Utilizing structured reporting formats empowers businesses to monitor performance, identify trends, and make informed decisions. This structured approach facilitates easier access to funding, builds trust with investors, and supports regulatory compliance. Furthermore, standardized formats simplify comparative analysis across periods, enabling businesses to track progress and identify areas for improvement.

This foundational understanding of financial reporting structures serves as a springboard for a deeper exploration of specific statement types, including income statements, balance sheets, and cash flow statements, and their respective roles in comprehensive financial management.

1. Accessibility

Accessibility in the context of financial statement templates refers to the ease with which individuals can obtain, understand, and utilize these tools. This encompasses factors such as availability in various formats (e.g., spreadsheets, software applications, online platforms), clarity of instructions and terminology, and compatibility with different technological resources. A readily accessible template removes barriers to entry, allowing even those with limited financial expertise to generate and interpret crucial financial reports. For instance, a small business owner without dedicated accounting staff can leverage a user-friendly online template to track income and expenses, facilitating informed financial management.

Enhanced accessibility promotes greater transparency and accountability within organizations. When financial information is presented in a clear and understandable format, it empowers stakeholders to make informed decisions. This can include internal decisions regarding resource allocation and investment strategies, as well as external decisions by potential investors and lenders. Furthermore, accessible templates contribute to improved regulatory compliance by simplifying the process of generating required financial reports. For example, a non-profit organization can use a pre-designed template to prepare accurate and consistent financial statements for grant applications and regulatory filings.

While technology has significantly broadened access to financial management tools, ensuring true accessibility requires ongoing efforts to simplify complex financial concepts and tailor resources to diverse user needs. This includes providing clear explanations of terminology, offering templates in multiple languages, and designing interfaces that are compatible with assistive technologies. Addressing these challenges strengthens financial literacy and empowers individuals and organizations to effectively manage their financial resources.

2. Standardized Structure

Standardized structure is a cornerstone of effective financial reporting, providing a consistent framework for presenting financial data within a simple business financial statement template. This consistency ensures clarity, comparability, and ease of interpretation for both internal and external stakeholders. A standardized structure facilitates efficient data analysis and informed decision-making by presenting information in a predictable and organized manner.

- Uniformity of Data PresentationStandardized templates dictate the placement and format of key financial elements, ensuring uniformity across reporting periods. For instance, assets are consistently presented on the balance sheet, while revenues and expenses are consistently presented on the income statement. This uniformity allows for straightforward comparison of financial performance across different periods, enabling trend analysis and identification of potential issues. A consistent structure eliminates ambiguity and promotes accurate interpretation of financial data.

- Enhanced ComparabilityStandardized templates facilitate comparisons between different businesses within the same industry. By adhering to a common framework, businesses can benchmark their performance against competitors, identify best practices, and assess their relative financial standing. Investors and lenders also benefit from this comparability, as it simplifies the evaluation of investment opportunities and creditworthiness across different companies.

- Simplified Auditing and Regulatory ComplianceStandardized financial statements simplify auditing processes. Auditors can readily locate and verify information within a familiar structure, streamlining the audit process and reducing the likelihood of errors. Furthermore, standardized templates aid in regulatory compliance by ensuring that financial reports adhere to prescribed formats and reporting requirements. This simplifies the process of filing required reports and reduces the risk of penalties for non-compliance.

- Improved Data Integrity and ReliabilityStandardized templates contribute to improved data integrity and reliability by minimizing the risk of errors and inconsistencies. Pre-defined formulas and data validation rules within templates help ensure accuracy in calculations and prevent data entry errors. This enhances the reliability of financial information, promoting trust among stakeholders and supporting informed decision-making.

The standardized structure inherent in simple business financial statement templates forms the foundation for sound financial management. By promoting clarity, comparability, and reliability, these templates empower businesses to effectively monitor their financial performance, communicate transparently with stakeholders, and make data-driven decisions that contribute to long-term success.

3. User-friendly design

User-friendly design plays a crucial role in the effectiveness of simple business financial statement templates. A well-designed template simplifies the process of entering and interpreting financial data, empowering individuals with varying levels of financial expertise to manage finances effectively. Intuitive layouts, clear labels, and logical data entry flows minimize the risk of errors and enhance the overall user experience. Consider a small business owner using a template to track monthly expenses. A user-friendly design allows them to quickly input data, generate reports, and identify trends without requiring extensive accounting knowledge.

Several key elements contribute to a user-friendly design in financial statement templates. Clear visual hierarchies, achieved through appropriate font sizes, headings, and spacing, guide the user through the information. Input fields should be clearly labeled and logically organized, corresponding to the natural flow of financial data. Drop-down menus and pre-populated fields can further simplify data entry, reducing manual effort and minimizing errors. Color-coding can be strategically employed to highlight key figures or variances, enhancing the visual appeal and facilitating rapid interpretation of financial information. Interactive charts and graphs can visually represent data, simplifying complex financial trends and enabling data-driven insights. For example, a template may use a line graph to visualize revenue growth over time, providing a clear and concise representation of financial performance.

The practical significance of user-friendly design in financial statement templates is substantial. It promotes accessibility, enabling individuals with limited financial expertise to manage their finances effectively. By simplifying data entry and interpretation, user-friendly templates save time and reduce the likelihood of errors. This contributes to improved financial management, enhanced decision-making, and increased financial transparency within organizations. Moreover, user-friendly templates facilitate communication with external stakeholders, such as investors and lenders, by presenting financial information in a clear and understandable format. However, maintaining user-friendliness while accommodating the complexity of financial data can present a design challenge. Templates must strike a balance between simplicity and comprehensive functionality, ensuring they cater to diverse user needs and evolving financial reporting requirements.

4. Customizability

Customizability is a critical feature of simple business financial statement templates, enabling adaptation to specific organizational needs and reporting requirements. While standardized structures provide a foundational framework, the ability to tailor templates enhances their practical utility. This adaptability empowers businesses to capture relevant financial data, generate targeted reports, and gain deeper insights into their financial performance. For example, a retail business might customize a template to track sales by product category, while a service-based business might focus on billable hours and project profitability.

Several aspects of customizability contribute to the effectiveness of financial statement templates. Flexibility in adding or removing data fields allows businesses to track specific metrics relevant to their industry or operational model. Modifying reporting periods enables analysis of financial performance over different timeframes, supporting short-term and long-term planning. Integrating with existing accounting software streamlines data entry and reduces manual effort. Customizable formatting options, including fonts, colors, and logos, enhance the visual appeal and professionalism of reports. The ability to generate reports in various formats (e.g., PDF, Excel) facilitates sharing and collaboration with stakeholders. For instance, a company seeking funding might customize a template to generate a comprehensive financial report tailored to the investor’s specific requirements.

Customizability, while beneficial, presents potential challenges. Excessive customization can compromise the standardized structure and comparability of financial statements. Maintaining a balance between flexibility and consistency is crucial for ensuring the integrity and reliability of financial reporting. Furthermore, complex customization options can increase the learning curve for users, potentially requiring additional training or technical expertise. Addressing these challenges requires careful design and implementation of customizable features within templates, prioritizing user-friendliness and adherence to established accounting principles. This empowers businesses to leverage the benefits of customizability while maintaining the integrity and value of their financial reporting processes. Ultimately, effective customization contributes to more insightful financial analysis, improved decision-making, and enhanced communication with stakeholders.

5. Comprehensive Overview

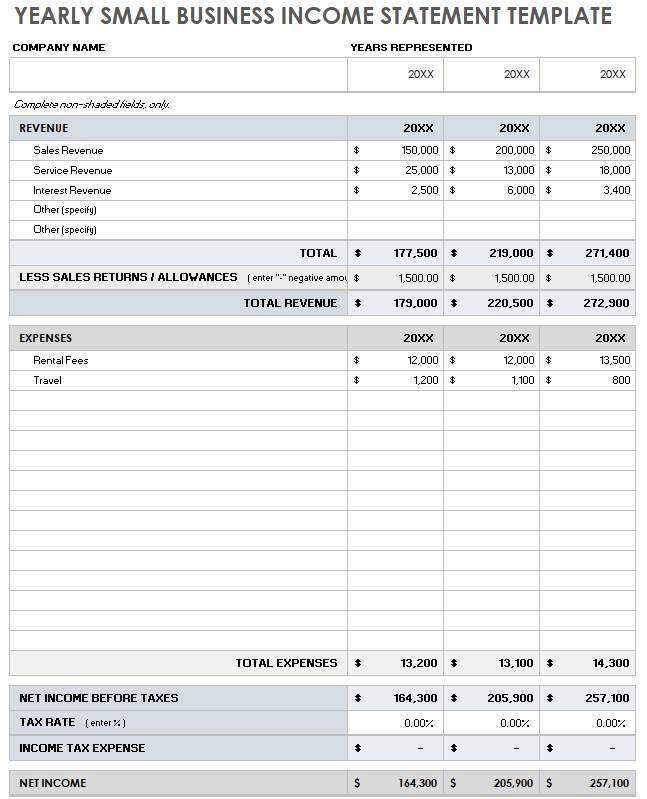

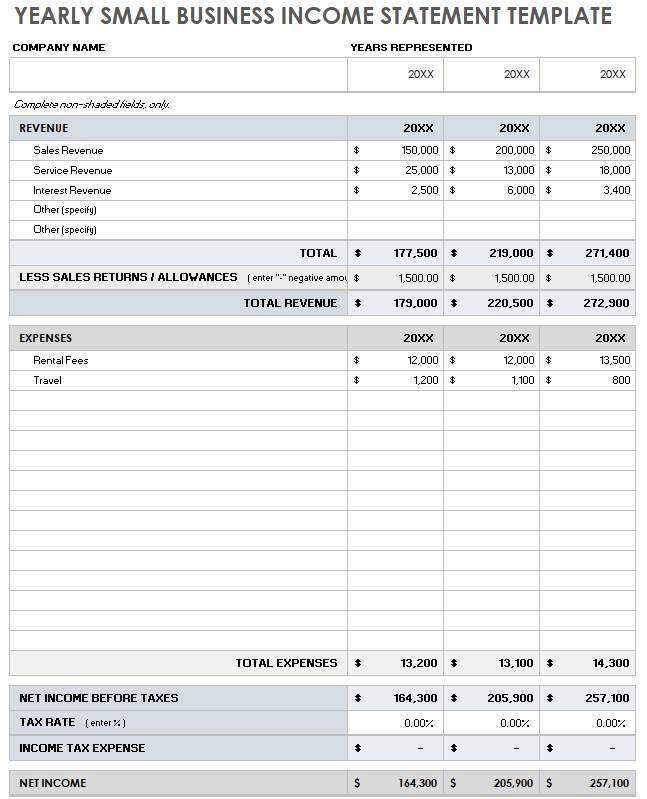

A comprehensive overview is a critical outcome of effectively utilizing a simple business financial statement template. Such templates, when properly designed and implemented, consolidate key financial data into a readily understandable format, offering a holistic view of an organization’s financial health. This consolidated perspective allows stakeholders to quickly grasp the overall financial position, performance, and cash flow of a business. For example, a well-structured balance sheet within a template provides a snapshot of assets, liabilities, and equity, offering immediate insight into the company’s financial strength and stability. Similarly, a concise income statement presents a clear picture of profitability over a specific period, highlighting revenues, expenses, and resulting net income or loss.

The value of a comprehensive overview facilitated by these templates lies in its ability to support informed decision-making. By presenting key financial information in a concise and accessible format, templates empower business owners, managers, and investors to identify trends, assess risks, and make strategic choices. For instance, a consistent decline in gross profit margin, readily apparent in a comparative income statement generated from a template, could signal pricing or production cost issues requiring immediate attention. Furthermore, a comprehensive overview is essential for effective communication with external stakeholders. Investors and lenders rely on clear and concise financial information to assess the viability and creditworthiness of businesses. A well-structured financial statement template ensures transparency and builds trust with these crucial stakeholders.

Achieving a truly comprehensive overview requires careful consideration of the specific information included within the template. While simplicity is paramount, the template must capture all essential financial elements relevant to the business’s size, industry, and operational model. Striking a balance between conciseness and completeness is crucial. Overly simplified templates may omit critical data, while excessively detailed reports can obscure key insights. Therefore, the design and implementation of a simple business financial statement template should prioritize clarity, accuracy, and relevance to ensure a genuinely comprehensive and actionable overview of financial performance. This balanced approach empowers stakeholders to make informed decisions, fostering financial stability and promoting sustainable growth.

6. Time Savings

Time savings represent a significant advantage of utilizing simple business financial statement templates. Manual preparation of financial statements is a time-consuming process, involving data gathering, calculations, and formatting. Templates automate many of these tasks, freeing up valuable time for analysis, interpretation, and strategic decision-making. Consider a scenario where a business owner spends several hours each month manually compiling financial data and creating reports. A template could reduce this time investment significantly, allowing the owner to focus on core business operations, such as marketing or product development. The time saved translates directly into increased productivity and potential for business growth. Templates pre-populate formulas and format elements, ensuring consistency and accuracy while reducing manual input. This efficiency is particularly valuable for small businesses and startups with limited resources.

The practical implications of time savings extend beyond individual tasks. Streamlined reporting processes contribute to faster financial analysis and decision-making cycles. This agility allows businesses to respond quickly to market changes, identify opportunities, and address potential financial challenges proactively. For example, a business using a template to track cash flow can quickly identify a potential shortfall and take corrective action, such as adjusting expenses or seeking short-term financing. Moreover, efficient reporting processes facilitate timely communication with stakeholders. Investors and lenders often require regular financial updates. Templates enable businesses to generate these reports quickly and efficiently, strengthening relationships and fostering trust. In a competitive business environment, the ability to access and interpret financial information rapidly can provide a significant competitive advantage.

While templates offer substantial time savings, effective implementation is essential to maximize benefits. Choosing a template appropriate for the business’s specific needs and ensuring data accuracy are crucial for generating reliable and meaningful reports. Furthermore, integrating templates with existing accounting software can further streamline data entry and reporting processes. Despite these considerations, the time savings associated with using simple business financial statement templates represent a significant advantage, contributing to improved financial management, enhanced decision-making, and increased operational efficiency. This efficiency ultimately supports long-term business sustainability and growth.

Key Components of Business Financial Statement Templates

Effective financial management relies on clear, concise, and accurate reporting. Templates for financial statements provide a standardized framework for organizing and presenting crucial financial data. Understanding the key components of these templates is essential for leveraging their full potential.

1. Income Statement: The income statement, also known as the profit and loss statement, reports a company’s financial performance over a specific period. It details revenues, expenses, and the resulting net income or loss. Key elements include revenue from sales, cost of goods sold, gross profit, operating expenses, and net income.

2. Balance Sheet: The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It presents a summary of assets, liabilities, and equity. Assets represent what the company owns, liabilities represent what it owes, and equity represents the owners’ stake in the company. The balance sheet adheres to the fundamental accounting equation: Assets = Liabilities + Equity.

3. Cash Flow Statement: The cash flow statement tracks the movement of cash both into and out of a company over a given period. It categorizes cash flows into operating activities (related to the core business operations), investing activities (related to the purchase and sale of long-term assets), and financing activities (related to debt, equity, and dividends). Understanding cash flow is crucial for assessing a company’s liquidity and ability to meet its financial obligations.

4. Statement of Retained Earnings (Optional): While less common in simple templates, the statement of retained earnings details changes in retained earnings over a specific period. Retained earnings represent the accumulated profits of a company that have not been distributed as dividends. This statement tracks beginning retained earnings, net income or loss, dividends paid, and ending retained earnings. It provides insight into how a company manages its profits over time.

5. Supporting Schedules (Optional): Simple templates may include supporting schedules to provide more detailed information about specific line items within the main financial statements. For example, a schedule of accounts receivable might detail outstanding customer invoices, while a schedule of accounts payable might list outstanding vendor bills. These schedules enhance transparency and provide a more granular view of financial data.

These interconnected components work together to provide a comprehensive view of a company’s financial health. Analyzing these statements individually and collectively enables stakeholders to assess performance, identify trends, and make informed decisions that contribute to long-term financial stability and growth.

How to Create Simple Business Financial Statement Templates

Creating effective financial statement templates requires a structured approach. The following steps outline the process of developing templates suitable for various business needs, promoting clarity, accuracy, and efficient financial management.

1: Determine the Purpose and Scope: Define the specific purpose of the template. Will it be used for internal management reporting, external communication with stakeholders, or regulatory compliance? Identify the target audience and their information needs. Consider the size and complexity of the business, as well as industry-specific reporting requirements.

2: Select Key Financial Components: Choose the essential financial statements to include in the template. Most simple templates will include an income statement, balance sheet, and cash flow statement. Consider adding a statement of retained earnings or supporting schedules for more detailed reporting. The selection of components should align with the defined purpose and scope.

3: Design the Layout and Structure: Design a clear and logical layout for each statement. Use clear headings, labels, and consistent formatting. Organize data fields in a way that reflects the natural flow of financial information. Consider using visual cues, such as color-coding or bolding, to highlight key figures or variances.

4: Incorporate Formulas and Calculations: Incorporate formulas and calculations within the template to automate data processing. This reduces manual effort and minimizes the risk of errors. Use spreadsheet software features, such as cell referencing and built-in functions, to streamline calculations and ensure accuracy.

5: Implement Data Validation and Error Checks: Implement data validation rules and error checks to ensure data integrity. This might include restricting input to specific data types (e.g., numbers, dates) or setting limits for certain values. Data validation helps prevent inconsistencies and maintains the reliability of financial reports.

6: Test and Refine: Thoroughly test the template with sample data to ensure accuracy and functionality. Verify that formulas and calculations are working correctly and that reports generate as expected. Refine the template based on testing results and user feedback.

7: Document and Train: Document the template, including instructions for use and explanations of key components. Provide training to users on how to effectively utilize the template. Clear documentation and training promote consistent and accurate reporting.

8: Regularly Review and Update: Regularly review and update the template to ensure it remains relevant and aligned with evolving business needs and reporting requirements. Regular maintenance ensures the template’s long-term effectiveness and supports informed financial management.

Developing well-designed templates provides a foundation for sound financial management. These templates streamline reporting processes, enhance data accuracy, and facilitate informed decision-making, ultimately contributing to long-term financial stability and growth.

Standardized financial reporting structures offer businesses a crucial tool for managing financial data effectively. From enhanced accessibility and standardized structure to time savings and comprehensive overviews, the benefits of leveraging these pre-designed formats are substantial. Understanding key components like income statements, balance sheets, and cash flow statements empowers informed decision-making. Furthermore, the ability to customize templates ensures reporting remains relevant to specific business needs and evolving circumstances.

Effective financial management hinges on accurate, accessible, and actionable financial information. Embracing structured reporting through thoughtfully designed templates is not merely a best practice; it is a fundamental requirement for navigating the complexities of the modern business landscape and achieving sustainable financial health.