Utilizing a personal balance sheet based on the principles outlined in Rich Dad Poor Dad can offer several key advantages. It allows individuals to clearly see their financial progress over time, highlighting areas for improvement. By focusing on acquiring income-generating assets and minimizing liabilities, the goal is to build long-term wealth and achieve financial independence. This method promotes a proactive approach to money management, encouraging users to think strategically about their finances and make informed decisions about investments and expenditures. Regularly updating and reviewing the balance sheet provides a powerful snapshot of financial health, enabling more effective planning and control.

This understanding of basic financial statements and their practical application is fundamental to building financial well-being. The following sections will delve deeper into the specific components of a balance sheet, how to create one, and practical strategies for improving one’s financial position according to the Rich Dad Poor Dad philosophy.

1. Assets

Within the framework of a Rich Dad Poor Dad financial statement template, assets hold a central position. They represent items owned that have the potential to generate income or appreciate in value. This emphasis on income-generating assets is a key differentiator from traditional financial statements, which often focus primarily on income and expenses. Examples of assets within this context include stocks, bonds, real estate, intellectual property, and businesses. The focus on assets aligns with the core philosophy of building wealth through acquiring items that put money in one’s pocket, rather than simply focusing on earning a higher salary.

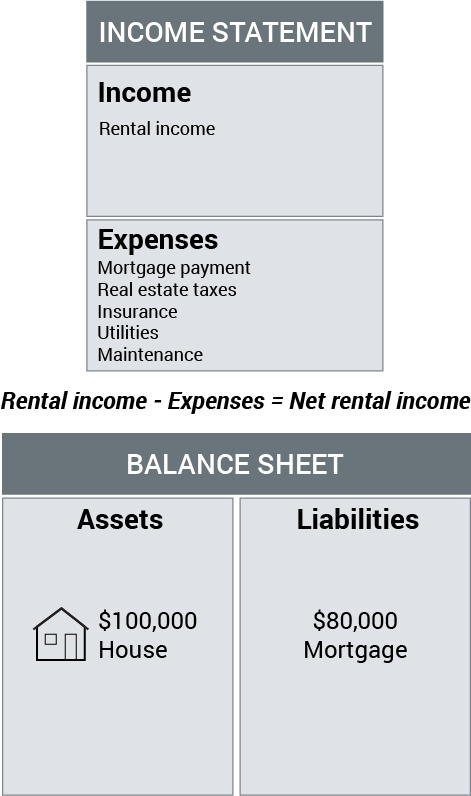

Categorizing possessions as assets requires careful consideration. A primary residence, while often considered an asset in traditional accounting, may be viewed differently within the Rich Dad Poor Dad framework. Unless it generates income, such as through rental income, it might be classified as a liability due to associated expenses like mortgage payments, property taxes, and maintenance costs. This distinction highlights the importance of critically evaluating what truly constitutes an income-producing asset. A car used solely for personal transportation, while having some resale value, primarily incurs expenses like fuel, insurance, and maintenance. Therefore, it would not typically be considered an asset within this specific framework. Conversely, a car used for a ride-sharing service, generating income, could be classified as an asset.

Understanding the role and significance of assets within a Rich Dad Poor Dad financial statement is crucial for building long-term wealth. This approach encourages proactive acquisition of income-generating assets and careful evaluation of expenditures. By focusing on assets that work for the individual, the goal is to create a sustainable financial foundation and achieve financial independence.

2. Liabilities

Liabilities, within the context of a Rich Dad Poor Dad financial statement template, represent any financial obligations or debts. Understanding and managing liabilities is crucial as they directly impact net worth and overall financial health. This perspective differs from traditional accounting where liabilities are simply recorded; the Rich Dad Poor Dad philosophy emphasizes minimizing liabilities to accelerate the journey towards financial independence. Examples of liabilities include mortgages, car loans, student loans, credit card debt, and personal loans. These obligations require regular payments, reducing cash flow and hindering wealth accumulation.

The significance of tracking liabilities in this context lies in their impact on long-term financial goals. A high liability burden reduces disposable income and limits investment opportunities. For instance, a large mortgage payment consumes a significant portion of income, leaving less for investing in income-generating assets. Similarly, high credit card debt accrues interest, further diminishing available funds. The Rich Dad Poor Dad philosophy emphasizes reducing liabilities strategically to free up cash flow for investments that build wealth. This approach promotes financial freedom by prioritizing asset acquisition and minimizing financial obligations that drain resources. For example, paying down a mortgage aggressively or consolidating high-interest debt can significantly reduce liabilities and free up capital for investment in income-generating assets.

Managing liabilities effectively is a cornerstone of the Rich Dad Poor Dad approach. By understanding and actively minimizing financial obligations, individuals can accelerate the growth of their net worth and create a more secure financial future. This focus on liability reduction, coupled with asset acquisition, is a powerful strategy for building lasting wealth and achieving financial independence.

3. Income (Cash In)

Within the Rich Dad Poor Dad financial statement template, income represents the cash flow generated from various sources. However, it’s crucial to distinguish between earned income and passive income, a key concept emphasized in the book. Earned income, derived from traditional employment, is viewed differently from passive income generated by assets. This distinction is fundamental to understanding the Rich Dad Poor Dad philosophy of building wealth through asset acquisition.

- Earned IncomeEarned income typically comes from salaries, wages, or self-employment. While essential for covering expenses and building a foundation, the Rich Dad Poor Dad philosophy posits that relying solely on earned income limits wealth-building potential due to its dependence on active work. A doctor’s salary, for example, ceases when the doctor stops working. This type of income is viewed as a stepping stone towards building passive income streams.

- Passive IncomePassive income, a core principle of the Rich Dad Poor Dad philosophy, represents money earned without direct, ongoing effort. This income stream is generated by assets, such as rental income from properties, dividends from stocks, or royalties from intellectual property. For example, rental income from a real estate investment continues regardless of the investor’s daily involvement. Building multiple streams of passive income is the key to achieving financial freedom.

- Portfolio IncomePortfolio income, derived from investments such as stocks, bonds, and mutual funds, represents another income stream within the Rich Dad Poor Dad framework. While similar to passive income, portfolio income often requires more active management and analysis. For instance, managing a stock portfolio requires research and decision-making. This income category highlights the importance of diversifying income sources beyond earned income.

- Business IncomeBusiness income generated from owning and operating a business aligns with the Rich Dad Poor Dad emphasis on creating assets. This income stream, while requiring effort and management, offers significant potential for wealth creation. Owning a successful business, whether a small local shop or a larger enterprise, generates income and can appreciate in value, further contributing to net worth. Unlike a job, a business can be built and eventually sold or passed on.

The Rich Dad Poor Dad financial statement template uses these income distinctions to emphasize the importance of shifting focus from earned income to passive income. By prioritizing asset acquisition and development, individuals can build wealth and achieve financial independence. Understanding the different types of income and their respective roles in the overall financial picture is crucial for effectively applying the principles outlined in Rich Dad Poor Dad.

4. Expenses (Cash Out)

Within the Rich Dad Poor Dad financial statement template, expenses represent the outflow of money used to cover various costs. However, the approach to categorizing and managing expenses differs significantly from traditional budgeting. Rather than simply tracking spending, the focus is on understanding how expenses relate to building long-term wealth and achieving financial independence. This involves distinguishing between expenses that support asset acquisition and those that drain resources without contributing to wealth creation.

A critical aspect of managing expenses within this framework involves differentiating between good expenses and bad expenses. Good expenses are those that contribute to building assets or generating future income. Investments in real estate, education that enhances earning potential, or starting a business are considered good expenses as they have the potential to generate future returns. Conversely, bad expenses are those that consume income without contributing to long-term wealth creation. Luxury purchases, excessive entertainment spending, or high-interest debt payments are considered bad expenses as they drain resources without generating future income. For example, purchasing a luxury car is a bad expense, while investing in a rental property, which generates income, is considered a good expense.

The practical significance of understanding and categorizing expenses within this framework lies in its impact on long-term financial health. Minimizing bad expenses frees up capital to invest in assets, thereby accelerating wealth creation. Regularly analyzing expenses within the context of asset acquisition allows individuals to make more informed financial decisions and optimize their spending to align with their long-term financial goals. By reducing unnecessary expenditures and prioritizing investments in income-generating assets, individuals can create a more secure and prosperous financial future.

5. Net Worth Calculation

Net worth calculation forms the cornerstone of the Rich Dad Poor Dad financial statement template. It provides a snapshot of one’s financial health by quantifying the difference between assets and liabilities. This calculation is not merely a bookkeeping exercise; it serves as a critical metric for evaluating financial progress and the effectiveness of strategies employed to build wealth based on the book’s principles. A consistent focus on increasing net worth, rather than solely on income, differentiates this approach from traditional personal finance management.

Calculating net worth involves subtracting total liabilities from total assets. A positive net worth indicates that assets exceed liabilities, while a negative net worth signifies the opposite. For example, an individual with $500,000 in assets (real estate, stocks, etc.) and $200,000 in liabilities (mortgage, loans) has a net worth of $300,000. Tracking net worth over time provides insights into the impact of financial decisions. An increasing net worth suggests effective wealth-building strategies, while a stagnant or decreasing net worth signals the need for adjustments. This regular monitoring encourages proactive financial management and facilitates course correction as needed. The emphasis on net worth encourages individuals to focus on acquiring income-generating assets and minimizing liabilities, rather than solely on increasing income.

The practical significance of net worth calculation lies in its ability to provide a clear and concise measure of financial standing. It serves as a motivational tool, encouraging focus on long-term financial goals rather than short-term gains. Regularly calculating and analyzing net worth empowers individuals to make informed decisions regarding investments, debt management, and expense control. Understanding the relationship between assets, liabilities, and net worth is fundamental to applying the principles outlined in Rich Dad Poor Dad and achieving financial independence.

Key Components of a Rich Dad Poor Dad Inspired Financial Statement

Effective personal financial management, as advocated in Rich Dad Poor Dad, hinges on understanding key components within a tailored financial statement. These components provide a framework for visualizing and analyzing one’s financial position, guiding decisions towards building long-term wealth.

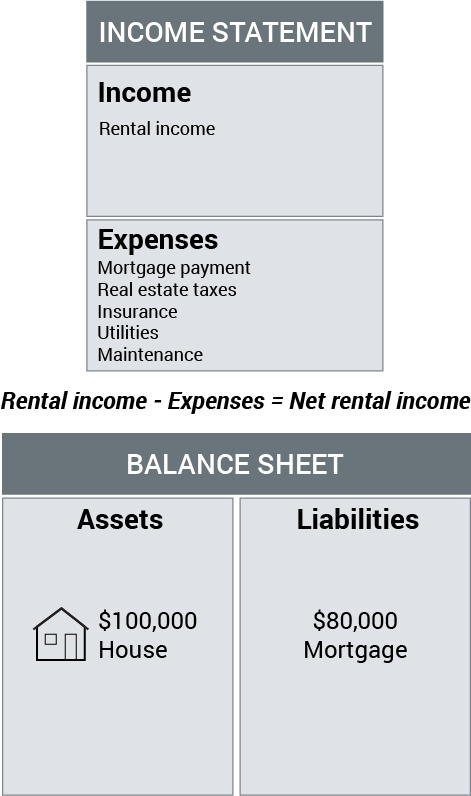

1. Income Statement: This statement details cash flow, distinguishing between earned income (salaries, wages) and passive income (generated by assets). This distinction emphasizes the importance of building passive income streams for financial independence.

2. Balance Sheet (Statement of Net Worth): This statement provides a snapshot of financial health by listing assets and liabilities. Calculating net worth (assets minus liabilities) offers a clear measure of financial progress and highlights the impact of financial decisions.

3. Asset Column: This section lists items owned that generate income or appreciate in value, such as real estate, stocks, bonds, and businesses. It emphasizes the importance of acquiring income-generating assets rather than simply accumulating possessions.

4. Liability Column: This section lists all debts and financial obligations, such as mortgages, loans, and credit card debt. Minimizing liabilities is crucial for freeing up cash flow to invest in income-generating assets.

5. Cash Flow Pattern Analysis: This involves analyzing the movement of money into and out of one’s accounts. It reveals spending habits and identifies areas where expenses can be reduced to free up more capital for investment.

6. Regular Review and Adjustment: This ongoing process involves regularly updating the financial statement and analyzing the trends in net worth, income, and expenses. It allows for adjustments to financial strategies as needed to ensure continued progress towards financial goals.

These interconnected components provide a comprehensive view of one’s financial standing, encouraging a proactive approach to building wealth through asset acquisition and liability management, aligning with the core principles outlined in Rich Dad Poor Dad.

How to Create a Rich Dad Poor Dad Inspired Financial Statement

Creating a financial statement based on the Rich Dad Poor Dad principles requires a focused approach, emphasizing asset acquisition and liability reduction. The following steps outline the process of developing and utilizing this specialized financial statement.

1: Determine Assets: List all income-generating assets. This includes rental properties, stocks, bonds, businesses, and any other possessions generating income. Clearly distinguish between assets and personal-use items. A primary residence, for example, may be considered a liability unless generating rental income.

2: Calculate Asset Value: Determine the current market value of each listed asset. Use accurate and up-to-date information for a realistic assessment of net worth.

3: Identify Liabilities: List all outstanding debts and financial obligations, including mortgages, car loans, student loans, and credit card debt. Be meticulous and inclusive in this process to gain a complete picture of financial obligations.

4: Calculate Liability Amounts: Determine the outstanding balance for each liability. This requires accessing current loan statements and credit reports for accurate figures.

5: Calculate Net Worth: Subtract the total liabilities from the total assets. This key figure provides a snapshot of current financial standing and serves as a benchmark for tracking progress.

6: Analyze Income Streams: Categorize income sources into earned income (salaries, wages) and passive income (generated by assets). This distinction highlights areas for improvement and emphasizes the importance of building passive income streams.

7: Track Expenses: Monitor all expenses, categorizing them as either contributing to asset growth or diminishing wealth. This analysis informs spending decisions and identifies areas for potential reduction.

8: Regular Review and Adjustment: Regularly update the financial statement, ideally monthly, to track progress and make necessary adjustments. Consistent monitoring and refinement are crucial for long-term success.

By following these steps and maintaining a focus on building assets and minimizing liabilities, individuals can gain a clearer understanding of their financial position and work towards achieving financial independence, aligning with the core tenets of Rich Dad Poor Dad.

Financial statement templates inspired by the Rich Dad Poor Dad philosophy offer a unique perspective on personal finance management. They emphasize the importance of building wealth through acquiring income-generating assets and minimizing liabilities. This approach encourages proactive financial planning, focusing on increasing net worth rather than solely relying on earned income. Utilizing these templates provides a structured framework for tracking financial progress, analyzing income streams, and managing expenses effectively. The distinction between good expenses (those contributing to asset growth) and bad expenses (those diminishing wealth) offers a practical approach to optimizing spending habits and aligning financial decisions with long-term goals.

Consistent application of these principles can lead to a significant shift in financial perspective, promoting long-term wealth creation and a path towards financial independence. Regularly reviewing and adjusting the financial statement allows individuals to adapt to changing circumstances and optimize their strategies for continued financial growth. Embracing the core concepts presented within these templates empowers individuals to take control of their financial destinies and strive for a more secure future.