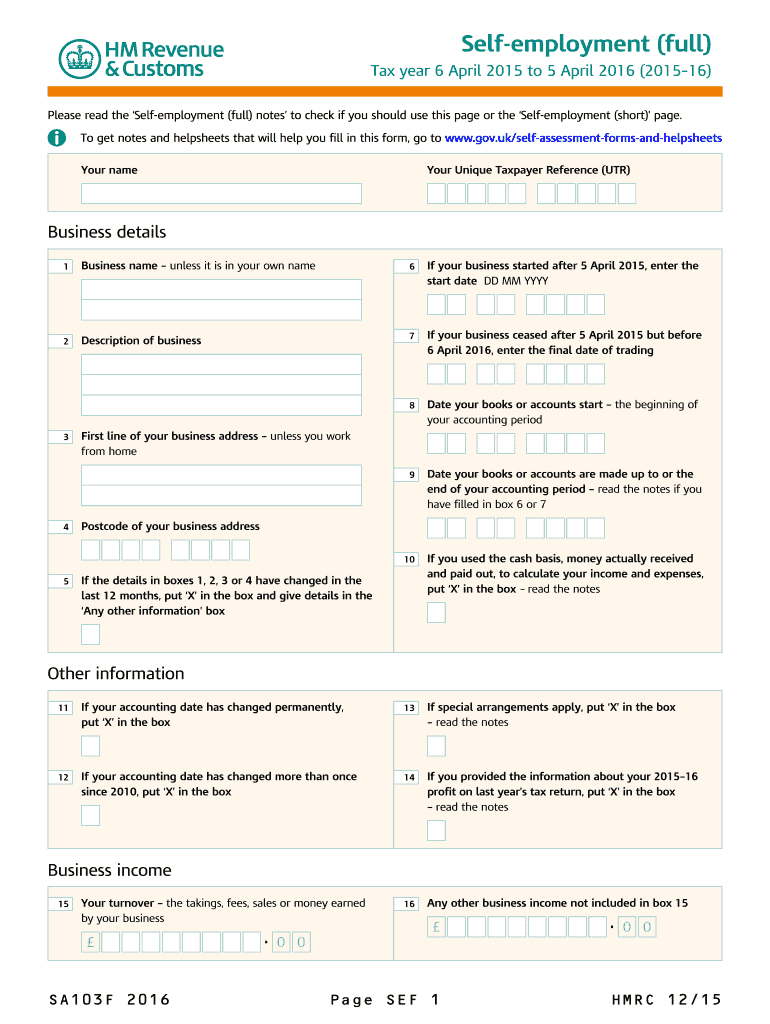

Navigating the world of taxes can often feel like deciphering an ancient, complex language. For many, especially those who are self-employed, freelancers, or earn income from various sources beyond a standard PAYE job, the annual self-assessment tax return is a crucial, yet sometimes daunting, responsibility. It’s not just about paying what you owe; it’s about accurately declaring your income and expenses to the tax authorities, ensuring everything is accounted for correctly and on time. This process, while essential, can be quite detailed, requiring meticulous record-keeping and a clear understanding of what information needs to be submitted.

This is precisely where a well-structured self assessment tax form template becomes an invaluable asset. Think of it as your personal guide through the maze of tax regulations, providing a framework that helps you gather all the necessary financial information in an organized manner. Rather than facing a blank page or a confusing official form for the first time each year, a template provides a familiar structure, prompting you for specific details and ensuring you don’t overlook any critical components. It’s about making a potentially stressful task a whole lot smoother and more manageable, giving you confidence in your submission.

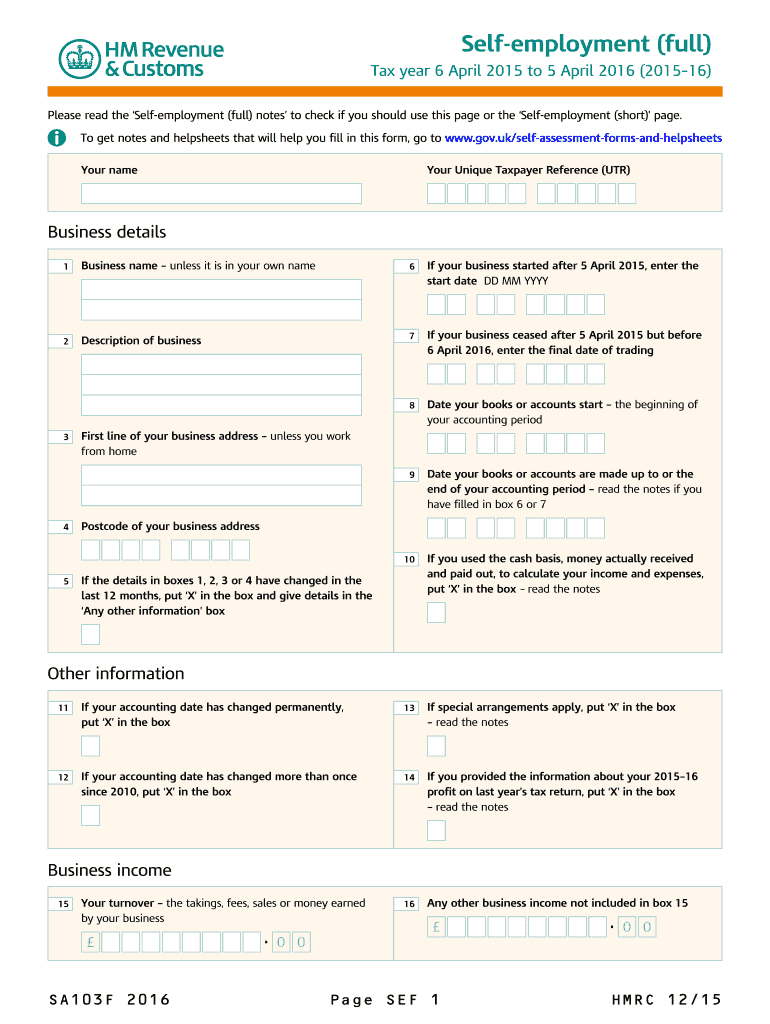

Understanding the Self Assessment Tax Process

Embarking on your self assessment journey requires a clear understanding of what’s involved. It’s not merely about filling in numbers; it’s about presenting a comprehensive financial picture for a specific tax year. Typically, you’ll need to report all your income, whether it’s from self-employment, property rentals, investments, dividends, or even certain foreign income. Alongside your income, you’ll also need to detail any allowable expenses that can be deducted, which can significantly reduce your taxable profit.

The official self assessment forms are designed to capture this information, but they can be extensive and vary slightly depending on your specific circumstances. For instance, someone with only self-employment income might use a different supplementary page than someone with significant property income. Understanding these nuances is key to selecting and using the right resources. A good self assessment tax form template will often replicate the structure of these official forms, providing prompts for each section you’re likely to encounter.

Key Sections You’ll Encounter

- **Personal Details:** Your basic information, including National Insurance number.

- **Income Sources:** Detailed breakdown of all your earnings, specifying the type of income.

- **Allowable Expenses:** Any costs wholly and exclusively incurred for your business or income-generating activities.

- **Capital Gains:** If you’ve sold assets like property or shares that have increased in value.

- **Pensions and Investments:** Reporting income from private pensions, annuities, or investment portfolios.

- **Tax Reliefs and Allowances:** Opportunities to reduce your tax bill through various reliefs you might be eligible for.

Having a template to guide you through these sections ensures you collect all relevant data before you even begin the official submission process. It acts as a checklist, helping you consolidate bank statements, invoices, receipts, and other financial documents into a cohesive overview. This level of preparation is not just about convenience; it significantly reduces the chances of errors, which can lead to delays or penalties.

Choosing and Utilizing Your Self Assessment Tax Form Template

When it comes to selecting a self assessment tax form template, you’ll find a variety of options available, each with its own advantages. Some people prefer simple printable PDFs that they can fill out by hand, providing a tangible way to organize their thoughts. Others might opt for digital templates, perhaps in spreadsheet format like Excel or Google Sheets, which offer the benefit of built-in calculations and easy amendments. There are also more sophisticated options integrated into accounting software or online tax tools, which can automate much of the data entry if you’ve already been tracking your finances there.

The best template for you really depends on your personal preferences, the complexity of your financial situation, and your comfort level with different technologies. Consider whether you need a template that caters specifically to self-employment, or if you have diverse income streams that require a more comprehensive layout. Remember, the goal is to simplify the process, not to add another layer of complexity.

Here are some tips for choosing and utilizing your template effectively:

- **Start Early:** Don’t wait until the last minute. Begin populating your template as soon as the new tax year starts, or at least several months before the deadline. This allows you to gather information gradually.

- **Categorize Meticulously:** Ensure your income and expenses are correctly categorized. A good template will have clear sections for different types of transactions.

- **Keep Records:** The template is a summary; you still need to keep detailed receipts, invoices, and bank statements as evidence for everything you declare.

- **Review and Double-Check:** Before transferring information to the official tax return, meticulously review every entry in your template. Even small errors can have consequences.

- **Seek Professional Advice If Needed:** If your tax affairs are particularly complex, or if you’re unsure about any section, don’t hesitate to consult a qualified tax advisor.

By proactively using a self assessment tax form template, you transform a potentially stressful annual obligation into a well-managed administrative task. It empowers you to take control of your financial reporting, ensuring accuracy and compliance. This systematic approach not only makes the current tax year’s submission smoother but also sets you up for success in managing your finances in the years to come.

Being prepared for your tax obligations is one of the smartest financial moves you can make. By taking advantage of tools like a well-designed template, you gain clarity over your income and expenses, ensuring that when the time comes to file, you do so with confidence and accuracy. It’s about building a solid foundation for your financial peace of mind, year after year.

Ultimately, managing your self assessment responsibilities effectively contributes to your overall financial well-being. It helps you understand your financial position better, enabling you to make informed decisions for your future and ensuring you meet your legal obligations without unnecessary stress.