Navigating the world of Payment Protection Insurance (PPI) claims can feel a bit like deciphering a secret code, especially when you’re dealing with a large institution like Santander. Many people were mis-sold PPI over the years, and even though the official deadline for making a claim has passed, there are still situations where you might be eligible to pursue a claim, particularly under the Plevin rule concerning undisclosed high commissions. The key to a successful claim often lies in presenting your case clearly and comprehensively, and that’s where a structured approach, often guided by a template, can be incredibly helpful.

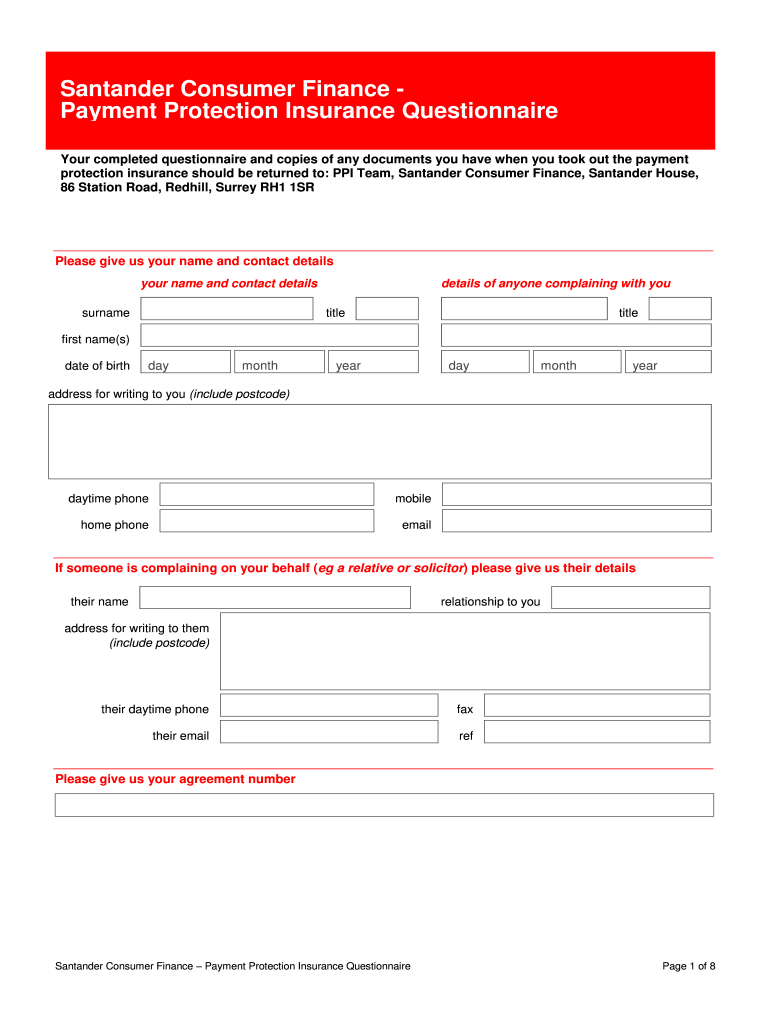

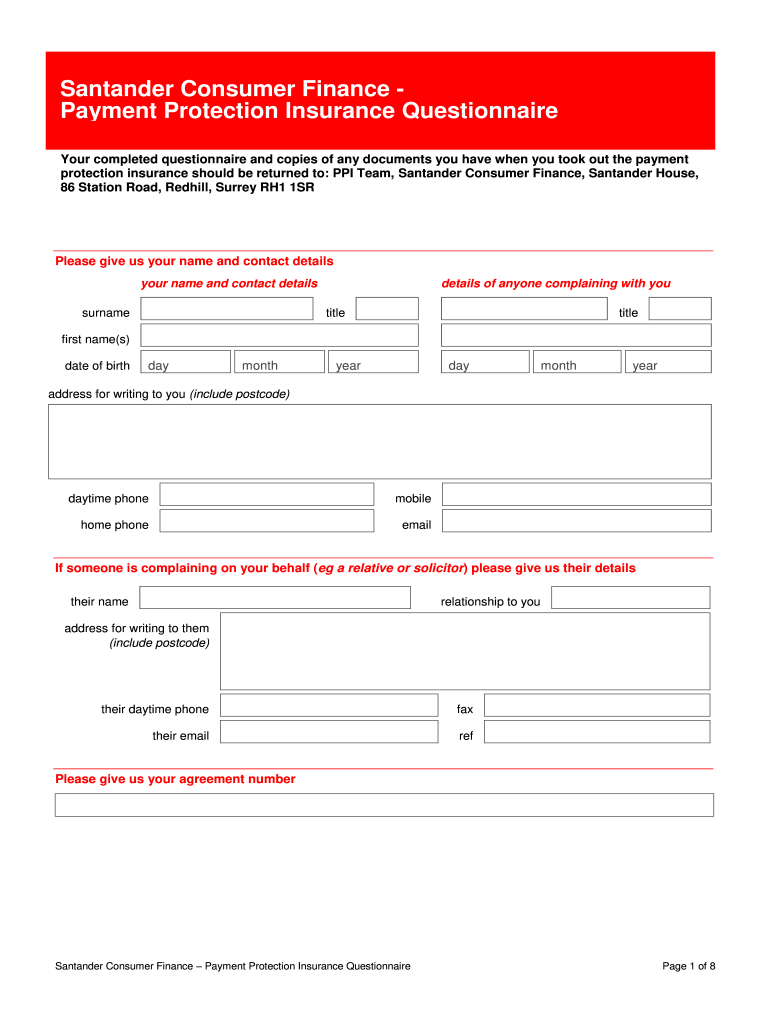

While Santander itself provides specific forms for making a complaint or a claim, understanding the typical elements that a robust claim needs, and having a general Santander PPI claim form template in mind, can significantly streamline your efforts. It’s about ensuring you don’t miss any crucial details and that your submission is as impactful as possible. This approach helps you organize your thoughts and present your argument effectively, whether you’re using an official form or crafting your own letter.

Understanding Your Santander PPI Claim Journey

Before you even think about filling out a form, it’s essential to understand the journey of a PPI claim. Payment Protection Insurance was widely sold alongside loans, credit cards, mortgages, and other forms of credit. It was designed to cover repayments if you couldn’t work due to illness, unemployment, or an accident. However, it was often mis-sold, either because it was added without consent, unsuitable for the customer’s circumstances, or commission levels were hidden. If you believe you were a victim of mis-selling by Santander, compiling a strong case is paramount.

Even though the main PPI claim deadline passed on August 29, 2019, specific circumstances, primarily related to the ‘Plevin rule’, allow for claims regarding undisclosed high commissions. This rule means that if more than 50% of your PPI premium went to the lender as commission, and this wasn’t clearly explained to you, you might still be entitled to a refund of that commission, plus interest. This nuance adds another layer of complexity to what you need to detail in your claim.

A successful claim hinges on accurate and comprehensive information. Before you even look for a Santander PPI claim form template or start typing, dedicate time to gathering all relevant documents. This preparation phase is often the most crucial part of the process, as it provides the evidence to back up your assertions. The more information you can provide, the stronger your claim will be, making it harder for the bank to dismiss your complaint.

Gathering your documents can be a bit of a treasure hunt. You’ll need to dig through old statements, policy documents, and any correspondence related to the credit agreement where PPI was attached. If you don’t have these, you might need to contact Santander directly to request statements or a Subject Access Request (SAR) to obtain all personal data they hold about you.

Key Information to Prepare

To build a solid claim, whether you’re using an official form or a generic Santander PPI claim form template, ensure you have the following information readily available:

- Account Details: All relevant account numbers (loan, credit card, mortgage, etc.) and the dates these accounts were opened and closed.

- Policy Details: Any PPI policy numbers, the start and end dates of the policy, and the premium amount.

- Proof of Mis-selling: Specific reasons why you believe the PPI was mis-sold to you (e.g., you were already covered by another policy, you weren’t told it was optional, you felt pressured to take it, you were self-employed at the time).

- Correspondence: Any letters or emails exchanged with Santander regarding the PPI policy.

The more detail you can provide about the circumstances surrounding the sale, the clearer your case will be. Remember, the goal is to make it easy for the bank to understand your complaint and see why you are entitled to compensation.

Navigating the Santander PPI Claim Form Template

Once you’ve meticulously gathered all your information, the next step is to compile it into a coherent complaint. While Santander has its own complaint process, using a structured approach, like the insights provided by a Santander PPI claim form template, can significantly help. This isn’t about finding an exact fill-in-the-blanks document from Santander, but rather understanding the typical sections and information required in a well-structured complaint to any financial institution.

A good template or guide will typically walk you through sections such as personal details, account identification, and the core of your complaint: why you believe the PPI was mis-sold. When detailing the reasons for mis-selling, be specific. Instead of just saying "I didn’t need it," explain why you didn’t need it. For instance, "I was already covered by my employer’s sick pay scheme," or "I was self-employed and the policy wouldn’t have paid out." Clarity in this section is paramount to your success.

When crafting the narrative of your claim, focus on facts and how the mis-selling impacted you. Did you feel pressured? Were you told it was compulsory? Was the cost of the PPI not clearly explained? These are the kinds of details that resonate and provide a strong foundation for your argument. Remember to keep a copy of everything you send to Santander, along with proof of postage, for your records.

After you submit your claim, Santander will have a set period (usually eight weeks) to investigate and provide a final response. If they uphold your complaint, they will offer compensation. If they reject it, or if you’re unhappy with their offer, you then have the right to escalate your complaint to the Financial Ombudsman Service (FOS). The FOS is an independent body that resolves disputes between consumers and financial businesses, and they can make a binding decision.

Taking the time to prepare your claim thoroughly, understanding what information is needed, and presenting it clearly can make a significant difference in the outcome. By focusing on the facts and detailing how the PPI was unsuitable for you, you equip yourself with the best possible chance for a successful claim. Even if the journey seems long, persistence and a well-documented case are your strongest allies.