Navigating the complexities of insolvency proceedings can feel like a labyrinth, especially when you encounter specific legal forms that seem to hold the key to resolving financial disputes. If you’re dealing with a situation where assets or funds need to be recovered within an insolvency context, particularly in the UK, you’ve likely come across the term "Section 336 claim." This specific claim is a crucial tool for creditors or insolvency practitioners seeking to claw back assets that might have been improperly transferred before a bankruptcy order. Understanding how to properly file such a claim is paramount to its success.

Whether you are an individual creditor, a company looking to recover funds, or an insolvency professional tasked with managing an estate, having a clear understanding of the section 336 claim process and what a typical section 336 claim form template entails is incredibly valuable. It’s not just about filling in blanks; it’s about providing precise information, understanding the legal implications, and ensuring your claim stands up to scrutiny. Let’s demystify this essential document and help you prepare for a successful submission.

Understanding the Section 336 Claim and Its Purpose

A Section 336 claim in UK insolvency law primarily relates to property that might have been sold or transferred at an undervalue, or where assets were disposed of in a way that disadvantages creditors, particularly within the two years leading up to bankruptcy. Essentially, it’s a mechanism for the trustee in bankruptcy to recover assets that were part of the bankrupt’s estate but were transferred away under specific circumstances. Think of it as ensuring fairness and maximizing the assets available to pay off creditors. Without a proper form to outline the details, these crucial recoveries simply wouldn’t be possible.

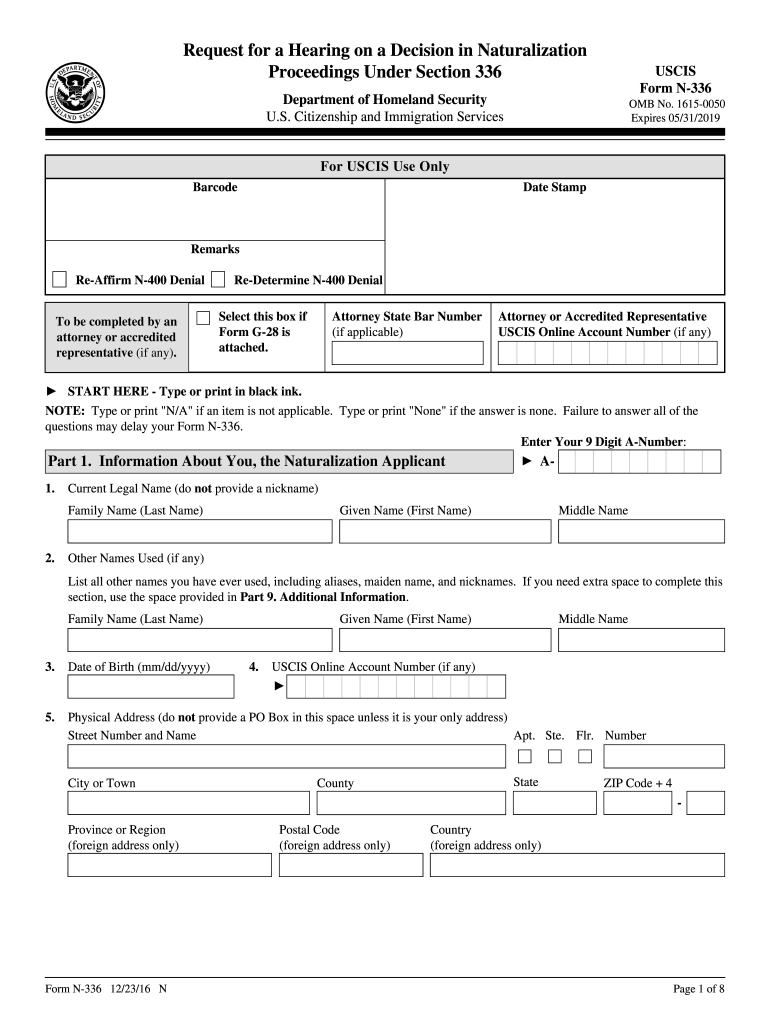

The form itself serves as a formal application to the court, detailing the specific transaction or disposition of property that the claimant believes falls under the scope of Section 336 of the Insolvency Act 1986. It’s the structured way to present your case, including who was involved, what was transferred, when it happened, and why it’s considered an "undervalue transaction" or similar breach. Precision here is not just recommended; it’s absolutely essential for the court to understand and potentially rule in your favour.

This claim is typically initiated by the trustee in bankruptcy, who has a duty to gather all assets belonging to the bankrupt estate. However, in some instances, a creditor might encourage the trustee to pursue such a claim if they believe there are recoverable assets that would benefit the estate and, subsequently, the creditors. The form acts as the initial pleading, laying out the factual basis and legal grounds for the recovery action. It’s your official request for the court to intervene and order the reversal of a problematic transaction.

Timeliness is another critical factor. There are often strict time limits within which these claims must be brought before the court. Missing these deadlines can lead to the claim being dismissed, regardless of its merits. This is why having a clear understanding of the section 336 claim form template and the process is so important, allowing you to prepare and act swiftly when necessary. It’s about being proactive and precise to protect the integrity of the insolvency estate.

Key Information Required on the Form

When you’re preparing a section 336 claim form, you’ll typically need to include several critical pieces of information to ensure its validity and strengthen your case.

- Claimant Details: Full name, address, and contact information of the party bringing the claim (usually the trustee in bankruptcy).

- Defendant Details: Full name, address, and any known contact information for the person or entity who received the property or assets.

- Bankruptcy Information: Details of the bankruptcy order, including the date it was made and the court that issued it.

- Description of Property/Assets: A clear and detailed description of the assets or property in question, including their estimated value at the time of the transfer.

- Transaction Details: The date of the transfer, the circumstances surrounding it, and why it is considered an "undervalue transaction" or other specified problematic disposition under Section 336.

- Supporting Evidence: A list of documents or evidence that supports your claim, such as transfer deeds, bank statements, valuations, or correspondence. These will often be attached as exhibits.

How to Accurately Complete and Submit Your Claim

Filling out any legal document, particularly something as significant as a section 336 claim, requires meticulous attention to detail. It’s not just about getting the right form; it’s about populating it with accurate, verifiable information that clearly outlines your case. Before you even put pen to paper (or fingers to keyboard), gather all relevant documents, including property deeds, bank statements, contracts, and any correspondence related to the transaction in question. A strong claim is built on solid evidence.

When working with a section 336 claim form template, you’ll find sections dedicated to identifying the parties involved, providing details of the bankruptcy, and, crucially, describing the transaction that is being challenged. Be precise when detailing the property or assets involved, their value at the time of transfer, and the date of the transfer. Avoid vague language; specific dates, amounts, and descriptions will significantly bolster your claim and make it easier for the court to understand your position.

One of the most important aspects is clearly explaining why the transaction falls under Section 336. This involves articulating whether it was a transaction at an undervalue, a preference, or another type of problematic disposition. You’ll need to demonstrate how the transfer impacted the bankrupt estate and, by extension, the creditors. This narrative, supported by your collected evidence, forms the core of your argument and needs to be compelling and legally sound.

Once the form is thoroughly completed and all supporting documents are collated, the final step is submission. This typically involves filing the claim with the appropriate court, often the High Court or a County Court with insolvency jurisdiction. Ensure you adhere to all court rules regarding filing, service of documents on the defendant, and payment of any required fees. It’s always advisable to retain copies of everything you submit for your records. If in doubt, seeking professional legal advice is a wise decision to ensure every step is handled correctly.

- Review All Details: Double-check all names, addresses, dates, and figures for accuracy. A small error can cause significant delays or even invalidate the claim.

- Attach Comprehensive Evidence: Ensure every piece of evidence supporting your claim is clearly referenced and attached. Organize them logically.

- Understand Deadlines: Be acutely aware of any statutory deadlines for bringing a Section 336 claim. Missing these can be fatal to your case.

- Seek Legal Counsel: If you’re not an insolvency professional, consulting with a solicitor specializing in insolvency law can provide invaluable guidance, ensuring your claim is robust and properly presented.

Successfully navigating a Section 336 claim requires a blend of legal understanding and meticulous administrative effort. By breaking down the process, understanding the purpose of each section on the form, and meticulously gathering your supporting evidence, you significantly increase the chances of a favourable outcome. Remember, these claims are about fairness and ensuring that, as far as possible, creditors receive their due from the bankrupt estate.

Ultimately, the goal is to present a clear, concise, and legally sound case to the court. With the right preparation and attention to detail, you can effectively utilize this important legal tool to recover assets and ensure the proper administration of an insolvency.