Managing recurring payments can often feel like herding cats. You want a smooth, predictable flow of income for your business, and your customers appreciate the convenience of automated payments. Enter ACH, or Automated Clearing House, payments—a fantastic solution for this very purpose. However, setting up these recurring transactions requires careful attention to detail, especially when it comes to gathering the necessary banking information and obtaining proper authorization.

This is where a well-designed recurruing ACH enrollment form template becomes an invaluable asset. It streamlines the entire process, ensuring you collect all the critical data accurately while providing a clear and professional experience for your clients. Forget about missing crucial details or scrambling to get proper consent; a standardized template takes the guesswork out of the equation and puts you on the path to seamless financial operations.

Why a Dedicated ACH Enrollment Form is Crucial for Your Business

In today’s fast-paced business world, efficiency and accuracy are paramount. For any enterprise relying on recurring revenue, such as subscriptions, memberships, or installment plans, ACH payments offer a multitude of benefits over traditional methods like credit cards or paper checks. They typically boast lower processing fees, higher retention rates due to reduced churn from expired cards, and a greater sense of financial predictability. But to harness these advantages effectively, a robust enrollment process is non-negotiable.

Simply asking for bank details over the phone or via email is fraught with risks, from human error in transcription to a lack of proper legal consent. A dedicated form acts as a single source of truth, a structured document that guides both your team and your customers through the necessary steps. It professionalizes your operation, builds trust with your clients by demonstrating your commitment to secure and compliant practices, and most importantly, provides an auditable record of their authorization for recurring debits.

Understanding what information is absolutely essential to collect is the first step in creating an effective form. Without the right details, the ACH transaction simply cannot be processed. This goes beyond just an account number; it involves precise banking identification and clear instruction.

Key Information to Collect for ACH Processing

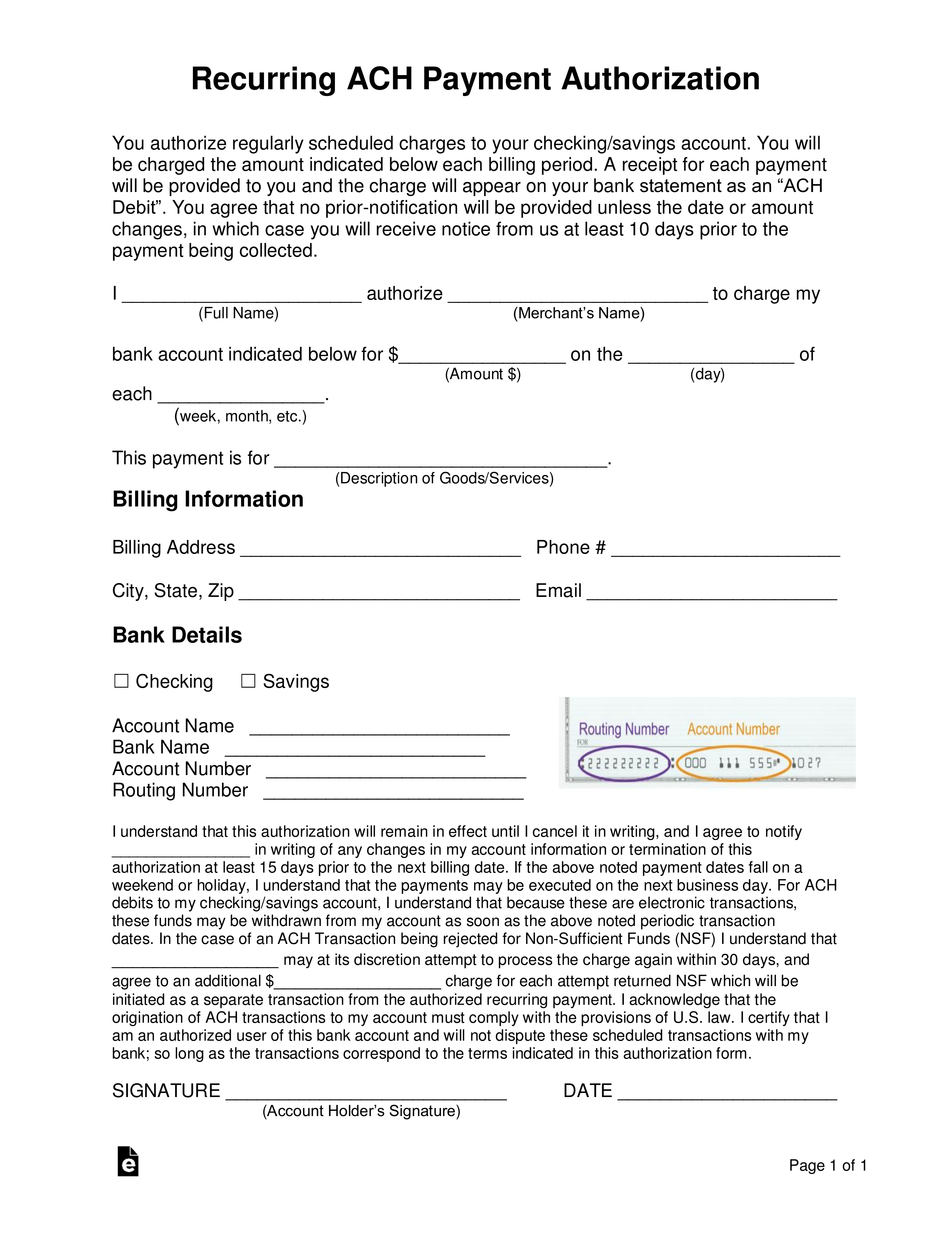

- Bank Name: The name of the financial institution where the customer’s account is held.

- Bank Routing Number: A nine-digit code that identifies the customer’s bank. This is crucial for directing funds correctly.

- Customer Account Number: The specific account number from which funds will be debited.

- Account Type: Whether the account is a checking or savings account. This distinction is important for processing.

- Authorization Statement: Clear, explicit permission from the customer for recurring debits, including the amount and frequency.

Beyond just collecting data, the form serves as a crucial legal document. It secures the necessary authorization from your customers, giving you the explicit right to debit their accounts on a recurring basis. This protects your business from disputes and ensures compliance with financial regulations, making it an indispensable part of your financial infrastructure. A comprehensive form also often includes clauses for changes, cancellations, and customer rights, providing a complete picture of the payment agreement.

Building Your Ideal Recurruing ACH Enrollment Form Template

Designing a recurruing ACH enrollment form template does not have to be a daunting task. The goal is to create a document that is straightforward for your customers to complete, comprehensive enough for your internal processes, and legally sound. Begin by outlining the distinct sections your form will need, thinking about the logical flow from the customer’s perspective. A good template balances user-friendliness with the critical information gathering required for successful ACH processing.

Start with the basics: your company’s information at the top, clear branding, and a title that immediately tells the customer what the form is for. Then, move into the customer’s personal details. This includes their full name, billing address, phone number, and email address. While some of this might seem redundant if you already have it, including it on the form itself ensures that all necessary information related to the payment agreement is contained in one single document, simplifying record-keeping.

The core of the form will be the financial information section. This is where you collect the bank name, routing number, account number, and account type, as previously discussed. Be sure to provide clear instructions on where customers can find these details, perhaps with a small diagram of a check or a note to contact their bank. Clarity here reduces errors and ensures a smooth setup.

Following the financial details, the authorization language is arguably the most critical component. This section must explicitly state that the customer authorizes recurring debits, the specific amount or method for determining the amount, the frequency (e.g., monthly, weekly), and the start date. It should also include terms for cancellation and dispute resolution. Providing a clear and concise statement here protects both parties and builds trust. Consider including a disclaimer about potential NSF (Non-Sufficient Funds) fees and how those will be handled.

To make your form truly effective, consider adding a space for an authorized signature and date. This confirms the customer’s agreement and acts as a final layer of consent. You might also include a reference to your company’s terms of service or privacy policy, either by directing them to your website or including a brief summary of relevant clauses. Having a well-structured and legally compliant recurruing ACH enrollment form template can significantly enhance your business’s financial operations.

A well-crafted recurruing ACH enrollment form template is more than just a document; it is a fundamental tool that underpins the stability and growth of your business’s revenue streams. It simplifies administrative burdens, minimizes the potential for costly errors, and ensures that your recurring payment processes are both efficient and compliant. By providing a clear, professional, and secure way for your customers to authorize payments, you foster trust and enhance the overall client experience.

Implementing a standardized form allows you to automate a crucial part of your financial operations, freeing up valuable time and resources that can be redirected toward other strategic business initiatives. It’s an investment in your operational efficiency and a commitment to providing a seamless, reliable service to your customers, ultimately contributing to your sustained success.