Utilizing these standardized forms offers several advantages. They streamline the application process by ensuring all necessary information is presented clearly and concisely. This clarity can expedite loan processing times. Furthermore, using these templates demonstrates professionalism and preparedness, which can strengthen an applicant’s credibility. Finally, the structured format can help business owners gain a better understanding of their own financials, contributing to improved financial management.

This structured approach to financial reporting is vital for securing SBA-backed financing. The following sections will explore the specific requirements for different loan programs, offer guidance on completing the required forms, and provide resources for additional assistance.

1. Standardized Forms

Standardized forms play a crucial role in the SBA loan application process, providing a structured framework for presenting financial information. These templates, specifically designed for SBA loan applications, ensure consistency and comparability across all submissions. This standardization simplifies the review process for lenders and the SBA, enabling efficient assessment of financial health and loan eligibility. Using standardized forms demonstrates an understanding of the required documentation and signals preparedness to potential lenders.

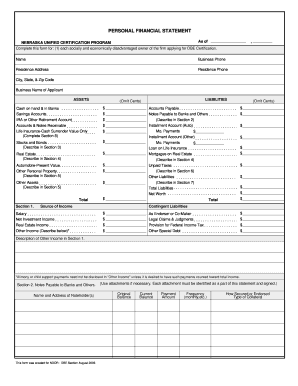

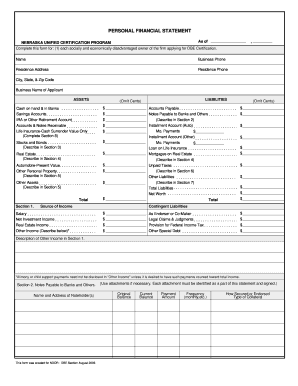

For example, the SBA Form 413, Personal Financial Statement, requires detailed disclosure of personal assets, liabilities, and income. Adhering to this standardized format ensures all necessary information is presented clearly and concisely, allowing for a comprehensive overview of an applicant’s financial standing. Similarly, the SBA Form 1919, Borrower Information Form, collects crucial business details in a structured manner, streamlining the information gathering process for both the applicant and the SBA. These examples illustrate the practical significance of standardized forms in ensuring a smooth and efficient loan application process.

Consistent use of standardized forms contributes to transparency and facilitates objective evaluation. While navigating the complexities of SBA loan requirements can be challenging, adhering to these prescribed formats simplifies the process and increases the likelihood of a successful application. Understanding and utilizing these standardized templates is therefore a crucial step for any business seeking SBA-backed financing.

2. Required Documents

Securing an SBA-backed loan necessitates the submission of specific financial documents. These required documents, often provided through standardized templates, form the core of the loan application and provide lenders and the SBA with the necessary information to assess creditworthiness and determine loan eligibility. The connection between required documents and these templates is fundamental; the templates provide the structure, while the documents themselves provide the substantive financial data. This structured approach ensures consistency and comparability across loan applications, streamlining the review process.

For instance, a common requirement is the submission of a balance sheet. The SBA provides a template for this document, ensuring consistent presentation of assets, liabilities, and equity. This standardized format allows lenders to quickly analyze a business’s financial position. Similarly, income statements, prepared using the appropriate template, provide a clear overview of revenues, expenses, and profitability over a defined period. Cash flow projections, another crucial component, offer insight into a business’s ability to manage its finances and repay the loan. These documents, prepared using SBA templates, collectively paint a comprehensive picture of the applicant’s financial health.

Understanding the required documents and utilizing the corresponding SBA templates is essential for a successful loan application. Failure to provide complete and accurate documentation, or deviation from the prescribed formats, can lead to delays or rejection of the application. Therefore, careful attention to these requirements is paramount. The structured approach facilitated by these templates not only streamlines the application process but also contributes to greater transparency and a more efficient evaluation of the business’s financial viability for the loan.

3. Financial Health

Financial health represents a critical factor in securing SBA-backed financing. The SBA business financial statement template provides the framework for demonstrating this health to lenders, offering a standardized and transparent view of a business’s financial standing. Accurately completing these templates allows lenders to assess key aspects of financial health, ultimately influencing loan approval decisions.

- ProfitabilityProfitability, a key indicator of financial health, is assessed through income statements. These statements, often prepared using SBA templates, detail revenues, expenses, and net income. Consistently profitable businesses demonstrate an ability to generate revenue exceeding expenses, signifying a lower risk for lenders. For example, a business consistently demonstrating strong profit margins through its income statements, prepared using the SBA template, signals a healthy financial position.

- LiquidityLiquidity refers to a business’s ability to meet short-term obligations. Balance sheets, prepared according to SBA guidelines, provide insights into liquidity by detailing current assets and current liabilities. A healthy current ratio, derived from these figures, suggests sufficient liquid assets to cover immediate debts. For instance, a business with a healthy current ratio, evident in its SBA-compliant balance sheet, demonstrates strong short-term financial stability.

- SolvencySolvency reflects a business’s long-term financial viability and its ability to meet long-term obligations. Balance sheets, particularly the debt-to-equity ratio, offer insight into solvency. A manageable debt load, evidenced by a low debt-to-equity ratio, indicates a lower risk of default. A business demonstrating a healthy debt-to-equity ratio within its SBA-compliant balance sheet signifies long-term financial stability.

- Cash Flow ManagementEffective cash flow management is essential for sustained financial health. Cash flow statements, prepared using SBA templates, detail the movement of cash in and out of the business. Positive cash flow indicates sufficient funds to cover operational expenses, debt service, and future investments. A business consistently demonstrating positive cash flow through its SBA-compliant cash flow statements indicates sound financial management practices.

These facets of financial health, clearly presented through SBA-compliant financial statements, collectively contribute to a comprehensive picture of a business’s financial stability and viability. This structured approach not only facilitates lender assessment but also empowers business owners with a clearer understanding of their own financial standing, ultimately increasing the likelihood of successful loan applications and contributing to long-term business success.

4. Loan Eligibility

Loan eligibility for SBA-backed financing hinges significantly on the information presented within the required financial statements, often prepared using SBA templates. These templates serve as a crucial tool in demonstrating eligibility by providing a structured framework for presenting financial data. The completeness, accuracy, and presentation of this data directly influence a lender’s assessment of a business’s qualifications for an SBA loan. A direct correlation exists between adherence to these templates and the likelihood of loan approval; meticulous completion reflects preparedness and professionalism, increasing credibility with lenders.

For instance, a business seeking a 7(a) loan must demonstrate sufficient cash flow to service the debt. This demonstration relies heavily on accurately completed cash flow projections within the designated SBA template. A clearly presented and realistic projection, adhering to the template’s structure, strengthens the application. Conversely, incomplete or inaccurate projections, or deviations from the prescribed format, can raise red flags and jeopardize loan eligibility. Similarly, eligibility for a 504 loan often depends on demonstrating a healthy debt-to-equity ratio, clearly presented within the balance sheet template. A well-structured balance sheet, adhering to SBA guidelines, facilitates lender assessment of this critical financial metric.

Understanding the relationship between loan eligibility and the SBA business financial statement templates is paramount for successful navigation of the application process. These templates not only offer a standardized format for presenting financial information but also serve as a guide for meeting specific eligibility criteria. Meticulous completion of these templates, coupled with accurate and comprehensive financial data, significantly increases the probability of loan approval, providing access to crucial funding for business growth and expansion.

5. Streamlined Process

Standardized financial statement templates offered by the SBA contribute significantly to a streamlined loan application process. These templates provide a clear and consistent structure for presenting financial information, reducing ambiguity and facilitating efficient review by lenders and the SBA. This structured approach minimizes back-and-forth communication, often required to clarify inconsistencies or missing information in ad-hoc financial documents. Consequently, using SBA templates directly impacts the efficiency of the loan application process, reducing processing time and accelerating access to capital.

Consider a scenario where a business submits financial statements without adhering to the SBA’s prescribed format. Lenders might require clarification or reformatting, leading to delays. In contrast, utilizing the SBA’s templates from the outset ensures all necessary information is presented in the expected format, minimizing the potential for queries and expediting the review process. This efficiency benefits both the applicant and the lender, facilitating faster decision-making. For example, using the SBA’s balance sheet template ensures consistent presentation of assets, liabilities, and equity, enabling lenders to quickly assess a business’s financial position without needing to decipher varying formats.

The practical significance of this streamlined process lies in its impact on access to timely funding. In the competitive business landscape, access to capital can be crucial for growth and success. The efficiency facilitated by SBA templates translates to quicker loan approvals, enabling businesses to seize opportunities and address challenges promptly. Ultimately, the use of these templates reflects professionalism and preparedness, strengthening the applicant’s credibility and contributing to a smoother, more efficient loan application experience.

6. Enhanced Credibility

Utilizing SBA-approved financial statement templates significantly enhances a business’s credibility during the loan application process. These templates provide a standardized and universally recognized framework for presenting financial information. This structured approach signals professionalism, preparedness, and a clear understanding of SBA requirements, fostering trust with lenders. Adherence to these templates demonstrates a commitment to transparency and accuracy, suggesting a higher likelihood of accurate and reliable financial reporting. This, in turn, reduces perceived risk for lenders, contributing to a more favorable assessment of the loan application.

Consider a scenario where two businesses apply for SBA loans. One submits meticulously prepared financial statements using the prescribed SBA templates, while the other submits disorganized and non-standardized documents. The lender will likely perceive the first business as more organized, prepared, and credible. This enhanced credibility can influence loan decisions, potentially leading to more favorable terms or a higher likelihood of approval. For example, presenting a balance sheet using the SBA template ensures consistent and clear presentation of assets, liabilities, and equity, instilling confidence in the lender regarding the accuracy and reliability of the financial data.

In the context of SBA loan applications, enhanced credibility, facilitated by the use of standardized templates, translates to a tangible competitive advantage. It signals financial transparency and professionalism, reducing perceived risk and fostering trust with lenders. This increased trust can be a deciding factor in securing funding, particularly in competitive lending environments. Therefore, leveraging these templates strategically contributes not only to a streamlined application process but also to a stronger, more credible presentation of a business’s financial health and viability, ultimately increasing the likelihood of loan approval and long-term success.

Key Components of SBA Business Financial Statement Templates

Understanding the core components of required financial documentation is crucial for navigating the SBA loan application process successfully. These components, presented through standardized templates, provide a framework for conveying essential financial information to lenders and the SBA.

1. Balance Sheet: The balance sheet provides a snapshot of a business’s financial position at a specific point in time. It details assets, liabilities, and equity, offering insights into the business’s financial strength and stability. Using the SBA-provided template ensures consistent presentation of this crucial information, facilitating efficient review by lenders.

2. Income Statement: The income statement, also known as the profit and loss statement, reports a business’s financial performance over a specific period. It details revenues, expenses, and net income (or loss), providing insights into profitability and operational efficiency. Adhering to the SBA template ensures consistent reporting of these figures, facilitating comparison and analysis.

3. Cash Flow Statement: The cash flow statement tracks the movement of cash both into and out of a business over a given period. It details cash flow from operating, investing, and financing activities, providing a clear picture of a business’s ability to generate and manage cash. Using the SBA template ensures consistent reporting of cash flow, enabling lenders to assess a business’s short-term and long-term financial sustainability.

4. Projections: Financial projections, typically covering a period of one to five years, forecast a business’s future financial performance. These projections include forecasted income statements, balance sheets, and cash flow statements. While not always required, they can be crucial for demonstrating the viability of the business and its ability to repay the loan, especially for startups or businesses seeking significant funding.

5. Supporting Schedules: Depending on the specific loan program and the complexity of the business, supporting schedules may be required. These schedules provide detailed breakdowns of specific line items within the core financial statements, offering greater transparency and facilitating a more in-depth analysis. Examples include schedules of accounts receivable, accounts payable, inventory, and long-term debt.

6. Personal Financial Statement: For certain SBA loan programs, applicants may also be required to submit a personal financial statement. This statement details the applicant’s personal assets, liabilities, and net worth, providing a comprehensive overview of their individual financial standing. This information helps lenders assess the applicant’s personal financial strength and commitment to the business.

These components, presented through standardized SBA templates, provide a comprehensive financial picture of the business, enabling lenders and the SBA to assess loan eligibility and make informed lending decisions. Accurate and thorough completion of these documents is essential for a successful loan application.

How to Create SBA-Compliant Financial Statements

Creating accurate and comprehensive financial statements is crucial for securing SBA-backed financing. The following steps outline how to prepare these documents effectively, adhering to SBA requirements and maximizing the likelihood of loan approval.

1. Gather Necessary Information: Begin by collecting all relevant financial records, including bank statements, tax returns, profit and loss statements, and balance sheets. Ensure all records are up-to-date and accurately reflect the business’s financial position. This thorough preparation forms the foundation for accurate and complete financial statements.

2. Obtain SBA Templates: Download the required SBA financial statement templates from the SBA website. These templates provide the necessary structure and ensure compliance with SBA reporting standards. Using the correct templates streamlines the review process and demonstrates professionalism to lenders.

3. Complete the Balance Sheet: Accurately populate the balance sheet template with details of assets, liabilities, and equity. Ensure all figures are consistent with supporting documentation. A clearly presented balance sheet provides a concise overview of the business’s financial health.

4. Prepare the Income Statement: Populate the income statement template with details of revenues, expenses, and net income (or loss) for the specified period. Ensure accuracy and consistency with supporting financial records. A well-prepared income statement demonstrates the business’s profitability and operational efficiency.

5. Develop the Cash Flow Statement: Complete the cash flow statement template, detailing cash flow from operating, investing, and financing activities. Accurate cash flow reporting provides critical insights into the business’s ability to manage its finances and repay the loan.

6. Develop Financial Projections (If Required): For certain loan programs or specific circumstances, financial projections may be necessary. Prepare projected income statements, balance sheets, and cash flow statements, typically covering a period of one to five years. These projections should be realistic and supported by market research and business plans.

7. Prepare Supporting Schedules (If Necessary): If required, create supporting schedules to provide detailed breakdowns of specific line items within the core financial statements. These schedules enhance transparency and provide a more granular view of the business’s financials.

8. Review and Verify: Before submission, thoroughly review all completed financial statements and supporting documents for accuracy, completeness, and consistency. Errors or omissions can lead to delays or rejection of the loan application. Careful review ensures a professional and credible submission.

Meticulous preparation of financial statements, adhering to SBA guidelines and utilizing the provided templates, significantly increases the likelihood of loan approval. This structured approach demonstrates financial transparency, professionalism, and a clear understanding of SBA requirements, instilling confidence in lenders and contributing to a smoother, more efficient loan application process.

Accurate and comprehensive financial reporting, often facilitated by standardized templates, forms the cornerstone of successful SBA loan applications. These templates provide a crucial framework for presenting financial data in a consistent and transparent manner, enabling lenders and the SBA to efficiently assess a business’s financial health, viability, and loan eligibility. Adherence to these templates streamlines the application process, enhances credibility, and increases the likelihood of loan approval, providing businesses with access to essential capital for growth and expansion. Understanding the requirements, utilizing the available resources, and meticulously completing these documents represent critical steps in securing SBA-backed financing.

Strategic utilization of these resources positions businesses for success in the competitive lending landscape. Thorough financial preparedness, demonstrated through accurate and well-presented documentation, not only facilitates access to capital but also strengthens a business’s financial foundation, contributing to long-term stability and growth. The ability to effectively communicate financial health through these standardized templates represents a significant advantage in securing SBA-backed financing and achieving sustained business success.