Using such a projection offers several advantages. It allows lenders to assess the viability and sustainability of the business model. It helps entrepreneurs identify potential cash shortfalls and develop strategies to mitigate financial risks. Further, it serves as a valuable management tool for tracking actual performance against projections and making necessary adjustments to business operations. A well-constructed projection demonstrates preparedness and strengthens the loan application, increasing the likelihood of approval.

This understanding of financial projections is foundational to exploring related topics such as loan application requirements, financial statement analysis, and business planning. A deeper dive into these areas will equip entrepreneurs with the knowledge and resources necessary to navigate the complexities of securing funding and managing a successful business.

1. Projected Revenue

Accurate revenue projections form the cornerstone of a credible financial projection for SBA loan applications. Overly optimistic or unrealistic revenue estimates can undermine the entire document and jeopardize loan approval. A thorough understanding of revenue projection methodologies is essential for presenting a compelling and viable financial picture.

- Sales Forecasting MethodsVarious methods exist for forecasting sales, including historical data analysis, market research, and industry benchmarks. For example, a business with several years of operational history might extrapolate past sales trends to project future revenue. Startups, lacking historical data, might rely more heavily on market analysis and competitor comparisons. Choosing the appropriate method and justifying its application strengthens the projection’s credibility.

- Seasonality and Cyclical TrendsBusinesses experiencing seasonal fluctuations in sales must account for these variations in their projections. For instance, a retail store might anticipate higher sales during the holiday season. Accurately reflecting these cyclical trends demonstrates a nuanced understanding of the business environment and contributes to a more realistic forecast.

- Pricing Strategies and Market PositioningProjected revenue is intrinsically linked to pricing strategies and market positioning. A premium pricing strategy might result in lower sales volume but higher profit margins. Conversely, a competitive pricing strategy could lead to higher sales volume but lower individual product profitability. The chosen pricing strategy should align with the overall business plan and be reflected in the revenue projections.

- Impact on Loan RepaymentProjected revenue directly impacts the perceived ability to repay the SBA loan. Lenders scrutinize revenue projections to assess whether the business can generate sufficient cash flow to meet its debt obligations. Realistic and well-supported revenue projections significantly enhance the likelihood of loan approval.

In conclusion, robust revenue projections are not merely hypothetical figures; they serve as a critical indicator of a business’s potential for success and its ability to manage debt. A well-constructed revenue forecast, based on sound methodology and realistic assumptions, strengthens the entire financial projection for SBA loan applications and increases the likelihood of securing funding.

2. Operating Expenses

Operating expenses represent the costs required to run a business’s core operations on a daily basis. Within the context of a financial projection for an SBA loan, a meticulous and comprehensive account of these expenses is crucial. Accurate operating expense figures directly impact the projected net cash flow, a key metric lenders use to assess loan repayment capacity. An understatement of expenses can lead to an overly optimistic cash flow projection, potentially misleading lenders and ultimately hindering the business’s ability to manage debt. Conversely, an overstatement of expenses might portray the business as less viable than it actually is, potentially leading to loan application rejection.

Several categories of operating expenses must be considered. These typically include, but are not limited to: cost of goods sold (COGS); selling, general, and administrative expenses (SG&A); salaries and wages; rent and utilities; marketing and advertising costs; research and development; and depreciation and amortization. For example, a manufacturing business will have significant COGS related to raw materials and production, while a service-based business might have higher SG&A expenses. Providing a detailed breakdown of anticipated expenses within each category demonstrates a thorough understanding of the business’s cost structure and enhances the credibility of the projection. Furthermore, it’s essential to consider how these expenses might change over time. For instance, rent escalation clauses in a lease agreement must be factored into future projections.

A clear understanding of operating expenses and their impact on projected cash flow is fundamental to both securing an SBA loan and effectively managing the business’s finances. Accurately forecasting these expenses provides lenders with confidence in the business’s viability and allows entrepreneurs to make informed decisions regarding pricing, resource allocation, and growth strategies. Negligence in this area can lead to inaccurate financial projections, jeopardizing loan approval and hindering long-term sustainability. Thorough expense analysis allows for the identification of potential cost-saving opportunities, further strengthening the financial position of the business. This detailed approach to expense management is essential for building a sustainable and successful enterprise.

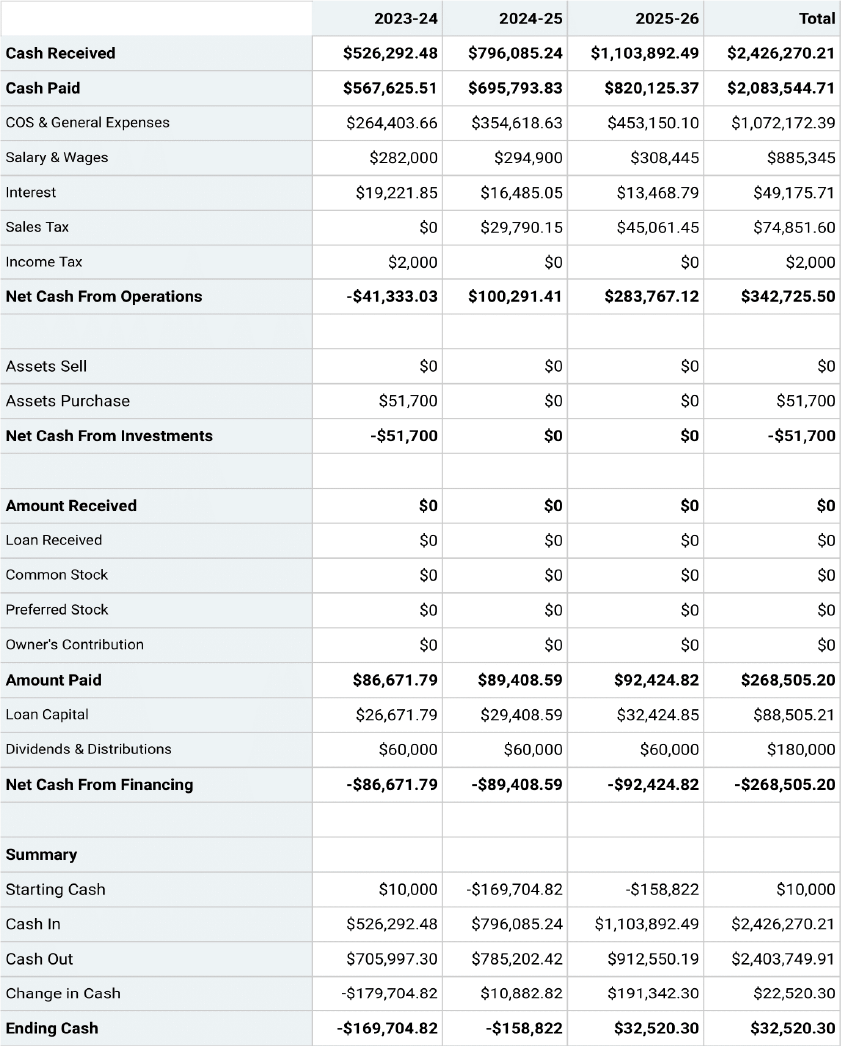

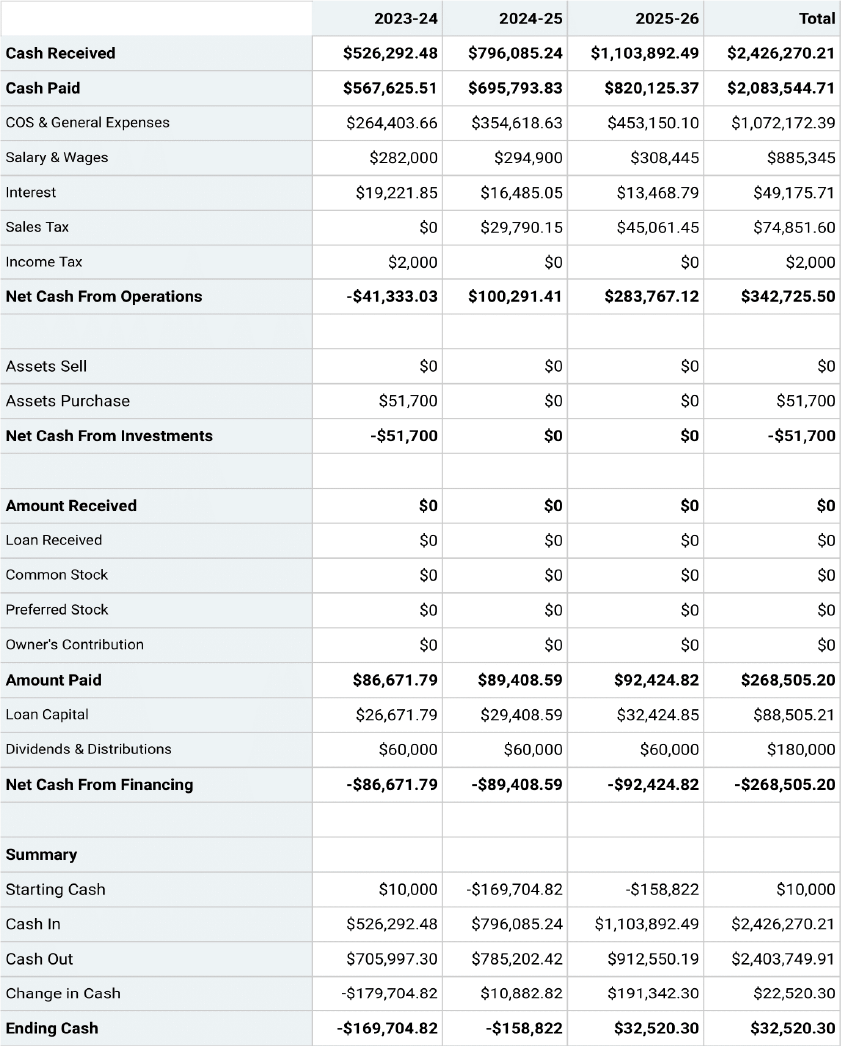

3. Financing Activities

Financing activities within a projection for SBA loans detail the inflow and outflow of cash related to funding sources. This section is crucial for demonstrating how the loan proceeds will be utilized and, importantly, how the business plans to repay the debt. It provides lenders with a clear picture of the capital structure and the long-term financial sustainability of the business. A comprehensive presentation of financing activities significantly influences the lender’s assessment of risk and the ultimate decision regarding loan approval. This section typically includes details regarding loan proceeds, loan repayments, equity contributions, and dividend distributions. For example, a business seeking an SBA loan to purchase new equipment would detail the loan amount received as an inflow and the subsequent loan repayments as outflows over the loan term. Similarly, any investments made by owners would be reflected as equity inflows.

The interplay between financing activities and the overall financial projection is critical. The loan proceeds, while representing an initial cash inflow, create a future obligation in the form of principal and interest payments. These outflows must be factored into the projected cash flow to ensure the business can meet its debt obligations without jeopardizing its operational viability. An inability to demonstrate sufficient cash flow to cover debt service can lead to loan application rejection. Furthermore, the structure of financing activities can impact the business’s financial ratios, influencing the lender’s perception of risk. For instance, a high debt-to-equity ratio might signal over-reliance on borrowed capital, potentially raising concerns about financial stability.

A clear and comprehensive presentation of financing activities within the projection is essential for securing SBA funding and demonstrating sound financial planning. This transparency builds lender confidence in the business’s ability to manage debt and achieve long-term sustainability. It allows lenders to assess the impact of the loan on the overall financial health of the business and evaluate the likelihood of successful repayment. A well-structured presentation of financing activities not only enhances the loan application but also provides the business owner with a valuable tool for managing future financial obligations and planning for growth.

4. Investing Activities

Investing activities within a projection for SBA loans detail the cash flow related to the acquisition and disposal of long-term assets. This section provides lenders with insight into how the business plans to utilize loan proceeds or internally generated funds for capital expenditures that contribute to long-term growth and productivity. Careful consideration of investing activities demonstrates a strategic approach to resource allocation and strengthens the overall financial narrative presented to lenders. Examples of investing activities include purchases of property, plant, and equipment (PP&E), investments in other companies, and the sale of existing assets. For instance, a restaurant seeking funding to expand its kitchen facilities would detail the purchase of new ovens and refrigerators as an investing activity, outlining the cost and anticipated impact on operational capacity. Conversely, the sale of an outdated delivery vehicle would be reflected as a cash inflow from investing activities.

The relationship between investing activities and the overall financial projection is multifaceted. Capital expenditures, while often essential for growth, represent significant cash outflows. These outflows must be carefully balanced against projected revenue and operating expenses to ensure the business maintains sufficient liquidity to meet its operational and debt service obligations. A well-structured plan for investing activities demonstrates a commitment to long-term growth without jeopardizing short-term financial stability. Furthermore, the types of investments made can signal the business’s strategic priorities and growth trajectory. For example, investments in research and development might indicate a focus on innovation, while investments in new production equipment might suggest a focus on expanding market share. This information provides lenders with valuable context for assessing the long-term viability and potential of the business. Analyzing the potential return on investment (ROI) for each planned capital expenditure further strengthens the business case presented to lenders. A clearly articulated ROI demonstrates that the investments are not only necessary but also financially sound, contributing to the overall financial health and sustainability of the business.

A comprehensive and strategically sound presentation of investing activities is a key component of a successful projection for SBA loans. It allows businesses to articulate their growth plans while demonstrating responsible financial management. By clearly outlining planned investments and their anticipated impact on the business, entrepreneurs can build lender confidence and increase their chances of securing funding. Moreover, a well-defined investment strategy serves as a valuable roadmap for long-term growth and value creation, contributing to the overall success and sustainability of the enterprise. Neglecting this aspect of financial planning can lead to missed opportunities for growth or, conversely, overextension of resources, potentially jeopardizing the financial health of the business. A balanced and well-articulated investment strategy strengthens the overall financial narrative and positions the business for long-term success.

5. Net Cash Flow

Net cash flow represents the overall difference between cash inflows and outflows within a given period on a projected financial statement for SBA loans. This crucial metric provides a comprehensive view of a business’s ability to generate cash from its operations, manage its investing activities, and meet its financing obligations. Understanding net cash flow is fundamental for both lenders evaluating loan applications and business owners assessing financial health. A positive net cash flow indicates the business generates sufficient cash to cover expenses, invest in growth, and repay debt. Conversely, a negative net cash flow suggests a potential inability to meet financial obligations, signaling higher risk to lenders. For example, a business with consistent positive net cash flow demonstrates strong financial performance and a greater capacity to repay a loan, increasing the likelihood of approval. Conversely, a business with persistent negative net cash flow, even if projected revenue is high, might struggle to repay a loan, potentially leading to default. Analyzing net cash flow across multiple reporting periods provides valuable insights into trends and potential future challenges.

The calculation of net cash flow within the projection incorporates data from all three core sections: operating activities, investing activities, and financing activities. Cash generated from operating activities, primarily through sales revenue and the collection of receivables, forms the foundation of net cash flow. Cash outflows from operating activities, such as payments for inventory, salaries, and rent, reduce net cash flow. Cash flows related to investing activities, such as capital expenditures for equipment purchases or proceeds from the sale of assets, further influence net cash flow. Finally, cash flows from financing activities, including loan proceeds, loan repayments, and equity contributions, complete the picture. The interconnectedness of these elements highlights the importance of a comprehensive and accurate financial projection. For example, a business might project strong revenue growth, but significant capital expenditures planned in investing activities could result in a negative net cash flow, potentially raising concerns for lenders. A thorough understanding of these interdependencies is crucial for both loan applicants and lenders.

Accurate projection and interpretation of net cash flow are pivotal for securing SBA loans and ensuring long-term business sustainability. Consistent positive net cash flow demonstrates financial strength and increases the likelihood of loan approval. It provides lenders with confidence in the business’s ability to manage debt and achieve its financial objectives. Furthermore, monitoring net cash flow over time enables business owners to identify potential cash shortfalls, make informed financial decisions, and implement corrective actions to maintain financial health. Failing to understand and manage net cash flow can lead to financial instability and jeopardize the long-term viability of the business. Therefore, a deep understanding of net cash flow is not merely a requirement for loan applications; it is an essential element of sound financial management and a key driver of long-term business success.

6. Ending Cash Balance

The ending cash balance within a projected financial statement for SBA loans represents the amount of cash a business anticipates having available at the end of each reporting period. This figure is not merely a residual amount; it serves as a critical indicator of short-term liquidity and financial stability. Lenders scrutinize the ending cash balance to assess a business’s ability to meet immediate obligations, manage unforeseen expenses, and maintain a financial buffer against potential disruptions. A healthy ending cash balance provides a cushion against unexpected downturns and demonstrates sound financial management, significantly influencing loan application outcomes. A consistent pattern of low or negative ending cash balances raises concerns about a business’s ability to manage cash flow effectively and meet its debt obligations.

- Relationship to Net Cash FlowThe ending cash balance is directly linked to net cash flow. It is calculated by adding the net cash flow for the period to the beginning cash balance. For example, if a business begins a period with $10,000 in cash and generates a net cash flow of $5,000 during that period, the ending cash balance will be $15,000. This dynamic relationship underscores the importance of accurate cash flow projections. Overly optimistic revenue projections or underestimated expenses can lead to an inflated ending cash balance, misrepresenting the business’s true financial position.

- Indicator of LiquidityThe ending cash balance serves as a primary indicator of a business’s short-term liquidity. Sufficient cash reserves are essential for meeting immediate obligations such as payroll, rent, and supplier payments. A consistently low ending cash balance suggests potential difficulty in meeting these obligations, raising red flags for lenders. Maintaining adequate liquidity is crucial not only for securing financing but also for navigating unexpected economic downturns or industry-specific challenges. A healthy ending cash balance provides the financial flexibility to weather such storms and maintain operational continuity.

- Impact on Loan DecisionsLenders carefully evaluate the projected ending cash balance throughout the loan term when assessing creditworthiness. A consistently positive and adequate ending cash balance strengthens the loan application, demonstrating the business’s ability to manage cash flow effectively and repay the loan as agreed. Conversely, a projected ending cash balance that frequently dips below a certain threshold signals financial instability and increases the risk of default, potentially leading to loan rejection. The ending cash balance provides a tangible metric for lenders to assess the business’s financial resilience and its capacity to withstand unforeseen challenges.

- Management Tool for Financial PlanningBeyond its importance for securing financing, the ending cash balance serves as a valuable management tool for ongoing financial planning. Monitoring the projected ending cash balance against actual results allows businesses to identify discrepancies, analyze underlying causes, and implement corrective actions. This proactive approach to cash management enables businesses to optimize working capital, identify potential cash flow bottlenecks, and make informed decisions regarding investments, expansion, and other strategic initiatives. Regularly reviewing and analyzing the ending cash balance provides valuable insights for maintaining financial stability and achieving long-term sustainability.

In conclusion, the ending cash balance within a projected financial statement for SBA loans is a crucial element for both securing funding and ensuring ongoing financial health. It provides lenders with a clear indicator of a business’s ability to manage cash flow, meet its obligations, and withstand financial challenges. For business owners, it serves as a valuable tool for financial planning, enabling proactive management of liquidity and informed decision-making. A thorough understanding of the ending cash balance and its relationship to other financial metrics is essential for navigating the complexities of securing funding and building a sustainable and successful enterprise. A strong ending cash balance not only enhances the credibility of the loan application but also provides a critical buffer for navigating the uncertainties inherent in the business environment, positioning the business for long-term growth and success.

Key Components of a Projected Financial Statement for SBA Loans

A comprehensive projection for Small Business Administration (SBA) loan applications requires meticulous attention to several key components. These components, when accurately presented and interconnected, provide a cohesive and credible narrative of the business’s financial health, viability, and capacity for loan repayment. Omitting or misrepresenting any of these components can undermine the entire projection and jeopardize the loan application.

1. Projected Revenue: Accurate revenue projections, grounded in realistic assumptions and supported by market research or historical data, form the foundation of a credible financial projection. This component reflects the anticipated sales or income generated by the business over the projected period and directly impacts the projected net cash flow and loan repayment capacity.

2. Operating Expenses: A detailed and comprehensive account of operating expenses is crucial for demonstrating a clear understanding of the costs associated with running the business. This includes costs such as cost of goods sold (COGS), salaries and wages, rent and utilities, marketing expenses, and administrative overhead.

3. Financing Activities: This section details the sources and uses of financing, including loan proceeds, loan repayments, equity investments, and dividend distributions. It provides lenders with insight into how the loan will be utilized and how the business plans to manage its debt obligations.

4. Investing Activities: Investing activities encompass the purchase and sale of long-term assets, such as property, plant, and equipment (PP&E). This component demonstrates how the business plans to invest in growth and expansion, providing context for the overall financial strategy.

5. Net Cash Flow: Net cash flow, derived from the interplay of operating, investing, and financing activities, represents the overall difference between cash inflows and outflows. This crucial metric reveals the business’s ability to generate cash and meet its financial obligations.

6. Ending Cash Balance: The ending cash balance reflects the amount of cash available at the end of each reporting period. This figure serves as a key indicator of short-term liquidity and the business’s ability to manage its cash reserves effectively.

These interconnected elements provide a comprehensive view of the business’s financial landscape, enabling lenders to assess risk and make informed decisions regarding loan applications. A thorough and accurate presentation of these components strengthens the business’s case for funding and demonstrates a commitment to responsible financial management. The absence or misrepresentation of any of these elements can undermine the credibility of the projection and jeopardize the loan application. Therefore, meticulous attention to detail and a comprehensive understanding of these components are essential for securing funding and ensuring long-term financial stability.

How to Create a Projected Financial Statement for SBA Loans

Creating a robust financial projection for a Small Business Administration (SBA) loan application requires a structured approach and attention to detail. The following steps outline the process for developing a comprehensive and credible projection.

1. Define the Projection Period: Establish a realistic timeframe for the projection, typically covering one to five years. The timeframe should align with the loan’s purpose and the business’s planning horizon. Shorter periods offer more granular detail, while longer periods provide a broader perspective on long-term financial sustainability.

2. Project Revenue: Utilize appropriate forecasting methods, such as historical data analysis, market research, or industry benchmarks, to estimate future revenue. Consider factors like seasonality, pricing strategies, and market positioning. Realistic and well-supported revenue projections are crucial for establishing credibility.

3. Estimate Operating Expenses: Meticulously account for all anticipated operating expenses, including cost of goods sold (COGS), salaries and wages, rent, utilities, marketing, and administrative costs. A detailed breakdown of expenses demonstrates a thorough understanding of the business’s cost structure.

4. Detail Financing Activities: Clearly outline all financing activities, including loan proceeds, loan repayment schedules, equity contributions, and dividend distributions. This section demonstrates how the loan will be used and repaid, providing lenders with key insights into the business’s financial strategy.

5. Outline Investing Activities: Include planned capital expenditures, such as purchases of property, plant, and equipment (PP&E), and the sale of existing assets. This component reveals the business’s growth plans and their potential impact on overall financial health.

6. Calculate Net Cash Flow: Determine the net cash flow for each period by subtracting total cash outflows from total cash inflows. Net cash flow serves as a crucial indicator of the business’s ability to generate cash and meet its financial obligations.

7. Determine Ending Cash Balance: Calculate the ending cash balance for each period by adding the net cash flow to the beginning cash balance. This figure reflects the cash reserves available at the end of each period and serves as a key indicator of short-term liquidity.

8. Review and Refine: Thoroughly review the completed projection for accuracy, consistency, and completeness. Ensure all assumptions are clearly documented and supported by relevant data. Refine the projection as needed to ensure it presents a realistic and credible picture of the business’s financial future. A well-constructed projection, grounded in realistic assumptions and supported by meticulous calculations, strengthens the loan application and demonstrates a commitment to sound financial management. This comprehensive approach not only increases the likelihood of loan approval but also provides the business owner with a valuable tool for ongoing financial planning and strategic decision-making.

Developing a robust projection for SBA loan applications requires meticulous attention to detail and a comprehensive understanding of its core components: projected revenue, operating expenses, financing activities, investing activities, net cash flow, and ending cash balance. Accurate and realistic projections in each of these areas, supported by credible assumptions and data, are crucial for demonstrating financial viability and the capacity to repay the loan. A well-constructed projection provides lenders with the necessary information to assess risk and make informed decisions, significantly influencing loan approval outcomes. Furthermore, the process of developing a projection serves as a valuable exercise for business owners, fostering a deeper understanding of financial dynamics and promoting sound financial management practices.

A projection is not merely a requirement for securing funding; it is a critical tool for strategic planning and long-term business success. It provides a roadmap for financial growth, enables proactive identification of potential challenges, and empowers informed decision-making. The disciplined approach required to develop a credible projection fosters financial awareness and strengthens the foundation for a sustainable and thriving enterprise. A commitment to accurate and thorough financial projections demonstrates not only preparedness for loan applications but also a dedication to responsible financial management, positioning the business for long-term growth and success.