Regularly generating this type of report facilitates proactive financial management. It allows for the identification of trends, potential problems, and opportunities for improvement. Tracking key financial metrics over time helps businesses understand their profitability, control costs, and optimize resource allocation. This leads to better budget planning and more accurate financial forecasting.

The following sections will explore the core components of this financial tool, providing practical guidance on its creation and utilization. Specific examples and best practices will be discussed to demonstrate the value and applicability of this essential business resource.

1. Revenue

Revenue forms the foundation of a simple monthly profit and loss statement template. Accurate revenue reporting is essential for determining profitability and making informed business decisions. Revenue represents the total income generated from a company’s primary operations, typically through sales of goods or services. A clear understanding of revenue streams is crucial for analyzing financial performance. For example, a software company might categorize revenue by product subscriptions, licensing fees, and professional services. This detailed breakdown allows for targeted analysis of each revenue stream’s contribution to overall profitability.

Accurately recording revenue within the monthly statement involves meticulous tracking of all sales transactions. This requires robust accounting systems and processes. Potential challenges can include dealing with returns, discounts, and deferred revenue. Consider a subscription-based service: recognizing revenue correctly requires accounting for the service period, not just the initial payment date. This ensures compliance with accounting principles and provides a more realistic picture of financial health. Furthermore, analyzing revenue trends over time can reveal valuable insights into market demand, pricing strategies, and sales effectiveness.

In conclusion, revenue is the linchpin of a meaningful profit and loss statement. Precise revenue reporting provides a basis for evaluating profitability, making informed decisions about resource allocation, and forecasting future performance. Addressing challenges related to revenue recognition ensures accuracy and provides a solid foundation for financial analysis. This ultimately allows businesses to adapt to market dynamics and achieve sustainable growth.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Within a simple monthly profit and loss statement template, COGS plays a crucial role in determining gross profit and ultimately, net income. Accurate COGS calculations are essential for understanding profitability and making informed business decisions. COGS includes direct material costs, direct labor, and manufacturing overhead. For a manufacturing company, this might encompass raw materials, wages of production staff, and factory utilities. A retailer’s COGS comprises the purchase price of merchandise sold. Understanding the composition of COGS allows businesses to analyze production efficiency and pricing strategies. For example, a furniture manufacturer could analyze COGS to identify opportunities for reducing material waste or improving labor productivity. This directly impacts profitability as lower COGS contributes to higher gross profit margins.

Calculating COGS accurately involves meticulous tracking of all costs associated with production or acquisition of goods. This requires robust inventory management systems and accounting procedures. Potential challenges include allocating indirect costs, valuing inventory, and handling variations in production costs. For instance, a company using the FIFO (First-In, First-Out) method to value inventory will have a different COGS than one using LIFO (Last-In, First-Out), especially during periods of price fluctuations. Choosing the appropriate inventory valuation method and consistently applying it ensures accuracy and comparability of financial data. Furthermore, analyzing COGS trends over time can provide valuable insights into production efficiency, supplier pricing, and the impact of changing material costs.

In summary, COGS is a critical component of a simple monthly profit and loss statement. Accurate COGS calculations provide essential information for assessing profitability, optimizing pricing strategies, and identifying areas for cost reduction. Addressing potential challenges related to inventory valuation and cost allocation ensures the reliability of financial reporting. This, in turn, supports sound business decisions and strengthens financial stability.

3. Gross Profit

Gross profit represents the financial gain remaining after deducting the direct costs associated with producing and selling goods or services (Cost of Goods Sold or COGS) from revenue. Within a simple monthly profit and loss statement template, gross profit serves as a key indicator of a company’s production efficiency and pricing strategies. Calculating gross profit involves a straightforward formula: Revenue – COGS = Gross Profit. This metric provides insights into the profitability of a company’s core operations before considering operating expenses. For example, a bakery selling bread for $3 per loaf, with a COGS of $1 per loaf, achieves a gross profit of $2 per loaf. This $2 represents the funds available to cover operating expenses and contribute to net income. Analyzing gross profit margins (Gross Profit / Revenue) helps businesses understand the relationship between pricing, sales volume, and profitability. A higher gross profit margin indicates greater efficiency in managing production costs relative to revenue generation.

The practical significance of understanding gross profit within the context of a monthly profit and loss statement is substantial. Tracking gross profit trends over time enables businesses to identify potential issues related to rising production costs, declining sales prices, or inefficient inventory management. For instance, if a manufacturer observes a consistent decline in gross profit margin, this might signal increasing raw material costs or intensifying competition. This information prompts further investigation and corrective action, such as exploring alternative suppliers, adjusting pricing strategies, or streamlining production processes. Furthermore, comparing gross profit margins with industry benchmarks provides valuable context for evaluating competitive positioning and overall financial health.

In conclusion, gross profit serves as a critical link between revenue generation and overall profitability. Its inclusion in a simple monthly profit and loss statement provides valuable insights into the efficiency of core business operations. Regularly monitoring and analyzing gross profit trends equips businesses with the information necessary to identify and address potential challenges, optimize pricing and production strategies, and ultimately, enhance long-term financial sustainability.

4. Operating Expenses

Operating expenses represent the costs incurred in running a business’s core operations, excluding the direct costs of producing goods or services (COGS). Within a simple monthly profit and loss statement template, operating expenses are crucial for determining operating income and ultimately, net income. Accurate tracking and analysis of operating expenses are essential for effective cost management and informed decision-making.

- Selling, General, and Administrative Expenses (SG&A)SG&A encompasses a broad range of expenses related to sales, marketing, administrative functions, and general overhead. Examples include salaries of sales and marketing personnel, advertising costs, office rent, utilities, and office supplies. Within the profit and loss statement, SG&A provides insight into the cost structure of supporting business functions. Analyzing SG&A trends can reveal opportunities for cost optimization and improved efficiency.

- Research and Development (R&D)R&D expenses represent investments in developing new products, services, or processes. These costs can include salaries of research personnel, laboratory equipment, and testing materials. In the profit and loss statement, R&D expenses reflect a company’s commitment to innovation and future growth. Tracking R&D spending helps assess the allocation of resources towards innovation initiatives.

- Depreciation and AmortizationDepreciation reflects the allocation of the cost of tangible assets (e.g., buildings, equipment) over their useful lives. Amortization represents the allocation of the cost of intangible assets (e.g., patents, copyrights) over their useful lives. These non-cash expenses are included in the profit and loss statement to accurately represent the decline in value of these assets over time. Understanding depreciation and amortization helps assess the long-term impact of capital investments.

- Other Operating ExpensesThis category encompasses operating expenses not specifically classified within other categories. Examples include repair and maintenance costs, professional fees, and insurance premiums. Including these expenses in the profit and loss statement provides a comprehensive view of all costs associated with running the business. Analyzing these expenses can reveal potential areas for cost savings and efficiency improvements.

By carefully analyzing these different types of operating expenses within the simple monthly profit and loss statement template, businesses gain a granular understanding of their cost structure. This understanding enables informed decision-making related to pricing strategies, resource allocation, and cost management initiatives. Ultimately, effective management of operating expenses contributes to improved profitability and sustainable financial performance.

5. Operating Income

Operating income, a key metric within a simple monthly profit and loss statement template, reveals the profitability of a business’s core operations after accounting for both direct costs (COGS) and indirect costs (operating expenses). Calculated as Gross Profit Operating Expenses, operating income represents the earnings generated from the fundamental business activities, excluding non-operating income and expenses such as interest or taxes. This metric provides a clear picture of operational efficiency and management’s ability to control costs. For example, a retail store generating $50,000 in gross profit with operating expenses of $30,000 achieves an operating income of $20,000. This $20,000 represents the profit generated solely from core retail operations before considering factors outside the direct control of core operations, like interest payments on loans.

Understanding operating income’s role within the profit and loss statement is essential for assessing a company’s financial health. Analyzing operating income trends over time offers valuable insights into the effectiveness of cost management strategies and the overall profitability of core operations. Declining operating income might signal escalating operating expenses, decreasing gross profit margins, or both. A manufacturer experiencing a consistent decrease in operating income could investigate potential causes, such as rising raw material costs, increasing administrative overhead, or declining production efficiency. This analysis facilitates informed decisions regarding cost control measures, pricing adjustments, or operational improvements. Comparing operating income with industry benchmarks provides valuable context for evaluating competitive positioning and identifying areas for improvement.

Effective management of operating income directly influences a company’s overall profitability and long-term financial sustainability. Within the simple monthly profit and loss statement template, operating income serves as a crucial indicator of operational efficiency and financial performance. Consistent monitoring and analysis of this metric empowers businesses to identify and address potential challenges, optimize resource allocation, and enhance overall financial health. This proactive approach to financial management is essential for achieving sustainable growth and long-term success.

6. Net Income

Net income, the ultimate bottom line within a simple monthly profit and loss statement template, represents the actual profit a business generates after accounting for all revenues and expenses. This crucial metric encompasses both operating and non-operating income and expenses, providing a comprehensive measure of financial performance over a given period. Understanding net income is fundamental for evaluating a company’s profitability and overall financial health.

- Calculating Net IncomeNet income is derived by subtracting total expenses (including COGS, operating expenses, interest expense, and taxes) from total revenues. This resulting figure represents the residual profit available to shareholders after all obligations have been met. Accurately calculating net income relies on precise accounting practices and meticulous record-keeping. For example, a company with $100,000 in revenue, $60,000 in COGS and operating expenses, $5,000 in interest expense, and $10,000 in taxes, reports a net income of $25,000. This $25,000 represents the profit generated after all expenses are considered. The accuracy of net income directly impacts financial reporting and business valuations.

- Interpreting Net IncomeNet income serves as a key indicator of a company’s financial performance and profitability. Analyzing net income trends over time offers valuable insights into the effectiveness of business strategies and overall financial health. Consistent growth in net income generally signals strong financial performance and effective management. Conversely, declining net income may indicate operational inefficiencies, increased competition, or economic downturns. Investors and stakeholders rely on net income figures to assess a company’s financial viability and investment potential.

- Non-Operating ItemsNet income considers non-operating items, which are revenues and expenses unrelated to core business operations. These can include interest income, interest expense, gains or losses from investments, and one-time extraordinary items. While these items may not reflect the day-to-day operations of the business, they still impact the overall profitability reflected in net income. For example, a company receiving interest income from investments would include this in the calculation of net income, even though it’s not directly related to the company’s core business.

- Impact on Financial StatementsNet income plays a critical role in other financial statements, particularly the balance sheet and the statement of cash flows. The net income figure flows into retained earnings on the balance sheet, impacting the company’s equity. It also serves as a starting point for calculating cash flow from operating activities on the statement of cash flows. This interconnectedness emphasizes the importance of accurate net income reporting for a comprehensive understanding of a company’s financial position.

Within the framework of a simple monthly profit and loss statement template, net income acts as a crucial performance indicator, summarizing the financial outcome of all business activities. This bottom-line figure represents the residual profit after all revenues and expenses have been considered, providing essential information for internal management, investors, and other stakeholders. By analyzing net income trends and understanding its components, businesses can make informed decisions regarding strategic planning, resource allocation, and overall financial management.

Key Components of a Simple Monthly Profit and Loss Statement

A concise monthly profit and loss statement provides a crucial overview of financial performance. Understanding its core components is essential for effective financial management and informed decision-making.

1. Revenue: Revenue represents the total income generated from a company’s primary operations, typically through sales of goods or services. Accurate revenue recognition is critical for assessing financial health.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing goods sold. Accurate COGS calculations are essential for determining gross profit and understanding profitability.

3. Gross Profit: Gross profit, calculated as Revenue – COGS, represents the profit generated from core operations before accounting for operating expenses. This metric provides insight into production efficiency and pricing strategies.

4. Operating Expenses: Operating expenses represent the costs incurred in running the business’s core operations, excluding COGS. Examples include salaries, rent, marketing expenses, and administrative costs.

5. Operating Income: Operating income, derived by subtracting operating expenses from gross profit, reveals the profitability of core operations. This metric helps assess operational efficiency and cost management.

6. Other Income/Expenses: This category encompasses income and expenses not directly related to core operations, such as interest income or expense, and gains or losses from investments.

7. Income Tax Expense: This represents the expense incurred for income taxes based on the pre-tax income earned by the business.

8. Net Income: Net income, the bottom line, represents the overall profit or loss generated after considering all revenues and expenses, including taxes. This metric provides a comprehensive view of financial performance.

These components, when analyzed collectively, offer a robust understanding of a company’s financial health, enabling informed decision-making and strategic planning for sustainable growth.

How to Create a Simple Monthly Profit and Loss Statement

Creating a simple monthly profit and loss statement involves a systematic approach to organizing financial data. The following steps outline the process of developing this essential financial tool.

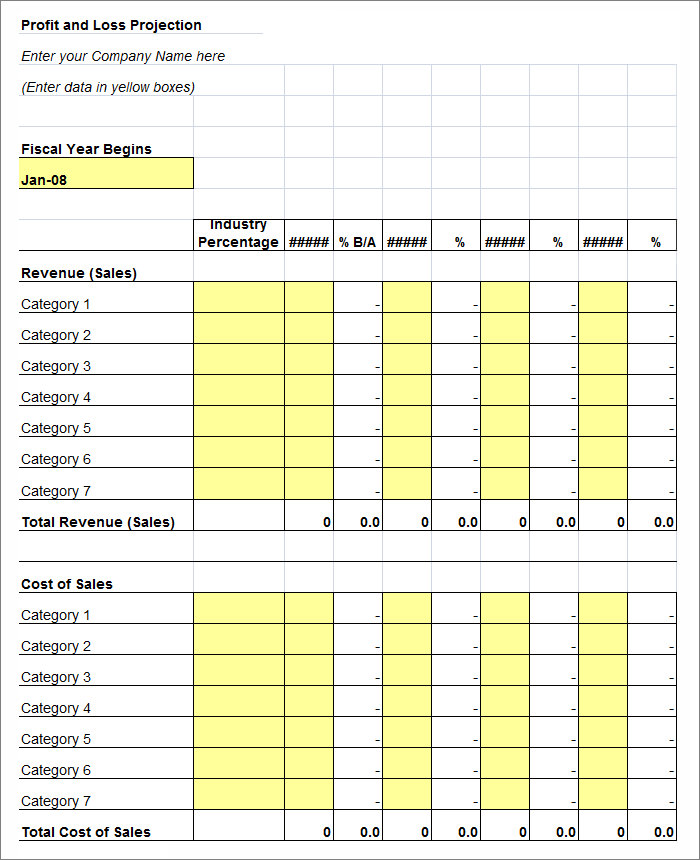

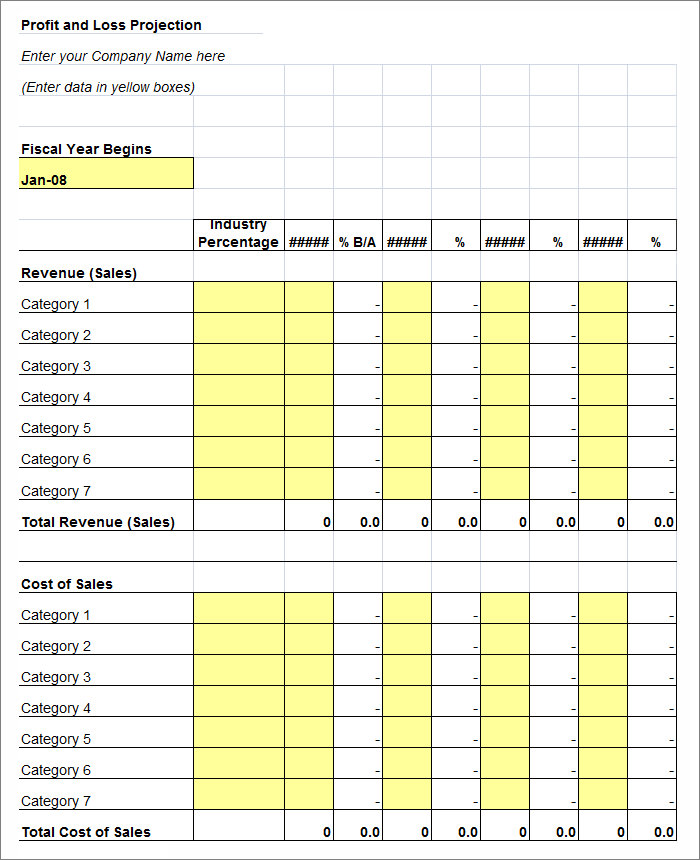

1. Choose a Template or Software: Begin by selecting a pre-designed template (spreadsheet software often offers these) or utilizing accounting software. A standardized format ensures consistency and simplifies the process.

2. Determine the Reporting Period: Specify the exact start and end dates for the month being analyzed. This ensures accurate tracking of revenue and expenses within the defined timeframe.

3. Record Revenue: Meticulously record all revenue generated during the reporting period. Categorize revenue streams for more detailed analysis (e.g., product sales, service fees).

4. Calculate Cost of Goods Sold (COGS): Determine the direct costs associated with producing goods sold. This includes direct materials, direct labor, and manufacturing overhead for manufacturers, or the purchase price of goods for retailers.

5. Calculate Gross Profit: Subtract COGS from Revenue to arrive at Gross Profit. This represents the profit generated before considering operating expenses.

6. Itemize Operating Expenses: Categorize and record all operating expenses, including salaries, rent, utilities, marketing, and administrative costs.

7. Calculate Operating Income: Subtract Operating Expenses from Gross Profit to determine Operating Income. This metric reflects profitability from core operations.

8. Account for Other Income and Expenses: Include any non-operating income or expenses, such as interest income, interest expense, or gains/losses from investments.

9. Calculate Pre-Tax Income: Add other income and subtract other expenses from operating income to arrive at pre-tax income.

10. Determine Income Tax Expense: Calculate the income tax liability based on applicable tax rates and pre-tax income.

11. Calculate Net Income: Subtract income tax expense from pre-tax income to arrive at Net Income. This bottom-line figure reflects the overall profit or loss for the period.

12. Review and Analyze: Carefully review the completed statement for accuracy and completeness. Analyze key metrics and trends to gain insights into financial performance and identify areas for improvement.

A well-structured monthly profit and loss statement provides valuable insights into financial performance. This structured approach, combined with regular review and analysis, allows for proactive financial management and informed decision-making.

Regularly utilizing a streamlined profit and loss reporting mechanism offers invaluable insights into financial performance. Tracking revenue, cost of goods sold, expenses, and resulting profit or loss provides a clear picture of an organization’s financial health. This information is crucial for making informed decisions regarding pricing strategies, cost management, and resource allocation. Understanding the core components of this financial tool and implementing a systematic approach to its creation ensures accuracy and facilitates meaningful analysis. This enables proactive identification of potential challenges and opportunities for improvement, contributing to informed strategic planning and enhanced financial stability.

Effective financial management hinges on timely and accurate data analysis. Consistent use of a well-structured profit and loss reporting structure empowers organizations to monitor performance, identify trends, and adapt to changing market conditions. This proactive approach is essential for achieving long-term financial sustainability and success in a dynamic business environment. Leveraging the insights gleaned from this essential financial tool positions organizations for informed decision-making and ultimately, the achievement of strategic financial objectives.