Starting a journey towards financial security often begins with a simple yet significant step: opening a savings account. It is where your hard-earned money can grow, offering a buffer for unexpected expenses or a fund for future aspirations. This foundational step is crucial for anyone looking to build a stable financial future, whether you are saving for a new home, education, or simply building an emergency fund.

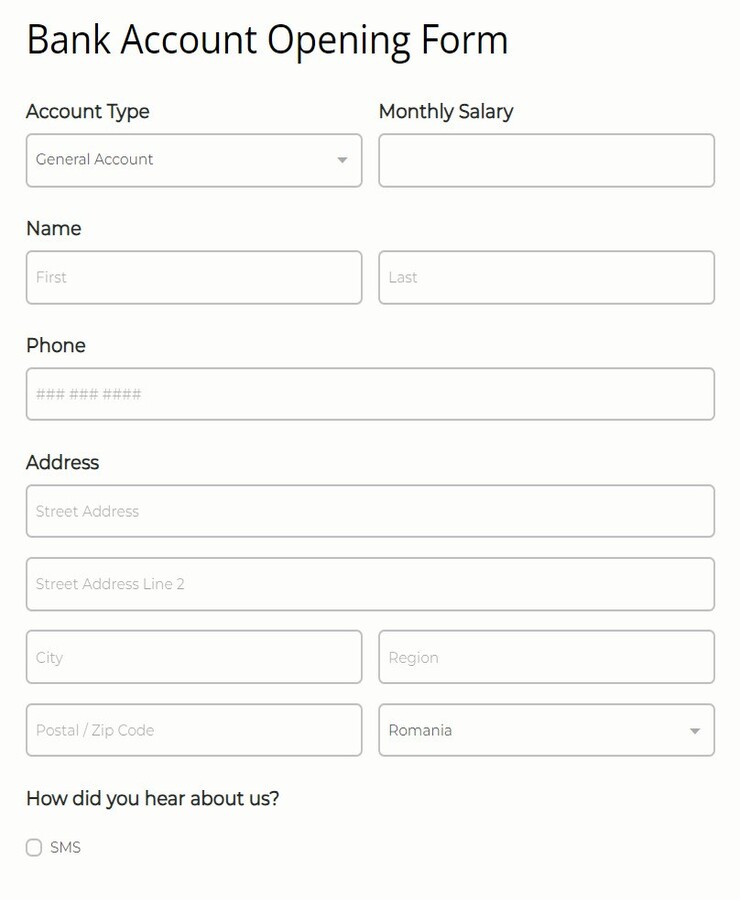

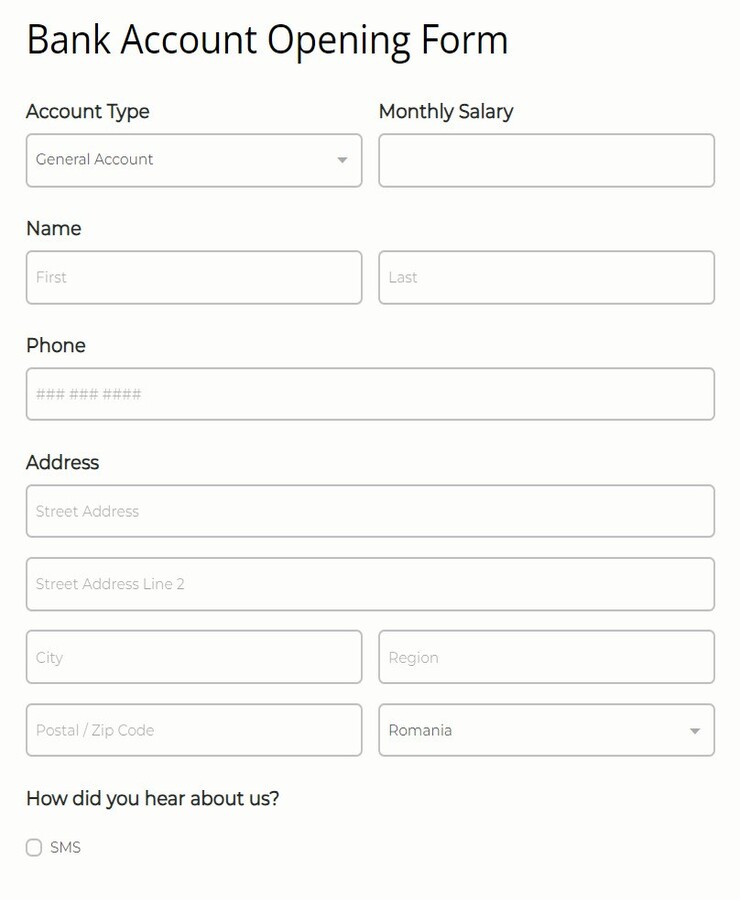

To open one of these accounts, you will typically interact with a financial institution and complete an application. This is where a well-structured savings account application form template becomes incredibly useful. It acts as a standardized roadmap, guiding both you and the bank through the necessary information exchange, ensuring a smooth and efficient process to get your savings journey underway.

What to Include in Your Savings Account Application Form Template

When you are looking to set up a new savings account, you will encounter a form designed to collect all the necessary details. A comprehensive savings account application form template is meticulously crafted to ensure that no vital information is missed, making the process secure and compliant with financial regulations. It’s essentially a checklist for both the applicant and the financial institution, covering everything from your identity to how you plan to manage your account.

Think of the form as a structured conversation. It starts by identifying who you are, moves on to how the bank can contact you, and then delves into the specifics required for financial transactions. This includes making sure your identity is verified, understanding your financial background, and sometimes even designating beneficiaries for your account. Each section is there for a reason, contributing to the safety and legality of your new savings account.

Key Personal Information

A good template will always prioritize clear and accurate personal identification. This is fundamental for security and compliance purposes. You will be asked for information that confirms your identity and allows the institution to conduct necessary background checks.

- Full Legal Name: Your complete name as it appears on official documents.

- Date of Birth: Essential for age verification and identity confirmation.

- Social Security Number or Taxpayer Identification Number: Crucial for tax reporting and regulatory compliance.

- Current Residential Address: For mailing statements and verifying your location.

- Contact Information: Phone number and email address for communication.

- Valid Photo Identification: Details from your driver’s license, passport, or state ID.

- Employment Details: Your occupation, employer’s name, and source of income, which helps the bank understand your financial profile.

- Beneficiary Information: Details of who would inherit the account’s funds in case of unforeseen circumstances.

- Signatures and Date: Your legal agreement to the terms and conditions.

Beyond these core details, some forms might also inquire about your preferred banking services, how you intend to fund the account initially, and your acknowledgment of various disclosures. It is all about creating a complete picture that allows the bank to serve you effectively and responsibly.

Streamlining the Application Process with a Template

The very essence of using a savings account application form template is to simplify and standardize what could otherwise be a complicated process. For individuals, it means a clear, step-by-step guide on what information is needed, reducing confusion and the likelihood of errors. For financial institutions, it ensures consistency in data collection, improves efficiency, and helps them adhere to strict regulatory requirements like Know Your Customer (KYC) guidelines.

A well-designed template helps to create a smooth workflow. Imagine walking into a bank or visiting their website, and everything you need to provide is laid out in an intuitive manner. This structured approach saves time for both the applicant and the bank staff, allowing for quicker processing times and a more pleasant customer experience. It also minimizes the back-and-forth often associated with incomplete applications, which can be frustrating for everyone involved.

Furthermore, templates are invaluable for ensuring that all necessary legal and compliance information is collected. Banks operate under a host of regulations, and these forms are designed to capture every piece of data required to meet those obligations. From anti-money laundering checks to tax reporting, the template serves as the primary tool to gather the necessary consent and information, ensuring that the bank can operate transparently and responsibly.

The adaptability of a template also plays a significant role in today’s digital world. While traditional paper forms are still common, many financial institutions offer digital versions of their application forms. These digital templates often come with features like auto-fill, error checking, and secure submission, making the application process even more seamless and accessible from anywhere. This modernization further enhances efficiency and customer convenience.

Having a clear, comprehensive form for opening a savings account makes the entire process feel less daunting. It transforms a potentially complex administrative task into a straightforward procedure, allowing you to focus on the exciting prospect of growing your savings.

Ultimately, whether you are starting your first savings account or opening an additional one, the clarity and thoroughness of the application form play a crucial role. A well-designed form ensures that all the necessary steps are covered, paving the way for a secure and hassle-free banking experience. It is a fundamental tool in making financial aspirations a reality, providing a solid foundation for your money management.