Managing small, day-to-day expenditures can often be more challenging than dealing with large invoices. Whether it is for unexpected office supplies, quick errands, or simply providing change to customers, a petty cash fund is a common necessity for many businesses. However, without proper structure, this seemingly simple fund can quickly become a source of confusion, errors, and even accountability issues.

This is where a dedicated and well-designed process comes into play. Establishing clear guidelines and utilizing the right tools are essential for keeping track of every penny. A standardized approach helps ensure transparency, simplifies reconciliation, and maintains financial integrity. So, if you are looking to streamline your cash management, understanding the importance of a solid request for petty cash change fund form template is your first step towards greater efficiency and control.

Why a Dedicated Form for Your Petty Cash Change Fund is a Game Changer

Imagine a scenario where various employees need access to small amounts of cash throughout the day. Without a formal process, requests might be verbal, amounts could be forgotten, and receipts might go missing. This casual approach often leads to discrepancies, difficult reconciliations at the end of the month, and a headache during audit season. There is no clear paper trail, making it nearly impossible to pinpoint where money went or who was responsible. It’s a recipe for disorganization that can impact morale and trust within the team.

A well-designed form, however, transforms this chaotic system into a streamlined operation. It introduces a layer of transparency and accountability that is otherwise missing. Every time cash is requested or replenished for the petty cash change fund, a record is created. This record details the amount, the purpose, and the individuals involved, providing an undeniable paper trail for all transactions. This dramatically simplifies the process of tracking funds, reduces errors, and makes reconciliation a far less daunting task.

Furthermore, a standardized form ensures consistency across the organization. It doesn’t matter who is requesting or approving the funds; the same procedure is followed every time. This uniformity helps to prevent misunderstandings and ensures that all necessary information is captured from the outset. It also makes it easier for new employees to understand the process quickly, integrating them smoothly into your financial protocols without extensive training on informal systems.

Ultimately, a dedicated form serves as a crucial control mechanism. It provides a formal process for requesting funds, requiring proper authorization before cash is disbursed. This not only safeguards the petty cash but also reinforces financial discipline within the organization. When employees know there is a formal process in place, they are more likely to be meticulous with their requests and vigilant about maintaining receipts, benefiting everyone involved.

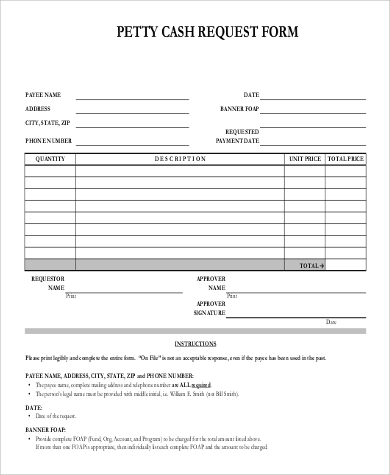

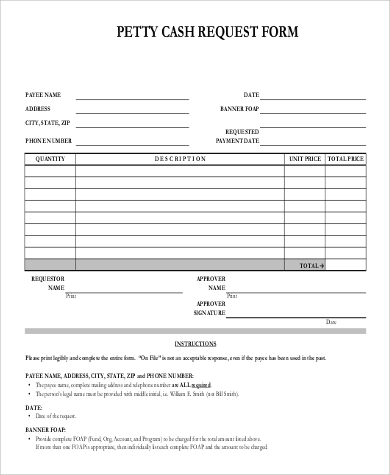

Key Elements to Include in Your Template

- Date of Request: Essential for tracking when the need arose.

- Department or Requester Name: Identifies who is initiating the request.

- Purpose of Fund: Clearly states why the change fund is needed (e.g., daily operations, making change for sales, specific project).

- Amount Requested: The precise sum of money being requested.

- Signature Lines: Spaces for the requester and the approving authority, indicating proper authorization.

- Date Approved or Disbursed: Marks when the fund was officially approved and when the cash was given out.

- Fund Custodian Name: The individual responsible for holding and managing the petty cash change fund.

- Fund Reconciliation Details: (Optional but highly recommended) A section to track how the fund is balanced and replenished, aiding in regular audits.

Setting Up and Managing Your Petty Cash Change Fund Effectively

Beyond simply having a form, the true power lies in how you implement and manage your petty cash change fund. The first step involves getting initial approval for the fund itself, determining an appropriate fixed amount, and then designating a reliable custodian. This custodian will be the primary person responsible for the physical cash, ensuring it is kept secure and that all disbursements and replenishments are documented accurately using your new request for petty cash change fund form template. It is a significant responsibility that requires trust and attention to detail.

Once the fund is established, the form becomes integral to its daily operation. It is not just for the initial setup. The form should be used whenever the fund needs to be replenished to its fixed amount, or when the custodian needs to account for significant expenditures that have reduced the cash on hand. Each replenishment request, backed by the initial expenses and corresponding receipts, flows through the same approval process, ensuring continuous oversight of the fund’s activity. This systematic approach prevents the fund from being depleted without proper authorization or tracking.

It is also crucial to establish clear policies and procedures that go hand in hand with the use of the form. These policies should outline who is authorized to make requests, what the maximum per-transaction limit is for petty cash use, and how often the fund should be reconciled. For instance, you might stipulate that the fund is counted and balanced weekly, or at the end of each business day if it is a very active fund. These guidelines provide the framework within which the form operates, making the entire system robust and reliable.

Regular reconciliation and auditing are the final pieces of the puzzle for effective petty cash management. The custodian, using the information from the request forms and the expense receipts, should regularly count the cash and compare it to the documented transactions. Any discrepancies must be investigated immediately. Periodic audits by a supervisor or an external party can further ensure compliance and identify any areas for improvement. The consistent use of the request for petty cash change fund form template provides the essential paper trail for these reviews, making it easy to trace every movement of cash and verify its legitimate use.

Implementing a structured approach to petty cash management brings a surprising amount of order to what can often be a chaotic aspect of daily operations. It moves petty cash from being a mysterious drawer of money to a fully accountable and auditable financial tool.

Having a robust system centered around a well-designed request for petty cash change fund form template isn’t just about controlling small amounts of money. It is about fostering a culture of financial responsibility and efficiency throughout your organization. It simplifies what could otherwise be a messy task, allowing your team to focus on their core responsibilities with confidence in the financial controls in place.