Utilizing such a framework offers several advantages. It streamlines the process of compiling financial information, reducing the likelihood of errors and saving valuable time. The standardized format enhances comparability across different periods or against industry benchmarks. Furthermore, a clear and organized presentation of financial data aids in informed decision-making, enabling businesses to identify areas for improvement and optimize profitability.

This understanding of a structured approach to P&L statement creation provides a foundation for exploring various related topics, such as financial analysis techniques, key performance indicators, and strategies for improving business profitability.

1. Standardized Format

A standardized format is crucial for effective financial reporting within a profit and loss statement numbers template. Consistency ensures data comparability across different periods and simplifies the analysis of financial trends. Standardization also facilitates benchmarking against industry averages, providing valuable context for performance evaluation.

- Consistent StructureA consistent structure ensures all profit and loss statements follow the same basic layout, regardless of the specific business or reporting period. This includes consistent placement of key figures like revenue, cost of goods sold, and operating expenses. For example, revenue is always placed at the top, followed by expenses, leading to the calculation of net income. This structural consistency allows for immediate comparison across different statements.

- Uniform TerminologyUsing uniform terminology ensures clarity and prevents misinterpretations. Specific terms, such as “Gross Profit” or “Operating Income,” have precise definitions and should be used consistently. For instance, using “Gross Profit” consistently, calculated as revenue minus the cost of goods sold, ensures all stakeholders understand the metric’s meaning and calculation.

- Defined Calculation MethodsStandardized calculation methods ensure accuracy and comparability. Metrics like net profit margin or return on assets should be calculated using the same formula every time. For example, consistently calculating net profit margin as net income divided by revenue allows for accurate trend analysis and performance comparisons.

- Specified Reporting PeriodClearly specifying the reporting period, whether it’s a month, quarter, or year, is essential for meaningful analysis. Comparing a quarterly statement with an annual statement without acknowledging the difference in timeframes can lead to inaccurate conclusions. Therefore, the reporting period must be clearly indicated on every statement.

These elements of a standardized format contribute significantly to the value of a profit and loss statement numbers template. By ensuring consistency and clarity, standardized formats facilitate accurate analysis, informed decision-making, and ultimately, improved financial performance. This standardization enables businesses to leverage the full potential of their financial data for strategic planning and growth.

2. Predefined Categories

A key feature of a robust profit and loss statement numbers template lies in its utilization of predefined categories. These categories provide a structured framework for organizing financial data, ensuring consistency and comparability. This structured approach facilitates accurate analysis and informed decision-making.

- Revenue StreamsCategorizing revenue streams allows businesses to track income from different sources. Examples include sales revenue, service revenue, and interest income. Separating these streams provides granular insights into business performance, enabling targeted strategies for growth. Within a template, these categories would have designated cells or rows for recording corresponding figures.

- Cost of Goods Sold (COGS)This category encompasses all direct costs associated with producing goods sold. Examples include raw materials, direct labor, and manufacturing overhead. Accurate COGS categorization is crucial for determining gross profit. Templates often include subcategories within COGS for detailed cost analysis, aiding in identifying areas for cost optimization.

- Operating ExpensesOperating expenses represent the costs of running the business outside of direct production. Examples include rent, salaries, marketing, and administrative expenses. Categorizing operating expenses allows for analysis of spending patterns and identification of potential efficiencies. Templates typically provide separate lines for each type of operating expense, promoting detailed tracking and control.

- Other Income and ExpensesThis category captures income and expenses not directly related to core business operations. Examples include interest income, investment gains, and losses from asset sales. Clear categorization of these items provides a comprehensive financial picture. Templates often segregate these items to avoid distorting the analysis of core business profitability.

These predefined categories, integrated within a profit and loss statement numbers template, contribute significantly to effective financial management. They streamline the process of data collection and analysis, facilitating informed decision-making and enhancing a business’s ability to monitor and improve its financial performance. The structured approach allows for clear tracking of financial health and provides actionable insights for future planning and strategic growth.

3. Automated Calculations

Automated calculations represent a crucial element within a profit and loss statement numbers template, significantly enhancing efficiency and accuracy in financial reporting. By automating key computations, these templates minimize manual data entry and reduce the risk of human error, allowing for more focused analysis and interpretation of financial data. This automation streamlines the process of generating accurate and reliable profit and loss statements, ultimately contributing to informed decision-making.

- Formula-Driven ComputationsTemplates utilize predefined formulas to automatically calculate key figures within the profit and loss statement. For instance, gross profit is calculated by automatically subtracting the cost of goods sold from revenue. Similarly, operating income is derived by subtracting operating expenses from gross profit. These automated computations ensure accuracy and consistency, eliminating the need for manual calculations and reducing the likelihood of errors.

- Real-Time UpdatesChanges in input data automatically trigger recalculations throughout the template. If the cost of goods sold increases, the gross profit, operating income, and net income figures are instantly updated to reflect the change. This real-time functionality provides immediate visibility into the financial impact of operational adjustments, enabling timely analysis and response.

- Reduced Manual InputAutomated calculations significantly reduce the need for manual data entry. Once the necessary inputs are provided, the template automatically performs the required computations, minimizing the risk of human error associated with manual calculations. This streamlined process saves time and resources, allowing for a more efficient workflow.

- Improved Accuracy and ConsistencyBy eliminating manual calculations, automated templates enhance accuracy and ensure consistency in financial reporting. The standardized formulas embedded within the template guarantee that calculations are performed uniformly across different periods and departments, promoting data integrity and reliable comparisons.

The integration of automated calculations within a profit and loss statement numbers template significantly strengthens financial reporting processes. By automating key computations, these templates free up valuable time and resources, allowing businesses to shift their focus from tedious manual tasks to insightful financial analysis. The resultant accuracy and consistency in reporting contribute to more informed decision-making and enhanced financial control, promoting overall business health and strategic growth.

4. Data Consistency

Data consistency represents a cornerstone of reliable financial reporting and analysis, particularly within the context of a profit and loss statement numbers template. Consistent data ensures the accuracy and comparability of financial information across different periods, enabling meaningful trend analysis and informed decision-making. Without data consistency, the insights derived from a profit and loss statement can be misleading, hindering effective financial management.

- Uniform Data EntryConsistent data entry practices are essential for maintaining data integrity. This includes using standardized formats for dates, currency values, and numerical entries. For example, consistently using “YYYY-MM-DD” for dates prevents ambiguity and ensures accurate temporal analysis. Within a profit and loss statement template, uniform data entry practices minimize errors and enhance the reliability of financial reports.

- Validated Data SourcesUtilizing validated data sources ensures the accuracy and reliability of the information populating the profit and loss statement. This includes verifying data from internal systems, external databases, and third-party providers. For instance, cross-referencing sales data from the point-of-sale system with inventory records validates the accuracy of revenue figures. Templates can incorporate data validation rules to minimize errors and ensure the integrity of information used in calculations.

- Regular ReconciliationRegular reconciliation of financial data is crucial for identifying and correcting discrepancies. This involves comparing data from different sources and resolving any inconsistencies. For example, reconciling bank statements with internal cash flow records helps identify and correct errors. Within a template, automated reconciliation features can highlight discrepancies, facilitating prompt corrective action and enhancing data accuracy.

- Version ControlMaintaining version control of profit and loss statements ensures a clear audit trail and facilitates comparisons between different iterations. Tracking changes made to the template or underlying data allows for easy identification of modifications and their impact on financial results. Version control enhances transparency and accountability in financial reporting. This becomes especially important when collaborating on financial statements, ensuring all parties work with the most current and accurate version.

These facets of data consistency are integral to the effective utilization of a profit and loss statement numbers template. By ensuring data accuracy, comparability, and reliability, consistent data practices empower businesses to derive meaningful insights from their financial information, facilitating sound financial management, strategic planning, and sustainable growth. Data consistency transforms the profit and loss statement from a static report into a dynamic tool for informed decision-making and enhanced financial performance.

5. Error Reduction

Accuracy in financial reporting is paramount. A profit and loss statement numbers template plays a crucial role in minimizing errors, thereby enhancing the reliability of financial analysis and decision-making. Reducing errors strengthens financial integrity, improves stakeholder confidence, and contributes to more effective resource allocation.

- Automated CalculationsTemplates automate calculations, minimizing manual data entry, a significant source of human error. For example, automatically calculating gross profit (revenue – cost of goods sold) eliminates potential keystroke errors. This automated approach ensures consistent and accurate calculations throughout the profit and loss statement, reducing the risk of mathematical discrepancies.

- Data ValidationTemplates can incorporate data validation rules to prevent the entry of incorrect data types or values. For instance, a validation rule could restrict entries in the “Revenue” field to positive numerical values. This preventative measure reduces errors at the point of entry, ensuring data integrity from the outset.

- Predefined FormulasUsing predefined formulas within the template ensures calculations are performed consistently. For example, consistently applying the formula for net profit margin (net income / revenue) eliminates inconsistencies that might arise from using different calculation methods. This standardized approach promotes accuracy and comparability across reporting periods.

- Centralized Data EntryA template provides a centralized location for data entry, reducing the risk of data duplication or inconsistencies that can occur when information is spread across multiple spreadsheets or systems. This centralized approach streamlines the data entry process and improves overall data management, reducing the likelihood of errors arising from fragmented data sources.

By minimizing errors, a profit and loss statement numbers template enhances the reliability and integrity of financial reporting. The resulting accuracy in financial data empowers organizations to make informed decisions based on a clear and trustworthy understanding of their financial performance. This, in turn, strengthens financial control, improves strategic planning, and contributes to overall business success. Reduced errors translate to more confident decision-making and a stronger foundation for growth.

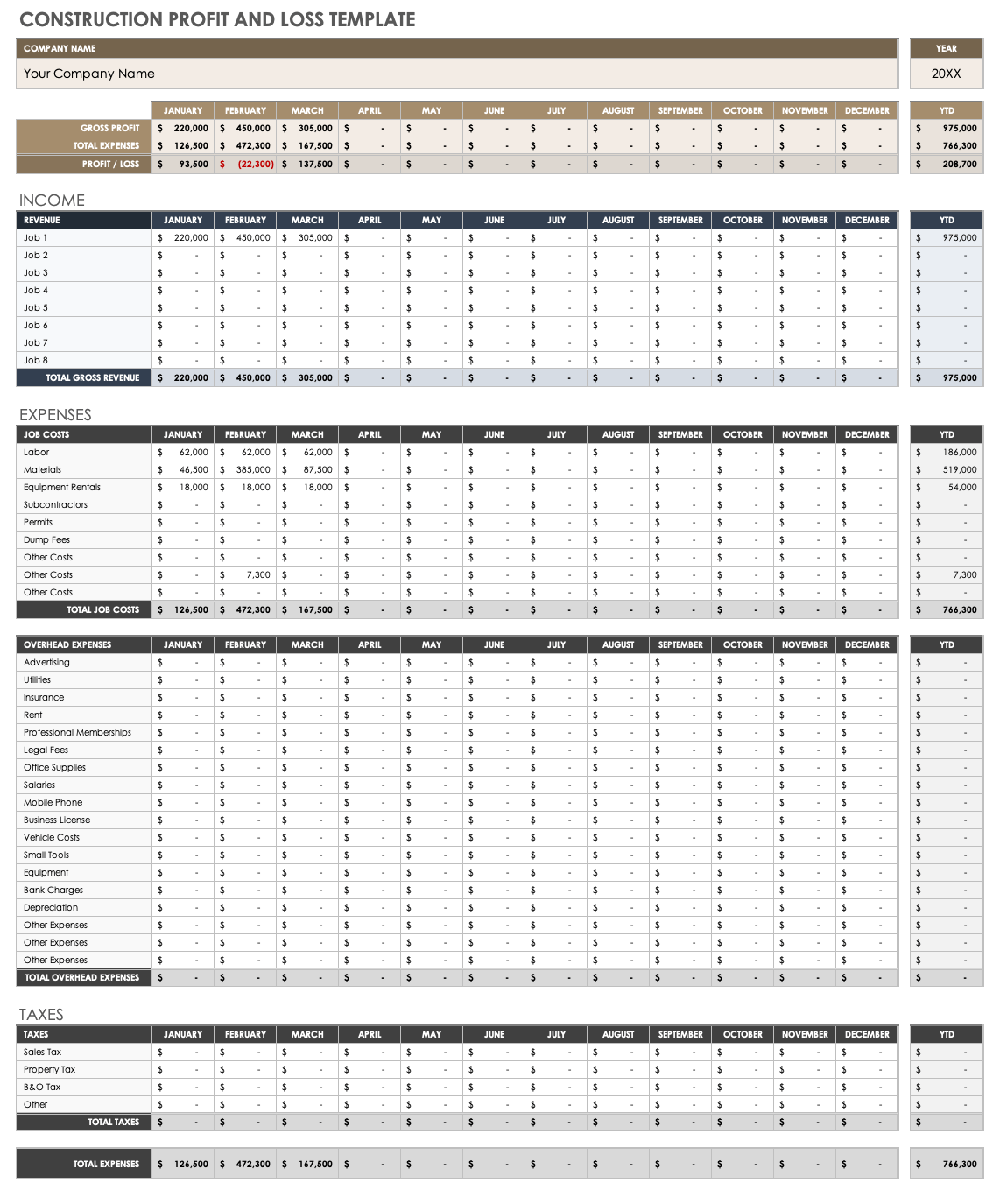

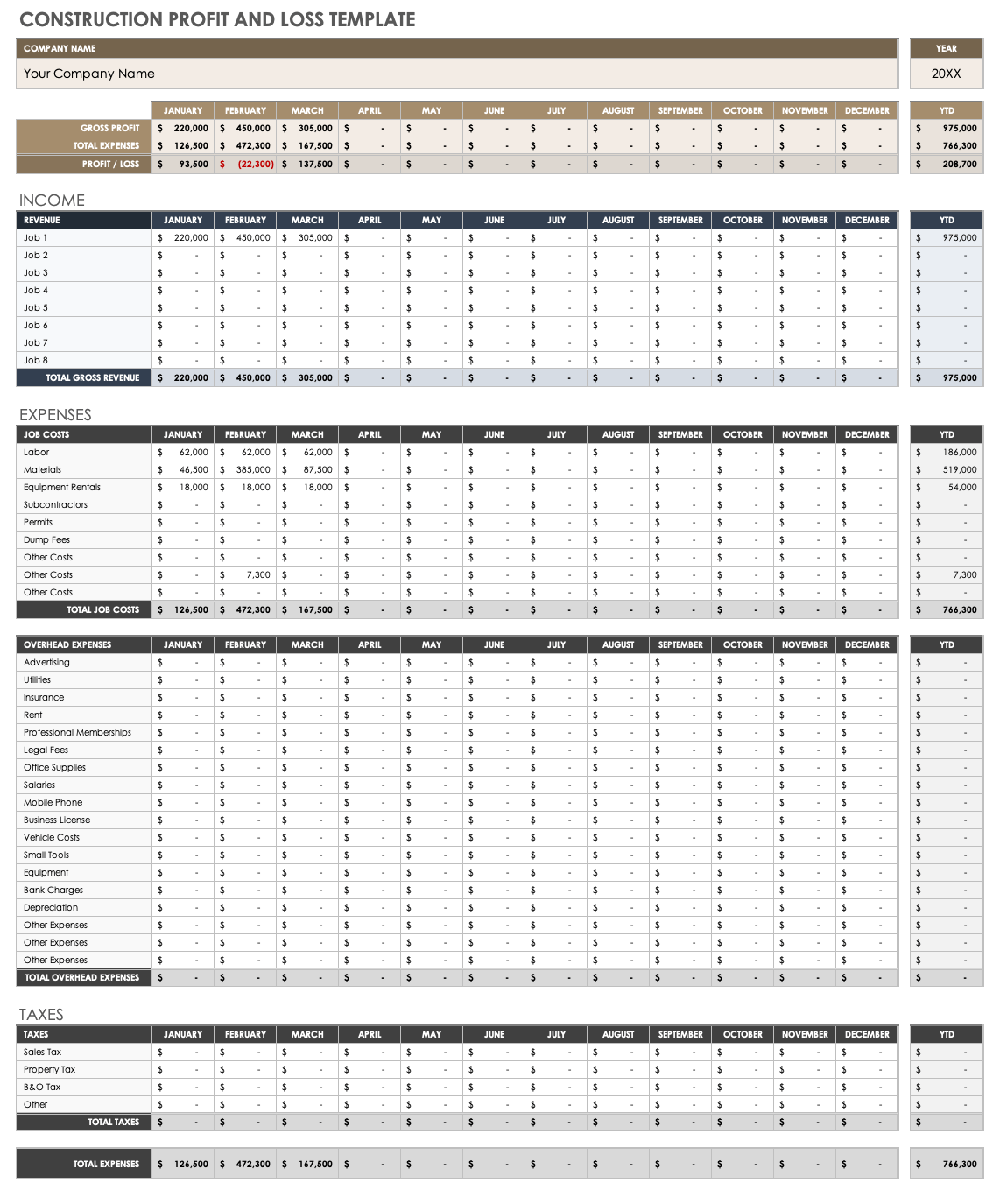

Key Components of a Profit and Loss Statement Template

A well-structured template ensures comprehensive and accurate financial reporting. Key components contribute to this structure, enabling efficient data analysis and informed decision-making.

1. Revenue: This section details all income generated from core business operations, including sales of goods or services. Accurate revenue reporting is fundamental to assessing overall financial performance.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold. Accurate COGS tracking is essential for determining gross profit and understanding profitability.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit indicates the profitability of core business operations before accounting for operating expenses.

4. Operating Expenses: This section encompasses all costs incurred in running the business, including salaries, rent, marketing, and administrative expenses. Detailed categorization of operating expenses facilitates cost control and efficiency analysis.

5. Operating Income: Derived by subtracting operating expenses from gross profit, operating income reflects the profitability of the business’s core operations.

6. Other Income/Expenses: This category captures income and expenses not directly related to core business operations, such as interest income or investment gains/losses.

7. Net Income: Representing the bottom line, net income is the final profit or loss after accounting for all revenues and expenses. This figure provides a crucial overview of financial performance.

8. Predefined Formulas and Automated Calculations: Embedded formulas automate key calculations, ensuring accuracy and efficiency in generating the profit and loss statement. This automation minimizes manual input and reduces the risk of errors.

These components work in concert to provide a comprehensive overview of financial performance, facilitating informed decision-making and effective resource allocation.

How to Create a Profit and Loss Statement Numbers Template

Creating a robust template provides a foundation for accurate and efficient financial reporting. The following steps outline the process of developing a profit and loss statement numbers template.

1. Choose a Software Platform: Select a spreadsheet software program or dedicated financial software. Spreadsheet software offers flexibility and accessibility, while specialized financial software often includes built-in accounting features.

2. Establish Reporting Period: Define the timeframe for the profit and loss statement (e.g., monthly, quarterly, or annual). Consistent reporting periods enable meaningful comparisons and trend analysis.

3. Define Revenue Categories: Establish clear categories for different revenue streams (e.g., product sales, service fees, interest income). This categorization provides granular insights into revenue generation.

4. Outline Cost of Goods Sold (COGS): Detail the direct costs associated with producing goods or services sold, including raw materials, direct labor, and manufacturing overhead. Accurate COGS categorization is crucial for calculating gross profit.

5. Categorize Operating Expenses: Create categories for operating expenses, including salaries, rent, marketing, and administrative costs. This categorization facilitates expense tracking and analysis.

6. Incorporate Other Income and Expenses: Include sections for income and expenses not directly related to core operations, such as interest income or investment gains/losses.

7. Implement Formulas for Key Metrics: Integrate formulas to automatically calculate key metrics like gross profit (Revenue – COGS), operating income (Gross Profit – Operating Expenses), and net income (Operating Income + Other Income – Other Expenses). Automated calculations enhance accuracy and efficiency.

8. Design for Clarity and Readability: Format the template for clear presentation, using consistent fonts, cell formatting, and clear labels. A well-designed template facilitates easy interpretation of financial data.

A well-structured template, incorporating these elements, enables efficient and accurate financial reporting, supporting informed decision-making and effective resource allocation.

A profit and loss statement numbers template provides a structured framework for organizing and analyzing financial data, contributing significantly to informed decision-making. Standardized formatting, predefined categories, and automated calculations ensure accuracy, consistency, and efficiency in financial reporting. Through error reduction and enhanced data integrity, such templates empower organizations to gain deeper insights into their financial performance, identify areas for improvement, and optimize resource allocation. Understanding and effectively utilizing these templates is crucial for sound financial management.

Effective financial analysis is essential for sustainable growth and long-term success. Leveraging the structure and functionality offered by a profit and loss statement numbers template allows organizations to transform raw financial data into actionable insights. This empowers businesses to not only understand their current financial standing but also to proactively adapt to changing market conditions and make strategic decisions that drive future profitability. Consistent application and refinement of these templates contribute to a more robust and resilient financial framework.