Utilizing a pre-built framework offers several advantages. It ensures consistency and completeness in reporting, reducing the risk of errors or omissions. This standardized approach simplifies financial analysis and facilitates comparisons across different periods or entities. Furthermore, it can save considerable time and effort compared to creating a statement from scratch. This efficiency is particularly beneficial for small businesses or individuals without dedicated accounting personnel.

Understanding the structure and benefits of this financial tool is crucial for effective financial management. The following sections will explore the different types of cash flow statements, offer practical guidance on how to use them, and provide illustrative examples to demonstrate their application in various scenarios.

1. Standardized Format

Standardized formatting is a crucial element of a cash flow statement template. This consistency ensures all relevant information is presented uniformly, facilitating clear analysis and comparison. A standard structure typically includes sections for operating activities, investing activities, and financing activities, providing a comprehensive overview of cash movement. This consistent structure allows stakeholders, including investors, lenders, and management, to quickly grasp the financial health of an entity. Without standardized formatting, comparing financial performance across different periods or businesses would be significantly more difficult and prone to misinterpretation.

For instance, a standardized template allows an analyst to quickly locate and compare net cash flow from operations across multiple quarterly reports. This comparison helps identify trends and potential issues. Similarly, standardized formatting facilitates benchmarking against industry competitors, offering valuable insights for strategic decision-making. The standardized presentation of data eliminates ambiguity and ensures all parties interpret the information consistently. This is crucial for informed investment decisions, accurate credit assessments, and effective internal financial management.

In conclusion, the standardized format inherent in cash flow statement templates provides a crucial framework for clear and consistent financial reporting. This structure facilitates efficient analysis, simplifies comparisons, and ultimately supports better financial decision-making. While specific templates may vary slightly, adherence to a standardized approach remains paramount for effective financial communication and analysis. This consistency promotes transparency and allows for a more accurate assessment of financial health and performance.

2. Financial Clarity

Financial clarity, a critical aspect of sound financial management, is significantly enhanced through the use of a sample cash flow statement template. Understanding the intricacies of cash flow is fundamental for businesses and individuals alike, and a structured template provides the framework for achieving this clarity. By categorizing and presenting cash inflows and outflows systematically, these templates enable users to gain a comprehensive understanding of their financial standing.

- Source IdentificationTemplates facilitate clear identification of cash sources. Whether from operating activities like sales, investing activities such as asset sales, or financing activities like loans, the categorization inherent in these templates makes it easy to pinpoint the origin of incoming funds. For instance, a business can quickly determine the proportion of cash generated from core operations versus external financing. This understanding is crucial for assessing financial health and identifying areas for improvement.

- Expenditure BreakdownCategorizing expenditures is equally crucial. Templates provide a structured format for separating expenses related to operations, investments, and financing. This breakdown offers insights into spending patterns, allowing for informed decisions regarding cost optimization. For example, a company might identify excessive spending on non-essential operational activities or realize a significant portion of cash outflow is directed towards debt servicing. This knowledge empowers targeted interventions to improve financial efficiency.

- Trend AnalysisUsing a consistent template over time enables trend analysis. By comparing cash flow statements from different periods, users can identify recurring patterns, seasonal fluctuations, or long-term trends in their financial activities. This historical perspective informs future projections and allows for proactive adjustments to financial strategies. A business might observe a consistent increase in operating cash flow during a specific quarter, allowing them to anticipate and plan for increased investment opportunities during that period.

- Performance EvaluationTemplates provide a quantifiable basis for evaluating financial performance. By tracking key metrics like net cash flow from operations, investing, and financing, users gain a clear understanding of overall financial health. This information is critical for assessing profitability, liquidity, and solvency. For example, a consistent negative cash flow from operations could signal underlying business problems requiring immediate attention, while a positive net cash flow provides a measure of financial stability and growth potential.

In conclusion, the structured approach of a cash flow statement template contributes significantly to financial clarity. By facilitating source identification, expenditure breakdowns, trend analysis, and performance evaluation, these templates empower users to gain a deeper understanding of their financial position and make informed decisions. This enhanced clarity is essential for effective financial planning, risk management, and achieving long-term financial goals.

3. Simplified Tracking

Simplified tracking of financial transactions represents a key benefit derived from utilizing a cash flow statement template. The structured format inherent in these templates streamlines the process of recording and categorizing cash inflows and outflows. This structured approach eliminates ambiguity and facilitates a more organized approach to financial management. Without a template, tracking cash flow can become cumbersome and error-prone, especially as the volume of transactions increases. The template provides predefined categories for different types of cash flows, ensuring consistent recording and simplifying subsequent analysis. For example, separating operating activities, investing activities, and financing activities allows for a clear understanding of the sources and uses of cash.

Consider a small business managing numerous daily transactions. Without a structured template, reconciling these transactions and understanding their overall impact on cash flow can be challenging. A template provides the necessary structure to categorize each transaction, whether it’s a sale, a purchase, a loan payment, or an investment. This systematic approach simplifies the tracking process, reduces the likelihood of errors, and allows for more efficient financial analysis. The simplified tracking facilitated by the template also enables timely identification of potential cash flow issues. For example, consistently low cash balances at the end of each month, as revealed by the template, could indicate a need to adjust spending patterns or explore financing options. This early identification allows for proactive intervention, preventing more serious financial difficulties.

In conclusion, simplified tracking, enabled by a cash flow statement template, forms a cornerstone of efficient financial management. The structured approach provided by the template streamlines the recording and categorization of cash flows, reducing complexity and improving accuracy. This simplified approach empowers businesses and individuals to maintain better control over their finances, identify potential problems proactively, and make more informed decisions. The time saved through simplified tracking can be redirected towards higher-level financial analysis and strategic planning, further contributing to financial health and stability.

4. Informed Decisions

Informed financial decisions rely on accurate and accessible data. A sample cash flow statement template provides the framework for organizing financial information, enabling stakeholders to make sound judgments based on a clear understanding of cash inflows and outflows. Utilizing a template promotes transparency and allows for a comprehensive view of financial performance, empowering data-driven decision-making processes.

- Strategic PlanningA well-structured cash flow statement informs strategic planning initiatives. By analyzing historical cash flow data, organizations can identify trends, anticipate future needs, and allocate resources effectively. For example, a consistent surplus in operating cash flow might suggest opportunities for expansion or investment, while a projected shortfall could trigger contingency planning. The template provides the foundation for these strategic decisions by offering a clear and concise view of financial performance.

- Investment EvaluationInvestment decisions benefit significantly from the insights provided by a cash flow statement. By projecting future cash flows associated with potential investments, organizations can assess their viability and potential return on investment. A template facilitates this analysis by providing a standardized format for comparing different investment scenarios and evaluating their impact on overall financial health. This structured approach minimizes risk and maximizes the potential for successful investments.

- Operational EfficiencyAnalyzing cash flow patterns within a standardized template can reveal opportunities for operational improvements. Identifying areas of excessive spending or inefficient cash management allows organizations to implement corrective measures and optimize resource allocation. For instance, a consistently high cash outflow related to inventory management might prompt an investigation into supply chain processes and potential cost-saving measures. The template provides the framework for identifying these inefficiencies and driving operational improvements.

- Financial Risk ManagementEffective financial risk management relies on accurate cash flow projections. By utilizing a template to model various scenarios, organizations can assess their vulnerability to financial shocks and develop mitigation strategies. For example, projecting cash flow under adverse economic conditions allows for proactive measures, such as securing lines of credit or adjusting operational budgets, to minimize potential negative impacts. The template provides the necessary structure for conducting these analyses and implementing robust risk management strategies.

In conclusion, the insights derived from a sample cash flow statement template are essential for informed decision-making across various aspects of financial management. From strategic planning and investment evaluation to operational efficiency and risk management, the structured information provided by the template empowers stakeholders to make sound judgments based on a comprehensive understanding of their financial position. This data-driven approach is critical for achieving financial stability, maximizing profitability, and ensuring long-term success.

5. Proactive Management

Proactive management, crucial for financial health, relies heavily on insightful analysis offered by cash flow statement templates. These templates empower organizations to anticipate financial challenges and opportunities, fostering strategic decision-making rather than reactive responses. A structured template transforms historical financial data into a predictive tool, allowing for informed adjustments to operational strategies, investment plans, and financing decisions. This proactive approach contrasts sharply with reactive management, which often addresses financial issues only after they materialize, potentially leading to lost opportunities or financial distress. Cause and effect relationships between cash flow fluctuations and business activities become clearer through consistent use of a template. For instance, a projected decrease in sales revenue, identified through projected cash flow analysis, could prompt proactive measures such as targeted marketing campaigns or cost-reduction initiatives.

Consider a manufacturing company anticipating seasonal fluctuations in demand. By analyzing historical cash flow data within a template, the company can predict periods of high and low cash flow. This foresight enables proactive inventory management, ensuring sufficient stock during peak seasons without excessive carrying costs during slower periods. Alternatively, a company projecting rapid growth can use a template to anticipate increased working capital needs. This proactive approach allows for timely pursuit of financing options, ensuring sufficient resources to support expansion without hindering operational momentum. These examples demonstrate the practical significance of proactive management enabled by cash flow statement templates. Without such foresight, organizations risk reacting to financial challenges rather than shaping them, potentially leading to missed opportunities and suboptimal financial outcomes.

In summary, proactive management, facilitated by cash flow statement templates, represents a shift from reactive financial management to strategic foresight. By leveraging historical data and projected trends, organizations can anticipate financial challenges and capitalize on opportunities. This proactive approach, driven by insightful analysis, is essential for maintaining financial stability, driving growth, and achieving long-term success in a dynamic economic landscape. The ability to anticipate, rather than react, empowers organizations to navigate financial complexities with greater confidence and control. This proactive approach, informed by data-driven insights, becomes a cornerstone of sustainable financial health and strategic advantage.

Key Components of a Cash Flow Statement Template

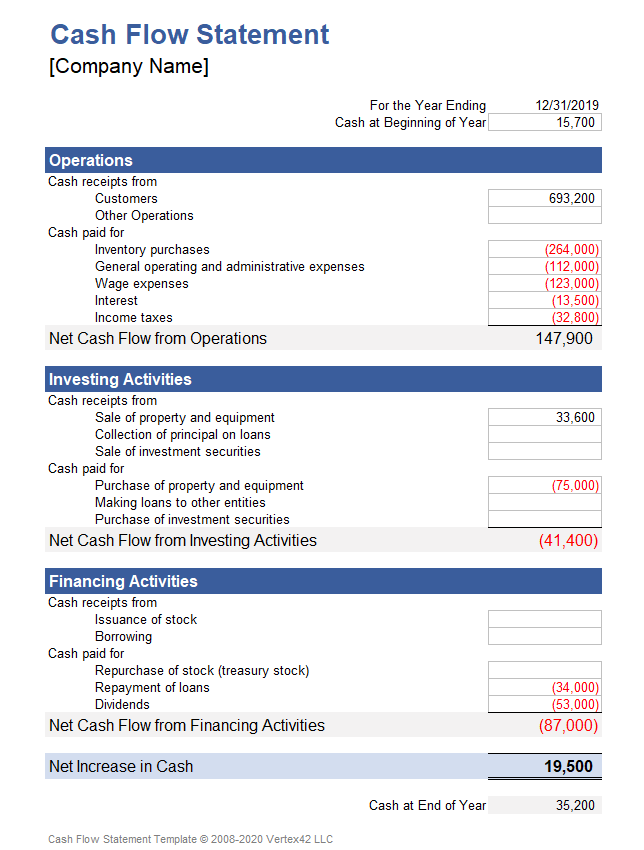

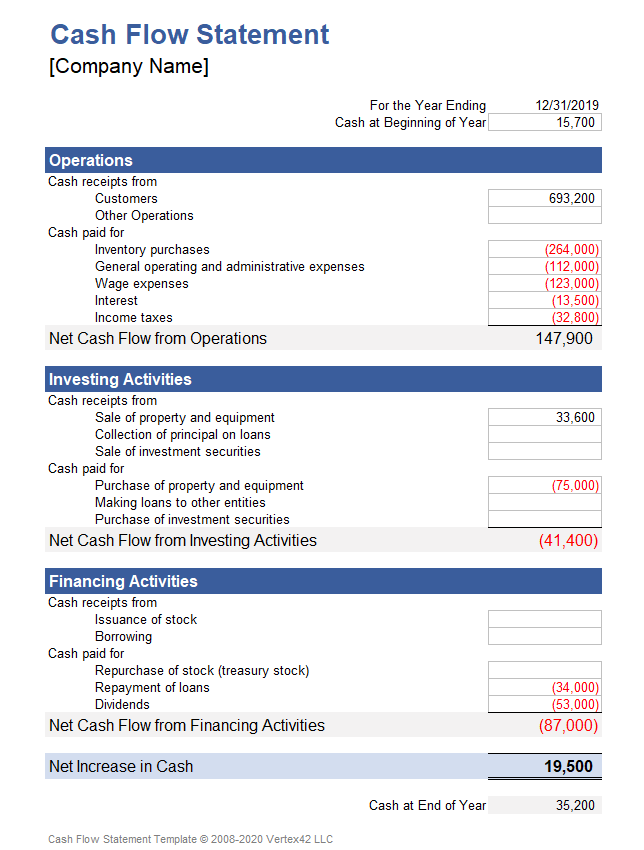

A well-structured cash flow statement template provides a standardized framework for analyzing an entity’s financial health. Several key components ensure comprehensive reporting and facilitate insightful analysis.

1. Operating Activities: This section details cash flows generated from the core business operations. Key elements include cash receipts from customers, cash payments to suppliers and employees, and other operating cash flows such as interest paid or received. Accurately representing operational cash flows is crucial for assessing a business’s profitability and sustainability.

2. Investing Activities: This section captures cash flows related to long-term investments. Purchasing or selling property, plant, and equipment (PP&E), acquisitions and divestitures, and investments in securities are typical examples. Analyzing investment activities provides insights into an entity’s capital allocation strategies and growth prospects.

3. Financing Activities: Cash flows arising from debt, equity, and dividend transactions are documented here. This includes proceeds from issuing debt or equity, repayment of principal, dividend payments, and stock repurchases. Understanding financing activities clarifies how an entity funds its operations and investments.

4. Beginning Cash Balance: The starting cash balance for the reporting period provides a crucial reference point. It represents the cash available at the beginning of the period and is essential for calculating the ending cash balance. This component ensures continuity in tracking cash flow over time.

5. Ending Cash Balance: This figure, calculated by summing the beginning cash balance and the net cash flows from operating, investing, and financing activities, indicates the cash position at the end of the reporting period. The ending cash balance is a key indicator of an entity’s short-term liquidity.

6. Non-Cash Transactions: While not directly affecting cash flow, certain significant non-cash transactions are often disclosed as a supplementary note. Examples include converting debt to equity, acquiring assets through leases, or exchanging assets. This disclosure provides a more complete understanding of financial activities impacting the overall financial position.

A comprehensive analysis of these components offers valuable insights into an entity’s financial performance and stability. Understanding the interplay between operational cash flows, investment activities, and financing decisions allows for informed assessments of profitability, liquidity, and long-term sustainability.

How to Create a Cash Flow Statement Template

Creating a cash flow statement template provides a structured approach to financial reporting. A well-designed template ensures consistency and facilitates accurate analysis. The following steps outline the process of creating a template suitable for various financial reporting needs.

1: Define the Reporting Period: Specify the timeframe covered by the statement, whether it’s a month, quarter, or year. A clearly defined period ensures consistency and allows for meaningful comparisons across different periods.

2: Structure the Main Sections: Establish distinct sections for operating activities, investing activities, and financing activities. This categorization provides a standardized framework for organizing cash inflows and outflows.

3: Detail Operating Activities: Within the operating activities section, include line items for cash receipts from customers, cash payments to suppliers, salaries and wages, rent, utilities, and other operating expenses. This detailed breakdown provides insights into the core business operations.

4: Outline Investing Activities: Include line items for capital expenditures (purchases of property, plant, and equipment), proceeds from the sale of assets, acquisitions and divestitures, and investments in securities within the investing activities section. This clarifies how cash is used for long-term growth.

5: Specify Financing Activities: Within the financing activities section, detail proceeds from debt or equity issuance, loan repayments, dividend payments, and stock repurchases. This clarifies how the entity funds its operations and investments.

6: Include Beginning and Ending Cash Balances: Incorporate fields for the beginning cash balance (carried over from the previous period) and the ending cash balance (calculated as the sum of the beginning balance and net cash flows from all activities). Tracking these balances ensures continuity and facilitates analysis of cash flow trends.

7: Add a Section for Non-Cash Transactions: While not directly impacting cash flow, significant non-cash transactions warrant disclosure. Create a designated area within the template or a supplementary note to record these transactions, such as debt-to-equity conversions or asset exchanges. This enhances transparency and provides a more comprehensive financial picture.

8: Consider Formulas for Calculations: Incorporate formulas within the template, particularly for calculating net cash flow within each section and the ending cash balance. Automated calculations minimize errors and streamline the reporting process. Spreadsheet software facilitates this automation.

A well-structured template ensures consistent reporting, facilitates accurate analysis, and supports informed decision-making. Regular updates and adherence to accounting principles maintain the template’s relevance and reliability.

Careful analysis demonstrates the value of a structured approach to financial reporting. Standardized templates provide a crucial framework for organizing and interpreting complex financial data related to operating activities, investing activities, and financing activities. The insights derived from a well-structured template facilitate informed decision-making across various aspects of financial management, from strategic planning and investment evaluation to operational efficiency and risk management. Simplified tracking, enhanced clarity, and proactive management capabilities further underscore the importance of utilizing a standardized approach to cash flow analysis.

Effective financial stewardship necessitates a commitment to understanding and utilizing appropriate tools. The insights gained from consistent and accurate cash flow analysis provide a cornerstone for financial stability and sustainable growth. Embracing a structured approach through a dedicated template empowers organizations and individuals to navigate the complexities of the financial landscape with greater confidence and control, paving the way for informed decisions and long-term financial success. A commitment to diligent cash flow analysis provides a foundation for navigating an increasingly complex and dynamic economic environment.