Navigating the world of applications, whether for a new apartment, a loan, or even certain government benefits, often brings one common request: proof of income. This crucial document helps verify your financial stability, assuring the requesting party that you have the means to meet your obligations. It’s a fundamental part of the trust-building process in many transactions, providing a clear picture of your earnings.

While the concept seems straightforward, gathering the right documentation can sometimes feel like a treasure hunt. This is where a well-designed proof of income form template becomes incredibly handy. Instead of scrambling for pay stubs, bank statements, or tax returns every single time, having a structured form can streamline the entire process, making it simpler for you to provide the necessary information accurately and efficiently. Let’s dive into what makes these forms so essential and how you can best utilize or even create one.

What Exactly is a Proof of Income Form and Why Do You Need It?

At its core, a proof of income form is a document that officially states how much money an individual earns over a specific period. This isn’t just about showing a paycheck; it’s about providing verifiable evidence of your financial capacity. For landlords, it confirms you can pay rent. For lenders, it reassures them you can repay a loan. For government agencies, it ensures eligibility for programs or assistance. It acts as a concise, consolidated record of your earnings, often summarizing information from various sources into one easy-to-read document.

The need for this type of verification arises in numerous aspects of life. Imagine applying for a mortgage; the bank needs to be certain you can manage the monthly repayments. Similarly, when you sign up for utilities like electricity or gas, especially if you have a less established credit history, they might ask for income verification to set up an account without a large deposit. Even for child support calculations or certain scholarship applications, demonstrating your income is a routine requirement.

Providing accurate and legitimate proof is paramount. Using official documents like pay stubs, employment verification letters, or tax returns is generally preferred. However, compiling these individually for every request can be cumbersome. This is why standardizing the process through a template is so beneficial, allowing for a consistent presentation of data while still relying on verifiable sources for the underlying information.

A dedicated form or template brings clarity and consistency to this often-repeated task. It guides you to include all the necessary details that typically accompany an income verification request, reducing the back-and-forth communication and ensuring nothing crucial is missed. This proactive approach saves time and reduces stress for both the individual providing the proof and the party requiring it.

Common Scenarios Requiring Proof of Income

- Rental Applications: Landlords often require income verification to assess a tenant’s ability to pay rent consistently.

- Loan Applications: Banks and credit unions use income proof to determine eligibility for personal loans, mortgages, or car loans.

- Government Benefit Applications: Many social assistance programs, unemployment benefits, or housing subsidies require proof of income to determine eligibility and benefit levels.

- Utility Setup: Sometimes, setting up new utility accounts (electricity, gas, internet) might require income verification, especially if credit history is minimal.

- Child Support Calculations: Courts use income documentation from both parents to determine appropriate child support amounts.

- Scholarship or Financial Aid Applications: Certain educational grants or scholarships might consider financial need, necessitating proof of income.

Crafting Your Own Proof of Income Form Template

Having a versatile proof of income form template at your disposal can be a game-changer. It means you’re prepared for those unexpected requests, or simply have a ready-to-go document for common scenarios. The beauty of a template lies in its adaptability; you can fill in the specific details as needed, ensuring all crucial information is consistently presented without having to start from scratch each time. This not only saves you precious time but also projects an image of professionalism and organization.

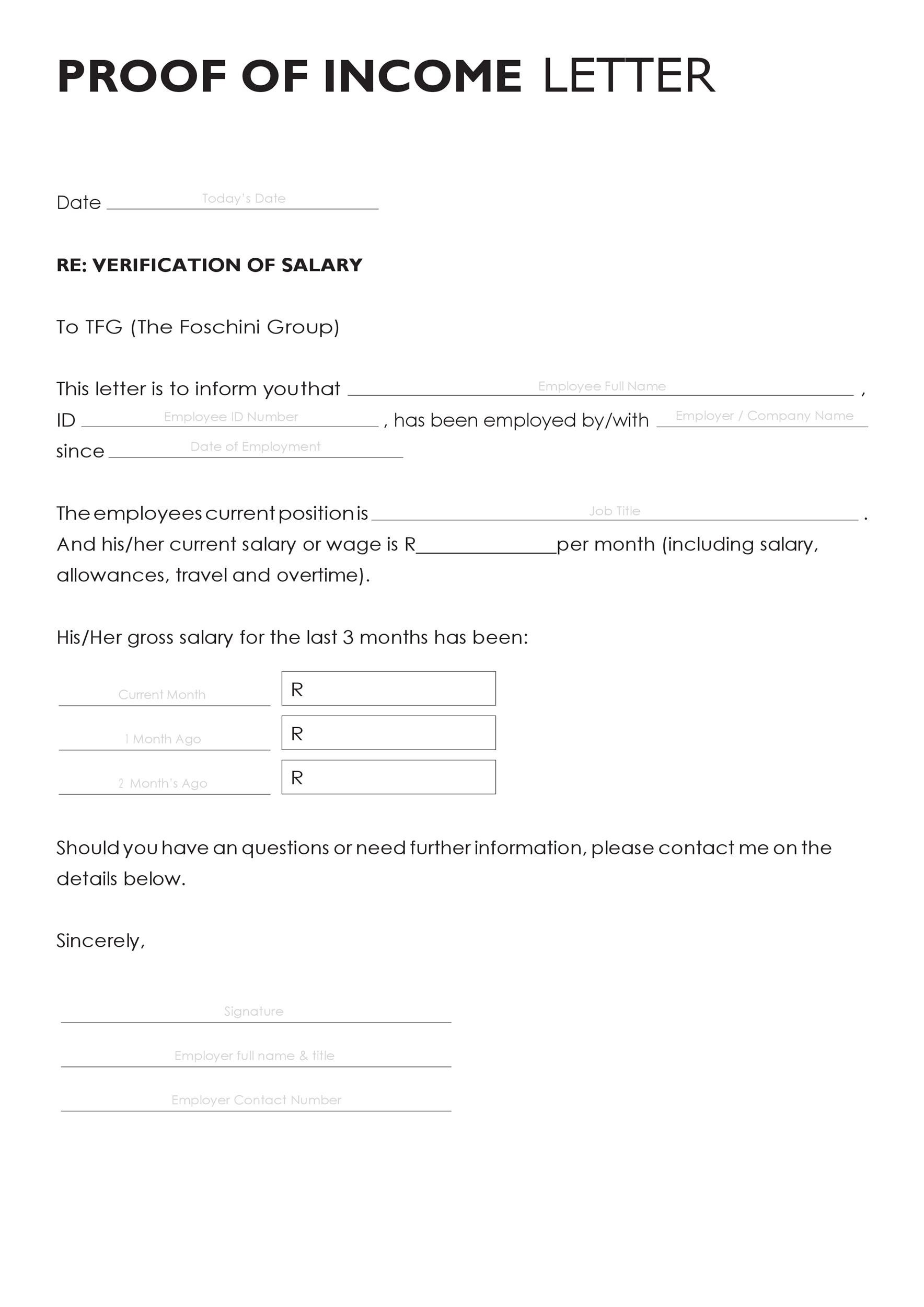

When designing or choosing a template, think about the essential pieces of information that any party would need to verify your income. This typically includes your full name, contact information, and social security number (or relevant identification). Then, you’ll need details about your employer or income source, such as the company name, address, and contact person. Most importantly, the form should clearly state your income amount, frequency (e.g., weekly, bi-weekly, monthly), and the period it covers.

Consider the different types of income you might need to document. For many, it’s a regular salary, but for freelancers, gig workers, or those receiving benefits, the source might be more varied. A good proof of income form template should have sections to accommodate these different streams, perhaps allowing for multiple income sources to be listed. This flexibility ensures that the template is useful regardless of your employment situation, providing a holistic view of your financial standing.

Finally, think about how the form will be used and verified. It’s often helpful to include a space for a signature and date, certifying the accuracy of the information provided. While a self-generated form is convenient, remember that some institutions may still require official documentation like pay stubs or an employment verification letter directly from your employer as supplementary proof. A well-structured template acts as an excellent summary, making the review of supporting documents much smoother for the requesting party.

Having a clear and accessible way to present your financial standing can simplify many of life’s administrative tasks. Whether you’re applying for a new place to live, securing a loan, or confirming eligibility for assistance, being able to quickly and accurately provide income verification puts you in a strong position. A carefully prepared form allows you to share your financial information transparently and efficiently, making the process smoother for everyone involved. Investing a little time into preparing such a document can truly pay off, saving you hassle and ensuring you’re always ready for whatever comes next.