Managing funds effectively is a cornerstone of any well-run organization, big or small. Whether you are overseeing charitable donations, project budgets, or departmental expenses, the process of disbursing money needs to be clear, accountable, and consistent. Without a proper system, things can quickly become confusing, leading to errors, delays, or even misallocation of vital resources. That’s why having a robust and reliable system for tracking expenditures is not just a good idea; it’s absolutely critical for financial health and transparency.

Think about all the moving parts involved: approvals, recipient details, purpose of funds, and the amounts themselves. Juggling these manually or with inconsistent methods can be a logistical nightmare. A standardized approach helps streamline everything, ensuring that every penny spent is documented and justified. It builds trust and provides a clear audit trail for anyone who needs to review the financial records, making your operations smoother and more credible.

Why a Dedicated Scumc Funds Disbursement Form Template is Essential

When it comes to handling specific financial transactions, particularly those involving distinct funds or unique organizational structures like what “SCUMC” might imply, a generic template simply won’t cut it. You need something tailored, something that speaks directly to the nuances of your operations. A dedicated scumc funds disbursement form template ensures that all specific requirements, compliance standards, and internal protocols are met without fail. It acts as a consistent guide for everyone involved, from the person requesting the funds to the one authorizing the payment.

Imagine the chaos if every request was handled differently, with varying information collected or missing crucial details. It would be a constant struggle to reconcile accounts, answer queries, and maintain financial integrity. A specialized template eliminates this guesswork, forcing all parties to provide the necessary data upfront. This not only speeds up the approval process but also significantly reduces the chances of errors or omissions that could lead to bigger problems down the line, such as audit discrepancies or compliance issues.

Beyond mere efficiency, using a specific template enhances accountability. When every transaction flows through a structured form, there’s a clear record of who requested what, why, and when. This transparency is invaluable for internal controls and external audits, demonstrating due diligence in managing financial resources. It empowers your team to make informed decisions and ensures that funds are always used for their intended purposes, fostering a culture of responsibility within your organization.

Furthermore, a well-designed template can serve as a training tool for new staff, quickly onboarding them into your financial procedures. It standardizes workflows, making it easier to scale operations without sacrificing accuracy or control. It’s an investment in your organization’s financial future, providing a solid foundation for all money-related activities.

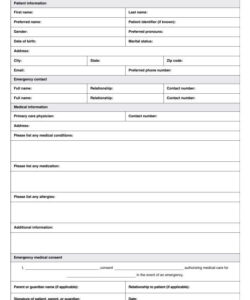

Key Information Your Scumc Funds Disbursement Form Template Should Include

- Requestor Details: Name, department, contact information.

- Date of Request: Crucial for tracking and timeliness.

- Disbursement Details: Amount requested, currency, payment method (e.g., check, bank transfer).

- Recipient Information: Full legal name, address, bank details (if direct deposit), or mailing address.

- Purpose of Disbursement: A clear, concise description of why the funds are needed. This is perhaps the most critical section for justification.

- Account Codes or Funding Source: The specific internal account or fund from which the money will be drawn.

- Approval Signatures: Spaces for all necessary approvals, with dates.

- Supporting Documentation: A checklist or section to note attached invoices, receipts, or other relevant papers.

Key Elements and Best Practices for Your Scumc Funds Disbursement Form Template

Crafting the perfect scumc funds disbursement form template isn’t just about listing fields; it’s about designing a user-friendly tool that serves its purpose effectively. Start by considering the flow of information. Is it logical? Does it guide the user through the necessary steps without confusion? Simplicity and clarity are paramount. Avoid jargon where plain language will do and ensure that instructions are clear and easy to follow. A form that is too complex will lead to errors and frustration, defeating its very purpose.

Think about how the form will be used in practice. Will it be filled out manually, or digitally? For manual forms, ensure ample space for writing. For digital forms, consider using dropdown menus, autofill features, and conditional logic to streamline data entry and reduce common mistakes. Digital forms also offer the advantage of immediate data capture and easier integration with financial management systems, further boosting efficiency and accuracy. This transition to digital, if not already implemented, can revolutionize your disbursement process.

Beyond the design, establishing clear internal policies for the form’s use is vital. Who initiates the form? Who are the approvers, and what are their respective limits? How is the completed form submitted and processed? These procedural guidelines should be communicated clearly to all relevant personnel to ensure consistent application. Regular training sessions can also help reinforce best practices and address any questions or challenges that arise from using the new template.

Finally, remember that a template is not set in stone. Regularly review its effectiveness. Gather feedback from users and approvers. Are there recurring issues? Is any information consistently missing or redundant? An agile approach to your template design allows for continuous improvement, ensuring it remains a valuable asset to your financial operations. Adapting it to evolving needs or regulatory changes will keep your financial management robust and responsive.

Smooth and accurate financial operations are the backbone of any successful endeavor. By systematically handling every outflow of funds, you not only ensure fiscal responsibility but also build a foundation of trust and transparency. It is about creating an environment where every financial decision is clearly documented and easily auditable.

Embracing well-defined procedures and utilizing tailored tools for fund management contributes significantly to the overall health and stability of an organization. This meticulous approach to handling finances safeguards resources and promotes effective allocation, paving the way for sustained growth and impactful achievements.