In the world of business, financial transactions are the backbone of growth and daily operations. Whether you’re lending money to a client, making an advance to an employee, or structuring a payment plan with a vendor, having a clear and legally sound agreement is absolutely crucial. This is where a promissory note comes into play, serving as a formal IOU that outlines the terms of a loan between two parties. It brings clarity and legal enforceability to what might otherwise be a simple handshake agreement.

Using a standardized promissory note business form template can be a game-changer for entrepreneurs and established companies alike. It ensures that all essential details are covered, reducing the risk of misunderstandings or disputes down the line. Imagine trying to draft every single loan agreement from scratch; it would be time-consuming, prone to errors, and potentially lead to overlooked legal stipulations. A reliable template streamlines this process, allowing you to focus on your core business activities while maintaining professional and legally sound financial records.

What Should a Good Promissory Note Business Form Template Include?

A truly effective promissory note business form template isn’t just a piece of paper; it’s a comprehensive document designed to protect both the lender and the borrower. It needs to clearly define the obligations of each party and specify the exact terms under which the money is borrowed and repaid. Missing even one crucial detail can render the note difficult to enforce or open to misinterpretation, potentially leading to costly legal battles.

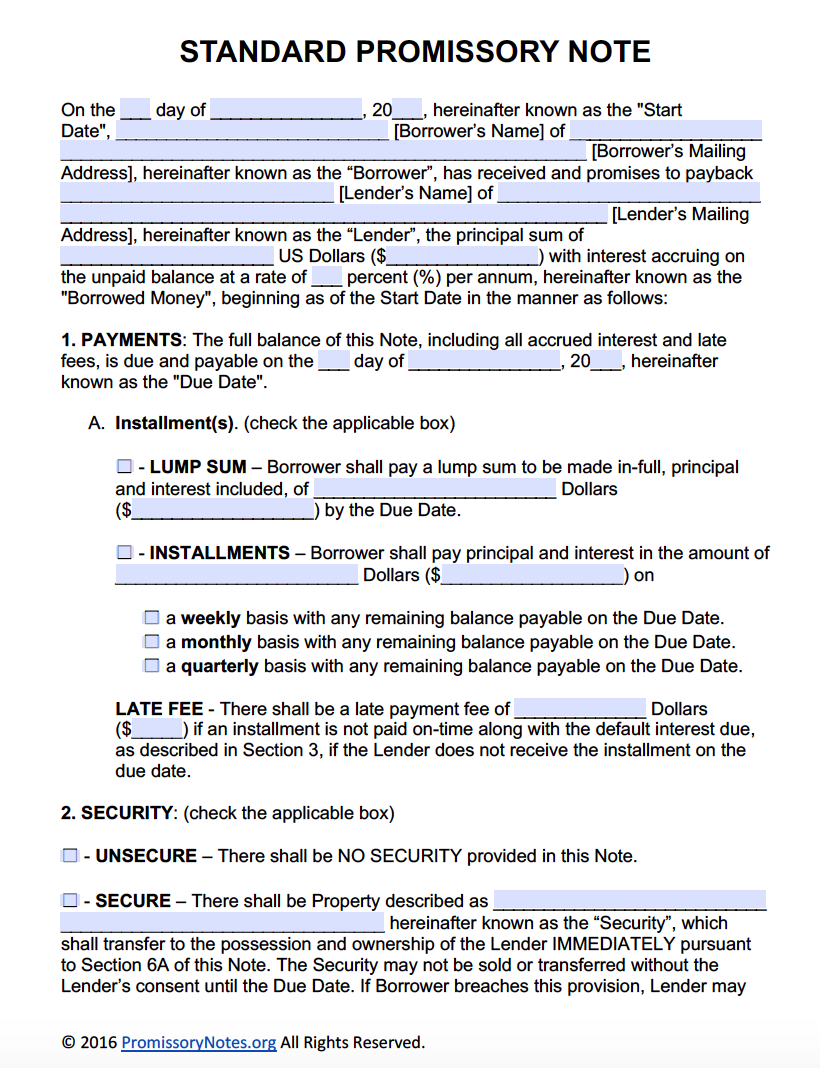

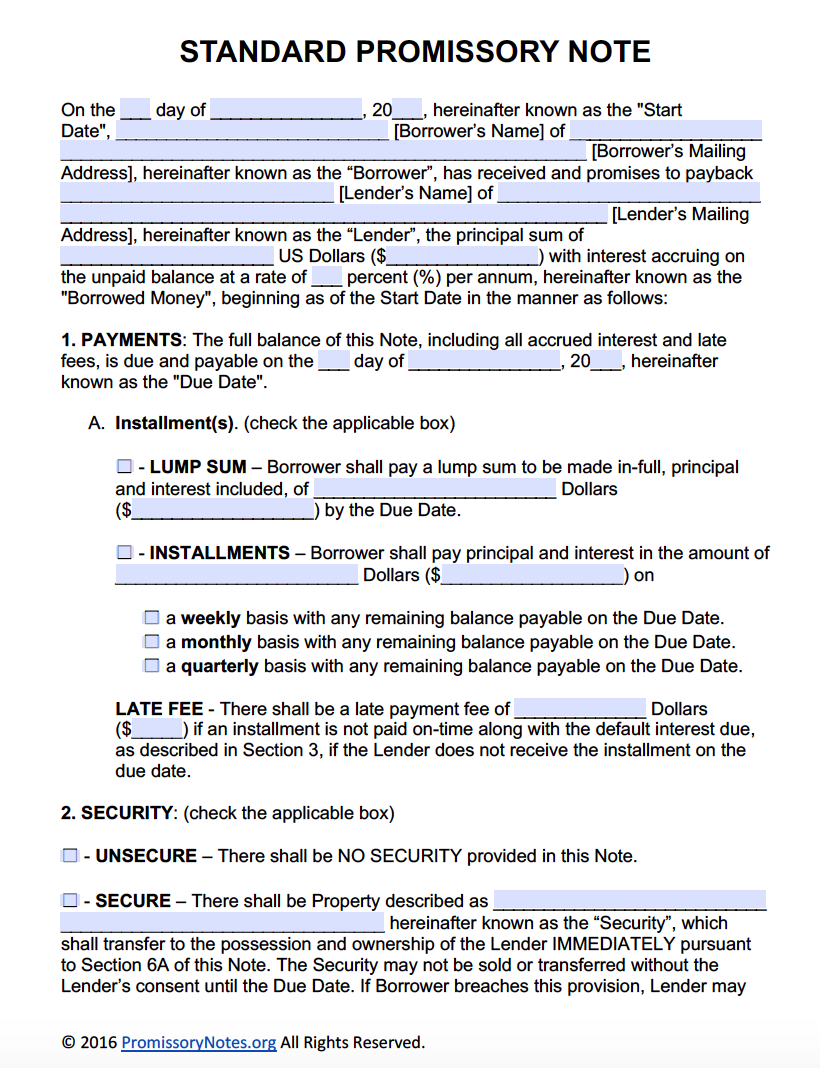

At its heart, a promissory note must identify who is borrowing and who is lending, the exact amount of money being borrowed (the principal), and how much interest, if any, will be charged. Beyond these basics, the repayment schedule is incredibly important. Will it be a single lump sum repayment, or will there be regular installment payments? What happens if a payment is missed, or if the borrower defaults on the loan entirely? These are all questions a robust template addresses.

Key Elements to Look For

- Borrower and Lender Information: Full legal names and addresses of both parties involved in the loan agreement.

- Principal Amount and Interest Rate: The exact sum of money borrowed and the agreed-upon annual interest rate, if applicable.

- Repayment Schedule: Clear terms detailing how and when the loan will be repaid, including dates, amounts, and frequency (e.g., weekly, monthly, quarterly).

- Late Payment Penalties: Specific consequences or fees for payments made after the due date.

- Default Clauses: Conditions under which the loan is considered in default and the actions the lender can take.

- Collateral (if any): A description of any assets pledged by the borrower to secure the loan. This makes it a secured promissory note.

- Governing Law: The state or jurisdiction whose laws will govern the note in case of a dispute.

- Signatures: Spaces for the dated signatures of both the borrower and the lender, often with a witness or notary public for added validity.

Beyond these elements, a well-designed promissory note business form template will also include provisions for acceleration clauses, allowing the lender to demand immediate full payment if certain conditions are breached. It will also specify how payments should be applied (e.g., first to interest, then to principal) and clearly state whether the note is secured or unsecured. Every clause is there to ensure that all parties have a complete understanding of their rights and responsibilities from the outset.

The goal is to leave no room for ambiguity. A thoroughly drafted note minimizes potential disputes and provides a clear legal pathway should disagreements arise. This forward-thinking approach saves both time and resources by laying out the groundwork for a smooth financial transaction.

Why Using a Standardized Promissory Note Template Saves You Time and Trouble

Imagine the time and effort it would take to consult with a lawyer every single time you needed a simple loan agreement for your business. While legal advice is invaluable for complex transactions, for routine lending or borrowing scenarios, a high-quality promissory note business form template offers an efficient and cost-effective solution. It provides a reliable framework, allowing you to quickly fill in the specific details of each unique transaction without reinventing the wheel.

One of the biggest advantages of using a template is the significant reduction in errors. When you start from scratch, it’s easy to forget critical clauses or misphrase legal terms. A pre-designed template, however, is built with legal best practices in mind, ensuring that all necessary information fields and standard legal protections are included. This consistency across your financial agreements not only makes your business operations smoother but also presents a more professional image to your clients and partners.

For instance, if you’re a small business owner offering payment plans for large purchases, a template ensures that every customer receives the same clear, legally sound agreement. Similarly, if you’re providing internal loans to employees, using a consistent promissory note form template prevents favoritism claims and maintains clear financial boundaries within your organization. It’s an essential tool for managing various types of financial arrangements efficiently and fairly.

- Consistency Across Transactions: Ensures every loan agreement is uniform, reducing confusion and the likelihood of disputes.

- Clarity for Both Parties: Clearly outlines terms, preventing misunderstandings before they arise.

- Reduced Legal Fees (for basic needs): Avoids the need for constant legal consultation for straightforward agreements.

- Easier Record Keeping: Standardized forms simplify filing and retrieval of important financial documents.

- Faster Transaction Closure: Allows for quick preparation of agreements, speeding up the process of securing funds or providing credit.

Ultimately, a good promissory note business form template empowers you to manage your financial relationships with confidence and precision. It serves as a foundational element of sound financial management, providing peace of mind knowing that your lending and borrowing activities are well-documented and legally enforceable. This proactive approach safeguards your interests and fosters trust in your business dealings, leading to stronger, more reliable financial partnerships.

Having a clear and precise document for any money exchange is not just good practice; it’s a fundamental aspect of sound business operations. By utilizing a comprehensive note, you’re not just securing a loan; you’re securing a relationship based on clear terms and mutual understanding. This proactive measure significantly reduces the potential for future conflicts and ensures that financial obligations are met as intended.

Investing a little time to understand and properly use an appropriate form for your financial agreements will pay dividends by protecting your interests and streamlining your operations. It’s an indispensable tool for any individual or entity involved in lending or borrowing, ensuring that every financial promise is as solid as a signed agreement can make it.