Life throws unexpected curveballs, doesn’t it? Whether it’s an emergency car repair, an unforeseen medical expense, or just needing a little extra buffer before payday, sometimes you need access to funds a bit sooner than your next scheduled salary. For many employees, a salary cash advance can be a lifeline, but for employers, managing these requests without a clear process can quickly become a headache. This is where having a reliable salary cash advance form template truly shines.

A well-designed template isn’t just a piece of paper; it’s a critical tool for clear communication, ensuring transparency for both the employee making the request and the employer approving it. It helps formalize what can often be an informal and awkward conversation, providing a structured approach to a sensitive financial matter. We’ll explore why having such a template is essential and what components make it truly effective for any business, large or small.

Understanding the “Why” Behind a Salary Advance Request

Employees seek salary advances for a variety of reasons, most of which are legitimate and often urgent. Common scenarios include unexpected medical bills, urgent home repairs, sudden travel necessities, or even bridging a gap between paychecks when an unforeseen expense arises. While these situations are personal, they directly impact an employee’s well-being and, by extension, their focus and productivity at work. Addressing these needs with a clear, established process shows an employer’s understanding and support.

From an employer’s perspective, managing individual cash advance requests on an ad-hoc basis can be time-consuming, prone to inconsistencies, and potentially lead to misunderstandings or even disputes. Without a standard procedure, it’s difficult to track advances, ensure fair treatment across all employees, and manage the administrative burden. There’s also the legal and accounting side of things; payroll deductions need to be correctly managed, and records kept meticulously.

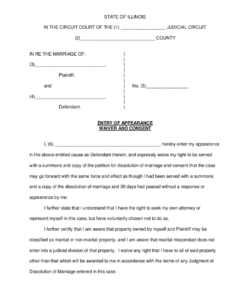

This is precisely why a structured approach, spearheaded by a dedicated form, becomes invaluable. It transforms a potentially chaotic situation into a systematic one. Instead of verbal requests and handshake agreements, there’s a written record detailing the terms, conditions, and repayment schedule, protecting both parties involved. It allows HR or finance departments to process requests efficiently, maintain proper financial records, and ensure compliance with internal policies and external regulations.

Key Elements Your Template Should Include

To be truly effective, your template should cover all the necessary bases. It needs to be comprehensive yet easy to understand and fill out. Here are the crucial components you should absolutely have:

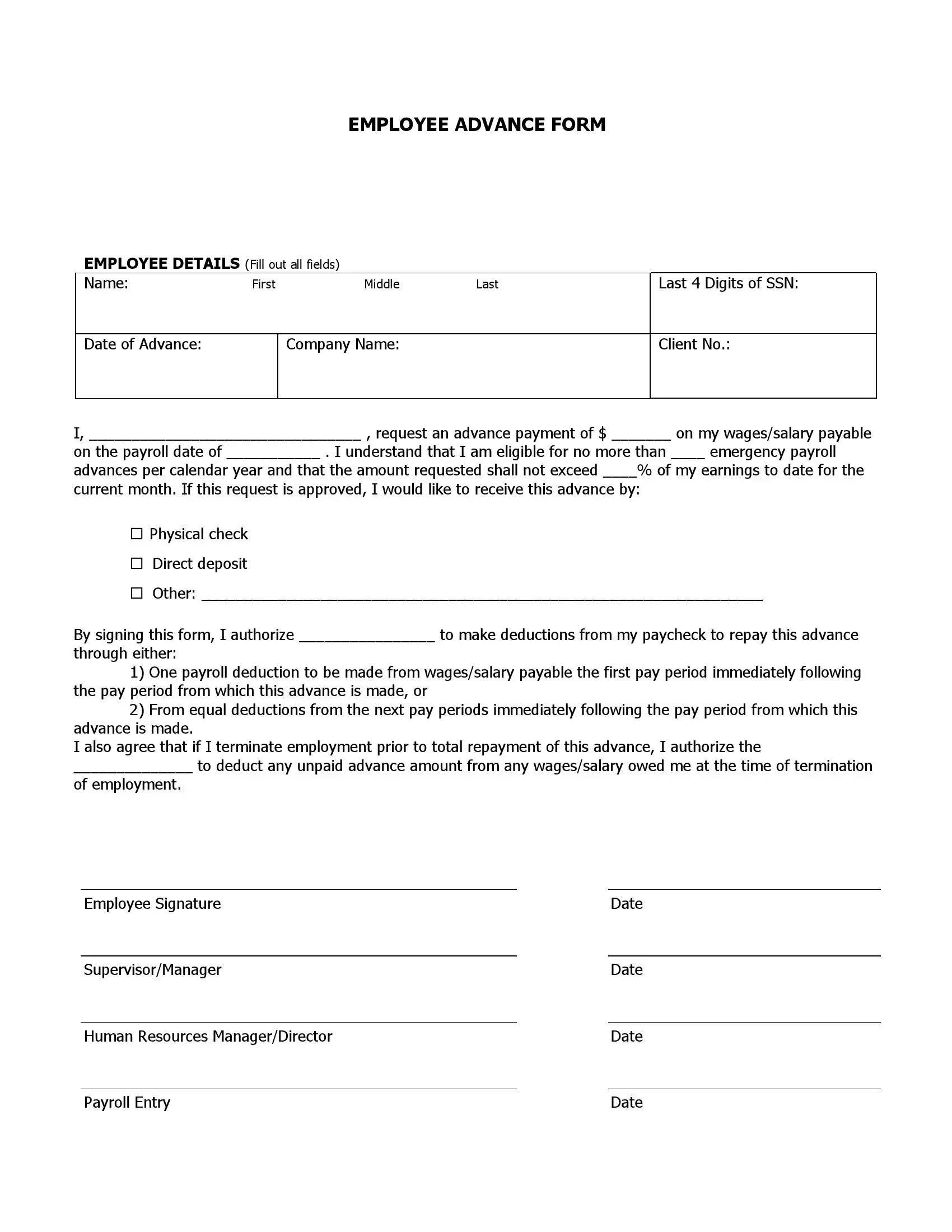

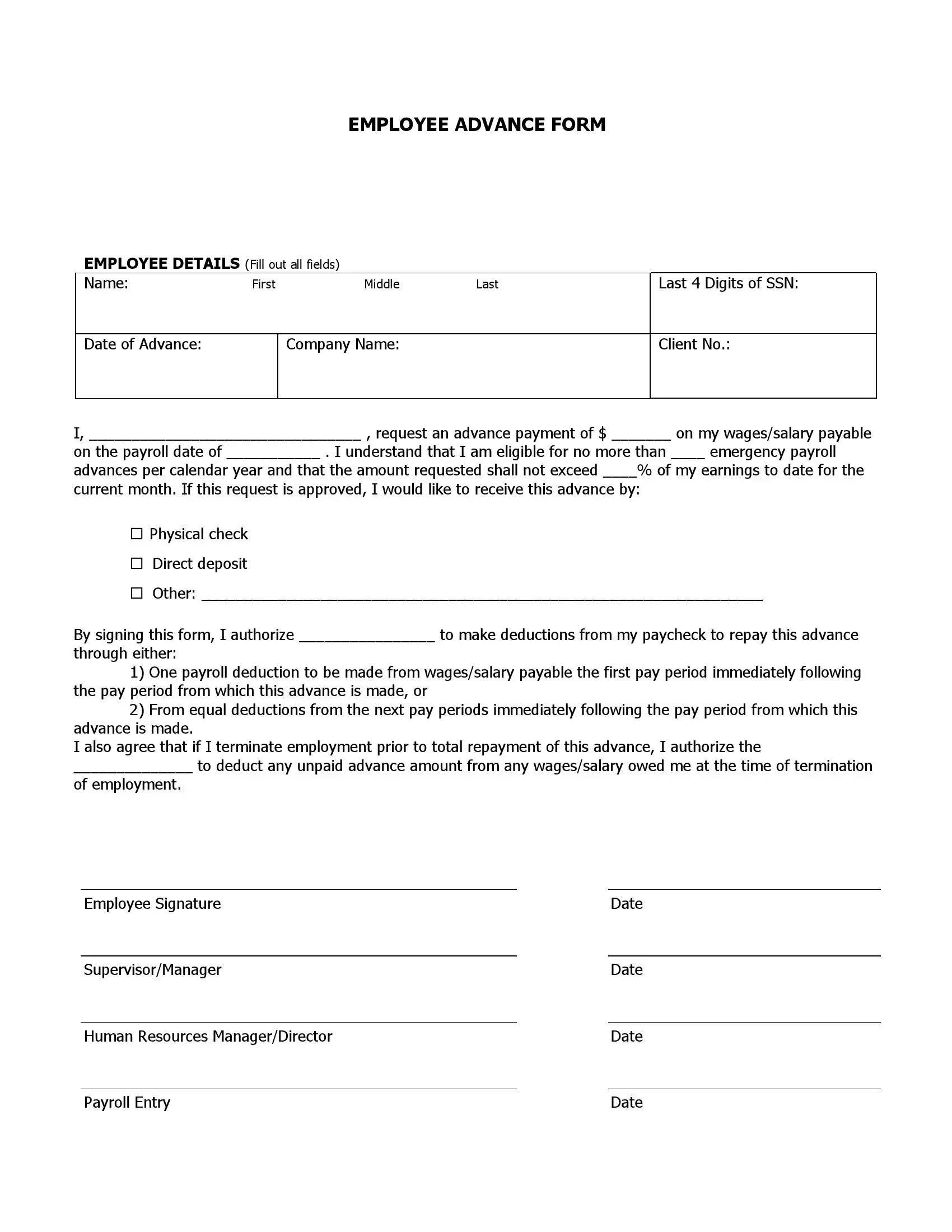

- Employee Information: This section should capture basic details like the employee’s full name, employee ID, department, contact information, and job title. This ensures the request is accurately attributed to the correct individual.

- Request Details: Clearly state the exact advance amount requested in both numerical and written form. Also, include a space for the employee to briefly explain the reason for the advance. While not always mandatory, understanding the context can sometimes help in decision-making or offer alternative solutions if the advance isn’t feasible.

- Repayment Terms: This is perhaps the most critical part. It must clearly outline how and when the advance will be repaid. This typically involves specifying the number of pay periods over which the advance will be deducted, the amount to be deducted from each paycheck, and the start date of these deductions. Be explicit about whether it’s a lump sum or installments.

- Authorization and Signatures: Spaces for the employee’s signature, acknowledging their understanding and agreement to the terms, are essential. Similarly, there should be spaces for the manager’s approval and, if applicable, the HR or finance department’s final authorization. Dates for all signatures are also crucial.

- Disclaimers and Policy Reference: Include a section for any relevant company policies regarding salary advances. This might include information about eligibility, maximum advance limits, or consequences of non-repayment. A statement indicating that this advance is not an entitlement and is subject to company approval is also a good practice.

How a Well-Designed Template Benefits Everyone

Implementing a standard form for salary advance requests brings a multitude of benefits, streamlining processes and fostering a more professional environment. For employees, it provides clarity and a clear path forward when they are facing a financial crunch. They know exactly what information is required, who to submit it to, and what to expect in terms of repayment. This transparency reduces anxiety and makes the process feel less like asking for a favor and more like utilizing a defined company benefit.

Employers, on the other hand, gain immense advantages in terms of control and consistency. A standardized process ensures that all requests are handled equitably, reducing the risk of perceived favoritism or discrimination. It also simplifies the administrative burden on HR and finance teams, as they no longer have to create new agreements for each request. Instead, they can follow a pre-defined workflow, ensuring all necessary information is captured for record-keeping and payroll purposes.

Furthermore, having a clear process outlined by a form helps in managing expectations. Employees understand the company’s policy regarding advances, including any limits or repayment conditions, before they even submit their request. This proactive communication helps prevent misunderstandings down the line and ensures that both parties are on the same page from the outset. It transforms what could be a difficult conversation into a straightforward transaction, built on trust and mutual understanding.

Ultimately, a robust salary cash advance form template serves as more than just a document; it’s a vital tool for effective financial management within an organization. It contributes to a more organized workplace culture, where employees feel supported in times of need, and the company maintains control and clear records. This level of professionalism benefits the entire workforce, reinforcing a positive and efficient operational environment for everyone involved.

Establishing clear guidelines and using a standardized method for financial requests showcases a company’s commitment to supporting its team while maintaining strong fiscal responsibility. It’s about creating a balance where employee needs are met within a framework that ensures fairness, accountability, and seamless administration.

By investing time in developing or sourcing a comprehensive template, businesses can significantly improve how they handle immediate financial needs. This not only eases the burden on administrative staff but also builds greater trust and understanding among employees, knowing there’s a structured and fair system in place when life’s unforeseen moments arise.