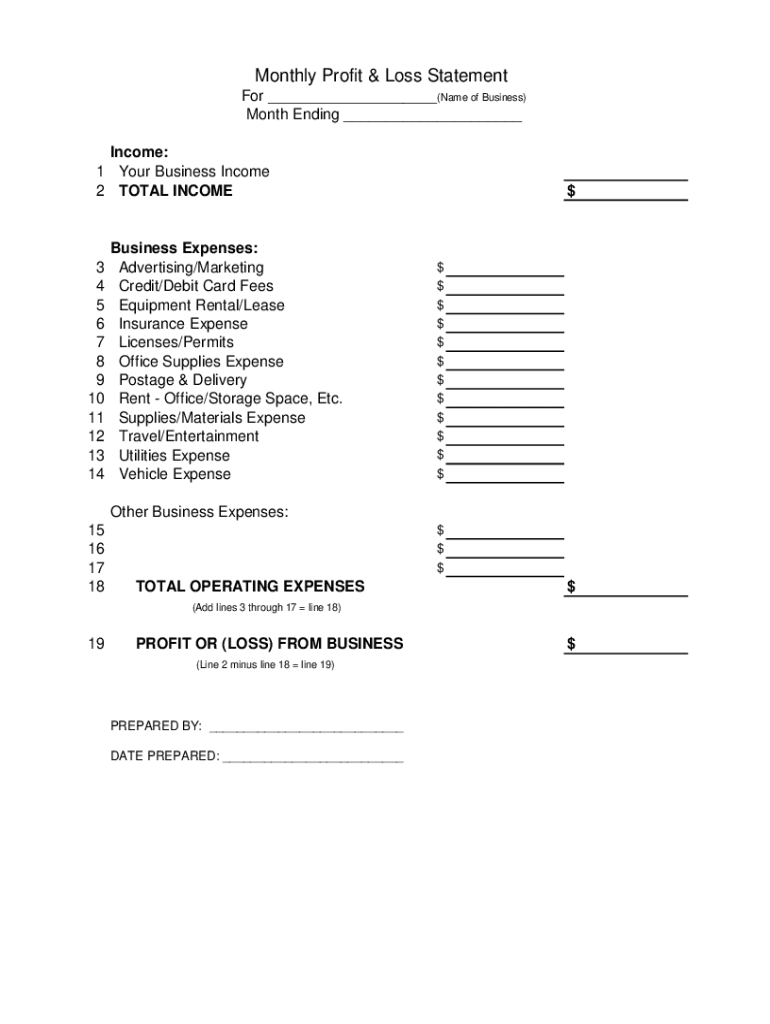

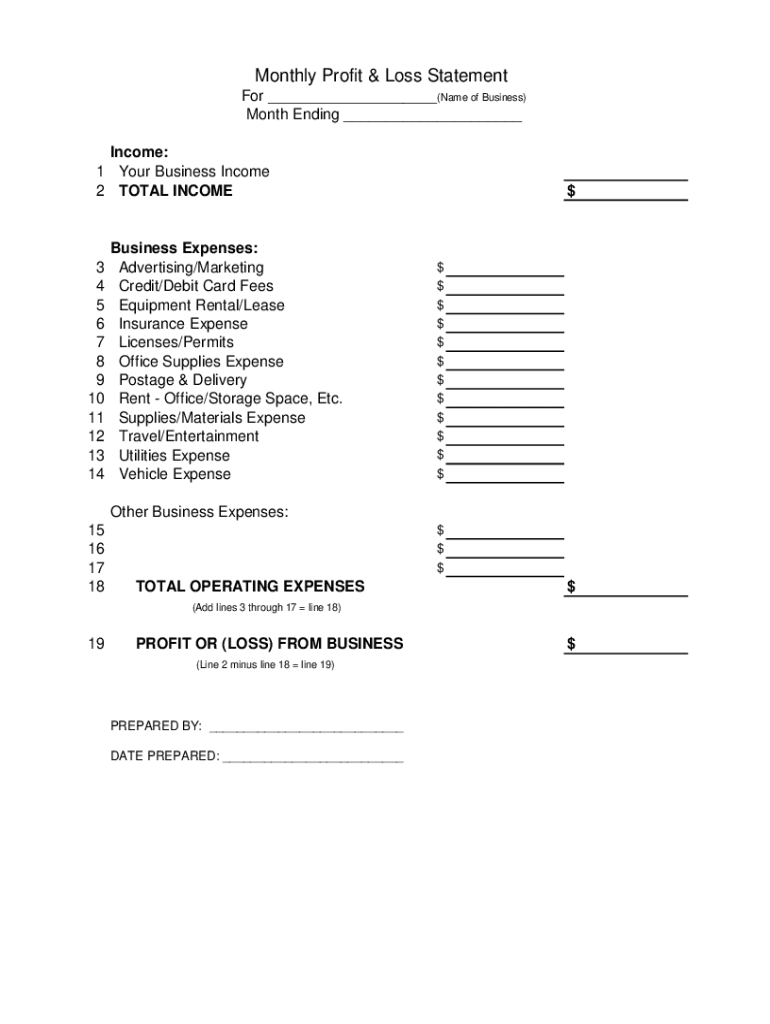

How to Create a Profit and Loss Income Statement Template

Creating a profit and loss income statement template provides a structured approach to analyzing financial performance. A well-designed template ensures consistency and facilitates accurate reporting. The following steps outline the process of creating a comprehensive template.

1. Define the Reporting Period: Specify the timeframe for the income statement, whether it’s a month, quarter, or fiscal year. This ensures consistency and allows for accurate period-over-period comparisons.

2. Structure the Revenue Section: Include lines for different revenue streams to provide a detailed breakdown of income sources. This allows for analysis of individual product or service performance.

3. Detail the Cost of Goods Sold (COGS): Break down COGS into its constituent parts, including direct materials, direct labor, and manufacturing overhead. This granularity facilitates cost analysis and control.

4. Categorize Operating Expenses: Create separate lines for various operating expense categories, such as selling, general, and administrative expenses (SG&A), research and development (R&D), and depreciation and amortization. This allows for detailed expense tracking and analysis.

5. Incorporate Non-Operating Income and Expenses: Include sections for non-operating income and expenses, such as interest income, interest expense, and taxes. This ensures a comprehensive view of all financial activities impacting profitability.

6. Calculate Key Metrics: Incorporate formulas to automatically calculate key metrics like gross profit, operating income, and net income. This automation improves efficiency and reduces the risk of errors.

7. Format for Clarity: Use clear labels, consistent formatting, and appropriate spacing to enhance readability and ensure the template is user-friendly. This facilitates interpretation and analysis.

8. Test and Refine: Populate the template with sample data to test its functionality and identify any necessary adjustments. Regular review and refinement ensures the template remains accurate and relevant.

A robust profit and loss income statement template provides a structured framework for analyzing financial data, enabling informed decision-making and contributing to effective financial management. By incorporating these key elements, organizations can gain valuable insights into their performance and identify areas for improvement.

Careful analysis provides crucial insights into financial performance, enabling informed decision-making and strategic planning. Understanding the components, from revenue and cost of goods sold to operating expenses and net income, allows stakeholders to assess profitability, efficiency, and overall financial health. Utilizing a structured template facilitates consistent reporting and analysis, promoting transparency and accountability.

Effective financial management hinges on the ability to extract meaningful insights from financial data. Regular review and analysis of the statement, combined with an understanding of industry benchmarks and trends, empowers organizations to identify areas for improvement, optimize resource allocation, and enhance long-term sustainability. This proactive approach to financial analysis is essential for navigating the complexities of the business landscape and achieving sustained growth.