Navigating the world of self-assessment tax returns can often feel like deciphering a complex puzzle. Whether you are a seasoned freelancer, a small business owner, or someone earning income outside of traditional employment, the annual ritual of declaring your earnings to the tax authorities can be daunting. It is a process that demands meticulous attention to detail, accurate record-keeping, and a clear understanding of what information needs to be submitted.

Fortunately, you do not have to tackle this challenge blindly. Many individuals find immense relief and clarity by utilizing a well-structured self assessment tax return form template. These templates are designed to simplify the process, guiding you through each required section and ensuring you capture all necessary financial information. Think of it as your personal roadmap to a smoother, less stressful tax season, helping you avoid common pitfalls and potential delays.

Why a Self Assessment Tax Return Form Template is a Game Changer for Your Finances

The thought of compiling all your income, expenses, and allowances for your annual tax return can be overwhelming. Without a clear framework, it is easy to miss deductions you are entitled to or make errors that could lead to queries from HMRC or other tax bodies. This is where a robust self assessment tax return form template truly shines, transforming a potentially stressful task into a manageable one.

A good template provides a logical flow, mirroring the structure of official tax forms but often presented in a more user-friendly format. It acts as a comprehensive checklist, reminding you of different income streams to report, various deductible expenses to consider, and personal allowances that might apply to your circumstances. This systematic approach not only saves you significant time but also drastically reduces the chances of oversight or miscalculation.

Key Benefits of Using a Template

The advantages of having a pre designed structure are numerous. It brings a sense of order to your financial data, making the preparation process much more efficient. Instead of hunting for information across various documents, a template helps you consolidate everything in one place, ready for transfer to your official submission.

- It provides a standardized layout that matches official tax return requirements.

- It includes clear sections for all types of income, such as self employed profits, property income, and dividends.

- It offers dedicated areas for logging allowable expenses, ensuring you do not miss out on legitimate deductions.

- Many templates come with prompts or reminders for common tax allowances and reliefs.

- It acts as a thorough checklist, guiding you through each step of the process.

- It significantly reduces the risk of errors and omissions, leading to more accurate submissions.

- It provides a clean, organized record for your own peace of mind and future reference.

Ultimately, using a template empowers you to take control of your tax obligations with greater confidence. It demystifies the process, allowing you to focus on accurately reporting your financial position rather than struggling with the form’s complexity.

What to Look For in an Effective Tax Return Template

While the concept of a self assessment tax return form template is beneficial, the effectiveness varies greatly depending on its design and comprehensiveness. Not all templates are created equal, so it is important to know what features to prioritize to ensure you pick one that truly serves your needs and simplifies your tax preparation journey.

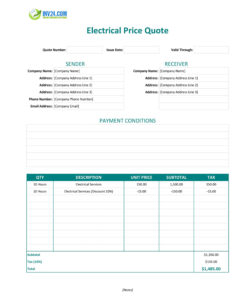

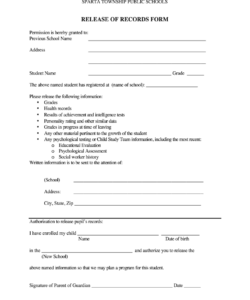

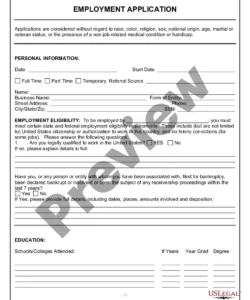

An ideal template should be intuitive and user friendly, even for those who are not tax experts. Look for clear headings, logical sequencing of sections, and ample space for entering your data. It should cover all the major components typically found in official self-assessment forms, from personal details and income sources to detailed breakdowns of expenses and capital gains, if applicable. Guidance notes embedded within the template can be particularly helpful, explaining what type of information is required for each field.

Consider whether the template is adaptable to your specific situation. For instance, if you have multiple income streams or specific types of expenses, ensure the template provides sufficient categories or allows for custom additions. The best templates are designed to be flexible while maintaining a core structure that aligns with tax authority requirements.

- User friendly layout: Easy to navigate and understand.

- Comprehensive sections: Covers all relevant income, expenses, and allowances.

- Clear instructions: Provides guidance on what information to include.

- Calculation areas: Space or built in functionality for calculating totals.

- Digital or printable options: Versatility for your preferred method of record keeping.

- Customization options: Allows for adaptation to unique financial circumstances.

- Accuracy assurance: Designed to prompt for all necessary information to minimize errors.

When selecting your template, prioritize those that offer clarity and completeness. While some might be very basic, a truly effective template will act as a robust assistant, guiding you through every step and helping you compile a return that is both accurate and compliant. Remember, the goal is to make your annual tax submission as straightforward and stress free as possible, setting you up for success well before the deadline approaches.

Taking a proactive approach to your tax return preparation can make a significant difference to your peace of mind. By organizing your financial information throughout the year and utilizing tools like a well designed template, you transform a potentially daunting task into a manageable process. This preparation ensures you have all the necessary details at your fingertips when the time comes to submit your official forms, whether online or by post.

Embracing these aids means you are not just completing a requirement; you are efficiently managing an important aspect of your financial life. With an organized approach, you can confidently meet your obligations, ensuring accuracy and potentially identifying opportunities for tax savings, all while avoiding the last minute rush and stress that often accompanies tax season.