Are you looking to boost your retirement savings and potentially lower your taxable income? Salary sacrifice superannuation is a fantastic strategy that many Australians use to achieve exactly that. It involves an agreement with your employer to redirect a portion of your pre-tax salary directly into your superannuation fund. This not only grows your retirement nest egg faster but also offers significant tax benefits, as these contributions are generally taxed at a concessional rate of 15% within the super fund, which is often much lower than your marginal income tax rate. It’s a smart way to get ahead financially without feeling the pinch as much as you might with after-tax contributions.

However, like any formal financial arrangement, setting up salary sacrifice requires clear communication and a proper agreement between you and your employer. This is where a well-structured salary sacrifice superannuation form template becomes incredibly valuable. It acts as the official document outlining your request, ensuring both parties are on the same page regarding the amount, frequency, and start date of these pre-tax contributions. Having a clear, professional template can streamline the process, prevent misunderstandings, and ensure everything is compliant with relevant regulations.

Understanding the Mechanics of Salary Sacrifice Superannuation

Salary sacrifice superannuation is essentially a voluntary agreement where you instruct your employer to pay a portion of your pre-tax salary directly into your super fund. This reduces your assessable income for tax purposes, as the money goes into super before income tax is calculated. For example, if you earn $80,000 and choose to salary sacrifice $10,000, your taxable income becomes $70,000. The $10,000 then gets taxed at the 15% superannuation contributions tax, which is often significantly lower than your marginal tax rate, especially for middle to higher-income earners. This strategic move can save you hundreds, if not thousands, of dollars in tax each year while simultaneously building your retirement wealth.

Beyond the immediate tax benefits, salary sacrifice contributions count towards your concessional contributions cap, which is currently $27,500 per financial year (this includes your employer’s mandatory super guarantee contributions). It is crucial to stay within this cap to avoid additional tax. By proactively contributing more to your super, you harness the power of compound interest, meaning your money earns returns, and then those returns earn more returns, accelerating your super balance growth over time. It’s a long-term investment strategy that provides substantial future financial security.

The beauty of salary sacrifice lies in its simplicity once the initial agreement is in place. It becomes an automated process handled by your payroll department, meaning you don’t have to worry about manually transferring funds or remembering to make extra contributions. This set-and-forget approach ensures consistency in your savings efforts, making it easier to stick to your financial goals. However, the initial setup is paramount, and a clear, concise salary sacrifice superannuation form template is the key to a smooth start.

Why a Formal Agreement is Essential

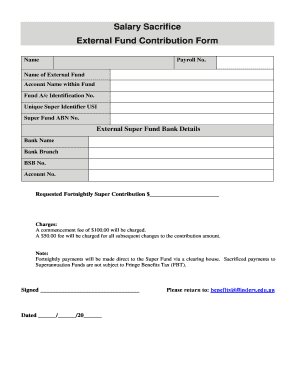

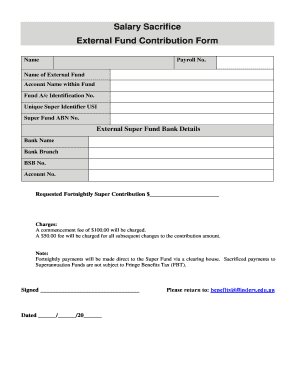

A formal agreement, typically in the form of a salary sacrifice superannuation form template, is not just a formality; it’s a legal and administrative necessity. It provides a clear record for both you and your employer of the arrangement. It clarifies:

- The exact amount or percentage of salary to be sacrificed.

- The start date of the arrangement.

- Your chosen superannuation fund details.

- Declarations from both parties confirming understanding and agreement.

Without such a document, there could be ambiguity, leading to potential payroll errors, disputes, or even issues with tax compliance. It ensures that your employer correctly processes the contributions as pre-tax amounts, which is vital for you to receive the intended tax benefits.

Navigating Your Salary Sacrifice Superannuation Form Template

When you decide to implement salary sacrifice, your employer will typically provide you with a form, or you might look for a general salary sacrifice superannuation form template online to understand the typical requirements. A good template should be clear, easy to understand, and cover all the necessary legal and administrative points. It should leave no room for ambiguity and ensure that both employee and employer responsibilities are clearly defined. Look for sections that explicitly ask for your personal details, employer details, and most importantly, the specific instructions for the superannuation contributions.

The core of any salary sacrifice superannuation form template revolves around the contribution details. You’ll need to specify the amount you wish to sacrifice, which can be a fixed dollar amount per pay period or a percentage of your salary. It’s often advisable to start with a modest amount and then review it as your financial situation changes. The form will also require the full name and Unique Superannuation Identifier (USI) of your chosen superannuation fund, along with your member number. This ensures the funds are directed to the correct account without delay.

Once you have completed your section of the form, it’s crucial to sign and date it, indicating your consent and agreement. Your employer will then review the details, sign to acknowledge their acceptance of the arrangement, and ensure their payroll system is updated accordingly. Keep a copy of the signed form for your own records, and it’s a good idea to confirm with your super fund after your first few pay cycles that the sacrificed amounts have been received correctly. This simple check can save potential headaches down the line and gives you peace of mind that your financial plan is working as intended.

The process of submitting and confirming your salary sacrifice is straightforward with a well-designed form. It removes any guesswork and ensures compliance. After submission, your employer’s payroll department will integrate your request into their system. You should see the change reflected in your payslips, typically showing your gross salary, the sacrificed amount, and your reduced taxable income. This transparency helps you monitor your contributions and confirm that the arrangement is functioning as agreed.

Utilizing a salary sacrifice superannuation form template is more than just paperwork; it’s a smart step in your financial planning journey. It empowers you to take control of your superannuation, potentially saving on tax while significantly boosting your retirement savings. By making consistent, pre-tax contributions, you’re not just saving for the future; you’re actively building a more secure and comfortable retirement.

Embracing salary sacrifice superannuation, facilitated by a clear form, is a powerful move towards financial well-being. It simplifies the process of making extra contributions to your super, turning a potentially complex financial strategy into an easily manageable part of your regular pay cycle. This proactive approach to your retirement savings can have a profound impact on your long-term financial security, making your money work smarter for you.