Keeping a close eye on your finances is a cornerstone of good money management, and sometimes, the simplest tools can make the biggest difference. If you’re someone who still relies on checks for payments, whether for rent, bills, or other expenses, you know how easy it can be to lose track of what’s been written, when, and to whom. This is where a simple yet powerful tool, a record of check form template, becomes an invaluable asset for maintaining financial clarity and peace of mind.

Think of it as your personal check register, but in a more organized and accessible format. It helps you accurately log every check you issue, ensuring you have a clear paper trail of your transactions. This isn’t just about knowing your balance; it’s about empowering you to budget more effectively, reconcile your bank statements with ease, and confidently address any discrepancies that might arise. It’s a foundational step towards greater financial control.

Why Keeping a Record of Your Checks is Absolutely Essential

In an increasingly digital world, checks might seem like a relic, but they remain a vital payment method for many individuals and businesses. However, without a systematic way to track them, you’re essentially operating blind. Imagine writing a handful of checks throughout the month for various services or payments, then trying to remember all the details when your bank statement arrives. It can quickly become a confusing and stressful task. A consistent record-keeping practice eliminates this guesswork entirely.

One of the primary benefits is simply knowing where your money is going. By logging each check, you create a real-time ledger of your expenditures. This immediate visibility allows you to monitor your spending habits, identify areas where you might be overspending, and stick to your budget more effectively. It’s about being proactive rather than reactive with your financial health. You’ll have a clear snapshot of your available funds at all times, preventing overdrafts and financial surprises.

Benefits Beyond Just Knowing Your Balance

A record of your checks offers several layers of financial protection and organizational ease:

- Budgeting and Expenditure Tracking: Instantly see what you’ve spent and what funds remain, helping you stay within your financial limits.

- Bank Reconciliation Made Easy: Comparing your bank statement to your personal check record becomes a quick and accurate process, catching errors or unauthorized transactions promptly.

- Proof of Payment and Dispute Resolution: Should a payment ever be disputed, your detailed record serves as undeniable proof of the check’s issuance, date, amount, and payee.

- Tax Preparation and Auditing: Organized records simplify tax season, making it easier to account for deductible expenses or income, and are indispensable if you ever face an audit.

Moreover, for businesses, even small ones, maintaining meticulous records of outgoing checks is crucial for financial reporting, managing cash flow, and ensuring compliance. It’s not just a good practice; it’s a fundamental component of sound financial management that protects you from potential headaches down the line.

What to Look for in a Comprehensive Record of Check Form Template

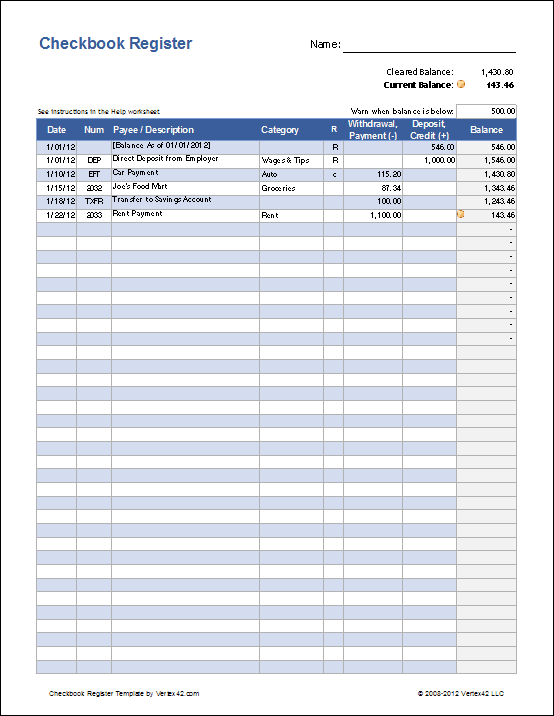

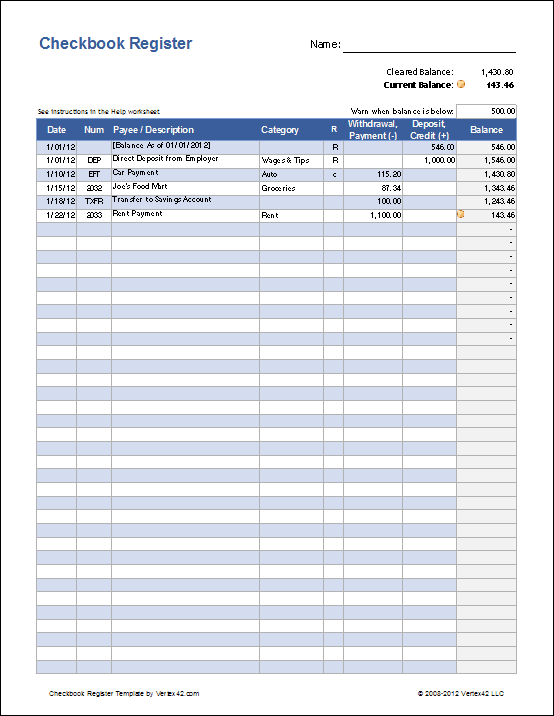

When choosing or creating a record of check form template, the key is to prioritize clarity, ease of use, and completeness. A good template should be intuitive enough for anyone to fill out, yet robust enough to capture all the necessary information for accurate financial tracking. It should serve as a simple, visual representation of your check-writing activities, making reconciliation and review straightforward. The best templates strike a balance between simplicity and detail, ensuring you get the information you need without unnecessary clutter.

At its core, any effective check record template needs to include several essential data points. These are the non-negotiables that provide a complete picture of each transaction. Think about what information you’d typically find on a check stub or in a traditional checkbook register. The goal is to replicate that digitally or on paper in a format that’s easy to read and update.

Here are the key fields a useful template should have:

- Date of Check: When the check was written.

- Check Number: The unique serial number on the check.

- Payee (To Whom It Was Written): The name of the person or entity receiving the payment.

- Amount: The exact monetary value of the check.

- Purpose/Memo: A brief description of what the payment was for (e.g., “Rent – April,” “Utility Bill,” “Groceries”).

- Cleared Status (Optional but helpful): A column to mark when the check has been cashed and cleared your bank account.

- Running Balance (Optional for real-time tracking): A column that automatically updates your account balance after each transaction.

Beyond these basics, you might consider templates that allow for additional notes or categorization. Some individuals find it helpful to add columns for the date the check was mailed, the account it was drawn from if you manage multiple accounts, or even a column to cross-reference with invoices or bills. Whether you prefer a digital spreadsheet or a printable paper form, the right template will empower you to keep your check transactions perfectly aligned with your overall financial picture.

Embracing a systematic approach to tracking your check payments is a small habit that yields significant financial benefits. By consistently using a detailed record for every check you issue, you transform what could be a source of confusion into a clear, organized, and easily verifiable part of your financial history. It’s about building a robust foundation for your money management, ensuring every dollar is accounted for and understood.

This level of detailed record-keeping provides an unparalleled sense of control and reduces financial stress. Knowing exactly what has been paid, when, and to whom, simplifies budgeting, streamlines bank reconciliation, and provides immediate answers to any payment queries. It’s a proactive step towards greater financial literacy and security, offering peace of mind that is truly invaluable.