Regularly generated, concise financial summaries facilitate prompt identification of trends, potential issues, and opportunities for improvement. These reports enable proactive financial management by providing the information necessary to adjust strategies and optimize resource allocation. They are crucial for tracking progress toward financial goals and maintaining a clear understanding of an organization’s profitability.

Further exploration will delve into the specific components of these reports, offer guidance on their creation, and illustrate their practical application in diverse contexts.

1. Revenue

Revenue, the lifeblood of any organization, forms the cornerstone of a streamlined monthly profit and loss summary. Accurate revenue recognition is critical for a realistic portrayal of financial performance. This figure represents the total income generated from sales of goods or services during a given month. For instance, a retail business would record all sales transactions, while a subscription-based service would recognize recurring monthly fees as revenue. Without a clear understanding of revenue, the remaining calculations within the statement become meaningless. Its placement at the top of the report underscores its fundamental importance.

The relationship between revenue and profitability is direct and often complex. Increased revenue doesn’t automatically translate to higher profits. Cost of goods sold and operating expenses must be considered. Analyzing revenue trends within monthly reports provides valuable insight into sales performance and market dynamics. For example, a consistent decline in revenue over several months could signal a need for adjustments in pricing strategies, marketing efforts, or product development. Conversely, a sudden surge might indicate the success of a particular campaign or seasonal demand. This information allows for proactive responses and informed strategic planning.

Accurately capturing and interpreting revenue within monthly financial summaries is crucial for sound financial management. This data point serves as a key performance indicator and provides the foundation for informed decision-making. Challenges in revenue recognition can arise from complex accounting standards, particularly for businesses with recurring revenue models. However, maintaining meticulous records and utilizing a consistent reporting framework ensures the reliability and value of this critical metric within the overall financial picture.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Within a streamlined monthly profit and loss summary, COGS plays a crucial role in determining gross profit and ultimately, net income. Accurate calculation of COGS is essential for understanding profitability and making informed business decisions.

- Direct MaterialsThis encompasses the raw materials used in production. For a furniture manufacturer, this would include wood, fabric, and hardware. Accurately tracking direct material costs is essential for precise COGS calculation. Overstating or understating material costs can lead to misrepresented profitability on the income statement. For example, failing to account for scrap material can underestimate COGS and inflate perceived profits.

- Direct LaborDirect labor costs include wages and benefits paid to employees directly involved in production. For a clothing manufacturer, this would include the salaries of sewing machine operators. Precisely allocating labor costs is critical, particularly in businesses where employees perform multiple roles. Misclassifying indirect labor as direct labor can distort COGS and impact profitability analysis on the monthly income statement.

- Manufacturing OverheadThis category includes indirect costs associated with the production process, such as factory rent, utilities, and depreciation of manufacturing equipment. Accurately allocating these overhead costs is essential for a complete COGS calculation. For instance, improperly allocating overhead costs can lead to inaccurate product costing and potentially misinformed pricing decisions.

- Inventory ChangesThe difference between beginning and ending inventory levels impacts COGS. An increase in inventory generally decreases COGS, while a decrease increases it. Accurately tracking inventory levels is crucial for reflecting true production costs in the monthly profit and loss statement. Inaccurate inventory accounting can distort COGS, leading to misleading profitability assessments. For example, failing to account for obsolete inventory can underestimate COGS.

Understanding and accurately calculating COGS within a monthly profit and loss summary is critical for evaluating profitability, making informed pricing decisions, and effectively managing resources. By meticulously tracking each component of COGS, businesses gain valuable insights into their operational efficiency and can identify opportunities for cost optimization, ultimately contributing to a more accurate and informative financial picture. Comparing COGS trends across multiple monthly statements can further reveal inefficiencies or areas for improvement within the production process. This data-driven analysis empowers businesses to make strategic adjustments and enhance overall financial performance.

3. Gross Profit

Gross profit, a key metric within a streamlined monthly profit and loss summary, represents the profitability of a company’s core business operations after accounting for the direct costs associated with producing goods or services. Calculated as revenue less cost of goods sold (COGS), gross profit provides insights into the efficiency of production and pricing strategies. Its placement on the income statement precedes operating expenses, highlighting its significance in overall profitability assessment.

- Relationship to Revenue and COGSGross profit is directly influenced by both revenue and COGS. Higher revenue and lower COGS contribute to increased gross profit. For example, if a company generates $100,000 in revenue and incurs $60,000 in COGS, the gross profit is $40,000. Analyzing the relationship between these three figures provides valuable insights into operational efficiency. A decreasing gross profit margin, despite increasing revenue, might indicate rising production costs, warranting further investigation.

- Indicator of Pricing EffectivenessGross profit serves as an indicator of the effectiveness of pricing strategies. A healthy gross profit margin suggests that products or services are priced appropriately to cover production costs and generate profit. Conversely, a low gross profit margin may signal the need for price adjustments or cost reduction measures. For example, a software company with high development costs but low subscription fees might experience a compressed gross profit margin, necessitating a review of its pricing model.

- Impact on Operating Income and Net IncomeGross profit directly impacts operating income and net income. A higher gross profit provides a larger base for covering operating expenses and ultimately contributes to higher net income. Understanding this relationship is crucial for making informed decisions about resource allocation and expense management. For instance, a manufacturing company with a strong gross profit margin has more flexibility to invest in research and development or marketing initiatives.

- Benchmarking and Industry AnalysisComparing a company’s gross profit margin to industry averages provides valuable context for performance evaluation. This benchmarking helps identify areas of strength and weakness relative to competitors. For example, a retailer with a gross profit margin significantly lower than the industry average may need to assess its pricing strategy, inventory management, or supply chain efficiency.

Analyzing gross profit within the context of a streamlined monthly profit and loss summary provides crucial insights into a company’s operational efficiency, pricing effectiveness, and overall financial health. Tracking gross profit trends over time allows for proactive identification of potential issues and opportunities for improvement, contributing to more informed decision-making and enhanced profitability.

4. Operating Expenses

Operating expenses represent the costs incurred in running a business’s core operations, excluding the direct costs of producing goods or services. Within a streamlined monthly profit and loss summary, operating expenses are crucial for determining net income. A comprehensive understanding of these expenses is essential for effective financial management and informed decision-making.

- Selling, General, and Administrative Expenses (SG&A)SG&A encompasses a wide range of expenses, including salaries of administrative staff, marketing and advertising costs, rent, utilities, and office supplies. These costs are essential for supporting the business but are not directly tied to production. For example, the salary of a marketing manager would fall under SG&A. Monitoring SG&A as a percentage of revenue helps assess administrative efficiency. An increasing trend might indicate excessive overhead costs requiring attention.

- Research and Development (R&D)R&D expenses represent investments in developing new products, services, or processes. These costs are crucial for innovation and long-term growth. For a technology company, R&D might include salaries of engineers and costs of laboratory equipment. Analyzing R&D spending helps assess a company’s commitment to innovation. Consistent investment in R&D can signal a focus on future growth and competitive advantage.

- Depreciation and AmortizationDepreciation reflects the allocation of the cost of tangible assets, such as buildings and equipment, over their useful lives. Amortization applies the same principle to intangible assets, such as patents and copyrights. Including these non-cash expenses provides a more accurate picture of the true cost of using these assets over time. For example, the monthly depreciation expense for a delivery truck reflects the portion of its cost allocated to that period.

- Other Operating ExpensesThis category includes expenses not readily classified elsewhere, such as legal fees, consulting fees, and impairment charges. Transparency in reporting these miscellaneous expenses is essential for maintaining the integrity of the financial statement. For example, significant one-time legal fees should be clearly explained in the accompanying notes to the financial statements to provide context.

Careful analysis of operating expenses within a streamlined monthly profit and loss summary is vital for assessing operational efficiency, identifying areas for cost optimization, and ultimately improving profitability. Tracking trends in operating expenses relative to revenue provides valuable insights into cost control effectiveness and supports informed resource allocation decisions. This detailed breakdown allows for proactive adjustments and strengthens overall financial health. By understanding the nuances of each expense category, organizations can make data-driven decisions that contribute to long-term financial sustainability.

5. Net Income

Net income, the culmination of a streamlined monthly profit and loss summary, represents the profit remaining after all expenses have been deducted from revenues. This bottom-line figure provides a crucial measure of a company’s profitability during a specific month and serves as a key indicator of financial health. Understanding net income is fundamental for evaluating performance, making informed decisions, and charting a course for future growth.

- Relationship to Revenue and ExpensesNet income is directly influenced by both revenue and expenses. Higher revenue and lower expenses contribute to increased net income. For example, if a company generates $100,000 in revenue and incurs $80,000 in total expenses (including COGS and operating expenses), the net income is $20,000. Analyzing the interplay between revenue and expenses provides insights into overall profitability and operational efficiency. Consistent monitoring of these elements within a monthly income statement allows for proactive identification of potential issues and opportunities for improvement.

- Indicator of Financial PerformanceNet income serves as a primary indicator of a company’s financial performance. Positive net income indicates profitability, while negative net income (a net loss) signals that expenses exceed revenues. Tracking net income trends over time provides valuable insight into the company’s financial trajectory. For example, consistently declining net income may warrant a review of pricing strategies, cost management practices, or operational efficiency.

- Impact on Retained Earnings and Financial PositionNet income directly affects a company’s retained earnings, which represent accumulated profits reinvested in the business. Higher net income contributes to stronger retained earnings, enhancing the company’s overall financial position. This, in turn, can influence access to capital and investment opportunities. For instance, a company with consistently healthy net income and growing retained earnings may find it easier to secure financing for expansion or acquisitions.

- Basis for Financial Analysis and Decision-MakingNet income serves as a foundational element for various financial analyses, including profitability ratios, return on investment calculations, and trend analysis. This information is essential for informed decision-making regarding pricing, resource allocation, and strategic planning. For example, a company might use net income data to evaluate the effectiveness of a marketing campaign or to assess the feasibility of a new product launch.

Within the framework of a streamlined monthly income statement, net income provides a concise yet powerful measure of a company’s financial health. Regularly monitoring and analyzing this key metric, in conjunction with other components of the income statement, empowers businesses to make informed decisions, optimize performance, and achieve sustainable growth.

6. Template Consistency

Template consistency is paramount for streamlined monthly profit and loss reporting. Utilizing a standardized format ensures comparability across reporting periods, facilitating trend analysis and informed decision-making. Without a consistent template, fluctuations in presentation can obscure genuine changes in financial performance, hindering accurate interpretation and potentially leading to misinformed strategic decisions. A consistent structure allows for immediate identification of key figures and their relative changes month over month, enabling efficient performance evaluation. For example, consistent placement of revenue, cost of goods sold, and operating expenses allows for quick calculation of gross profit and net income margins, facilitating performance comparison across time.

Consider a business that alters the categorization of expenses each month. One month, marketing expenses might be categorized under “Selling Expenses,” while the next month, they are included under “General and Administrative Expenses.” This inconsistency makes it challenging to track trends in marketing spending and assess its effectiveness over time. Conversely, a consistent template ensures that marketing expenses are consistently categorized, enabling accurate trend analysis and informed budget allocation decisions. Another example lies in the consistent calculation of key metrics. If the formula for calculating gross profit margin changes from one month to the next, comparing margins becomes meaningless. Template consistency ensures that calculations remain uniform, facilitating accurate performance evaluation and trend identification.

Consistent template usage within monthly financial reporting fosters clarity, accuracy, and efficiency in financial analysis. This practice allows stakeholders to focus on interpreting the data rather than deciphering the report’s structure. Challenges in maintaining template consistency can arise from software changes, personnel turnover, or evolving reporting requirements. However, establishing clear guidelines and providing adequate training mitigates these risks. Ultimately, prioritizing template consistency strengthens the reliability and value of monthly profit and loss summaries, empowering informed decision-making and contributing to improved financial outcomes. This practice promotes data integrity, supports meaningful comparisons, and enhances the overall utility of financial reporting, fostering a clearer understanding of performance trends and supporting informed strategic decisions.

Key Components of a Streamlined Monthly Profit and Loss Statement

Effective financial management necessitates a clear understanding of the core components within a concise monthly profit and loss statement. The following elements provide a foundational framework for analyzing financial performance.

1. Revenue: This represents income generated from primary business activities. Accurate revenue recognition is crucial for a realistic portrayal of financial health. For product-based businesses, this typically involves sales of goods, while service-oriented businesses recognize revenue from service delivery.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit and understanding product profitability.

3. Gross Profit: Calculated as revenue less COGS, gross profit reflects the profitability of core business operations. This metric provides insights into pricing strategies and production efficiency. A healthy gross profit margin indicates effective cost management and pricing.

4. Operating Expenses: These expenses encompass costs incurred in running the business’s core operations, excluding COGS. Examples include salaries of administrative staff, marketing expenses, rent, and utilities. Careful management of operating expenses is crucial for overall profitability.

5. Operating Income: This represents profit generated from core business operations after deducting COGS and operating expenses. Operating income reflects the efficiency of core business functions before considering non-operating income and expenses.

6. Other Income and Expenses: This category includes income and expenses not directly related to core business operations, such as interest income, investment gains or losses, and extraordinary items. These items provide a comprehensive view of the company’s overall financial activities.

7. Net Income: This bottom-line figure represents the profit remaining after deducting all expenses from revenues, including COGS, operating expenses, and other income and expenses. Net income serves as a key indicator of a company’s overall financial health and profitability.

Comprehensive analysis of these components provides valuable insights into financial performance, enabling informed decision-making and strategic planning for sustained growth and profitability. Regular review of these interconnected elements allows for timely identification of trends, potential challenges, and opportunities for optimization.

How to Create a Simple Monthly Income Statement

Creating a streamlined monthly profit and loss statement involves a systematic approach to organizing financial data. The following steps outline the process of developing a template for tracking and analyzing monthly financial performance.

1. Establish a Consistent Reporting Period: Define a consistent monthly reporting period (e.g., calendar month). This ensures comparability across periods and facilitates trend analysis.

2. Categorize Revenue Streams: Clearly identify and categorize all sources of revenue. This might include sales of goods, service fees, or subscription revenue. Detailed categorization allows for analysis of revenue trends by segment.

3. Determine Cost of Goods Sold (COGS): Calculate COGS by summing direct costs associated with production, including raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit.

4. Categorize Operating Expenses: Systematically categorize operating expenses, including selling, general, and administrative expenses (SG&A), research and development (R&D), and depreciation/amortization. This detailed breakdown allows for insights into cost drivers.

5. Calculate Gross Profit and Operating Income: Calculate gross profit by subtracting COGS from revenue. Calculate operating income by subtracting operating expenses from gross profit. These metrics provide key insights into profitability at different operational levels.

6. Account for Other Income and Expenses: Include any non-operating income or expenses, such as interest income, investment gains/losses, or one-time charges. This provides a holistic view of financial performance beyond core operations.

7. Calculate Net Income: Determine net income by subtracting all expenses from total revenue. This bottom-line figure provides a comprehensive measure of profitability for the reporting period.

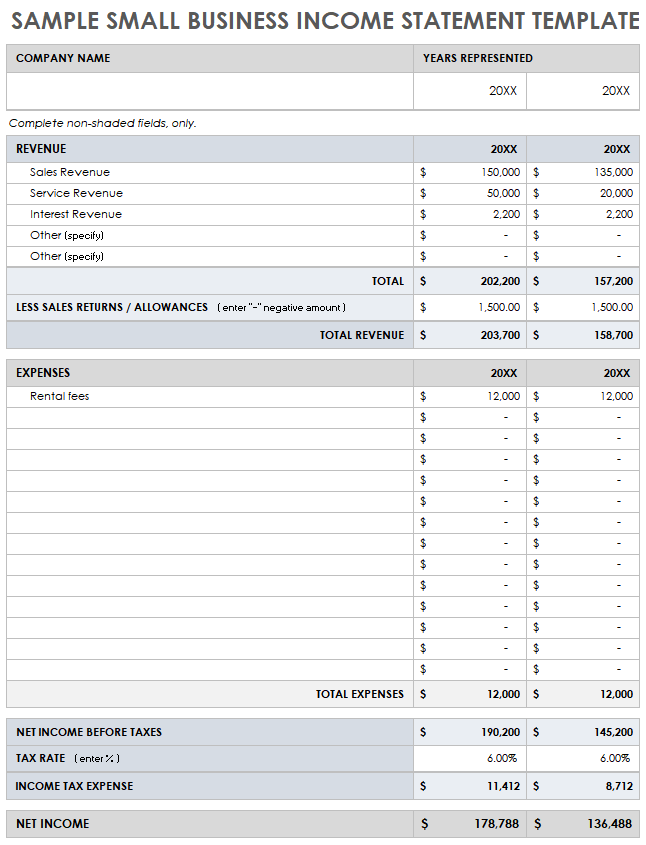

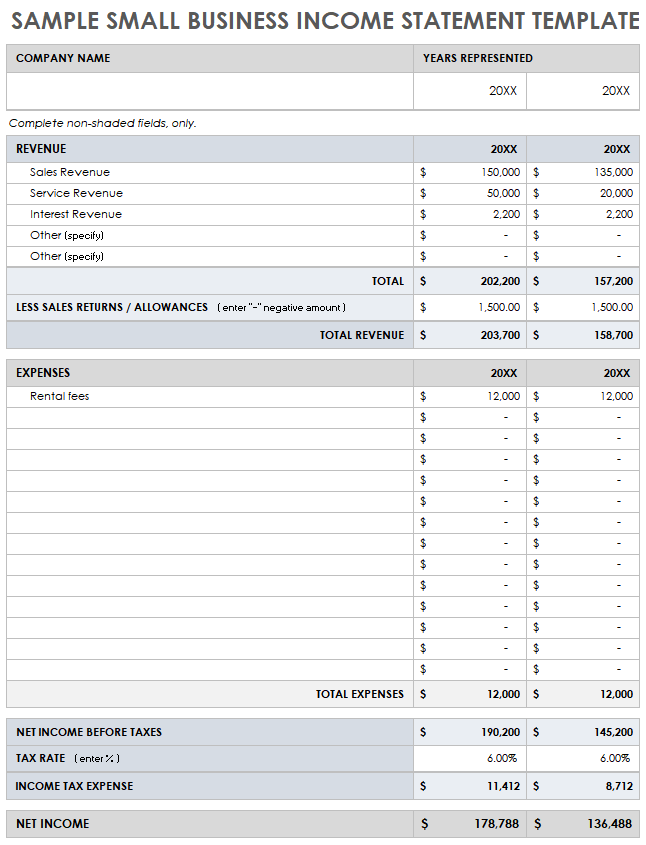

8. Utilize a Template: Employ a spreadsheet software or dedicated accounting software to create a reusable template. This ensures consistency in format and calculations across reporting periods. The template should clearly label each component and incorporate formulas for automated calculations.

By following these steps, organizations can develop a standardized and informative monthly income statement, providing a clear and consistent view of financial performance over time, which enables effective monitoring, analysis, and informed decision-making.

Streamlined monthly profit and loss summaries provide essential insights into an organization’s financial performance. Understanding key components, such as revenue, cost of goods sold, operating expenses, and net income, is crucial for informed decision-making. Consistent template usage ensures comparability across reporting periods, facilitating trend analysis and accurate performance evaluation. From revenue recognition to net income calculation, each element contributes to a comprehensive understanding of financial health, enabling proactive adjustments and strategic planning.

Regularly generating and analyzing these concise financial reports empowers organizations to identify areas for improvement, optimize resource allocation, and ultimately achieve sustainable growth. The insights gleaned from these reports serve as a compass, guiding strategic direction and fostering financial stability. Their value lies not only in providing a snapshot of current performance but also in informing future strategies and contributing to long-term financial success.