Ever wondered how businesses truly know if they’re making money or just spinning their wheels? The answer often lies in a vital financial document: the profit and loss statement, commonly known as a P&L. This isn’t just for big corporations; small businesses, freelancers, and even side hustles can benefit immensely from tracking their financial performance with a well-structured P&L.

Understanding your income versus your expenses over a specific period is fundamental to making smart business decisions. That’s where a clear, easy-to-use profit and loss statement form template comes in handy. It simplifies the process, allowing you to quickly visualize your financial health without needing to be an accounting wizard. Let’s dive into why these templates are so powerful and what makes a good one.

Deconstructing the Essentials of a Profit and Loss Statement

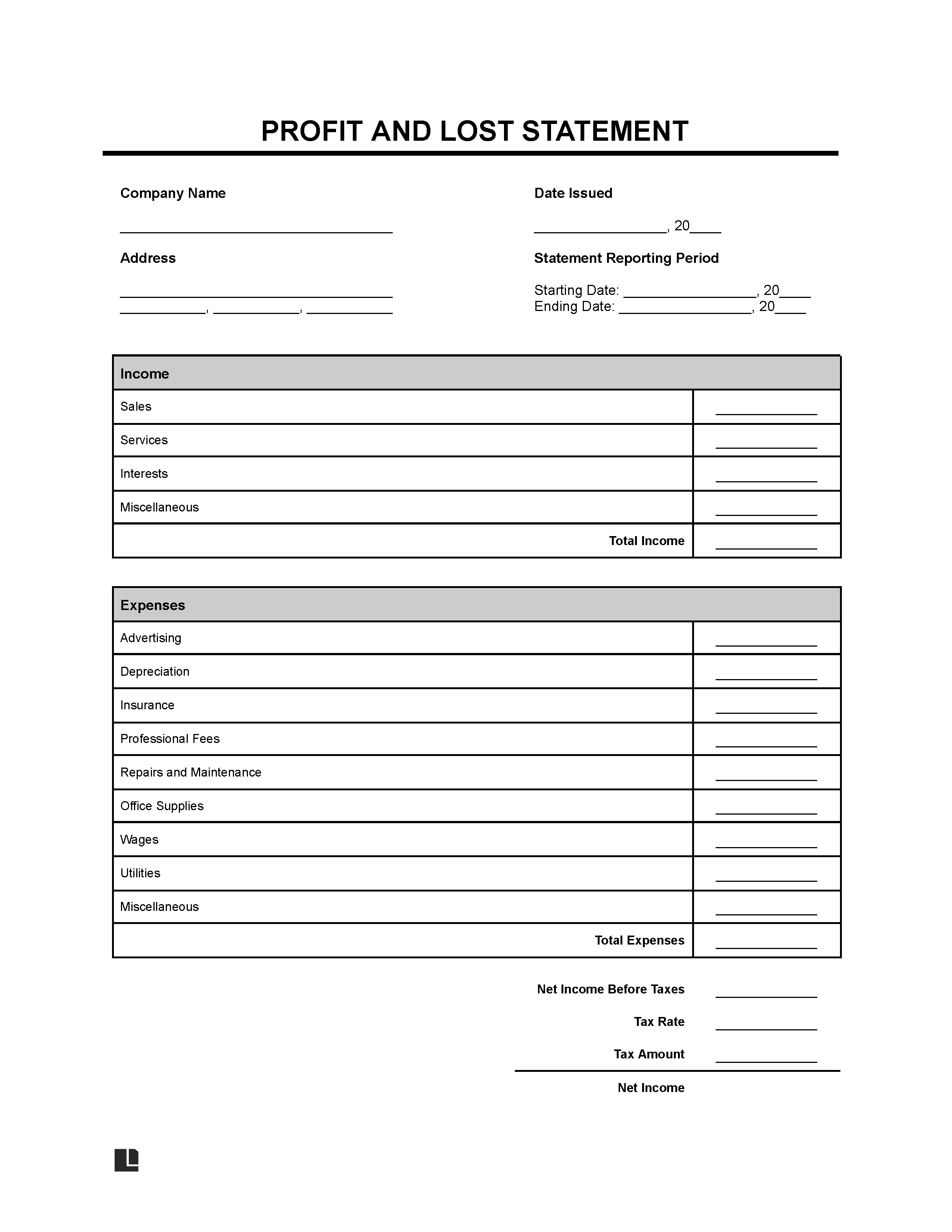

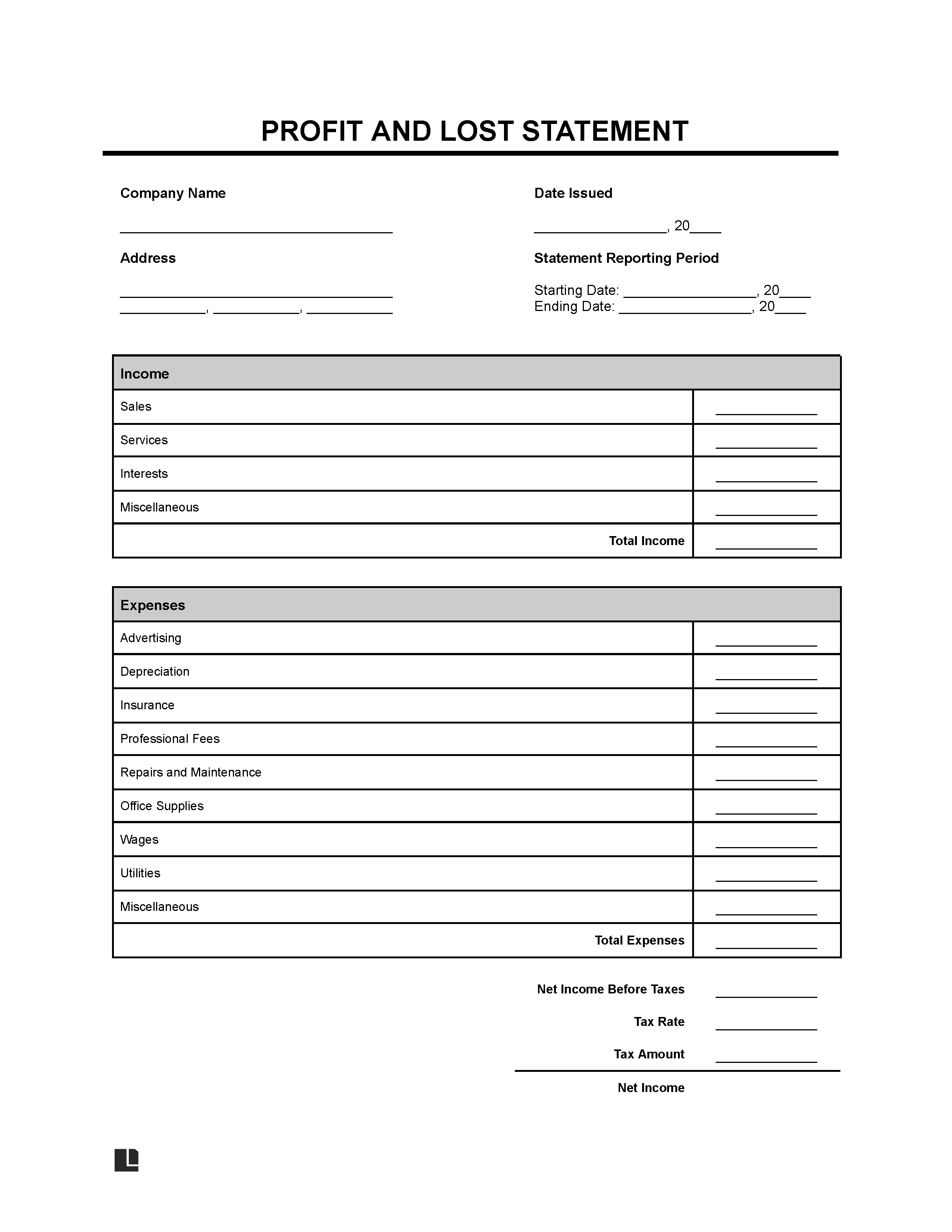

A profit and loss statement, sometimes called an income statement, provides a snapshot of your business’s financial performance over a specific period, such as a month, quarter, or year. It’s designed to show you whether your company is profitable by comparing all your revenues to all your expenses. Think of it as a detailed report card for your business’s financial activities.

Understanding the core components of a profit and loss statement is crucial for interpreting its insights. It’s not just about listing numbers; it’s about understanding what each number represents in the grand scheme of your operations. A good profit and loss statement form template will guide you through populating these fields accurately.

At its heart, a P&L statement begins with your total revenue – all the money your business earns from its primary activities. From there, it systematically deducts various costs to arrive at your net profit or loss. This step-by-step subtraction helps you see where your money is going and where you might be able to make adjustments to improve profitability.

Key Sections You’ll Find in a P&L Template

When you use a profit and loss statement form template, you’ll typically encounter these main sections:

- Revenue: This is the top line, representing all the money earned from sales of goods or services.

- Cost of Goods Sold (COGS): These are the direct costs attributable to the production of the goods or services sold by a company.

- Gross Profit: Calculated by subtracting COGS from revenue. It tells you how much profit you make directly from your sales before considering operating expenses.

- Operating Expenses: All the costs incurred in running your business that are not directly related to production, such as rent, salaries, marketing, and utilities.

- Operating Income: This is your gross profit minus operating expenses, showing profit from core business operations.

- Other Income and Expenses: Non-operating items like interest income, interest expense, or gains/losses from asset sales.

- Net Income (or Loss): The final figure at the bottom of the statement, representing your total profit or loss after all expenses have been deducted from revenue.

Each of these elements contributes to the overall picture of your financial health, providing valuable insights into operational efficiency and spending habits.

Finding and Utilizing the Right Template for Your Needs

The beauty of a well-designed profit and loss statement form template is its versatility. Whether you’re a startup, a growing small business, or simply tracking personal income and expenses for a side gig, there’s a template out there that can fit your specific requirements. The goal is to find one that’s intuitive and adaptable, allowing you to focus on your numbers rather than struggling with complex formatting.

Many online resources offer free or low-cost templates in various formats, including Excel, Google Sheets, or even dedicated accounting software. These templates often come pre-formatted with the necessary categories and formulas, saving you considerable time and effort. The key is to select a template that not only looks good but also aligns with the level of detail you need for your business and industry.

Once you have your chosen profit and loss statement form template, the real work begins: populating it with your actual financial data. This involves meticulously tracking every dollar that comes in and goes out. While it might seem daunting at first, consistent data entry transforms your P&L from a blank sheet into a powerful analytical tool. Remember, accuracy is paramount; incorrect figures will lead to misleading conclusions.

Beyond simply tracking, a P&L statement is a strategic tool. Regularly reviewing your completed statement can reveal trends, highlight areas where expenses are getting out of hand, or show you opportunities for increasing revenue. It enables you to make informed decisions about pricing, staffing, marketing, and overall business strategy, driving your business towards greater profitability and stability.

Armed with a clear understanding of your revenues and expenses, you gain unparalleled clarity into your business’s financial heartbeat. This insight empowers you to identify strengths, pinpoint weaknesses, and make proactive decisions that drive growth and optimize performance. It’s about moving beyond guesswork and relying on solid data to guide your financial future.

By consistently utilizing a profit and loss statement, you’re not just recording history; you’re actively shaping the future of your financial success. This proactive approach ensures you’re always aware of where you stand, allowing you to adapt, pivot, and capitalize on opportunities as they arise, ultimately building a more resilient and profitable enterprise.