Navigating the world of self-employment offers incredible freedom and flexibility, but it often comes with a unique set of challenges, especially when it’s time to prove your income. Whether you’re applying for a loan, renting a new apartment, or qualifying for certain benefits, lenders and landlords typically look for clear, consistent documentation of your earnings. This can feel like a complex maze when you don’t have a traditional W-2 form to hand over.

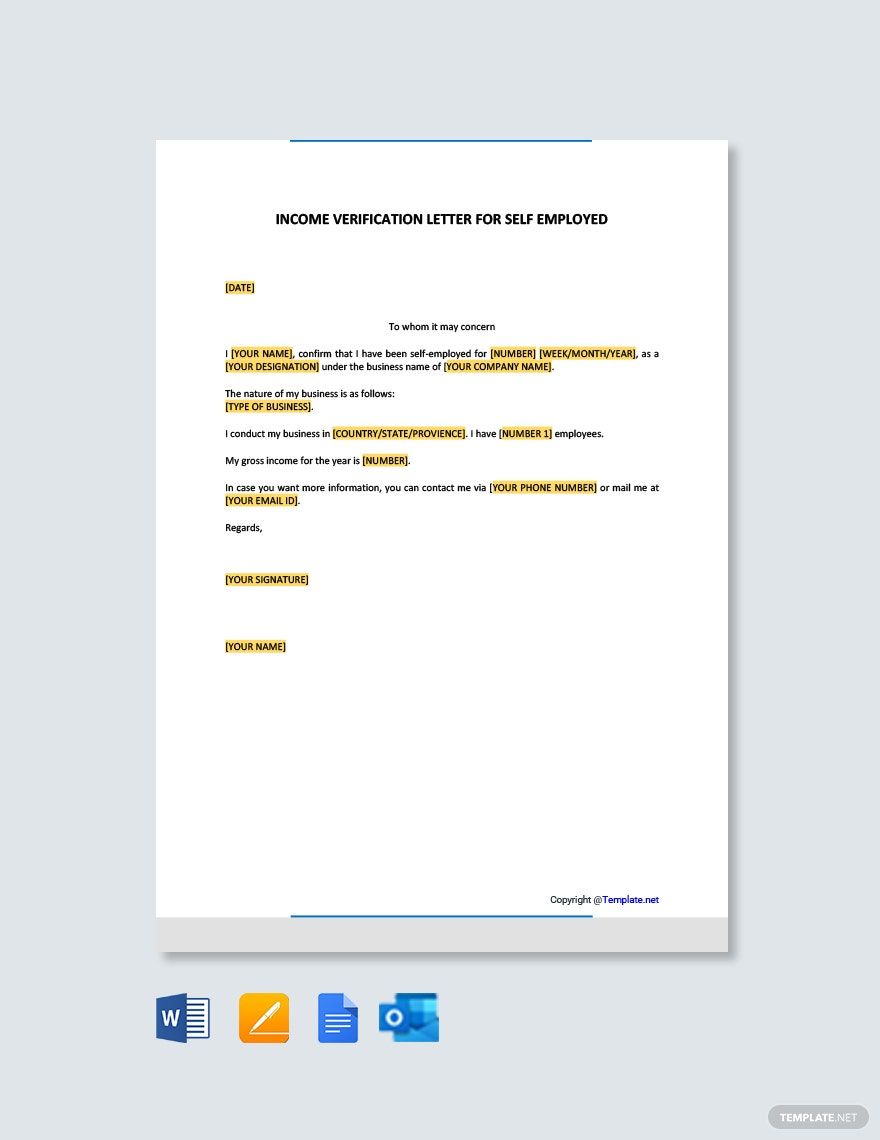

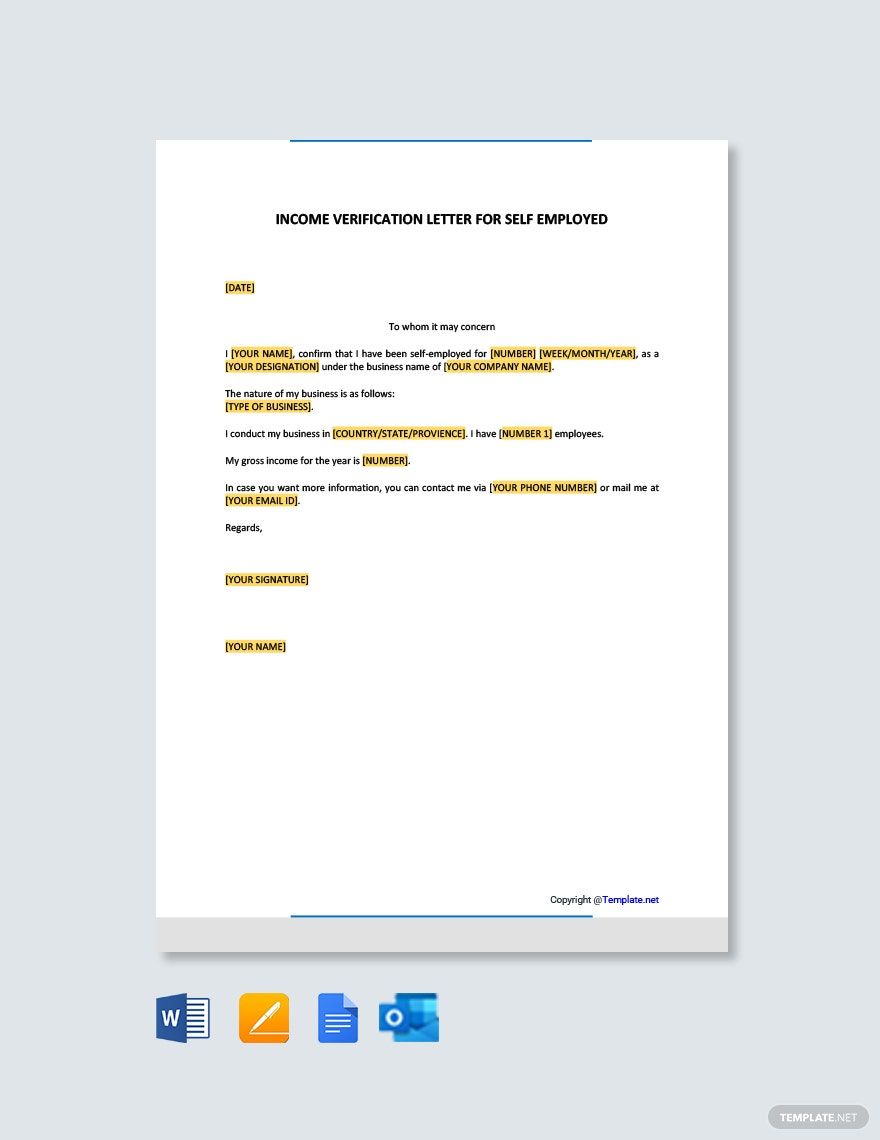

That’s where a well-designed self employment income verification form template becomes an invaluable tool. It acts as a bridge, translating your diverse income streams into a format that traditional institutions can easily understand and accept. By providing a structured, professional overview of your earnings, you can streamline the verification process, reduce stress, and present yourself as a reliable and organized individual, making your financial interactions much smoother.

Understanding the Importance of Income Verification for the Self-Employed

For many self-employed individuals, proving a steady income can feel like an uphill battle. Unlike employees who receive regular pay stubs and annual W-2 forms, your income might fluctuate, come from various clients, or be subject to different payment schedules. Financial institutions, landlords, and even some government agencies are often set up to process standard employment documentation, which can leave self-employed individuals feeling like they’re trying to fit a square peg into a round hole.

This is precisely why proactive documentation is so critical. Without a clear, organized method of presenting your earnings, you might face delays, requests for excessive paperwork, or even rejections for applications that you would otherwise qualify for. Think of applying for a mortgage: the lender needs to assess your ability to repay, and scattered bank statements alone might not paint the full, clear picture they require.

A dedicated income verification form, specifically tailored for the self-employed, helps to consolidate this information into an easily digestible format. It provides a snapshot of your financial health, outlining not just how much you’ve earned, but also the sources and periods of those earnings. This level of clarity helps build trust with the requesting party and significantly speeds up the verification process, reducing the back-and-forth communication that can often be frustrating.

Furthermore, having a robust self employment income verification form template on hand demonstrates your professionalism and organization. It shows that you understand the requirements for financial transactions and are prepared to meet them efficiently. This can be a significant advantage when you’re competing for a rental property or trying to secure a competitive loan rate, as it instills confidence in your financial stability and reliability.

Key Elements of an Effective Template

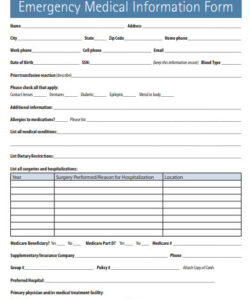

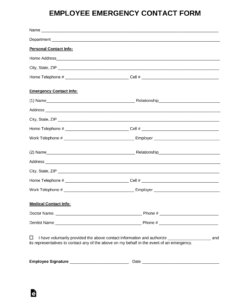

* **Your Business and Personal Details:** This includes your full legal name, business name (if applicable), address, contact information, and potentially your Employer Identification Number (EIN) or Social Security Number.

* **Requester’s Information:** Space for the name and contact details of the entity requesting the verification (e.g., bank, landlord, government agency).

* **Income Period:** Clearly define the specific period for which income is being reported (e.g., last 3 months, last 6 months, previous fiscal year). This ensures both parties are looking at the same timeframe.

* **Detailed Income Breakdown:** This is the core of the form. It should list individual income sources, dates of payment, the amount received from each source, and a brief description of the services rendered. You might also include a total for the specified period.

* **Declaration and Certification:** A statement affirming the accuracy of the information provided, often accompanied by a space for your signature and the date. This adds a layer of official certification.

* **Supporting Documentation List:** A section to indicate what supporting documents are attached (e.g., bank statements, invoices, tax returns, client contracts). This helps the requester know what to expect and ensures all necessary information is submitted together.

Leveraging Your Self Employment Income Verification Form Template for Success

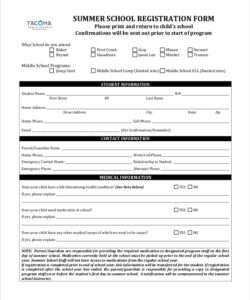

Once you have a solid self employment income verification form template, the key is knowing how to use it effectively in various scenarios. This tool isn’t just about filling in numbers; it’s about presenting your financial story in a clear, compelling, and verifiable manner. Start by populating the template with accurate and up-to-date information. Ensure every field is meticulously completed, as omissions can lead to delays and additional scrutiny from the requesting party.

For optimal impact, always gather and prepare your supporting documentation alongside the form. While the template provides a summary, documents like bank statements, invoices, client contracts, and past tax returns are the empirical evidence that backs up your claims. Think of the form as the cover letter and the supporting documents as your detailed resume; both are necessary for a complete and credible application. Organize these documents neatly, perhaps with a clear table of contents, to make it easy for the reviewer to cross-reference information.

When faced with a specific request, customize the template as needed. For instance, a landlord might be interested in the last six months of consistent income, whereas a mortgage lender might require two years of tax returns in addition to more recent income data. Adapt the income period and the types of supporting documents you highlight or include based on the specific requirements of the request. This demonstrates your attention to detail and willingness to meet their particular needs.

Finally, always keep a copy of every submitted form and its accompanying documentation for your own records. This not only serves as a paper trail for future reference but also allows you to quickly replicate the process if another verification is needed. By treating your self-employment income verification seriously and professionally, you empower yourself to navigate financial milestones with confidence and ease.