Using a pre-designed structure for cash flow analysis facilitates better financial management. It enables informed decision-making regarding budgeting, investments, and operational efficiency. This readily accessible financial overview allows stakeholders to quickly assess financial performance and identify potential areas for improvement or growth. The simplified format makes it easier for even those without advanced financial expertise to understand the cash flow dynamics.

Understanding the core components and benefits of organized cash flow analysis provides a foundation for deeper exploration of financial planning and management strategies. The following sections will delve into the specifics of creating and interpreting these crucial documents, offering practical guidance for effective financial control.

1. Standardized Format

A standardized format is fundamental to a simple cash flow statement template. Consistency ensures clarity, comparability, and ease of interpretation, crucial for effective financial analysis and decision-making. A structured approach allows stakeholders to readily grasp the financial status of an entity regardless of their financial background.

- Consistent StructureA consistent structure ensures all essential elements are present and organized predictably. This includes clear sections for operating activities, investing activities, and financing activities. A standardized layout facilitates quick identification of key figures, such as net cash flow from each activity. For example, consistent placement of net income at the beginning of the operating activities section aids in tracking profitability’s impact on cash flow.

- Uniform TerminologyUsing uniform terminology eliminates ambiguity and promotes accurate interpretation. Standard terms like “net income,” “capital expenditures,” and “debt repayment” provide a common language for financial reporting. This clarity prevents misinterpretations that could arise from using varying labels for the same financial activities. Consistent terminology allows for benchmarking against industry averages and comparing performance across different entities.

- Comparable PeriodsPresenting data for comparable periods, such as month-over-month or year-over-year, enables trend analysis and performance evaluation. This allows for identifying patterns and potential issues. For example, comparing cash flow from operations across multiple quarters can reveal seasonal trends or operational inefficiencies. Consistent timeframes are essential for accurate performance assessment and forecasting.

- Clear PresentationClear presentation through visually organized formatting, including consistent use of headings, subheadings, and numerical formatting, enhances readability and comprehension. A well-structured format minimizes the risk of overlooking crucial data points and facilitates efficient analysis. This contributes to better-informed decision-making based on a readily accessible overview of cash flow dynamics.

These facets of a standardized format collectively enhance the usability and value of a simple cash flow statement template. This structured approach simplifies the complexities of cash flow analysis, enabling stakeholders to extract meaningful insights and make informed financial decisions. This contributes directly to improved financial management and overall organizational health.

2. Categorized Cash Flows

Categorization is a cornerstone of a simple cash flow statement template, providing a structured view of an entity’s financial activities. Organizing cash flows into distinct categories allows for a deeper understanding of the sources and uses of funds, facilitating informed financial analysis and decision-making.

- Operating ActivitiesThis category encompasses cash flows directly related to the core business operations. Examples include cash received from customers, cash paid to suppliers, and cash paid for salaries and wages. Analyzing operating cash flow reveals the profitability and efficiency of core business functions. A healthy operating cash flow is crucial for long-term sustainability.

- Investing ActivitiesInvesting activities involve cash flows related to the acquisition and disposal of long-term assets. This includes purchasing or selling property, plant, and equipment (PP&E), investments in other companies, and lending or collecting on loans. Analyzing these flows provides insight into an organization’s investment strategies and their impact on overall financial health. Significant negative cash flow from investing activities might indicate substantial capital expenditures for future growth.

- Financing ActivitiesFinancing activities relate to how an organization raises capital and manages its financial structure. This includes issuing or repurchasing stock, borrowing or repaying debt, and paying dividends. Analyzing financing cash flows provides insight into an organization’s capital structure and its dependence on external funding. Large positive cash flows from financing activities might suggest an increased reliance on debt.

- Clarity and InsightCategorizing cash flows into these three distinct areas offers a clear, organized view of financial activities. This structured presentation enhances understanding, allowing stakeholders to assess the financial health and performance of an entity. For instance, comparing the relative proportions of cash flow from each category can reveal insights into an organization’s financial strategy and potential risks.

Categorized cash flows are integral to a simple cash flow statement template, providing the necessary structure for meaningful analysis. By segregating cash flows into operating, investing, and financing activities, this approach enhances transparency and facilitates informed decision-making, ultimately contributing to improved financial management and stronger organizational performance.

3. Period-Specific Tracking

Period-specific tracking is essential for maximizing the utility of a simple cash flow statement template. Regular monitoring of cash inflows and outflows, whether monthly, quarterly, or annually, provides a dynamic view of an organization’s financial performance. This temporal dimension allows for timely identification of trends, potential issues, and opportunities for improvement, which is crucial for proactive financial management. Without regular tracking, a simple cash flow statement template becomes a static snapshot, limiting its value for ongoing financial control.

The frequency of tracking should align with the specific needs and characteristics of the organization. A rapidly growing startup might require monthly tracking to closely monitor burn rate and runway, while a more established enterprise might find quarterly tracking sufficient. For example, a seasonal business might benefit from monthly tracking to anticipate and manage fluctuations in cash flow related to peak and off-peak periods. The key is to establish a tracking cadence that provides sufficient granularity for informed decision-making without becoming overly burdensome. Consistent period-specific tracking facilitates comparisons across time, enabling analysis of trends and the effectiveness of implemented strategies. For instance, tracking cash flow from operations over consecutive quarters can reveal the impact of cost-cutting measures or changes in pricing strategies. This analysis supports proactive adjustments to financial plans and operational activities.

Period-specific tracking enables proactive management of cash flow and facilitates informed decision-making. This dynamic approach allows organizations to identify and address emerging financial challenges, capitalize on opportunities, and optimize resource allocation. Challenges in maintaining consistent tracking can arise from data collection and processing limitations. However, leveraging technology and streamlined processes can overcome these hurdles, ensuring the ongoing value and analytical power of a simple cash flow statement template. By consistently tracking cash flow over defined periods, organizations gain the necessary insights to navigate financial complexities and achieve sustainable growth.

4. Accessibility for Analysis

Accessibility is a critical feature of a simple cash flow statement template. Ready access to clear, concisely presented financial data empowers stakeholders to perform effective analysis and make informed decisions. A well-designed template facilitates timely review and interpretation, promoting proactive financial management. Without readily accessible data, the template’s value diminishes significantly. For example, a readily accessible template enables a business owner to quickly assess the impact of a new product launch on operating cash flow, facilitating adjustments to marketing spend or inventory management.

Accessibility encompasses several key aspects. Data should be readily available, whether through cloud-based platforms or easily shared files. The format should be user-friendly, promoting quick comprehension. Visualizations, such as charts and graphs, can further enhance understanding, particularly for those without deep financial expertise. For instance, a chart visualizing the trend of cash flow from operations over several quarters can quickly reveal seasonal patterns or the impact of operational changes. Furthermore, integration with other financial tools, such as budgeting software or accounting systems, streamlines data aggregation and analysis. A small business owner, for instance, might integrate their template with their accounting software to automatically update cash flow data, eliminating manual data entry and reducing the risk of errors.

Effective analysis requires not only accessible data but also the appropriate tools and resources to interpret it. Training materials, documentation, and support resources can empower stakeholders to leverage the template effectively. This fosters a culture of data-driven decision-making throughout the organization. Addressing potential barriers, such as software compatibility issues or data security concerns, is crucial for maximizing accessibility. Overcoming these challenges ensures that the simple cash flow statement template remains a valuable tool for informed financial management, driving organizational success.

5. Actionable Insights

A simple cash flow statement template’s ultimate value lies in its capacity to generate actionable insights. These insights, derived from the organized and categorized presentation of cash flow data, empower stakeholders to make informed decisions, improve financial performance, and drive organizational success. A template devoid of actionable insights becomes a mere record-keeping tool, failing to leverage the power of financial data for proactive management. For example, a consistent negative cash flow from operations, readily apparent in a well-structured template, might prompt an immediate review of pricing strategies, cost-cutting measures, or operational efficiency improvements. Conversely, a consistently positive cash flow from operations provides opportunities for strategic investment, expansion, or debt reduction. The template acts as a catalyst, transforming raw data into strategic directives. This transformation hinges on the clarity and accessibility of the presented information.

Real-world applications of actionable insights derived from a simple cash flow statement template are numerous. A retailer experiencing declining cash flow from sales during a specific quarter might investigate underlying causes, such as changes in consumer behavior, increased competition, or ineffective marketing campaigns. Insights from the template can inform adjustments to inventory management, pricing strategies, or promotional activities. A manufacturing company observing a significant increase in cash outflow for capital expenditures might use this insight to evaluate the return on investment of those expenditures, ensuring alignment with long-term strategic goals. A non-profit organization experiencing volatile cash flows from donations might implement strategies to diversify funding sources or optimize fundraising efforts. In each scenario, the template provides the necessary data to inform proactive interventions and drive positive change.

Converting data into actionable insights requires careful interpretation and analysis. Stakeholders must understand the context of the data, consider external factors, and align insights with overall organizational objectives. Challenges can arise from data inaccuracies, inconsistent tracking, or a lack of expertise in financial analysis. However, the benefits of leveraging actionable insights far outweigh the challenges. By empowering informed decision-making, a simple cash flow statement template becomes a crucial tool for financial control, strategic planning, and long-term organizational sustainability.

Key Components of a Simple Cash Flow Statement Template

Effective cash flow management requires a clear understanding of the core components within a streamlined template. These elements provide a structured framework for analyzing financial performance and making informed decisions.

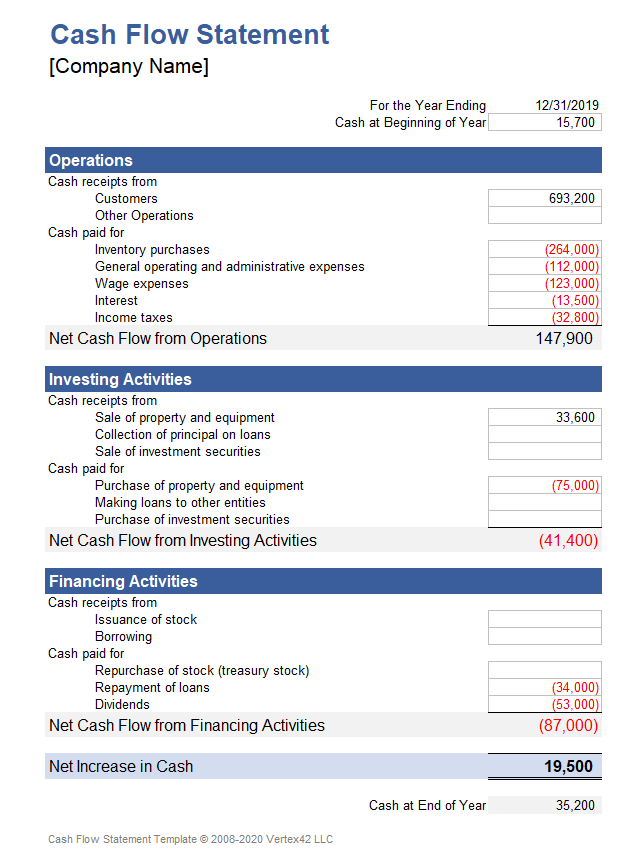

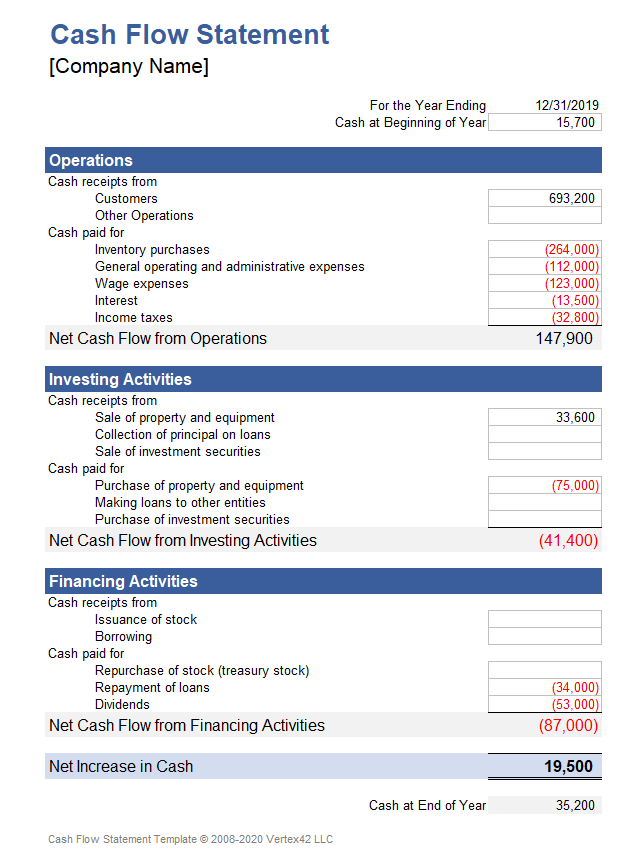

1. Beginning Cash Balance: The starting point for the specified period, representing the cash available at the beginning of the month, quarter, or year. This figure provides context for subsequent cash flow changes.

2. Cash Flow from Operating Activities: This section details cash generated or used in core business operations. Key elements include cash received from customers, cash paid to suppliers, and cash paid for operating expenses like salaries and rent.

3. Cash Flow from Investing Activities: This section tracks cash related to long-term investments. Key elements include purchases and sales of property, plant, and equipment (PP&E), investments in other entities, and proceeds from the sale of investments.

4. Cash Flow from Financing Activities: This section details cash flows related to capital raising and debt management. Key elements include proceeds from issuing debt or equity, repayment of debt, and dividend payments.

5. Net Increase/Decrease in Cash: This crucial figure represents the overall change in cash during the period. It is calculated by summing the net cash flows from operating, investing, and financing activities. A positive value indicates a net increase in cash, while a negative value indicates a net decrease.

6. Ending Cash Balance: This represents the cash available at the end of the period. It is calculated by adding the net increase/decrease in cash to the beginning cash balance. This ending balance becomes the beginning balance for the subsequent period, ensuring continuity in tracking.

A comprehensive understanding of these components provides a foundation for interpreting cash flow statements, enabling stakeholders to assess financial health, identify trends, and make informed decisions to optimize resource allocation and drive organizational success.

How to Create a Simple Cash Flow Statement Template

Creating a simple cash flow statement template provides a structured approach to tracking and analyzing an organization’s cash inflows and outflows. This structured approach facilitates informed financial decision-making and promotes better financial health.

1. Define the Reporting Period: Specify the timeframe for the cash flow statement, whether monthly, quarterly, or annually. Consistent reporting periods facilitate trend analysis and performance comparisons.

2. Establish Starting Cash Balance: Determine the cash on hand at the beginning of the reporting period. This figure serves as the foundation for calculating subsequent cash flow changes. Accuracy in this initial figure is crucial for the overall integrity of the statement.

3. Categorize Cash Flows: Organize cash inflows and outflows into the three primary categories: operating activities, investing activities, and financing activities. This categorization provides insights into distinct cash flow sources and uses.

4. Detail Operating Activities: Itemize cash flows directly related to core business operations. This includes cash received from customers, cash paid to suppliers, and cash paid for operating expenses (e.g., salaries, rent, utilities). Clear documentation within this category is essential for understanding profitability and operational efficiency.

5. Detail Investing Activities: Itemize cash flows related to the acquisition and disposal of long-term assets. This includes purchases and sales of property, plant, and equipment (PP&E), investments in other entities, and proceeds from the sale of investments. Accurate tracking of these flows provides insight into long-term investment strategies.

6. Detail Financing Activities: Itemize cash flows related to capital raising and debt management. This includes proceeds from issuing debt or equity, repayment of debt, and dividend payments. This section illuminates an organization’s capital structure and financial strategy.

7. Calculate Net Cash Flow: Determine the net increase or decrease in cash by summing the net cash flows from each of the three categories. This crucial figure represents the overall change in cash during the reporting period.

8. Determine Ending Cash Balance: Calculate the ending cash balance by adding the net increase or decrease in cash to the beginning cash balance. This ending balance becomes the beginning balance for the subsequent period, ensuring continuity in tracking.

A well-structured template, consistently applied, transforms raw financial data into a powerful tool for analysis, planning, and proactive financial management. This structured approach fosters financial transparency and supports informed decision-making at all organizational levels, contributing to long-term stability and growth.

A simple cash flow statement template provides a crucial framework for understanding the financial health of any organization. Its structured approach, categorizing cash flows into operations, investing, and financing activities, offers clear insights into the sources and uses of funds over a specific period. From determining the beginning and ending cash balances to tracking net increases or decreases, the template facilitates informed decision-making, allowing stakeholders to identify trends, assess financial performance, and adapt strategies proactively. Accessibility and consistent application of this template are key to extracting actionable insights, which are essential for effective financial management. Utilizing such a template transforms raw financial data into a powerful tool for analysis, planning, and achieving long-term financial stability.

Effective cash flow management is not merely a financial exercise; it is a cornerstone of organizational success. A well-maintained cash flow statement, even in its simplest form, provides a roadmap for navigating financial complexities, capitalizing on opportunities, and mitigating risks. Adopting a proactive approach to cash flow analysis, facilitated by a clear and accessible template, empowers organizations to achieve financial sustainability and long-term growth. The insights gleaned from consistent tracking and analysis provide a critical foundation for informed decision-making, enabling organizations to not only survive but thrive in a dynamic economic landscape.